Debt and Black Holes

It always amuses me when news regarding national debt doesn't seem to cause much outrage in the States. Sometimes, people blame the other side of the aisle during elections. One may see scorching remarks in the comment sections. A few interested parties may talk amongst themselves, but there is an overall lack of interest for the everyday person.

There are recent claims that the current trajectory will push the US national debt to over $50 trillion within the next ten years. Here are two takes on this development: one from New York Post and the other from CNSNews.

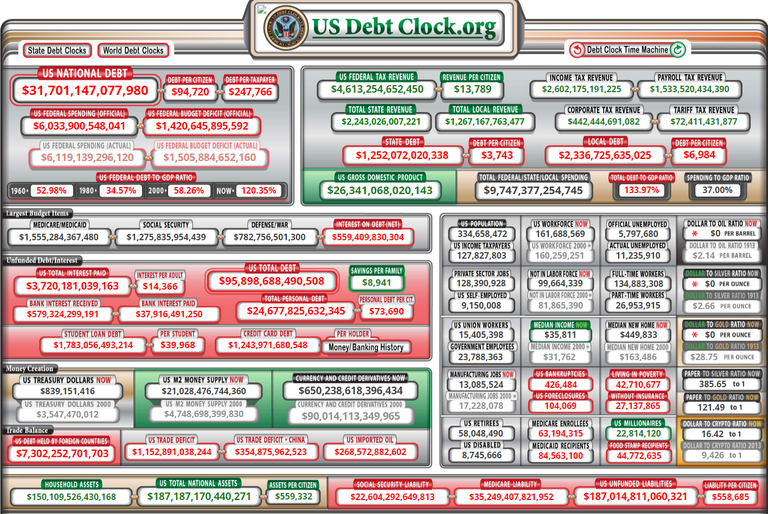

You can compare those articles' claims to this snapshot of the National Debt Clock at the time of this writing.

It often baffles me how the average person thinks "reducing the deficit" is good. It's overspending. It doesn't matter how much deficit you reduce because it's still overspending. Deficit reduction has become the misdirection that distracts the public from poor fiscal practices.

I'm still trying to figure out where the half a million dollars worth of assets per American family come from. It's also amusing to see where that $9000 of savings is from when most people live paycheck to paycheck. Would someone please tell the news agencies that the debt-GDP ratio has long surpassed 100%?

Debating on what to do personally

Some of my colleagues and I have discussed what we could do to best protect our interests. We already set aside what we could for purchasing assets. The most recent discussion touched on taking out our 401K and using whatever is left, after the penalties, to buy things that could hedge against the incoming economic hardship. The current trend seems to suggest 401K is a black hole for purchasing power you may never see again.

For those of you who are unfamiliar, in the US, a 10% penalty is automatically taken out of your account if you withdraw the 401K before you are 59.5 years old. That money counts as income for your tax return that year. So, you are looking at losing around 30% of the funds. Sure, there are some protections under federal law to prevent your retirement from going to zero. The question becomes whether your money is worth anything when you get it.

As the USD continues to lose value, part of me feels I could be better off using that money to buy land or several BTCs. Not to mention, I get an extra several hundred dollars a month for not contributing to my 401K. I could also use that money to stave off inflation or buy more hedges.

Of course, this is no financial advice. I haven't made a decision yet. I'll reevaluate this plan around the next bull cycle in 2025. I'm young enough to start over my 401K as needed.

Posted Using LeoFinance Beta

When I moved 10 years ago I pulled my 401k, as a hedge of sorts. The penalties were rough but I was able to stack some silver with it. Things are definitely not looking good for the dollar

500k I’m assets and 9k in savings??? What are they smoking?? I can see maybe the assets because house prices are inflated so bad.

Deficit reduction… LOL “We plan to spend 1 billion less over 10 years but we are still spending 500 billion more than what we are bringing in…” What a joke!!

Sounds like that move worked out okay for you.

Yeah, we see them bs-ing, but unfortunately, plenty of people still believe the lies.

Paradoxically, if the national debt is eliminated, there will likely be no USD on the planet, because it's all created from debt...

I think many are tired of fake money.