Bullish (Bunny-ish?) on stacking!

It's a brand new year! With it comes some reevaluations. I modified my DCA strategy to include precious metals in my monthly purchases. I haven't purchased metals consistently since 2020. The last two years involved mostly sporadic purchases as I need funds elsewhere.

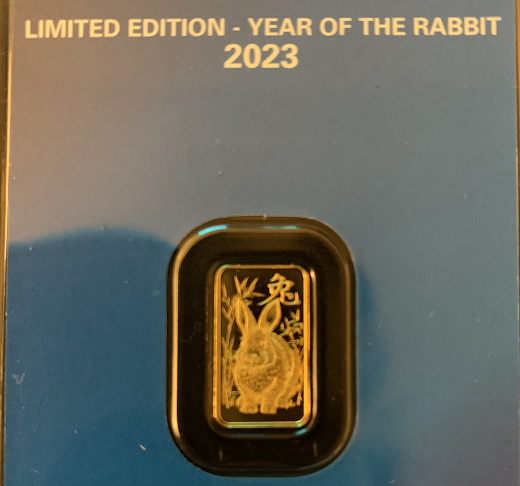

To start, I picked up a one-gram piece featuring the rabbit. The new lunar year will happen on the 22nd of this month. And yes, it will be the Year of the Rabbit. With the ways things are packaged, the plastic outweighs the actual gold.

Sometimes, I wish I had enough disposable income to buy over an ounce of gold outright. Well, I probably could if I plan it out better. Those who chose the DCA approach contribute substantial capital to their portfolios each year.

I picked up a few ounces of silver as well. This time, I found a 3-ounce Indian arrowhead. I decided to put up a regular one-ounce bar to show the scale. I haven't seen too many unique silver pieces from the metal dealers I frequent. I will have to settle for regular bars in the foreseeable future.

The current economic uncertainties led me to diversify my hedges. While I believe crypto is the future, it is still untested against the financial meltdown we will experience. The current not-so-QE environment will be a great time to gather data. Despite the potential downside, I am excited about the prospects for those who have and are preparing.

Should there be a currency reevaluation for the USD, I would like to have things swing in my favor. Never say it could never happen because no one entity is exceptional to the point where it exalts itself above the tides of time.

Remember, not your keys, not your crypto. If you don't hold it, it's not yours. Keep those assets under your custody. Avoid third parties, if possible.

Posted Using LeoFinance Beta

I gifted $PIZZA slices here:

@pixresteemer(1/5) tipped @enforcer48 (x1)

Please vote for pizza.witness!

Nice haul, pal. Looking into making my entrance into gold. Just might f around and convert my IRA.

Good luck!

That is a silver bar still worth holding.

Do people still trade crypto this period

I'm sure there are still people trading.

Happy New Year, @enforcer!

Great way to start the new year!!!

Posted Using LeoFinance Beta

Same to you!

I do have a few small gold, less than 1/10 oz, but I agree, while there advantages to having fractional, I'd rather have full ounces being more cost effective. Luck favors the prepared.

Posted Using LeoFinance Beta

It definitely requires different planning for sure. I'm not sure if I want to try experimenting with that right now.

Wow this is so lovely and beautiful.

The pictures don’t do them justice.

Wow that arrow head looks really sick

It looks much better than the 1oz version.

Wao this rabbit design gold bar looks so beautiful. If I had invested only in gold in the last four years, today I would have made a lot of profit because the price of gold here in Pakistan has gone from 30,000 to 200,000. And still hearing that gold will go even higher. I am thinking to invest some money in gold.

It doesn't hurt to have some!

DCA is a joke with most things, that being said, not with gold and silver. You have the right idea, and I'm glad you know to hold it in your own way!

Posted Using LeoFinance Beta

The other way to talk about it is "recurring purchases", but that sounds less cool.

But yeah, I personally wouldn't try to buy large amounts of metals at a time since I haven't figured out how to be discrete about it yet.

The Gold bar is nice. Great for collecting !

Indeed!

That's a really nice nugget! Got myself the Tiger (Lunar Series) of last year. Looking forward to get more soon.

Another year of stacking.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @enforcer48, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Dear @enforcer48,

Our previous proposal expired end of December and the Hivebuzz project is not funded anymore. May we ask you to review and support our new proposal (https://peakd.com/me/proposals/248)?

Thank you for your help!