Being A Usefool Tool In The Wrong Hands

Today someone told me there will be some changes regarding the interest rates. In my line of work you work with the law and official documents. So unless there's an official document issued by the bank or the government, any talk can be labeled as gossip and has no value at all. However, I took a look at how the interest rates stand at the moment and remembered what I said in 2020. (I tried to look up my post about the topic, but can't find it.)

2020 was a year many of us won't forget easily and it will also be written in the history books for several reasons. Apart from the covid created lockdowns and human losses, it was obvious from the start that economical consequences are going to follow, which won't be nice.

Photo by Scott Warman on Unsplash

People were looking at options to save the value of their capital. Some rushed to the stores to buy whatever they could put their hands on, while those who had more than the day to day expenses wanted a more profitable option.

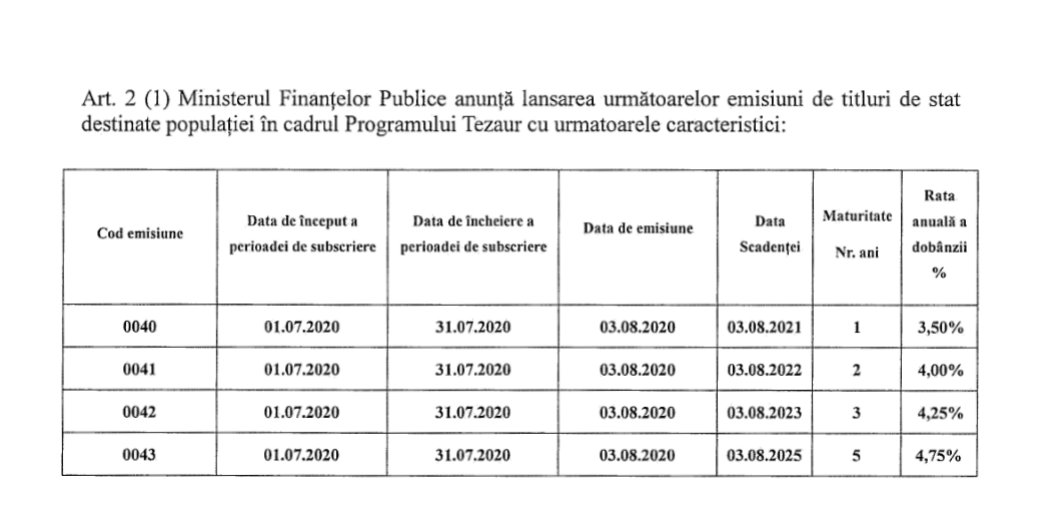

Financial institutions also knew they needed a plan to make ends meet or to survive and shortly after the lockdown was over, the Romanian Treasure launched a bond program with the following offers:

As you can see, there were 4 options, with the annual interest rate ranging between 3.5% and 4.75%, the longest period being 5 years.

When I saw the offer, I knew right away that this was not the best for investors, not by far, but there are people who only trust the government and certainty is the most important aspect when it comes to investment. Well, by buying bonds you can definitely be certain that you're getting the interest rate they are offering you, but nothing more.

For those of you who are not familiar how bonds work, these are issued by the state treasury and have a fixed annual interest rate. Interest rates are payed out annually and at the end of their term, the state treasury is paying the initial investment back to the investors. Bonds are issued all the time, based on the treasury needs. It's basically a way to borrow funds from the population.

Fast forward, there were bonds issued in 2021 and 2022 too, quite many times, but what I want to show you is this.

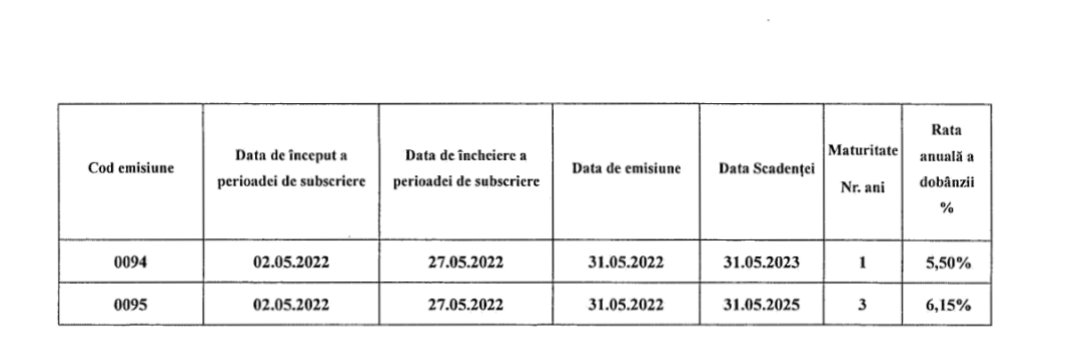

These bonds were issued in May 2022, this time there were only two options available and the longest period was 3 years, instead of 5.

If you look at the annual interest rate, these were already higher than two years ago. The interest rate for 1 year wass 2% higher and interestingly, for 3 years the difference was only 1.9%.

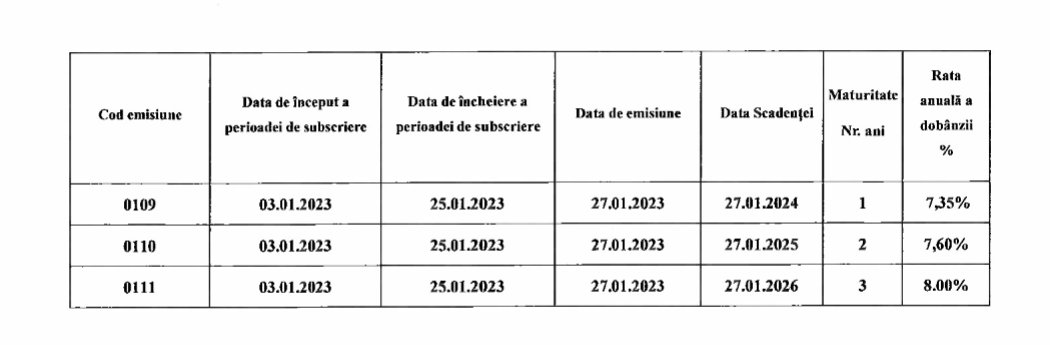

This year has just began and bonds are available again, but at a very different rate, ranging from 7.35% to 8%.

Now imagine those who bought 5 year bonds in 2020, with an interest rate of 4.75%. They still have to wait for 2 years to be able to get their investment back.

How much is the inflation in Romania right now? According to an article, citing the National Institute of Statistics, the inflation rate was 15.9% in 2022 alone. Is this real? I highly doubt it, in my opinion it's much higher and don't forget to add the inflation for the previous two years as well as that counts too. Prices have doubles, in some cases tripled since then.

Knowing how much the official interest rate is, compare it tot the annual interest rate offered by the treasury for bonds and you know the answer to the question if bonds are a profitable investment, or not.

Banks are not any better when it comes to interest rates, they are offering a bit more, but their interest rate is way below the inflation rate.

My intention was not to compare annual interest rates to BTC, but can't help it as BTC is an investment option too. So even if I only compare the 2020 July level to where we're now, sitting on your hands the entire time you could have doubled your investment easily as the difference between the 2020 July level and now is 92% to the upside. But obviously you could have ridden those nice waves and make a lot more money.

We want decentralization and freedom. However, freedom comes with responsibilities. If you want to preserve your capital, you either learn how or you'll be providing capital for others to make money. It's the painful truth.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- Community List And Why It Is Important To Post In The Right Community

Posted Using LeoFinance Beta

This is one thing that has made me skeptical about putting my money in a savings account in a bank, why put it there with some shitty interest rate when I can earn more(on hbd for instance). In my country a dollar to cedi is almost 12 Cedis so no matter how long I leave it I will most definitely be making profit.

There was a time I wanted to buy treasury bills but after much research on it, I stopped myself. I compared it to a lot of crypto investments and it was not nice.

There are people who always want to play it safe so they always want to go to the bank. Maybe they are not educated enough about the crypto space but then I also think they are scared.

Posted Using LeoFinance Beta

Bonds may work when there's no inflation and you have no better option but in the broken world economy we are living in, there's no such thing and I don't think it will ever be. I think the elders are the one still investing in bonds. The younger generation has better options.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thank you!

Posted Using LeoFinance Beta

Lovely post, this points us to the fact traditional investments are losing relevance because they are often not enough being built around it to create any impactful value streams.

Traditional investments have lost relevance a long time ago.That's why we have crypto today.

Posted Using LeoFinance Beta

Most of the time, I feel there should be more of an emphasis/education about crypto investments. It allows you to gain way more interest, when you invest wisely. But also maybe people are just too scared of the volatility in the crypto market.

Most of the countries don't know what to do with it, so there's a long way till crypto education will happen, but we're going to get there.

High schools and universities are teaching about the old system, they don't even care if what they teach is still valid or not.

Posted Using LeoFinance Beta

I agree with you, I think the only way we can develop into the crypto system is when the governments of various countries come together to have a talk about it, and when they decide to accept it, we’ll then see education and more people promoting the usage of cryptocurrency. That’s what I think will be our way forward if we are going to adapt to this crypto space.

Well you never know… with time we might see some interest by the government bodies.

The truth is, there's no time to waste and wait for others to educate people. It's our responsibility to learn. Crypto meant to bring freedom and this means you make your own choices.

Posted Using LeoFinance Beta

That's a pretty harsh ending, but it's true. Unfortunately, that's the reality. I don't know when people will realize it, but you don't have many options in the market to tolerate inflation. There are none at all. Instead, we have to turn to options like crypto. In crypto, you either become a whale or you lose everything. Or you can take small profits and get out.

Many are afraid of change, especially those who are over middle age period already. Learning a new system, when they didn't even know the old one, is not easy. For some it's easier to blame others, than take matters into their own hands.

Yes, crypto is the only alternative at the moment.

Posted Using LeoFinance Beta

If i understand bonds very well, it means, you can only benefit from bonds provided there's no inflation and considering the current global economy, it indicates that most people who participated in bonding years back are currently in loss, which is very bad. In my country for instance, the inflation rate is currently above 30 percent and I believe most other countries are facing similar crisis. Thanks for this educational post @erikah

Bonds are for the super rich, that diversify and buy influence. Anything else is a waste of potential.

Posted Using LeoFinance Beta

Inflation is affecting many things and it's getting harder. The cryptocurrency that is supposed to be the game changer for our generation it's also doing badly recently.

But I think the best plan it's to watch the kind of investment you will invest your money in, to avoid losing everything.

Thank you for this wonderful post, you are amazing !!

Congratulations @erikah! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 34000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I got one shocking debt alert from my bank when I went to verify from the bank I was told it's for card maintenance and I asked for how many years.

Traditional banks has many reasons to stop using them.