The Hive-Backed Dollar (HBD) and How it Can Carry HIVE to Mainstream Adoption

Decentralized stablecoins are growing. Something I have been tracking is how much they are growing - they have consistently been eating away at the market dominance of centralized stablecoins.

Stablecoins like DAI are gaining more and more traction over stablecoins like USDC/USDT. This is a great thing for the industry.

Centralization is a massive risk. That's not to say that decentralization is risk-free... we don't have to look too far in the past to see UST and the decentralized stablecoin that deathspiraled and cost this industry billions of dollars.

That being said, Decentralization carries a lot of benefits. If a decentralized stablecoin comes along and is able to successfully capture billions of dollars in capital inflows and not deathspiral (and that is quite important).

HBD is so valuable to the Hive ecosystem and the broader crypto ecosystem. It's also very tiny. There is only 11.2M HBD in circulation right now and 7M of that (62.5%) is staked in HBD savings. This % keeps growing as well, so there is only 4.2M HBD that is available to be bought on the market and that figure keeps decreasing.

The only real ways to get significant quantities of HBD outside of buying that 4.2M is either:

- Have a DHF proposal and earn HBD payouts from it

- HIVE->HBD conversions which requires buying and burning HIVE

Both of these (should) be bullish for Hive. The 2nd is obviously bullish for Hive. The 1st is a bit more theoretical. In that funding from the DHF should be going to projects that are actively developing things that are highly valuable for Hive as an ecosystem - a debate about whether or not this is occurring for most of the currently funded Hive DHF projects is outside the scope of this article.

Let's start by addressing some concerns circling HBD and then talk about a bearish and bullish case scenario.

I am going to be quoting and using images from @dalz's most recent post about HBD interest and inflation data. The man is a one-stop-shop for all the best data on Hive, so give him a follow and refer to this article he wrote as the source of all the following charts and quotes.

Worries of Inflation Created by HBD Savings

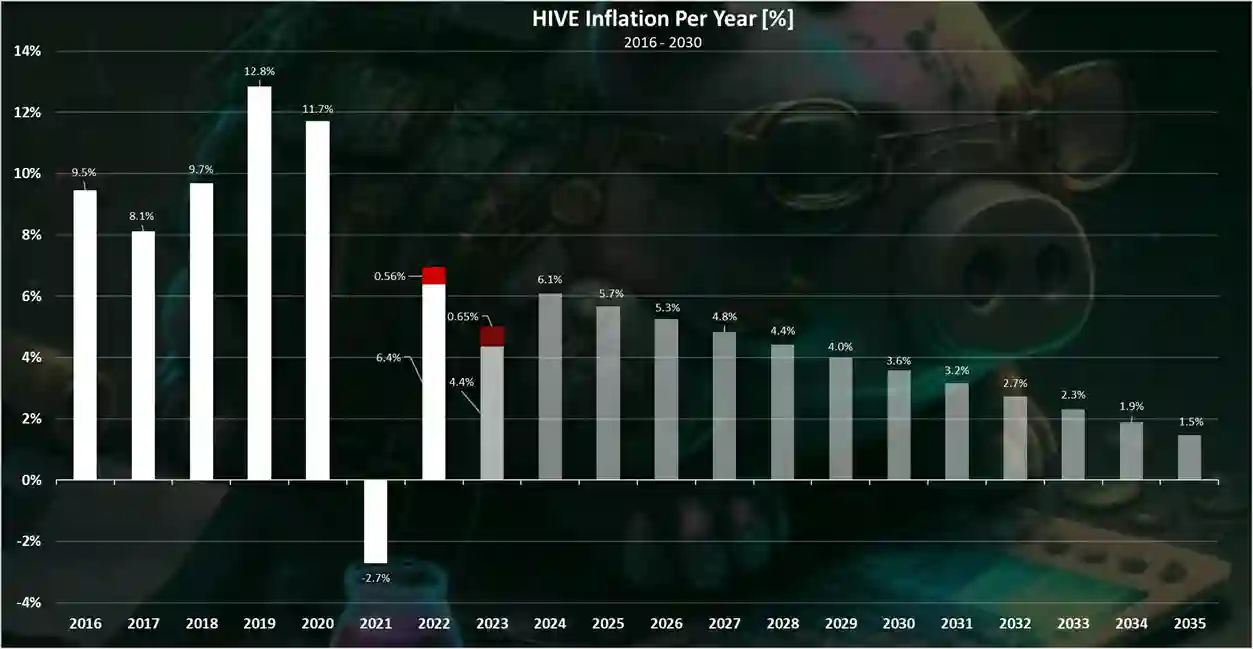

"Currently, the regular inflation rate for 2023 is around 6.5%. However, for example, Hive inflation for 2021 was deflationary at -2.7% due to conversions. The realized inflation for 2022 was same as the projected rate at 7%, while in the first half of 2023, we are slightly under the projected rate of inflation, around 5%."

Frankly speaking, a lot of people are worried about HBD inflation. That is, now that the earnings rate for HBD is 20% APR for saving it, people are worried that it's causing a ton of inflation.

The numbers speak to the exact opposite. Anyone who says they are worried about HBD's 20% savings APR causing inflation simply ignore the actual numbers or they live in the future and believe that it isn't a problem now but will some day be a problem.

While it someday could be a problem, you could also step into the street and get hit by a bus. Look both ways and be prudent would solve both of these problems.

HIVE was deflationary (-2.7% inflation) in 2021. it was 7% in 2022 which was the projected amount of inflation and in the first half of 2023, we are at 5% which is also the projected inflation rate for this year.

"Up to 2023 the numbers are realized, and after that, they are projected"

Of that 7% in 2022, HBD interest accounted for 0.56% of it.

The projected % of total Hive inflation that HBD is expected to account for in 2023 is 0.65% of the total HIVE Inflation - 7% - (using data from the first half of 2023 and extrapolating to the end of the year).

There is 7M HBD currently in savings. The circulating supply of HBD is 11.2M. Which means that even if some whales come in and buy up the 4M HBD that's out there (and trust me when I tell you that they won't be able to buy all of that 4M because much of it will remain in traders' hands / liquid on exchanges / market makers, etc.), there will only be 11M HBD in savings.

What IFs on Getting 20M+ HBD in Savings

One of the main arguments against 20% APR is that if we get a really large quantity of HBD in savings - say 20M - then the interest being paid to the $20M in savings will start to add up to a larger % of total HIVE inflation.

Sure, that is true but where will that extra 9M HBD come from?

We just said there is only 11.2M HBD out there and the supply is not growing very quickly. Actually, it decreases much of the time.

So where do they get the 9M HBD?

Ah conversions. The mechanism where they have to Buy HIVE and then BURN IT.

"On the upside we would expect more HBD in the savings, conversions from HIVE to HBD, making HIVE deflationary. For additional 10M HBD at the current price we need to burn 27M HIVE at the current prices. This will inevitably push the HIVE price up, lowering the potential inflation from HBD interest."

Dalz says that if an additional 10M HBD hit the market, it means that 27M HIVE (at current prices) was bought and burned in order to get it.

Wow. 27M HIVE burned from the supply. Since most HIVE is staked as HIVE POWER, what do you imagine the price of HIVE will do if someone comes in and buys 27M of it only to burn that HIVE POWER?

Bullish Scenario for HIVE & HBD

So this brings us to a quite bullish scenario for HIVE and HBD. We want more HBD in savings, not less. The circular economy of HIVE thrives on money coming into the ecosystem.

This is incredibly important. It's also one of the key reasons for the rapid rise of LUNA and UST.

There was an obviously poor ending to LUNA and UST but they had no mechanisms in place to address issues that were blatantly obvious in the months leading up to the deathspiral of UST.

- they had no haircut rule (we do)

- they had no way to address APR quickly (we do)

- they grew way too fast (we have certain limitations due to HBD & HIVE liquidity on exchanges)

HBD and HIVE are very different compared to UST and LUNA. UST was hard-pegged to $1.

HBD is not hard-pegged to $1. It's a stable-ish coin which means that if the system starts taking on immense stress, the haircut rule comes into play as well as other mechanisms. The HBD price dips below $1 and conversions change to be more attractive to burn HBD and get HIVE and vice versa.

A Big Experiment

I promised a bear case. The bear case in my honest opinion would be the amount of HBD in savings growing too fast to handle. It would mean tens of millions of HBD getting staked into savings and earning interest and that interest outpacing HIVE inflation and creating a materially high % of inflation for HBD savers.

If this happens and happens quickly, the inflation rate on HIVE could start increasing.

As that happens, people may freak out and start selling HIVE.

As these people sell HIVE, the HIVE price will go down. Right now the minimum HIVE price is $0.075 to defend the HBD peg.

If the price of HIVE starts spiraling downward from $0.35 to $0.075, people will get more and more afraid. A bank run on HIVE may happen where users power down HIVE and sell it as fast as they can.

Users with HBD in savings may also get scared. They may start dumping HBD as fast as they can in preparation for a de-pegging.

So we see here that the biggest risk to the Hive ecosystem is:

- Rampant inflation

- Bank run on fears of rampant inflation

- Bank run on fears of de-pegging due to HIVE debt issuance via HBD

This all being said, it begins with getting too much HBD in savings. Meaning, we get so much HBD in savings to the tune of tens of millions of HBD AND the HIVE market cap doesn't grow to support this.

Keep in mind:

"If we set the price of HIVE double than that is today then the inflation form the HBD interest will be half from the number above"

As the HIVE price increases, the % of inflation from HBD actually decreases. Since HBD remains at $1 and HIVE increases beyond $0.37.

Counter Argument

My counter argument to the bear case for HIVE/HBD is that in order to get tens of millions of HBD into savings, we need to buy and burn 3x as much HIVE (at current prices) in order to actually get the HBD into circulation.

I simply have a hard time seeing that happen and happen in a rapid manner that makes it hard to operate on Hive.

What I mean is that if this starts to happen, it will be an obvious occurance. All of us will see it and it will take weeks, months, if not years.

So we can see the danger coming a mile away. LUNA and UST did not have that. They started deathspiraling before anyone could realize it let alone make any protective changes.

Do Kwon is believed to have seen it coming and that's why he started loading up on BTC to defend the peg in the months leading up to LUNA's demise.

Imagine if he could have reminded everyone that if it deathspiraled, UST would be worth less than $1 and then conversions could take place so people could unwind.

Additionally, haircut rules and the APR interest rate could change.

All of these things protect HIVE from a deathspiral.

That being said, being mindful and having these discussions is vital to the future of Hive. I believe HBD's renewed economic focus on this ecosystem has the chance to take HIVE to incredible new heights and onboard a mass of new users and capital to this blockchain. We desperately need both of these things.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 3.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

The Hive.Pizza team manually curated this post.

$PIZZA slices delivered:

@torran(7/10) tipped @khaleelkazi

Join us in Discord!

Thanks for this, I learn a lot about this one and might save HBD more.

I'm saving more! I think it's a good move

Balancing an economy is not simple. The Hive one is pretty small right now, but if it got huge then it could make things trickier. I just read a post by @demotruk on circular HBD economies, so you seem to be thinking about similar things.

I've not got a lot of HBD savings as I find HP more interesting, but it's good to have these options.

I agree, it definitely gets harder as things get bigger

That being said, I think Dalz has done a great job of outlining that it's not going to suddenly get HUGE overnight... it takes buying HIVE and converting it (burning it in the process) to print a bunch of HBD

That would make the HIVE price balloon like crazy, enriching all HIVE POWER holders

The balancing act that HIVE-HBD ecosystem has between HIVE POWER, HBD savings, conversions and generally low liquidity is quite fascinating

It prevents us from growing super large in a short period of time which is both a hinderance and a protection

Amazing, get to learn a lot from you. Had a query how can we create this cycle on daily basis....

Glad you like the posts! I've got more coming!

Do you think Hive Backed nation is a good idea???

When Hive Backed Khaganate?

HBN

Basically, having more HBD, burning more hive and keeping it at decent price. It's not easy running the ecosystem. It's great to see all those safety mechanism in place.

Yes 100%. It's a complex system but the good news is that it scales up very slowly

Just 186,000 earns you 100 HBD per day at the moment. It's one of the easiest ways in recent times I can think of making $100 a day which is often a goal for many.

Yep and $600k will get you $10k per month which is another fixated goal for many

Working my way to getting $600k in there. It's tough because of low liquidity but I think that's healthy for the ecosystem, that was one of my main points in the post

People worried about what would happen if $20m+ was in savings clearly have not tried to buy any significant amount of HBD lol. it's very hard

That's life changing money even with the crazy high inflation.

Wish I understood better all the economics behind HBD/Hive, but I also believe that HBD can be a great catalyst for the Hive-ecosystem. Just see how Luna grew, we just need to learn from their misstake

That's exactly right - examine what they did right and what they did wrong

I think Hive-HBD has a good solution for what they did wrong, now we need to look also at what they did right in spurring so much dev activity and bringing billions of dollars into their ecosystem

Got to learn alot from you, can actually grow and save my HBD with the guide from this post

I'm glad I could help!

Yeah I was going to say this, the APR can always be adjusted if the savings inflation is climbing higher than that of Hive

Exactly. Hive is a nimble blockchain, we have good parameters in place that can literally change on a dime

APR can change nearly instantaneously once witnesses agree and that's if it even comes down to doing something drastic like that. Otherwise, let the haircut rule take over and the economy fix itself

Just wait for when Hive is at $5 how much conversion and burning will take place as doing it now is just not the right time due to price.

Happy to have @leofinance as a witness

https://reddit.com/r/CryptoCurrency/comments/1563nyc/the_hivebacked_dollar_hbd_and_how_it_can_carry/

The rewards earned on this comment will go directly to the people( @acidyo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Forget BTC and ETH, Imma gonna dollar cost average into HIVE.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

I am always looking forward to that day and it makes me excited everyday 🤩 !PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Interesting analysis. Now would be sound to buy more $HIVE and stake a minimum $HBD, due to the fact that $HIVE can have a 5x-10x on a short term. 2x would be keeping $HBD for 4+ years, given the compounding effect. On a side note $HBD is a safe heaven when the market is high and a decrease is expected.