xPolyCub Mechanics

xPolyCub all the rage?

Polycub has been up and running 2 weeks now, and many users have taken to the high-yield xpolycub single staking pool. There's a lot to say about how it all works, and many people have no idea. Even I had no idea how it worked when I dumped $23k into this farm 5 minutes after launch. That didn't stop the bag from going to $140k in 48 hours, and then crashing rapidly thereafter to something like $70k.

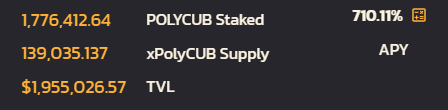

One of the most important thing to note about xPolyCub is that the listed APY is extremely inaccurate. That is to say that the 710% listed above is only how much yield is allocated to the pool via raw emissions. It currently does not take into account the 50% penalty farm from all the other farms getting rolled into it. Currently many users are taking the penalty, so the penalty farm is actually more than the yield being allocated there directly.

- Yesterday I marked the ratio at 12.3229 at 8:30 PM.

- Today at 12:30 PM the ratio sits at 12.7876.

- This is a 3.77% gain in 16 hours.

- Extrapolate linearly to 5.657% in 24 hours.

- That's 2065% APR.

- 527,452,264% APY.

Of course we know APR and APY assume sustained yields for an entire year, so this data is extremely biased and just outright false, but it's fun to speculate anyway and throw a ridiculous number out there during the hyperinflationary phase.

But how is the ratio calculated?

https://docs.polycub.com/polycub-token/token-supply-and-emission

In the docs it just says...

- Sushiswap (xSUSHI staking contract = xPOLYCUB staking contract)

- Adamant Finance (50% early harvest penalty paid back to xPOLYCUB stakers)

Since no one has bothered to look up how xSUSHI works yet, I figured I'd bite the bullet and answer this question because people have been asking questions in Discord.

https://help.sushidocs.com/products/sushiswap-staking-sushibar-xsushi

When users make trades on the SushiSwap Exchange a 0.3% fee is charged.

0.05% of this fee is added to the SushiBar pool in the form of LP tokens for the relative pool.

When the rewards contract is called (minimum once per day) all the LP tokens are sold for Sushi (on SushiSwap Exchange). The newly purchased Sushi is then divided up proportionally between the xSushi holders in the pool, meaning their xSushi is now worth more Sushi.

Currently you will not see the gained amount until you have withdrawn.

It started as 1 Sushi = 1 xSushi, but just like LP tokens the price of xSushi changes over time depend on how many Sushi rewards are in the pool.

We see that the Polycub platform has adapted this technique and implemented it in a slightly different way. Unlike SushiSwap, Polycub is not a DEX; it does not have exchange fees to pull from to bolster the price of the single-staking pool. Rather Polycub combines the utility of both xSUSHI and Adamant at the same time, pulling yield into xPolyCub with the 90-day timelock that exists on all farms.

Shoot, I was supposed to save that for another paragraph.

Yes, the timelock ("x blocks" in the docs) is 90 days. If you claim before then, 50% of your farm immediately boosts the xpolycub ratio.

So xpc gets two yields.

- Regular emission rate inflation.

- Timelocked penalty farm.

Most of us already knew this.

What I was unsure of is HOW this actually happens; how the ratio is shifted exactly, and over what timeframe.

The newly purchased Sushi is then divided up proportionally between the xSushi holders in the pool, meaning their xSushi is now worth more Sushi.

Essentially what has been done is that xPolyCub & xSushi are actually LP tokens, but they are LP tokens in a single staking pool that measure a user's percent worth of that pool. Once we have LP tokens, they remain a static unchanging number of share tokens, but others can enter the pool behind us and dilute our shares.

For example.

- I entered the xPolyCub pool as soon as I could with 9000 Polycub.

- I received 8400 xPolyCub tokens.

- The current ratio was 1.07 Polycub to 1 xPolyCUB.

- As yield entered the pool it was distributed to all xpc holders.

- If 10k entered a pool of 100k tokens, the ratio would increase by 0.1

- Anyone who wants to enter the pool must match the current ratio.

- Just like a normal LP pool paired to another token.

In essence, an LP which pairs polycub to xpolycub is forged. However, instead of buying xpolycub tokens out of the pool like a traditional AMM, one must instead mint them at the current ratio. This ratio can only increase because when users leave the pool they only end up taking their fair share, leaving behind the exact same ratio. As yield coins continue to pour in, the ratio just keeps going up.

However, once we fully realize how it works, we can also see that the more people are in xpc, the more competition there is, and the harder it is to increase the ratio in the first place. Conversely, if a lot of people exited the xpc single staking pool it would be much easier for the ratio to increase, because the yield is being spread out across less LP tokens.

Pretty weird.

I honestly did not fully understand it until now. And I'm willing to bet only like 10% of the people that read that poor description understand it as well. Baby steps, fam.

Conclusion

Well, I think that's pretty much it. Gonna keep this one short and sweet. I believe I have very accurately described exactly how xpolycub works (perhaps in a clunky way). I feel like if you asked polycub degens how it works 90% of them would not actually know how it works. Such is technology. I don't have to know how to build a car in order to use a car.

Even after a recent price drop of polycub from $1.27 to $1.10, the price of xpc still sits at $14. If I had been a diamond hand and just held it this entire time, my $23k investment of 8400 xpc would be worth $117,600. LOL wow... pure insanity.

Unfortunately, I was not a diamond hand. You know I probably would have been had I known that the APY listed on the frontend was TOTALLY wrong but, you know, I trusted the information I was given. Silly me :D

That being said, don't interpret this as complaining. I may have 'lost some money' in terms of opportunity cost and degenerate gambling, but I rather like my positioning at the moment, and I'm still up quite a bit. So far this has been a very fun experiment indeed.

Surprisingly... at 2000% APR, the xPolyCub pool still isn't crowded and is the most profitable pool by far. On top of that, you don't get penalized 50% for exiting before the 90 day timelock. There is no timelock because there is no harvest. Everything auto-compounds immediately. It's a pretty cool little way of doing it that might even be slightly more secure/efficient than the CUB kingdom because of how it works.

Posted Using LeoFinance Beta

The bigger question is how do you just have $26K sitting around to throw into something like this? What am I doing wrong? :P I missed the ball and held most of my earnings as locked before I realized I needed to move them over into xpoly as soon as possible. By then I think the ratio was over 4. I had some in there, but not as much as I should have.

Posted Using LeoFinance Beta

lol $20k was from CUB itself.

I sold 20% of my LP stack to participate.

Of course that's when CUB was trading for 37 cents and not... 20.

haha :D good move buddy!

I such a small fish! Even when I think I am doing good, there is always a bigger fish to humble you. I probably invested a tenth of what you did. I didn't move anything out of Cub though.

How do you sell your cub??

I can't find a good guide on how to do it.

any info is appreciated

!LUV

Posted Using LeoFinance Beta

@simplegame(2/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

pancake swap

Hey @bozz, you see that the $20k came from selling 20%... hehehe!

Down at 20¢ I'm buying up CUB for sure!

Posted Using LeoFinance Beta

If I had some liquid funds I would be buying some too. All of my other tokens are down right now though!

Understandable... If you can work out the math it may be worth it htough. I moved some fiat over mosly because I don't want that sitting in the bank while the USD is quickly moving out of its position as the "reserve currency". What the Leo team has build with Cub and company seems to be a lot more of a safe haven than a US Savings Account.

If I need cash, I'l lleverage my crypto and borrow against it... it's working very well for a couple people I know!

Posted Using LeoFinance Beta

Very interesting! I have some stuff I can move, I am just not sure how big of a loss I want to take on it.

Thanks. I still don't fully get it, but when I started to get the gist of how it was I just moved everything in there from the other pools.

Maybe not the move for very long, but for now seems good. Don't know how I will determine when that changes. Too much math ! :-)

Posted Using LeoFinance Beta

this is pretty cool. I'm bookmarking so I can refer back. You know me. It's gonna take more than a few reads!

Posted Using LeoFinance Beta

Read how this all have started with Toruk

Posted Using LeoFinance Beta

Interesting. Thanks for the info

Posted Using LeoFinance Beta

PolyCUB surprised us with amazing mechanics and sustainability transpires from this model. I would like to see how things will evolve after 90 days when locked PolyCUBs will be flying around...

Posted Using LeoFinance Beta

It's definitely wise to study all this stuff extensively. Took me a while to figure out that the "yield" on xPOLYCUB isn't a numerical compounding situation — if you have 100 xPC, you always have 100xPC, that amount stays constant. It's the number of regular POLYCUB that gets higher, when you decide to exit your stake.

Anyways, thanks for the Sushi explanation!

=^..^=

Posted Using LeoFinance Beta

Yeah. Basically you maximize your xpolycub yield by adding as many as possible as soon as possible. Notice I said maximize, because your actual yield is unknown and varies with polycub price. You can only really know what your xpolycub yields when you sell :-)

All you can really know is that if you add as much as possible as early as possible your yield will be better than if you add less and later. Clear as mud. At least that's the best I could be bothered to figure out.

Posted Using LeoFinance Beta

leofinance’s promise of a token with numbers always going up is more or less cemented and in XPolycub, they've delivered that mandate no doubt in my own opinion . Educative article as always , thanks for the heads up. Best Regards!!

so when people claim their locked tokens early from Farms, the 50% penalty causes the ratio of PolyCUB to xPolyCUB to increase?

also can you explain "raw emissions"

"That is to say that the 710% listed above is only how much yield is allocated to the pool via raw emissions."

Thanks!

Posted Using LeoFinance Beta

'Degenerate Gambling'...lol

I'll say your gambling skills are admirable, and I don't use those three words (gambling, skill and admirable) in the same statement often

Those are three words you don't see often together anywhere!

Posted Using LeoFinance Beta

Wen CUB moon? I have staked for a very long time. The big phat numbers always seem to appear at the beginning.. what does it look like after CUB's lifetime? I'm still staked and staking polycub in rewards, but I'm hoping I'm not feeling like I do with CUB? Is this a 10 year investment?

Great explanations, as always!

Posted Using LeoFinance Beta

@edicted: Always providing massive value

Posted using LeoFinance Mobile

Look a those bags grow! Congrats on yoyr growth although you see your moves as a bit clunky. I am getting in5o th8s cub polycub xpolycub thing late. Better late thsn never me thinks! Go all things Hive!! Keep Growing!! Stay Cool. 🌼

Posted Using LeoFinance Beta

Hi @edicted, you just received an upvote from @gotgame on behalf of https://hypeturf.io.

Hypeturf is HIVE frontend built by @gotgame where you can earn rewards on Hive by creating engaging content and commenting on posts.

I'm gonna have to re-read that art of the post... I don't understand it fully.

I came in at 1:4 ratio because I was late getting my airdrops, oh well still made out in the end (for now). Hopefully it plays out in a very similar way on the next Blockchain!

Thanks for explaining that @edicted

Posted Using LeoFinance Beta

Thanks for explaining the yields on xPOLYCUB in a way even I can understand :)

Posted Using LeoFinance Beta

This is tuitive. I like to say I understand it a bit more. It now makes more sense to me. When you join the pool it gets match 1:1 so I kind of get it. But the ratio bit is still awkward !

Just wondering, won't all of it also slow down once the emission rates drop? Still, the returns so far are amazing and it keeps compounding by adding in the early harvest rewards.

Posted Using LeoFinance Beta

My biggest question is what happens when the airdrop is and high yields are over so there is very little coming into the xpolycub farm.

It looks great at the moment as people are willing to take the 50% hit knowing that they can make more than that by getting their funds liquid.

Once that incentive is gone then surely most people will wait out the 90 days for their earnings and not give away the money.

I think that a lot of people will remove funds at that stage as who wants to be tied in to a defi site for 90 days to earn rewards?

Posted Using LeoFinance Beta

SO much went to the making of this DEFI.

As long the positive needle stays put. I am in.

Crypto manages to make things harder unless you sleep and walk crypto you may understand a comma out of all these.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I'm still going through everything to understand it more haha!

Well, @edicted is there any hard cap on Polycub? I mean on the doc we see 26 million at the max..

Xpolycub is doing well and it moving higher everyday .I believe that it will continue go higher.

My exact thoughts after reading this post.

But no worries.

I can always return for many more reads.

I walked away with a better understanding than I had before though.

Thank you @edicted

I did the same mistake as you. I was attracted by 2000% APR in POLYCUB-USDC farm and ignored 1000% APR in xPOLYCUB. Now, I know 1000% APR is totally WRONG, it should be much higher. However, I still think it's not too late to enter xPOLYCUB so I moved a little bit of my portfolio to xPOLYCUB

Posted Using LeoFinance Beta