Binance Auto-Invest Option Review

It's been two months since Binance launched the Auto-Invest option and today I'd like to share my experience with this tool.

Last year in the middle of July, when we had that heavy correction in the market, I decided to set up my pension fund, which means investing around $40 each month in BTC and ETH. Then in December (I think) Binance came out with this Auto-Invest option, which was something similar to my plan, but automated with the saving option.

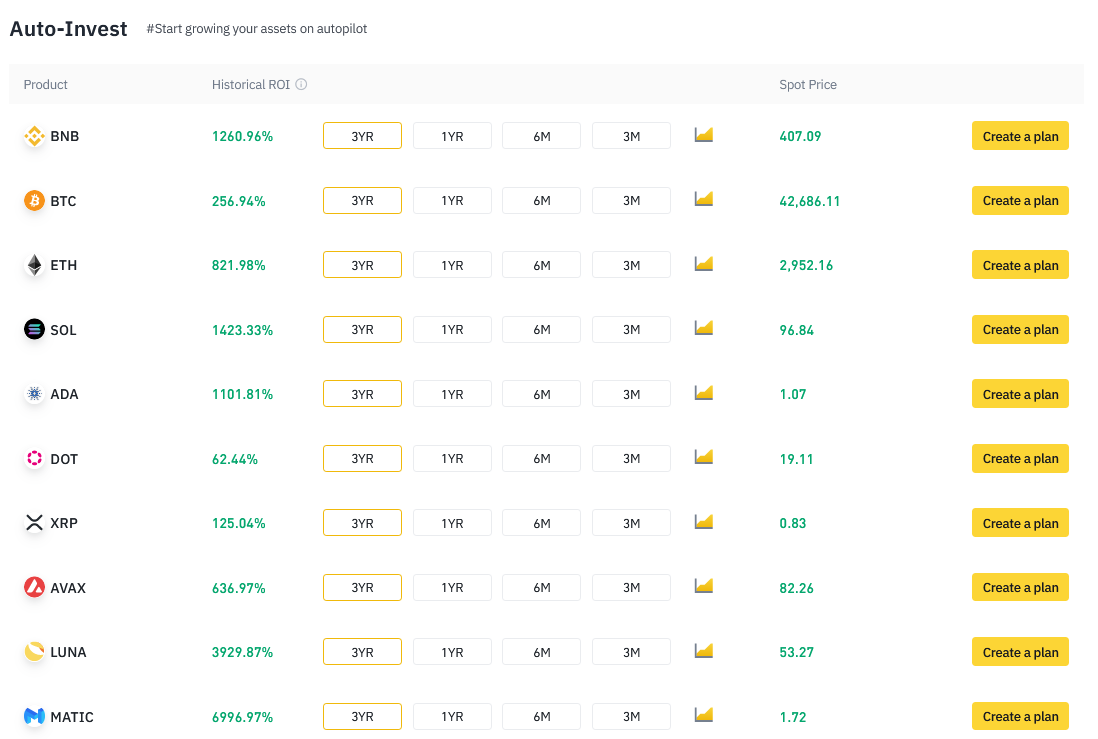

At first there were only three assets participating, BTC, ETH and BNB. Then three days later DOT, ADA and SOL were added.

Since then, the list has become longer and now there are 13 assets in total to choose from.

I started with BTC and ETH in December as this is a long term project for me and had to choose the most reliable ones, that will be with us in 10 or 20 years from now. Then when ADA was added, I decided to include it as besides the previous two, the Cardano ecosystem is the one I trust the most.

How It Works

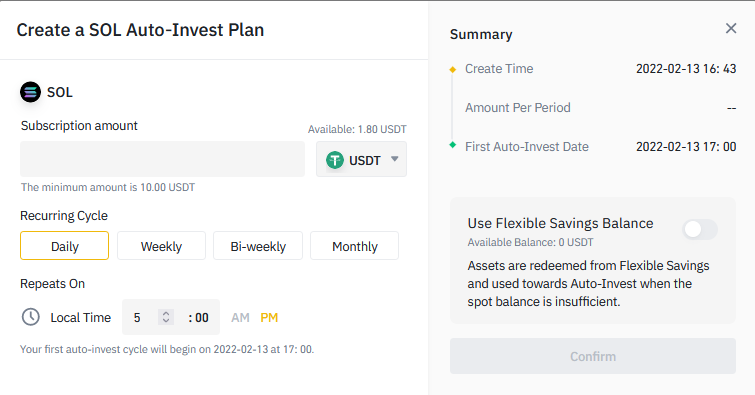

Setting up your plan is very easy. You can choose your daily, weekly, bi-weekly or monthly plan, also set up the time when the bot can create a spot order on your behalf, automatically.

This is a convenient option as it saves you from manually doing it each and every time. Funds are taken from your spot wallet and in case your spot wallet doesn't have the necessary funds, you can opt for the bot to access your Flexible Savings wallet. I don't think I'm going to ever use this option as trusting a bot blindly with swapping one asset for another without considering the risk to reward ratio is not smart in my opinion.

So basically when the time comes, the bot is placing a spot order on your behalf, with the amount you have previously determined, executes it at market price and also stakes the asset in the flexible pool for you.

In case you don't have USDT to cover the order value and don't have the "Use Flexible Saving Balance" option enabled, it marks as failed and tries next time when it's due.

Pros

One good thing about this option is that you can adjust the plan according to your needs. Nothing is set in stone, you can change not only the period, but the day and the time of the buys. I've been gaming the bot ever since I've started using the auto-invest.

The bot doesn't care what the actual market situation is but I do. They say long term it doesn't matter if you buy BTC at 42k or 43k as it's going to 220k anyway, which may be true. However, when I see HTF RSI at the very top, I know it has to reset and then I have a better opportunity to get more coins for my USDT. So then why pay more for less, right?

This is why I've been hiding my USDT in ridiculous market orders, like "Buy ADA at $1", when ADA was trading at $1.25. Those orders might get filled now by the way.

As you can see on the chart, roughly one week ago ADA was trading at $1.25. If I would have left the bot buy me $20 worth ADA, now I would be feeling very bad. The Daily RSI was at 95. Since then we had a 16% drop and it looks like it's not over yet.

Cons

Although there is an option to set minutes as well, it's not working, so you set the hour only and that's it, which is everything but convenient. With a volatile market as the cryto market, one minute can mean eternity and one hour could mean even 10k change in BTC price.

The other thing that I don't like is that if you've set the plan for weekly and have already bought this week, the smartass bot doesn't let you buy again on another day during the week. So you can game the bot to one point but there are limits.

Auto-Invest vs Staking

As I said earlier, there are 13 assets you can create an auto-invest plan for. I'm not going to go through every single asset now as I've chosen 3 of them and these are the ones I'm interested in to earn the max I can for.

Auto-Invest will automatically deposit your purchased crypto into your Flexible Savings account, so you can earn passive income easily. source

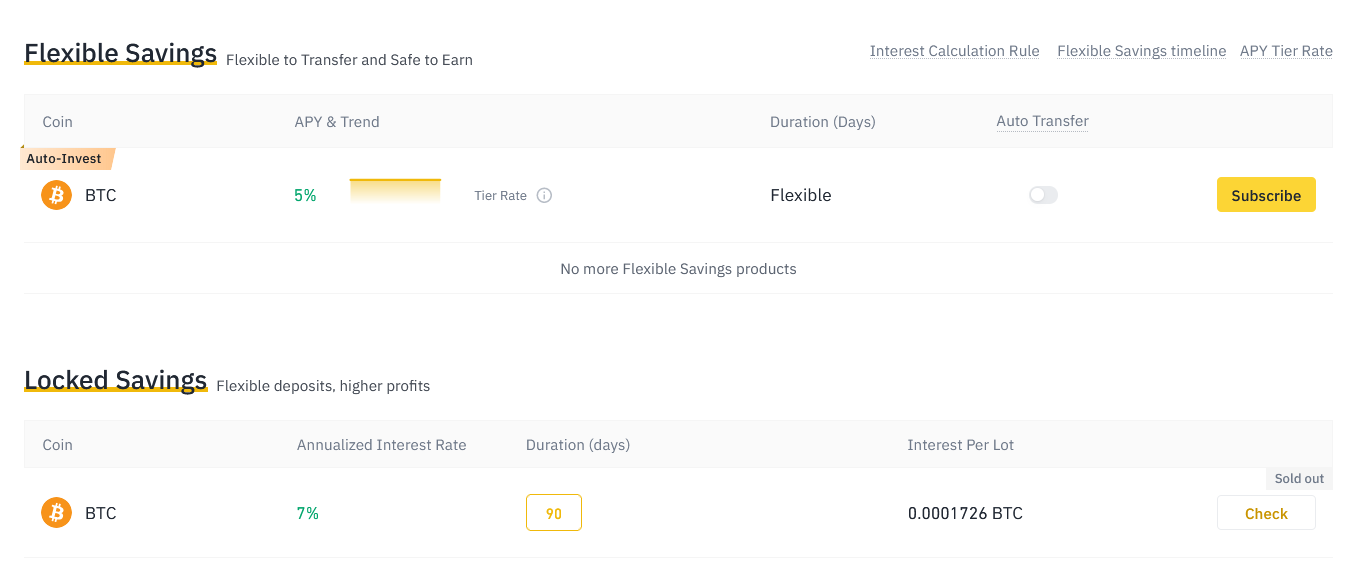

So basically the bot is creating a deposit on your behalf and adding to it every time your buying is due. This sounds good as any earning is good, but if you look deeper into things, it may not be the best option after all.

BTC has an interest rate in Flexible Savings of 5.00% if your stake is between 0-0.01 BTC and 0.80% if your stake is between 0.01-0.5 BTC. In case your stake is bigger than 0.5 BTC, you get 0.10%.

As you can see on the screenshot above, 90 days locked savings can bring you 7%. The problem with this locked savings is that it's sold out most of the times. I've never seen it available yet, although I'm checking it regularly.

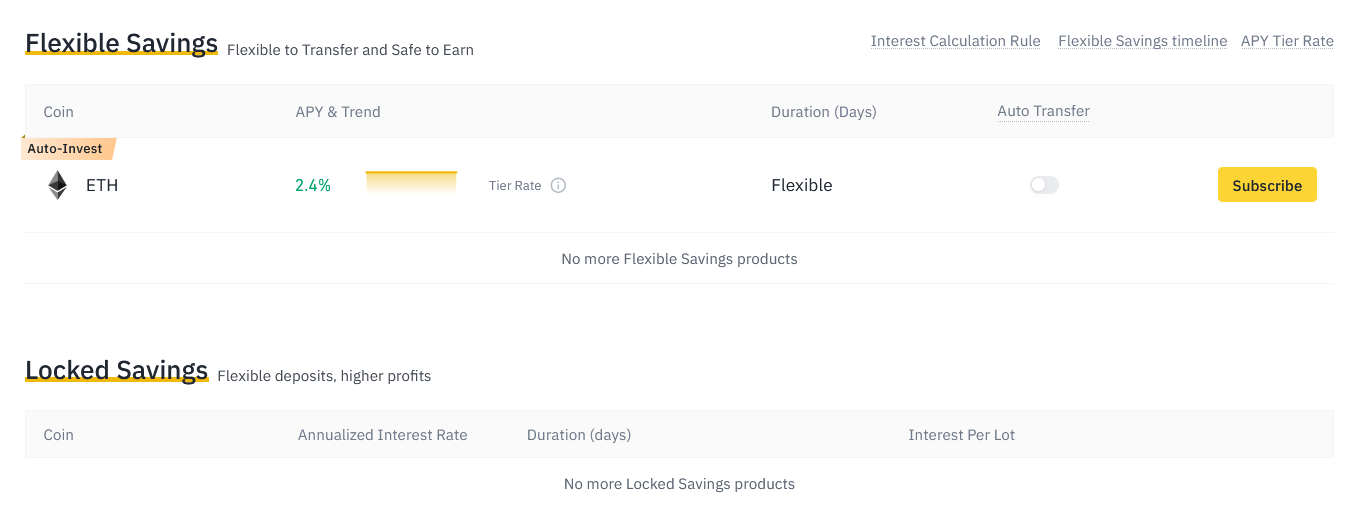

In case of ETH, things are different. Flexible savings can bring you 2.4% if your stake is between 0-0.2 ETH and 0.1% if your stake is bigger than 0.2 ETH and there's no locked savings option for ETH on Binance.

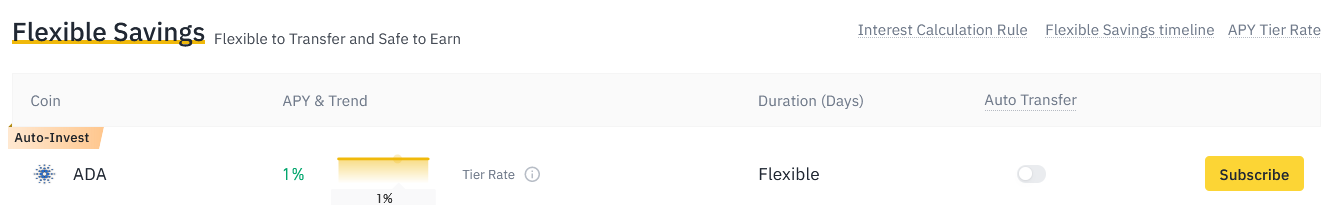

In case of ADA, things are very different. You get 1% in flexible savings (with auto-invest), up until 500 ADA, which is reduced to 0.3% in case you have more than 500 ADA.

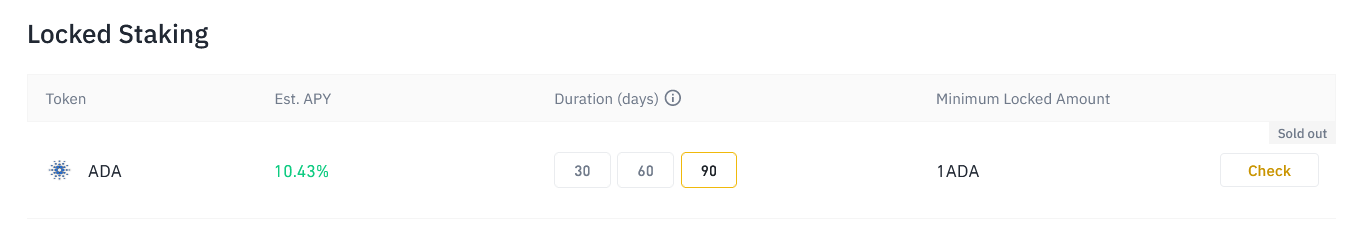

The better option for ADA is obviously locked staking as you can get 10.43% APY for 90 days. But then again, you need to keep your eyes on this option constantly as the competition is high.

Conclusion

Auto-Invest is a convenient option for those who don't have time to watch the market constantly and don't really care about extra earnings. Otherwise, from financial point of view, it is not the most profitable.

BTC and ETH are ok for me for now but I've already pulled my ADA out and have staked it in the flexible staking pool. I didn't have much anyway.

Posted Using LeoFinance Beta

Auto-Invest seems convenient, but it's really just not my thing. I am not sure if it's a mental thing or so, but I just really enjoy having full control over what happens to my assets!

!1UP

It's not a mental thing. If you have a bit of knowledge and do the math, you see the difference between choosing the best option and letting the bot buy blindly.

Posted Using LeoFinance Beta

You have received a 1UP from @mezume!

@leo-curator, @ctp-curator, @neoxag-curator, @pal-curator, @pob-curator, @vyb-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Many thanks @mezume, I really appreciate it.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Congratulations @erikah! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 240000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: