Salty Elon Haters Teach Us About Lifestyle Cost

]

]

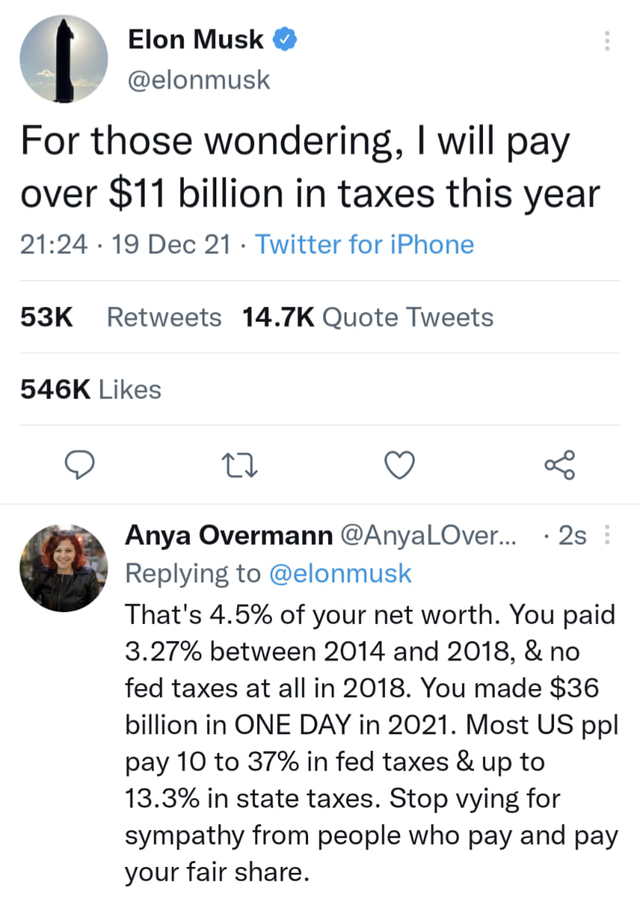

So our ole favorite crypto pump n dumper Elon Musk tweeted the other day about how he's paying more income tax than anybody else in history.

And then there were the haters with responses like the one clipped here. He only pays whatever percent of his net worth.

I'm not even going to get into the fact that income taxes are paid on income, not net worth. The hater in this case really has no idea what she's talking about. It's offensive to me as a tax pro, but whatever.

Instead, I want to take this opportunity to talk about why rich people get richer.

In a phrase: lifestyle drag.

Every adult has heard that they should spend less than they make. It's good advice. Almost nobody follows it, and for good reason: they can't afford to.

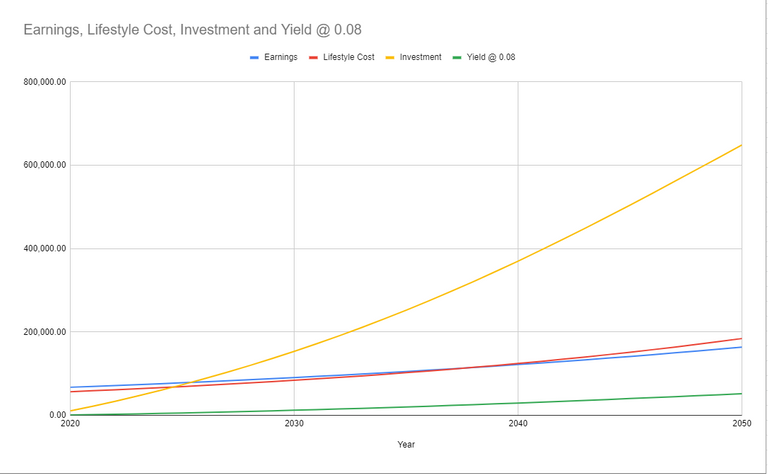

If you read financial self-help, you'll find charts like this one:

The yellow line is the investment portfolio growing over time. It tells a nice story. This person ends up with an portfolio worth 600k, which will generate enough yield to cover 28% of his lifestyle. The remaining 72% will be covered by social security and a reduction in lifestyle expense in retirement. I got these numbers from the St Louis FRED database.

It's a great story. It's too bad it isn't true.

The vast majority of retirement plans do not survive intact until retirement. Someone gets sick, loses a job, wants to buy a house, whatever. People cash in their savings and spend them. That yellow line drops back to zero.

Even when people leave their savings alone, it's not enough. Instead of covering 28% of their lifestyle, they cash in all their savings over 1 to 3 years and don't adjust their spending. Then those couple years go by and the have to adjust their spending because they are broke.

So, what is the problem in this scenario and what does Elon have to do with it?

It's all about, like, ratios man.

We have 3 variables in this scenario: earnings, lifestyle cost, and investment yields.

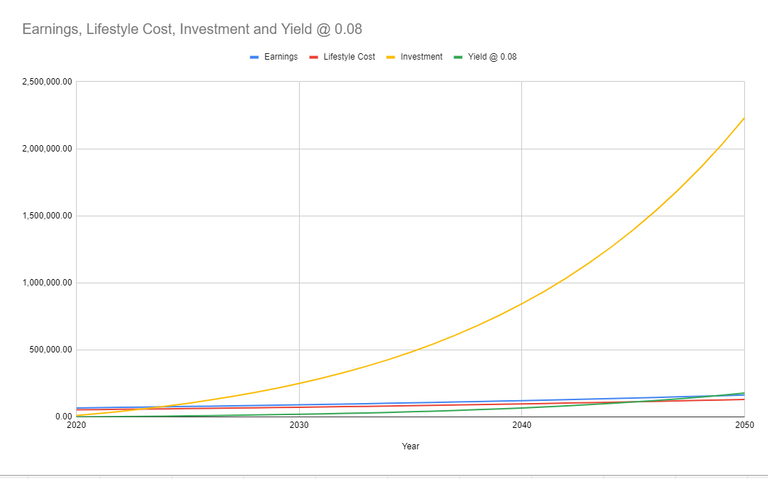

Door #1

The "normal" key to making the investments work for you and getting richer is for your lifestyle cost to not wipe our your investment capabilities. You simply can't afford to spend more than 80% of your income and invest for the future.

This is what an 80/20 split looks like:

Now the same earnings translate to a portfolio of 2m+ and covers 136% of the lifestyle cost. Spending problems solved.

Door #2

Or you can be a super-go-getter and outearn your spending. This is difficult but can work.

In this scenario, lifestyle spending remains the same as Mr. Broke 28%, but earnings are more than double to start and grow faster:

If you're good at earning money, totally works.

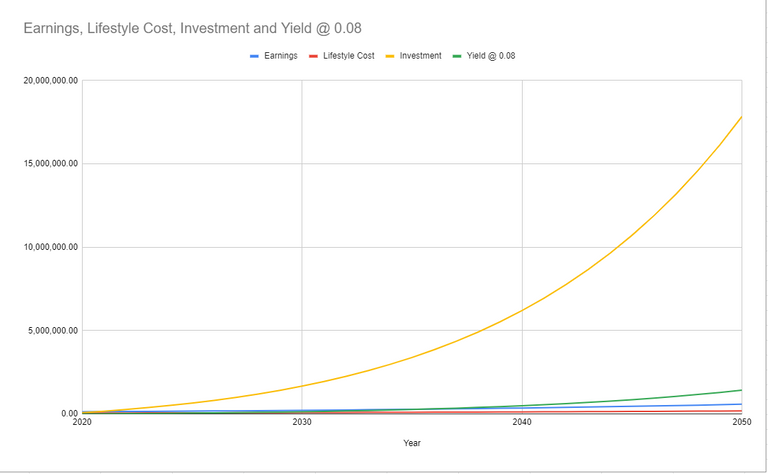

Door #3

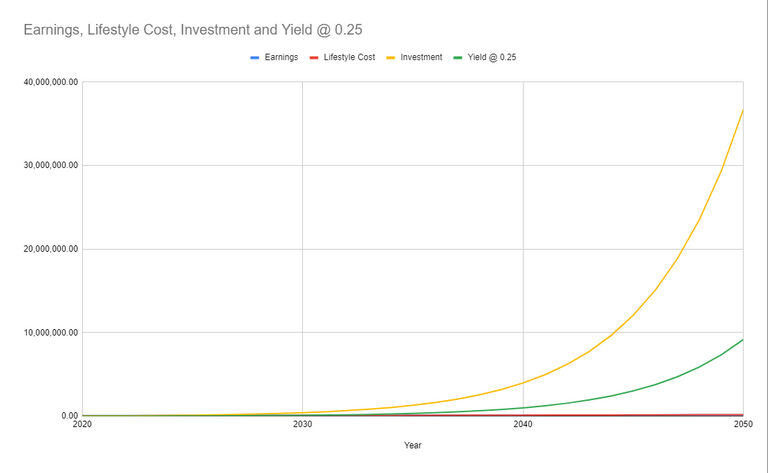

Or you can do like Elon did. Have your investments explode in value way, way above the stock market 8% average rates.

This is also the crypto model so far (although I think future returns will be lower than historical returns).

If we go back to Mr. Broke 28% and change his returns from 8% to 25%, he hits that future date with almost 40 million.

Elon, and most very wealthy people, has seen his business equity skyrocket over the last few years to the tune of hundreds of percent per year.

For me personally, I've gone through both Door #2 and Door #3. My savings rate is huge and my investments have done phenomenally (but mostly in just the last year).

Lifestyle is a cost. It's a necessary cost though. The trick is finding the balance between what makes living today worthwhile and that future need for money. There's no "right" answer. I can tell you though that broke old people are pretty miserable.

And that's why salty Elon haters are salty. They are Mr. Broke 28% and they don't see any path out of their situations.

Posted Using LeoFinance Beta

It is offensive to us not tax pros also.

But then again, explain finance to some is like explaining nuclear physics to a 5 year old.

Great breakdown of the three options. The way you spelled it out, door #2 and #3 are ideal for crypto. Since most still have their regular jobs, they can use crypto earnings to help with Door #2. Then, based upon what is received, can turn around and ride the bull with either than token or swap into something else for Door #3.

It will take some time as the charts show. The early days are like watching grass grow. That is the power of compounding of which one of the vital components is time.

Sadly, for most, compounding only comes in with debt. They compound the credit card balances over 7 years and then are surprised when they are $35K (or more) in debt. Well 18% APY compounding over 7 years can add up to a whole lot from a small starting point.

It works both ways.

Posted Using LeoFinance Beta

Oh and by the way, if anyone who agrees with the dimwit in the tweet, Musk is paying a combined 53% between Federal and State tax in 2021.

Anyone wonder why he picked his ass up and moved to Texas?

Posted Using LeoFinance Beta

Not saying I agree with dimwits, but is that the before his lawyers and accounts find ways chop the number down figure, or what he actually paid?

Sure, back in the fifties, the nominal top federal income tax rate was 90% and it's about 40% now, but is there even one super wealthy person who actually paid/pays anything like those rates? If so, they’re getting lousy tax advice.

Actually that is not fully accurate. Yes the top federal income tax rate was that but it was not applied in the same way. The tax base was different and the rate only kicked in after a certain amount (like $200K).

Today any tax bracket kicks in from the first dollar.

So once again, people are misled.

Posted Using LeoFinance Beta

I should have said marginal top rate.

After deductions. Standard deduction for most people, but lots of itemized deductions for high-income folks who have competent tax advisors.

Supposedly he is actually paying $11 billion in tax.

Back in the 1950s rich people didn't pay those top rates either.

You can still find bricked up windows in the UK that were done to avoid window taxes in the 1700s.

People who have wealth have always taken steps to prevent or reduce the amount of taxes paid.

Posted Using LeoFinance Beta

The effective tax rate for the top 1% is within 3% of the top effective tax rate that they've ever paid historically, FYI.

The rich pay almost as much in taxes as they ever have, and yet people are stupid enough to think that they aren't paying anything.

The only real tax loophole that is preventing some very wealthy people from paying a lot in taxes is carried interest, and that only applies to a minority of workers in private equity funds.

Exactly why he moved his ass to Texas lol.

That ladies reply to his tweet trigged no other thought in my head then, OK so you are telling me your have a broke mindset.

Posted Using LeoFinance Beta

<3

You're right, but it shouldn't be. The real barrier is emotional - having money and then not spending it is incredibly hard. Being able to project out to your future self 30-50 years down the line is almost impossible for people to wrap their heads around.

Posted Using LeoFinance Beta

It is the same with governments. Thomas Sowell calls this "stage one" thinking. Most people never get beyond the immediate effect of what they do economically (yummy food, new shiny car, lots of votes in the next election) to think about what happens down the line--to them and/or to others. It works for politicians because somebody else will pay the costs beyond "stage one."

The more my net worth increases, the less inclined I am to spend.

Who knew that the desire to appear wealthy can be sated by actually being wealthy.

@nealmcspadden I totally agreed with you here some people tends to spend more than they earn that will really makes them to be a circle nothing to hope for. then you see at the end of the year no good investment in return.

Almost everyone spends as much as they can.

Posted Using LeoFinance Beta

Well said and great perspective on the fact that in one way or the other we need to outearn our spendings.

Posted Using LeoFinance Beta

Yeah, that's basically it.

Posted Using LeoFinance Beta

How can crypto make any American any money in reality though when the guberment will take 40%+ on all your defi profits because they're all short term moves (less than a year?). I mean, that's pretty fucked up and communist.

Posted Using LeoFinance Beta

This is one reason why autocompounders like Cub Kingdoms are much more efficient.

Posted Using LeoFinance Beta

How does autocompounding farms mitigate taxes though?

For example, the one way I believe I can mitigate some taxes is by wrapping my $SPA on FTM. It's a rebasing protocol pegged to its increasing index so, in theory, me wrapping my sSPA should not be equivalent to the taxes I would pay if I had just merely held and staked SPA.

Posted Using LeoFinance Beta

As it compounds on your behalf there are no transactions hitting your wallet.

Posted Using LeoFinance Beta

How are rebase tokens different than auto-compounding tokens though?

Posted Using LeoFinance Beta

With rebase tokens the number of tokens in your wallet is changing. With autocompounders it isn't.

Posted Using LeoFinance Beta

In Italy it would be impossible to do great business, the taxes are very high. I think they are higher than those in the US

Some Italians have figured it out. I don't know the specifics though.

Posted Using LeoFinance Beta

What would we do if crypto wasnt around? The 8% on stonks sounds like a really slow and hard way :)

It is.

I did the same math when I was in my 20s and actively rejected it because it took so long to get going.

Here I am 20 years later wishing I could go back and change my perspective.

Posted Using LeoFinance Beta

2022 wish list item number 31. To pay 11 billion in tax :)

lol you and me both

Posted Using LeoFinance Beta

Haters are always ready to hit and this is the example.I also don't understand the tax issue. May be another fact that rich people get richer and I agree with this point. I like sir Elon Musk ❤️

Posted Using LeoFinance Beta

Most informed Elon haters such as myself, hate him more on the fact that he's a massive scam artist, rather than his boring tax behaviour

I'm not a fanboy either. But can't deny the results.

Posted Using LeoFinance Beta

Anytime I hear people talking about tax I don’t know much about it because here in Africa taxes are not that effective and many citizens here don’t even pay them, but all these percent on tax is just too much..

Posted using LeoFinance Mobile

Don't worry, in a decade or two you'll be stuck with the same systems lol

Posted Using LeoFinance Beta

The system won’t matter as long as I am successful

Posted using LeoFinance Mobile

I had an Accountant tell me to let him worry about taxes. If I have to pay taxes, it's because I'm making money. He said I should instead worry about making more money.

Posted Using LeoFinance Beta

This post is so insightful and makes us all understand that finances aren't just as basic savings and your income but requires some restrain, dedication and most of all you need to know what you are doing.

Amazing post

Posted Using LeoFinance Beta

Glad you liked it

Posted Using LeoFinance Beta

"The trick is finding the balance between what makes living today worthwhile and that future need for money. " You said this beautifully. Everyone will draw the line in a different place. !BBH

Posted Using LeoFinance Beta

Yeah, there's a financial talking head named Dave Ramsey. Most of his investment advice is terrible, but one thing he is absolutely right about is: "personal finance is personal."

Posted Using LeoFinance Beta

Dave is pretty rigid. But in his defense, many of his callers are pretty dumb ( "Dave, I have $200,000 in student loans. Should I lease a BMW?) Also, he probably has PTS from his long past bankruptcy. He is terrified of debt because it hurt him. He avoids it like I avoid alcohol. Except on Hive. !BEER

All good points. You're probably right about the debt trauma.

In general, I'm OK with his get out of debt advice considering his audience demographic. It's when he turns around and says "now buy high fee, tax inefficient mutual funds" that I have real problems.

Posted Using LeoFinance Beta

I agree.

View or trade

BEER.Hey @nealmcspadden, here is a little bit of

BEERfrom @fiberfrau for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Its peoples mindsets that need to change. Allot are still stuck in the system put in front of them by the government and current school teachings. That system is designed to keep most living paycheck to paycheck. Many can't save money because they have no clue how to. Congrats to everyone here on HIVE because if you are on here reading this its likely you broke that mold or are about to. Regarding taxes, there should be a cap on that crap.

Posted Using LeoFinance Beta

My college actually had a steam whistle you could hear all over campus to mark the beginning and ending of classes. It was designed to simulate a factory environment in the late 1800s, when the school was founded.

A max tax is an interesting idea.

Posted Using LeoFinance Beta

Many times I have been told that spending more than I earn will lead me to ruin, and you know what? I keep spending every day more than I earn and the worst thing is that they are things that I don't even need.

Instead of criticizing elon for what he earns, maybe those haters should see what he does to earn that much.

Finally I will try to investigate this more to take door 3, which was the one I liked the most.

Posted Using LeoFinance Beta

I think most companies in the world would go bankrupt with even 0,5% networth/ value tax yearly.

The value is in IP/ machines / contracts. Most of them hold not that much cash.

0,5% for 1B valuation would mean 5 Million additional taxes. Sounds not that much, but if it's all in machines or tech, it can hammer everything down and slow down over years (also cut to add more employees).

I don't understand the mindset of those people, because the damage is higher than every possible earning.

Money is based on future value/leverage ( credit system). So if you take value from today, you have less tomorrow.

But:

Taxing the rich sounds better and needs no explanation right? Because everything is unfair and is all their fault.

Everything should be free right?

Posted Using LeoFinance Beta

The part(s) I always find hilarious about wanting to tax rich people more is that 1, there's not enough rich people to go around, and 2, if you give the government more money what are they going to do with it? Bomb more people?

Not like the tax base comes anywhere close to government spending anyways.

Posted Using LeoFinance Beta

And with more tax, the government is forced to be more inefficient.

The biggest net spender in fiat is always the gov.

And gov doesn't work as a business, they can forever make loss bets and go on with that.

In the end, the citizens pay the bill.

The most retarded thing IMO is to print fiat into force people in a direction with the money.

It's far far away from free markets.

A better way is, if the government ( or the citizens) want a change, simply add a price tag to something you don't want and give it 1 to 1 to something you want to support.

No middlemen.

Don't want to burn coal? add an additional price per mhw there and give the difference to in mhw to renewable ( for example saving technology, that works for decades).

But yeah governments don't think that way about long-term plays.

its also spent extremely inefficiently. Private contractors likely given insanely bloated amounts for projects in return for favors.

Thanks for the read. an interesting way to say buy Splinterlands assets and hold them :P in all seriousness cutting my living expenses down to almost nothing well on an avg fresh out of high school income and focusing on investing has paid off more then the college degree I earned at the same time.

It's a plan that works!

Posted Using LeoFinance Beta

$11 Billion or 11 Trillion, these kinds of Haters Elon will never satisfy until he's living out of a cardboard box without a penny to his name.

Posted Using LeoFinance Beta