Silicon Valley Bank | The 16th Largest Bank in the U.S. Goes Under

Bank runs are not exclusive to Crypto. In fact, crypto didn't even invent them. There's a reason that they're called bank runs afterall.

In a fractional reserve system, if enough people start withdrawing at the same time and some bad news cycle coincides, you can quickly see a bank go under. They may very well have the capital to cover deposits, but it might be tied up in investments.

Afterall, that's how a bank makes money, right? They take deposits and then utilize those deposits to buy assets, lend it out for interest, etc.

A basket of options often makes up what a bank owns in terms of assets. These various assets are earning interest and when people come to the bank to withdraw, things are ok. The problem is when everyone starts frantically withdrawing. That's when the bank is under pressure to liquidate positions - often at a loss.

Silicon Valley Bank | The 16th Largest Bank in the U.S. Goes Under

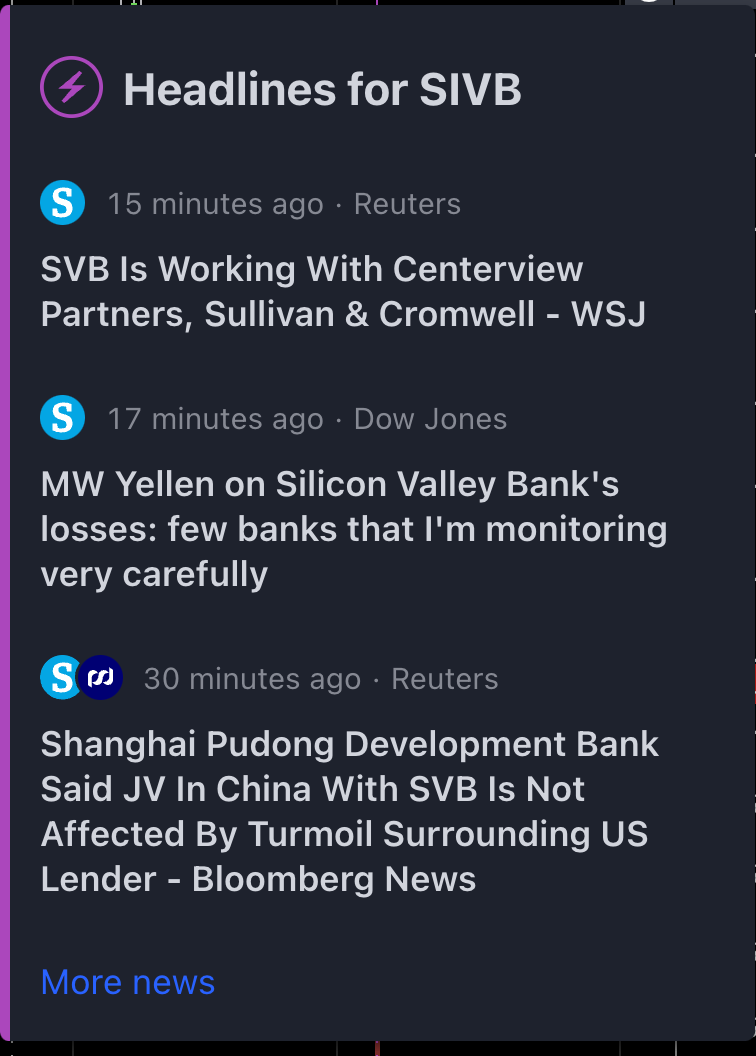

SVB opened down 70% today. That's a nasty candle. After Silvergate Bank (a different institution that serviced a lot of large crypto firms / exchanges. I wrote about them yesterday) went under, people are already on edge. Then they started hearing about some interesting pieces of news out of SVB:

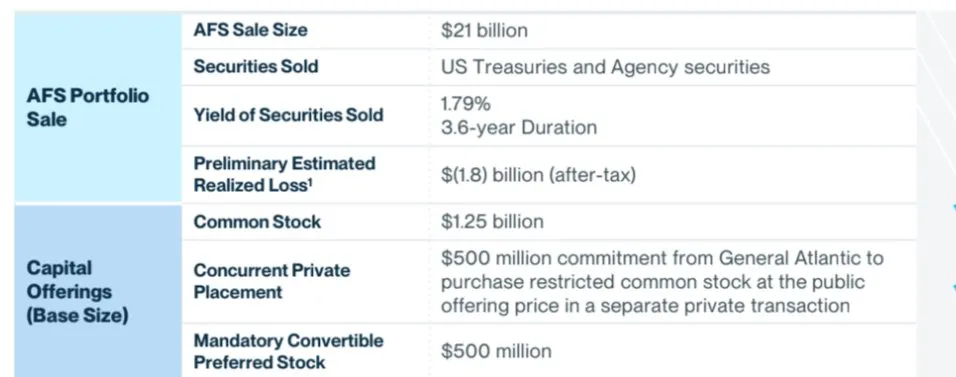

- SVB sold $21B in medium-duration securities, realizing a $1.8B loss

- The bank stated publicly that they were taking $500 Million from General Atlantic

- Simultaneously, they announced a 2.25 Billion equity and debt offering to raise capital

This was the equivalent of yelling FIRE! in a movie theatre. We saw a bank go under and at the same time saw another bank liquidating assets at a loss while simultaneously announcing that they were raising capital to help with deposits.

Samir - Former SVB Employee on Twitter

The Bank Run

What followed was a massive bank run. SVB primarily services venture capital firms and tech companies in Silicon Valley - as the name aptly suggests - and an enormous number of withdrawals happening all at once led to an inevitable failure in the fractional reserve banking structure at SVB.

They announced that they will be looking to get bought out.

The Broader Economic Thesis

There are a lot of ideas floating around about the economy right now. People are trying to figure out what the hell is going on.

We live in uncertain times. Whether you're in business or even just a middle-class family living in America and trying to buy your groceries.

Everyone is hurting right now. Even the billionaires are losing net worth like there is no tomorrow.

The FED's economic policies have undoubtedly weakened not only America but the entire world. We're seeing a lot of pain right now as we whipsawed from a 0 interest rate in environment and free money everywhere to high interest rates and everyone clenching their buttcheeks for a potential recession / depression.

In my opinion, we're in for more pain until the FED reverses course. Nobody knows when that is going to happen but the FED is undoubtedly driving the ship right now.

We were sitting on a massive asset bubble caused by FED economic policies both before and during COVID. Things accelerated during COVID, but they were already headed in that direction.

I'm sure this will come as no surprise to you, but this strengthens my belief in programatic monetary policy. Why the F*ck in 2023 are we reliant on a guy to decide what happens to monetary policy on the whims of whatever the hell he feels like doing?

The FED is looking at delayed data, they are biased and most importantly, they are human. They make mistakes. Why are we not relying on programmatic monetary policy? Why don't we have real-time economic data feeds?

Bitcoin solves this. I'm not saying that BTC will replace the USD or become the primary currency in the world. I think we'll always have government-backed money. BUT I am a firm believer that BTC will be a safe-haven for programmed store of value. Nobody can change the protocol. Everyone has a voice. It's owned by no governments that have biases.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

https://twitter.com/2429520006/status/1634226853815676929

https://twitter.com/1472693700933345286/status/1634566838846619648

The rewards earned on this comment will go directly to the people( @kalibudz23 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Bitcoin only solves things as long a people don't sell at the same time.

We saw what happened last year when that TerraLuna guy sold all his bitcoin reserves in an effort to raise funds to prop up his coin, and in the process tanked bitcoin from $45,000 to $16,000.

It's eerily similar to Silicon Valley Bank panic selling their medium term bonds at a loss.

All these systems are vulnerable to panic sellers.

Absolutely true but there is a big difference here and comparing the two is apples and oranges.

When people sell BTC, they're selling their money. 1 BTC = 1 BTC.

When people panic withdraw from a bank, they're straining the fractional reserve nature 1 USD does not = 1 USD when "70%" of the total asset are tied up in duration-based assets.

Posted Using LeoFinance Beta

Well let's put it this way: the purchasing power of bitcoin (in terms of food, clothes, property etc you can buy with it), is 44% of what it was before TerraLuna guy panic sold his reserves.

Purchasing power is the only true value, as sadly you can't eat bitcoin :-)

The lack of liquidity in crypto is a serious problem, as it leaves the whole eco-system vulnerable to panics.

heheh...

Bitcoin as a network continues to function just fine though. These banks, not so much. This is why self custody is so revolutionary.

Well with crypto, you could be holding on to a useless coin, with these traditional systems you'll have nothing to hold on to.

Arguably drives the ship all the time....

Except when they want to drown crypto exchanges

yup

In the United States, account balances up to 300K in deposits are insured. Banks are required to have FDIC on their deposits.

So this wouldnt be a bank run in the traditional sense. As we saw in 2008, deposits are safe when another bank takes over. This might be the situation here as the Fed (ironic) might have to step in, take the toxic debt off the books and sell the assets to another bank.

Being VC money, it is possible many simply had balances that exceed that level. If that is the case, it could be an expensive lesson.

Posted Using LeoFinance Beta

It's this. It's where start-ups hold their cash. Something like 90% uninsured.

Circle (USDC) is stated as having some deposits there also. So now we have contagion back into crypto. Leaching into BUSD due to the Binance 1-1 USDC BUSD conversions.

There could potentially be some blockchain start-ups with money there also. Which could hit their token values once they announce.

And so it begins. Domino pieces falling one after another and Bitcoin gaining more traction and mass adoption.

Yeah, this ist insane! What do you think will it mean for #USDC Coin?

Similar thing is happening in Nigeria but its governmental policy induced. With the aim to curb vote buying, the central bank of Nigeria change the banknotes and advice all to return all the old notes. After great struggle, everyone deposited their money with banks. No cash in circulation, investment or generation of funds by the banks. Banks/market now are ghost towns! Inflations is the order and biting everyone seriously

We'll be fine sha, little by little everyone is getting use to the system

Thats right. But its affecting every sector seriously. #gosh

I heard BAT wants to use Blockchain to sort out our finance issue

From what I've read they invested $80bn in 10 year mortgage-backed securities to generate yield when rates were down at 1.5%. So it sounds like a huge asset-liability duration mismatch. Which bit them when rates rose and people started to withdraw for better yields elsewhere - yields which SVB couldn't afford to match.

According to this article they were already $15bn in the hole (on their HTM portfolio) at last year-end!

https://blog.argonautcapital.co.uk/articles/2023/03/10/silicon-rupture/

It's shocking to me (as a non-expert is US banking) that they were allowed to continue to operate in this position. How do they pass any kind of stress test with this balance sheet? And why weren't they managing their duration mismatch / hedging their interest rate risk to begin with?

Films like margin call give the impression that US banking is all hyper-technical rocket-science. But these guys appear to have failed because they couldn't manage interest rate risk. It beggars belief.

So that many later come to say that Bitcoin and cryptocurrencies are too risky... The traditional financial-banking system has no morals to talk to us about risk, when there are so many precedents that show that the real risk lies in fiat money and the banking conventional institutions.

Financial institutions going bankrupt is what tells us that Bitcoin and cryptocurrencies in general are the economic future of the world, although, as you said, fiat money will always exist.

I fully agree with what you say in this post, especially that we cannot trust the human factor to regulate something like global monetary policy. But here the political factor, interests and status quo has a lot to do with it. Plus, I also believe that Bitcoin has great potential to become an insurance for the programmed store of value in the future (and I say this, despite the huge down it has hit these days).

Very good post. Greetings.

Posted Using LeoFinance Beta

I hope the government doesn't bail out this bank but I wouldn't be surprised if they did. Take tax payer money to bail out a bunch of VCs who tend to be rich. I am also not surprised that they released the news so late in the week so it dies over the weekend. It's all about faith and confidence in the system is required. Otherwise, it's a death cycle.

Posted Using LeoFinance Beta

Wow, this issue with fractional reserve system, reaches every economy. I could swear that banks in Nigeria have been sending numbers to themselves because non of them have any value withing their walls to handle massive withdraws.

I wrote a post about what happened with Silvergate, it seems like the financial system will never hear the last of crypto. We've gone from destroying things for our financial system to destroying the financial system... By we, I mean central exchanges, they are the only ones interested in these banks.

We are going to experience disinflation, @Khal. Disinflation will wipe out the past 3+ years of gains that speculators have seen in high-growth foreign and tech stocks. I think this will definitely harm the startup cult, but that's not always a bad thing, as we have seen with the SPAC bubble that popped, everyone with a business plan and an idea was being handed money with no concern about sustainability, profit, or how to even solve the problems they were claiming to address.

I think the Fed will raise their target rate range to 6% before any easing takes place. Gotta smash all the markets first.

Posted Using LeoFinance Beta

Thank you for holding virtualgrowth token. You have been included in today's post.

Posted Using LeoFinance Beta

I have heard they had to sell those securitites before maturation because a big Federal Home Loan debt came due. It's curious that a Federal Agency would insist on a payment, which would render the borrower insolvent, especially a bank.

If I was wearing a tin foil hat I might be suspecting Federal Plan Choke Point was real. I shall try not to pay attention to the man behind the curtain pulling the strings.

Posted Using LeoFinance Beta