The HBD Factor

Like many others before me there was a time in which I wanted to give up on our stable coin entirely. However, in the last few years we've developed upgrade after upgrade and finally the light at the end of the tunnel can be seen. HBD has made great strides and now more than ever we need to respect and praise the work that has been done. This is truer now than ever with the regulatory attack on stable coins kicking into high gear; going so far as to call them "securities", which is obviously absurd by even 100-year-old Howey Test metrics.

Recent HBD upgrades:

- HIVE >> HBD conversions

- Exponentially more volume on the internal market.

- First because of the stabilizer.

- Second because of manual limit orders.

- All users have access to a more trustworthy system.

- This trust creates a flywheel of more liquidity.

- 20% sustainable yields on the savings accounts.

- Shockingly sustainable on a mathematical debt-ratio level.

What are the possible future upgrades?

- A derivative bond market that allows locked HBD in a bond to be traded like NFTs. The auction house that facilitates this utility can use the same tricks as legacy bond markets to make these NFTs more fungible and liquid.

- Dapps built on Hive that destroy HBD debt in exchange for another asset. The best current example of this is destroying HBD for curation on the trending tab. However gaming protocols like Ragnarok will kick this feature into high gear.

- The 5% fee to convert HIVE >> HBD may be dialed down to 2%-3% to narrow the market gap of our stable coin.

- The debt-ratio haircut may eventually be raised higher than 30% if Hive can prove that our demand for debt is stable and will not initiate a bank-run during bear markets.

- Developing nations will continue to utilize HBD for physical brick-and-mortar transactions given that their national currencies can not be trusted.

- These are just some ideas.

The sky is the limit when it comes to programmable money.

What are the properties of HBD?

At this point I truly believe that HBD is the best stable coin in the entire cryptosphere and nobody outside our little corner of the internet even realizes it yet. We've had issues with the peg breaking to the downside before, but given our current debt ratio on top of the stabilizer protocol this is not something we have to worry about for quite some time. This is hugely impressive considering we just suffered a year long bear market. Given the history of the previous bear market and how poorly our debt performed back then, it's easy to see that we've made great strides.

HBD outsources volatility

It's also important to note here that the existence of HBD makes Hive even more volatile than it would be otherwise. This is a counterintuitive phenomenon in which demand for stable coins is positively correlated to the rest of the market rather than negatively correlated.

It's easy to assume that when crypto number-go-up stable-coins should lose a bit of their market cap. After all, stable-coins get sold into Bitcoin to make number-go-up, right? Absolutely not, and we see this proven every bull market as value pours in from the outside and sends all market caps to the moon, including stable coins. After all, how is anyone going to take gains temporarily if not by selling their pumped bags into stables while the market is going up?

The same exact thing happens to Hive.

In a bull market Hive will automatically be destroyed and turned into HBD as HBD demand also increases with Hive. This makes Hive pump even more given a flywheel-effect. Then during the bear market the opposite happens: it becomes more and more worth it to convert that HBD back into Hive at a discount and end up with a lot more Hive than when it was originally sold.

Typical buy low sell high type stuff. However, once again, because HBD outsources its own volatility to Hive, Hive then becomes double volatile in both directions. Maybe some people don't think this is worth it, but I think the numbers speak for themselves.

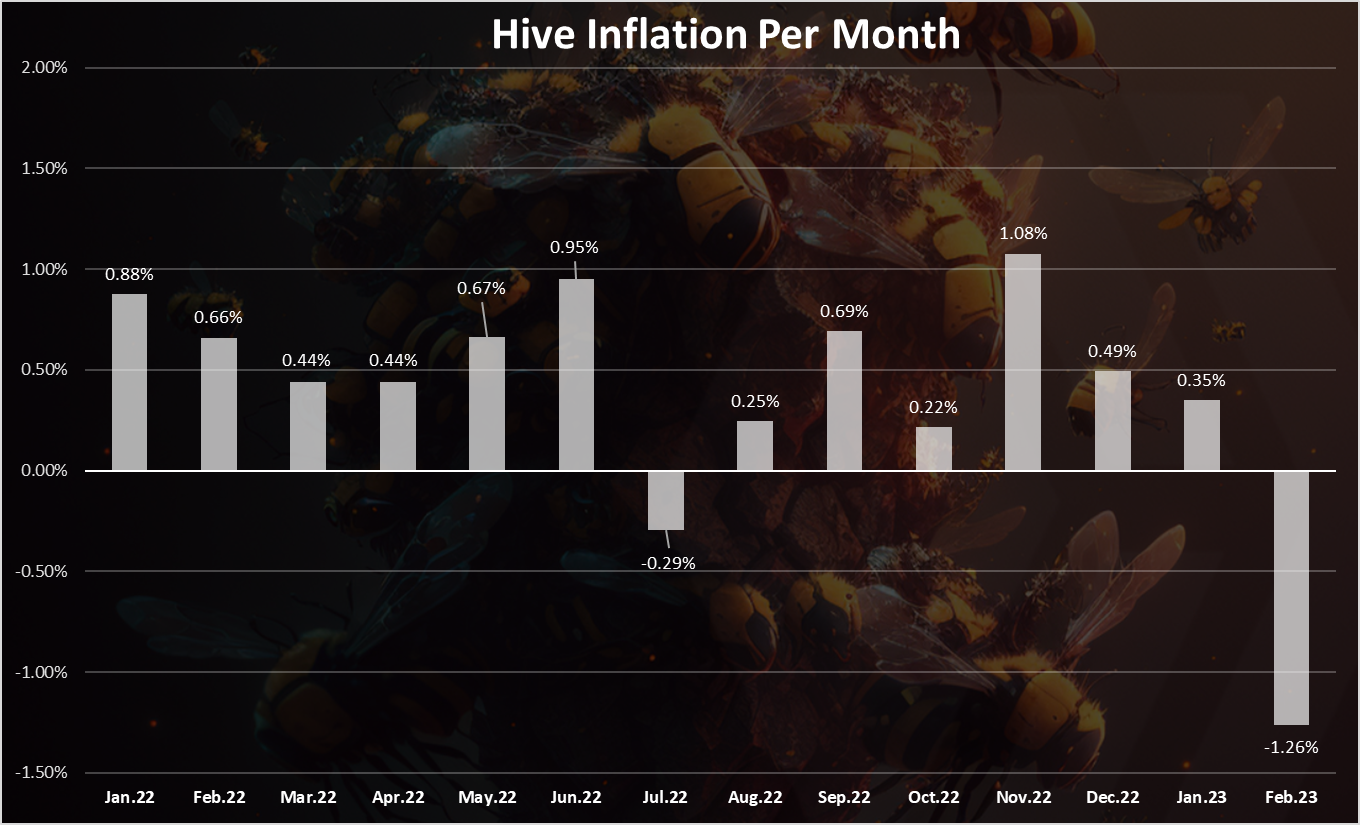

In this analysis post by @dalz we can see very clearly that Hive being able to leverage debt into a stable asset pegged to USD is extremely useful. In fact, during the month of February Hive went extremely deflationary due to all the HIVE >> HBD conversions that occurred. Even though we print a significant amount of inflation (~7% a year?) for the reward pool and the @hive.fund and witness block rewards we still has less Hive in circulation after February than before it.

The numbers don't lie

At the beginning of February we had 396.4M Hive in circulation.

At the end of February we had 391.3M Hive in circulation.

All because the demand for our debt increased and Hive was destroyed to meet that demand.

Is this short term thinking?

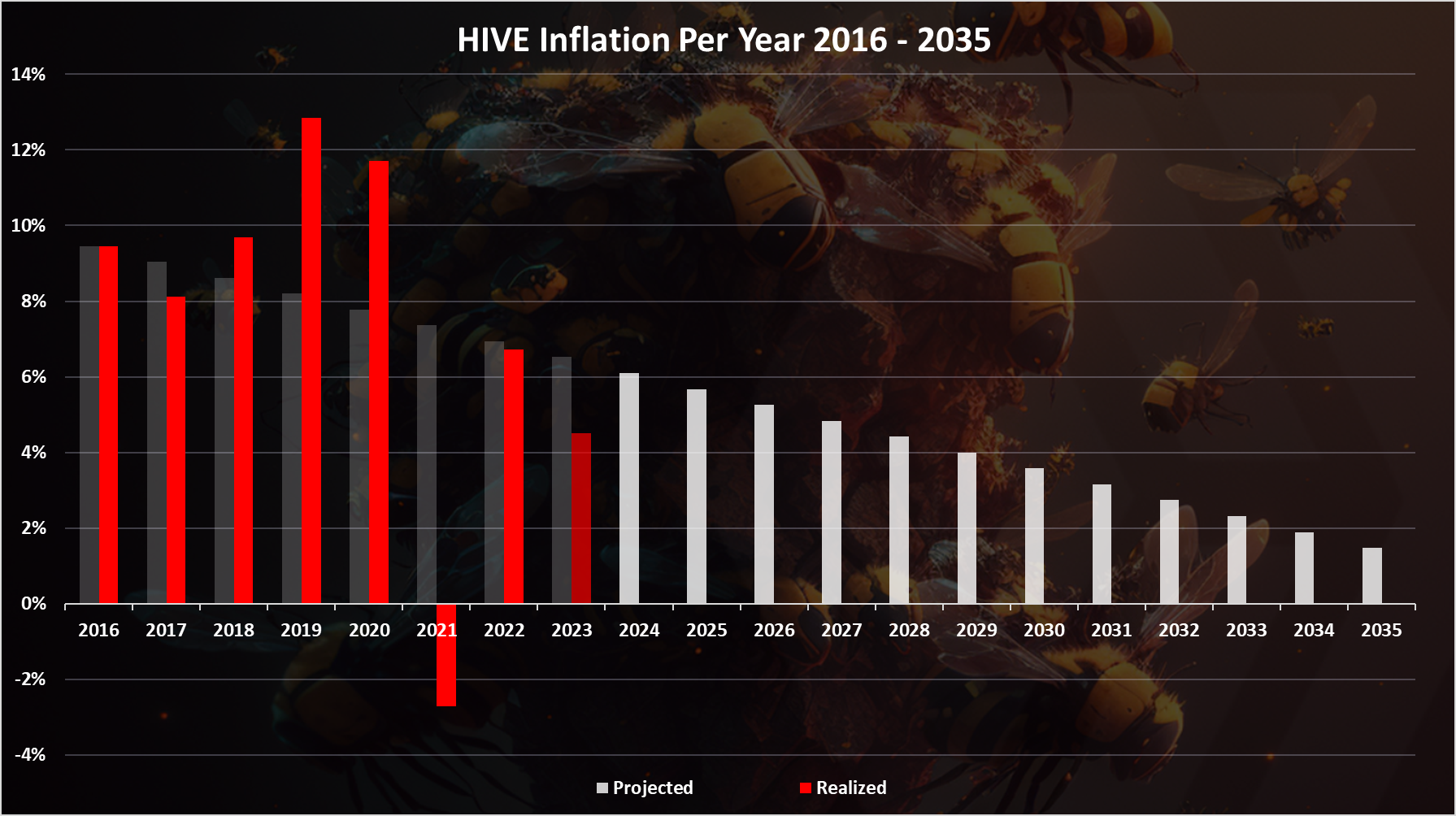

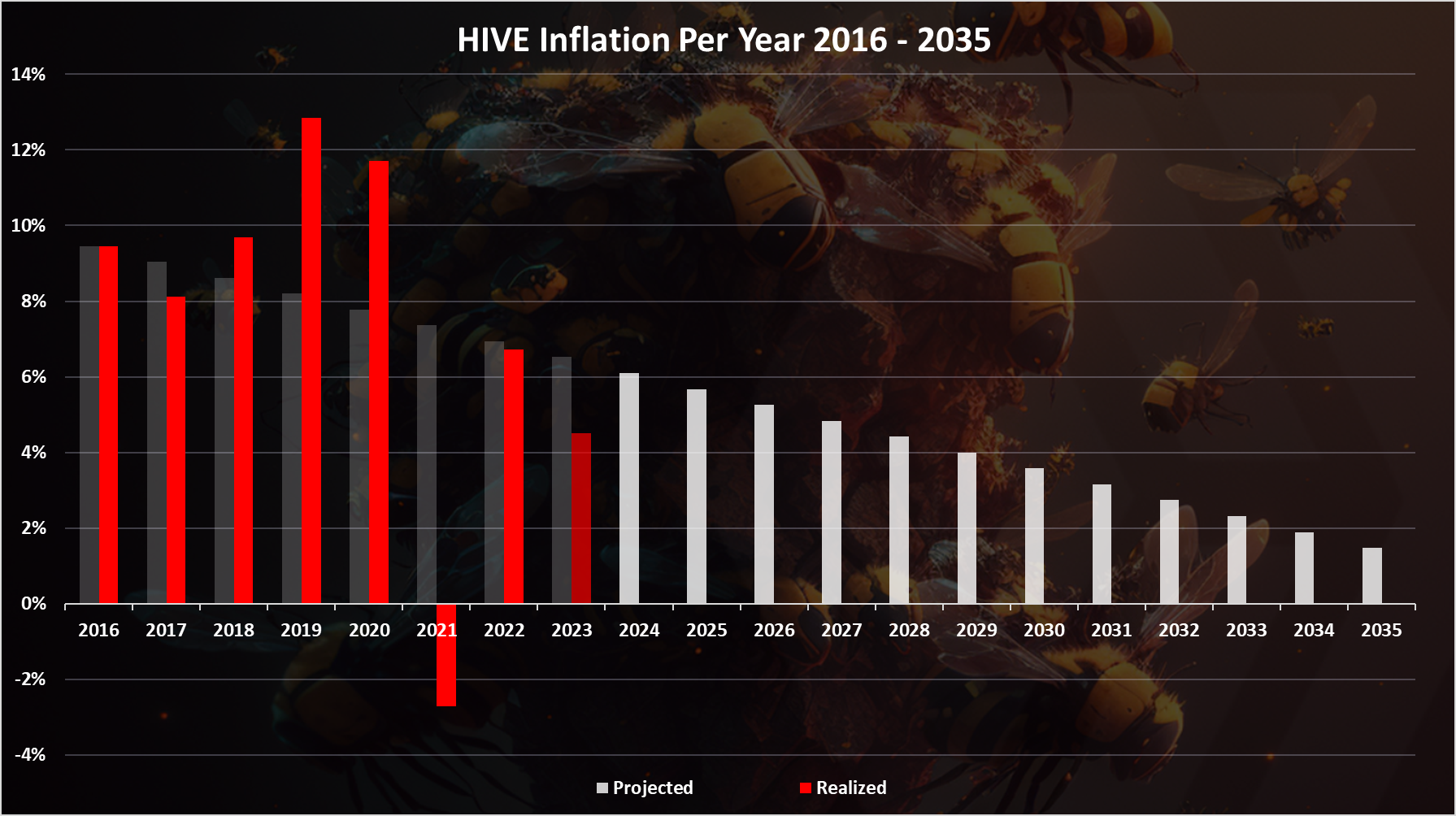

You might be asking if this kind of deflation is sustainable. It we look at the data we can see that back when we called ourselves Steem a bit of an economic disaster occurred. Sure, 2017 was a good year and less tokens were printed... but then the crypto winter hit us like a ton of bricks and oodles of tokens were being printed out of thin air as the debt ratio continually capped out at the old 10% haircut while HBD was constantly being converted into Hive. This was not a good situation and we all felt the sting of failure.

However, now that HBD has all these upgrades in play the chance of this happening again is quite low. HBD can't spike to the upside like it did in 2017. The hard-cap for HBD today is $2. This is the price that it becomes possible to print HBD infinitely and dump it on the market at zero risk for massive profits. Meanwhile in 2017 the debt spiked to $13 and completely wrecked us in the bloodbath that came afterwards.

In 2020 Hive was able to purge a lot of its own toxicity. Many bad actors on the network with a lot of tokens dumped their millions onto the market and exited, which in turn created a delayed reaction within the 2021 bull market. Purging all that bad stake, in addition to quarantining the Ninjamine, was a huge long-term benefit to this network. It is still unclear how far we've come since those dark times.

If we look at the entire year of the 2021 bull market, Hive was deflationary by over 2%. Let's be honest that's pretty insane. What's even more insane is that the snapback in 2022 didn't even overprint tokens like we would have expected it to. Again we came in ever so slightly underneath the target inflation rate. The combination of these 2 years is truly impressive and a very good sign of things to come.

What does it all mean?

It means that as long as the Hive community can continue to increase our demand for debt we may end up becoming a permanently deflationary network given enough infrastructure developments. While many would celebrate this reduction, I personally do not believe it is the ideal state, and would push to increase emissions to counterbalance the deflation (assuming there was a good place to allocate those extra tokens). Luckily this is not a 'now' problem so we don't have to think about it and can just throw it on the back burner.

Conclusion

HBD is hands down the best stable coin on the market. We jacked up our yields to 20% to compete with the big dogs like UST and the like, and now all the big dogs and VC money have been flushed down the toilet during a brutal bear market. Hive still stands strong after all of it, which is honestly hard to believe considering how much we've struggled in the past. We may have reached the tipping point and haven't even realized it yet.

No matter what the price does, 2023 is going to be a huge year for development. That much is certain. Nobody has slowed down just because the bear market is depressing. If anything many developers on Hive are more committed than ever in spite of the bear market. When times get tough on Hive, the community hunkers down and fights. Communities that roll over during the bear market are not to be taken seriously. Couldn't be us.

Posted Using LeoFinance Beta

Good afternoon @edicted , what did you mean by the part that:

Do I need to pay any debt to HBD?

You do not need to pay anything. In order for HBD to be valued at 1 USD the network has to back up the value of HBD. If the price of HBD goes below one dollar the holders of Hive Dollars can convert them to a dollar's worth of Hive. In other words, the network owes HBD holders the value of one dollar...that is where the debt comes from.

The system has a limit on how many Hive tokens it can use to back up the value of HBD (to avoid a scenario where it prints too many of them...that would be bad for Hive). The limit is 30% of the virtual supply. The virtual supply is the sum of the current hive supply and the circulating HBD supply (expressed in Hive).

If the current Hive supply is 392 million tokens the potential virtual supply is 560 million. The amount of hive set aside at this moment is 168 million (which is 30% of 560 million) In theory, at the current prices Hive can sustain a circulating HBD supply of 70 million.

Right now, even if the price of Hive goes to 7.4 cents the value of HBD would still be guaranteed to be converted to one dollar's worth of Hive. All these figures are not written in stone and they can change with the price and supply of Hive and also with how much HBD is in circulation.

Thanks for the explanation, it helped me a lot, have a great weekend.

!LUV

@onthewayout, @wlffreitas(1/1) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

Then we realize its a train coming!

And the name of that train is dollar hyperinflation!

We could see HBD worth thousands of dollars, because it can't keep up with the dollar dropping

😝

You didn't read the part where it says that HBD is hard capped at 2$ right?. That's impossible according to Edicted.

Unfortunately the hard cap breaks if the dollar falls too fast.

Hbd seemed like such a pedestrian investment when I first started getting involved and was looking for 10x gains.

Now, I sock some away every month and use it to snap up hive when dips happen. I really do cover my hp so I can curate with more voting power and delegate 50% of my stack to folks powering up and building.

Really looking forward to the development this year. Half of me hopes hbd stays stable so I can ignore my small stack and have it grow consistently.

What a great token!

Hbd is really the best stable coin ,so far on the Hive network and I really love it

those are some good suggestions! Hope to see them implemented rather sooner than later

I think HBD is stable, I don't know if the 20% APR can last forever, but I think even if it was 10%, there's still a lot of stuff.

I always tend to accumulate a bit of HBD to have a reserve, I think it's useful to take advantage of all the possibilities that our fantastic ecosystem offers 😉

It is unlikely (essentially impossible) that the 20% can or will last forever, but forever isn't really very interesting.

It could, plausibly, last for 10 years: If HIVE increased by 30% per year, which makes HBD 20% interest inherently sustainable, HIVE would still only be around $2 billion market cap, which is not a lot relative to other blockchains. Or even longer. Or it could end up looking excessive (and reduced by witnesses) sooner. Either way, might as well enjoy it while it lasts.

Well yes I agree meanwhile let's enjoy it while it lasts then we'll see what the future will say 😉

I'm certainly impressed with HBD, that being said unless someone is pretty knowledgeable about crypto and this ecosystem and navigating slippage and friction it is still complicated for them. I think it provides a huge opportunity to create mechanisms to utilize this economy to facilitate the flow of funds to HIVE directly or in directly.

Hive Backed Dollars are the most important aspect of our blockchain.

It has the potential alone to catapult HIVE into the top 10.

Posted Using LeoFinance Beta

https://twitter.com/1474070952325656577/status/1632197090271952897

https://twitter.com/1415155663131402240/status/1632227488310124545

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

While HBD has been in development for years now, I just can't say it is in level with BUSD, USDC, and USDT. One reason is perhaps the network that uses it. Unless HBD gets its deserved attention to commerce, e-commerce, and SMEs, I think it still sits below the ones above mentioned.

But again, HBD now is trusted in terms of value. It seems that the coin is ready for commercial purposes.

I wonder if HBD grow in market cap will it become more vulnerable to de-pegging attacks or more resilient.

I don't understand half of what you wrote, so for the benefit of non market heads, how can we safely get involved?

Posted Using LeoFinance Beta