Saying nice things about Polycub!

Polycub is down to 55 cents.

No surprises there.

I really tore into the tokenomics yesterday,

and there is still much more to say on that front.

But also there is something to be said for the 7.2M coins total.

If we assume the lowest market cap possible is around $2M (like cub/leo),

then the lowest the token price can go is 28 cents.

Which honestly is not that bad if it makes a swift recovery from there.

But it's more about the tech than the price sometimes.

The price can do anything in the short term and most of the time day trading is a fool's errand. Everyone even makes jokes about how they'd all be rich if they just betted against every prediction I've ever made... and they would probably be right. The market is psychic and knows how to extract value from us in the most unforgiving ways.

Leofinance has put in a lot of work into these things, and it would honestly just be rude to focus a bias on all the negative indicators. Especially after making a good chunk of money only to cut and run for dear life. Still... if I recall correctly, I made it pretty clear that I'm not a fan of deflationary assets and that it was always going to be a highly speculative gamble gamble situation for me personally.

So what's the good news with Polycubbers?

- Vault (Protocol Owned Liquidity)

- Loans

- Bonding

- The concept of pendulums that manipulate inflation.

All of these technologies can be easily ported over to CUB once the kinks on Polycub have been ironed out, making them a modular and powerful addition within the EVM web that's being created here.

Vault (POL)

This is basically a wallet that the protocol itself controls, whose resources are used to benefit everyone using the platform. The trick here is to actually create ways for the vault to capture value and then subsequently use that value for the greater good (and to capture even more value). It takes money to make money, amirite?

One of the main ways that the vault captures value is through the 10% harvesting fees on the kingdoms. There are many theoretical ways that the vault could capture value, and we should certainly give it more consideration.

Loans

Another way the vault can capture value is through interest rates. There are plans to allow xpolycub to act as collateral for a loan. The interest for said loans is paid off by a mere fraction of the yields that the xpolycub stack was generating anyway. This is potentially a very powerful (and more importantly low-risk) solution that provides value to both the users and the Vault in a symbiotic relationship. Very exciting stuff, but we have to wait for it! Soon™

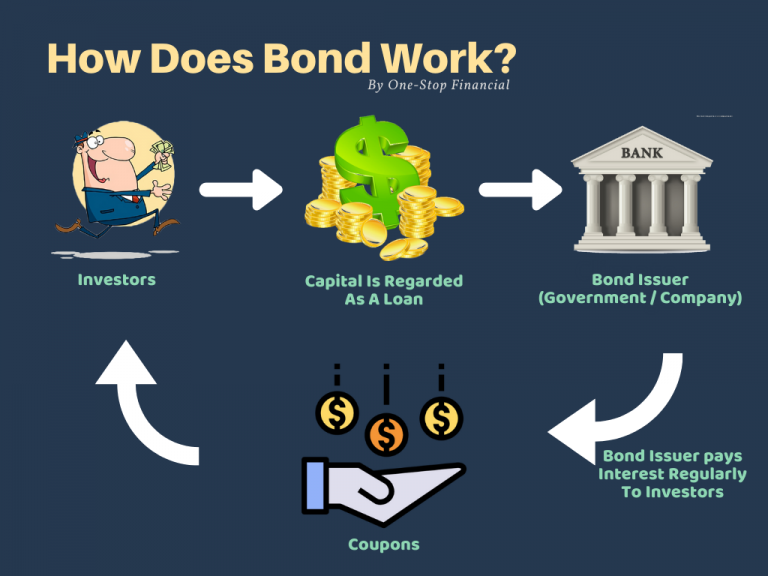

Bonds

Bonds are basically... the opposite of loans. Instead of the Vault giving you a loan, you are giving the vault a loan and charging the Vault interest on that loan. If I'm being honest, I believe bonds have zero intrinsic value and negative estimated value. The reasoning behind this logic is fairly simple.

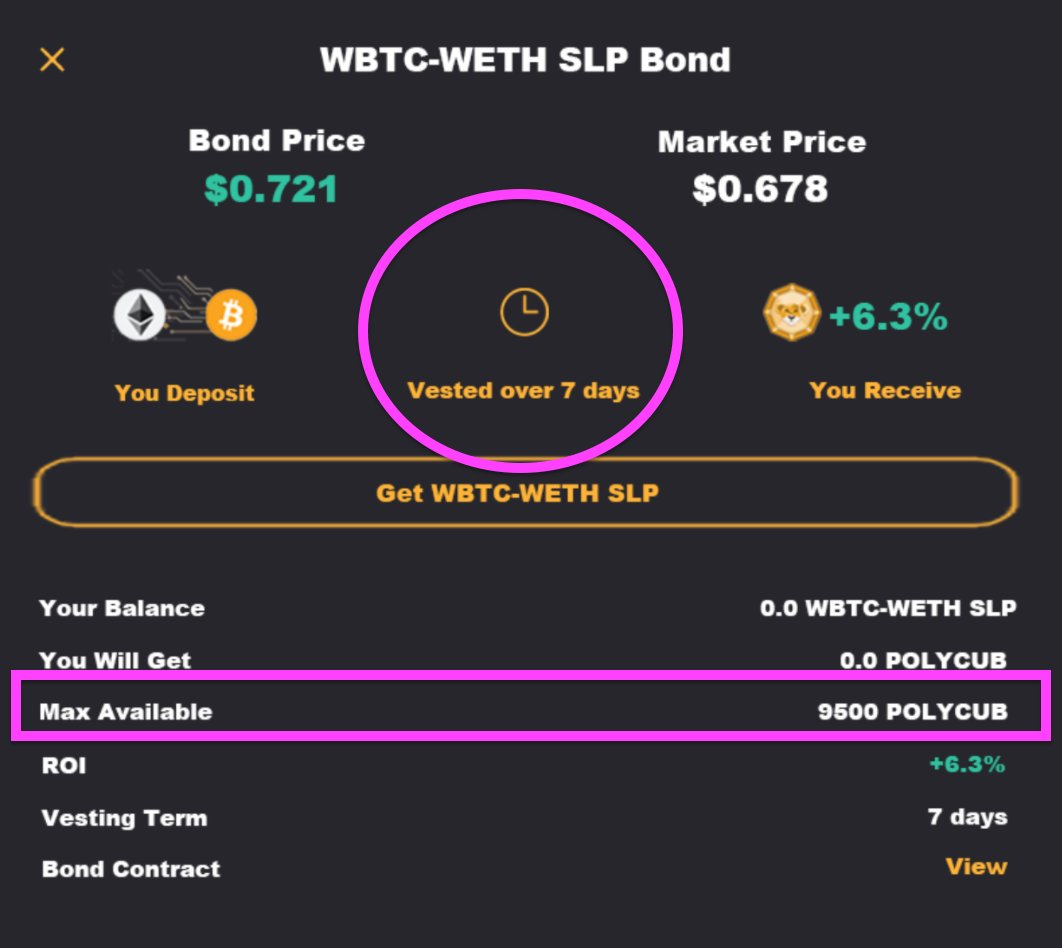

Looking at potential examples given on Twitter...

What is the point of a 7 day bond? We make people wait 90 days to farm their LP but 7 days for a bond? And even if we did make the vested time period 90 days or even a year, how does that provide value to the vault? Over the long run this will only extract value from it. Paying users more for something they were going to do anyway is not helpful.

Definition of a loan.

The reason why the Vault giving users a loan has value is simple: the user knows how to leverage that loan into more value than the interest they have to pay on the loan. This is the point of loans: to get things now that will be worth more than getting them later.

You get a loan for a car because you need the car now. You need it to drive to work to make money. You need it to go to the store to buy groceries or whatever else. You get a loan for a house because buying a house straight up is simply not an option for 99.9% of the population. By not paying rent and instead paying the mortgage, we put equity into the house and conserve the value rather than giving it away to a landlord. Loaning money to the government via bonds is the same thing: in theory the government is going to leverage that loan into more value than what they have to pay you back. Loans are supposed to be a win/win situation for both parties involved.

Is that the case with DEFI bonding?

Because I fully do not understand how the Vault could possibly leverage that loan into more value than what they have to pay back. It's really as simple as that.

Thus, the first iteration of bonding on Polycub can largely be considered a gimmick or a novelty that doesn't actually add any intrinsic value to the protocol. That being said, even as a gimmick this functionality could grab attention from the outside or be used to further the marketing campaign, which at this point would obviously be just as good as having synergistic value. People like to farm and earn yields. Bonds let people farm and earn yields. Easy.

Bonding is such a new thing that it might not have to be set up in a way that makes perfect sense on inception. The only way I could imagine bonding actually working long-term is if the vesting period was permanent, and the LP tokens became permanent property of the vault. In exchange for those LP tokens, the user would essentially earn yield at a higher rate than the free-market LPs basically forever as some kind of passive income untradeable NFT. Actually... if it was an NFT you could make it tradable, because the Vault would still own the LP tokens, and users could trade the yield from one account to another on some kind of secondary market... interesting thought.

In any case, I think bonding needs a lot of work in order for both parties involved to get something out of the deal (intrinsic definition of a loan). However, getting it up and running in whatever form it takes during the opening iteration will be a good thing so we can start testing it in the field and making changes as necessary.

Pendulums

I've made it pretty clear that the current iteration of pendulum yield manipulations do not operate in a way that I agree with. But I have been thinking of the concept of the pendulum more and this idea that we should be automating yield allocations in certain ways is a solid one.

I was theory-crafting yield manipulations myself with my own token, and I figured at the start it would be a DPOS solution where governance votes would be in control of everything. However after writing posts like this: democracy is trash... I realize that allowing degens to manipulate yields and expecting them to do what's best for the network (rather than purposefully creating pump/dumps) is a bit foolish and naïve. The best solution is one that people don't control (if possible).

And that is where pendulums come in.

And after a bit more theory-crafting I realized that many different kinds of pendulums could be created.

Pendulum #1: Price Stability

Of all the pendulums, this one would have the most power. This one would be able to increase or reduce total inflation/emissions while trying to expand or contract the network based on, not only current supply and demand, but also expected supply and demand based on the delayed reaction domino effect that happens when manipulating yields. This certainly needs more explanation, but at this point I'd have to save it for an entirely new post dedicated just to pendulum theory.

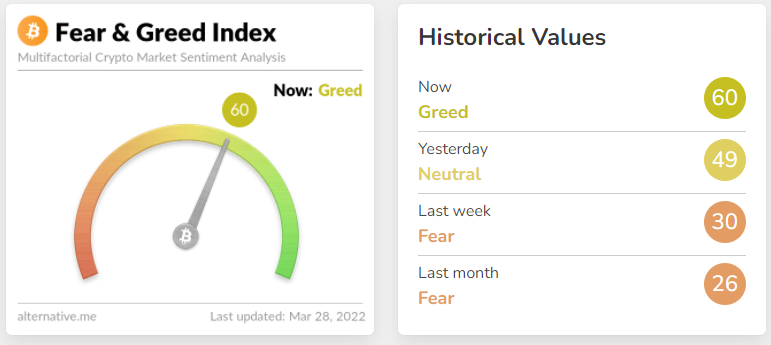

Pendulum #2: Fear/Greed Index

It is absolutely shocking how some of these fear and greed indexes can beat the market and give us the exact information we need to DCA trade in one direction or another. Sell off small amounts during periods of extreme greed and buy the dip during periods of extreme fear. On the average these things are right more often than wrong and can be used by the pendulum to conserve value within the system.

Within the context of yields, a Fear/Greed pendulum would allocate more yield to the risky LP while in fear mode and swing back to the safe pool during greed mode. Looking at CUB, the risky and most profitable LP is CUB/BNB, while the hedged LP is CUB/BUSD.

Pendulum #3: Elasticity Maker

Acting as a support beam for the Price Stability pendulum, the elasticity pendulum would focus solely on how much yield is allocated to the single-staking pools. As I have said before, the single-staking pools can be seen as a liability that provide no actual liquidity to the network and are best utilized for providing supply to the LPs when demand is high and price is going up.

By lowering yield to the single-staking pool this pushes volume into the LPs, keeping not only the price stable, but the network as a whole stable as well. The lower the yield is in the single staking pool the more wiggle room there is to increase it later when price falls below acceptable price targets and the network requires another liquidity injection to suck tokens out of the LPs to push the price back up, or better yet lure money in from the outside to accomplish the same goal. High yield stablish assets are extremely desirable to anyone within the crypto arena.

Bitcoin TA March 27th:

https://leofinance.io/@edicted/market-watch-make-or-break

Bitcoin looking madly bullish

Of course coming from me that means this resistance line at $45k is going to punk us hard in the short term and send us cratering back towards a bounce at $40k, but that's irrelevant. In the medium term, Bitcoin and crypto in general are bullish for many reasons.

You gotta love how Bitcoin just does the opposite of everything I say on the short-term timeline. Market really has my number. But truly, this market is crazy bullish for the next 3 months in my opinion as we approach April and May, which are usually green candles on top of an 18-month bull cycle that's been happening since 2016. If the legacy economy doesn't collapse like the house of cards that it is in the next 3 months, I think we'll be doing quite well by then. I have very little faith that we can maintain much longer than that though. Eventually the chickens will come home to roost.

Conclusion

Being so grossly bearish on Polycub yesterday put a bad taste in my mouth. There are many fundamental developments here that need to be explored, and I've made it quite obvious at this point that my feelings on the matter are extremely mixed and volatile, just like the market itself.

Truth be told, I am looking to buy back into Polycub, especially when Vault loans go live and it is clear that there is actually enough liquidity in the vault to accommodate such a thing. If my temporarily bearish play on Polycub were to play out perfectly, the overall market will be peaking in three months, but Polycub will be at all time lows and I'll be able to rebuy my entire stack at a huge discount. Zero sum game is zero sum. Gamble gamble.

If the price of PolyCUB keeps dipping then people will not use Bonds to buy it because they would get it for cheap directly from the market.

I think after the airdrop, the price will go down even more because people might be selling their free airdrops for quick money. Then you and I can enjoy the discounts @edicted. 🤓

Posted Using LeoFinance Beta

let's hope that the recent rise of many cryptos works as an impulse for this one to do the same, I don't know but it seems to me that we are approaching a good ground with these cryptos.

It's good you are putting this all out there I like your thought processes as an educational tool for me. I'm still the worst student but I realize that it trickles in bit by bit and I begin to understand all these hard things. Keep em coming. Not only to explain but you always give away little thought gems

Posted Using LeoFinance Beta

wen next chain?

Btw, I think there should be some mechanic to stop move funds from project 1 to project b.

Instead of an airdrop, something like you farm from another defi project or cub. Ot addition to the airdrop.

Some extra % so prices would move more up.

For additional funds, Khal should sell on hive "LP tokens" for the chains.

So hive users without any idea how it works can stake funds and forget them.

Like a donation for the stakers that dump :D joke besides, IMO that would allow more people to buy into the game.

I'm cheering for it. I want it to work. I have hedged my bets pretty well on PolyCub as I see it as a large test. If it passes, we see all other EVM's and it is wildly bullish for the whole LEO-verse. If it fails, we go through another year of wen/soon's before the next EVM has a LEO bridge. Wildly bearish for CUB is the near term post airdrop.

Exactly, seems we're on the same page. While people think many are waiting to pour out all they've earned via Airdrop to the market, the reverse might be the case. The price right now isn't favourable to even think of dumping maybe at $4-1.20 people would have.

It is cub that stands a chance of attracting more selling pressure, because as we know it, some people bought in to get the drops, now the drops is over and the drops seem to have more value being built, so what next? Dump cub and buy polycub to get an increased stake, that's what I expect tho.

If polycub were to even touch $0.20 I'd call that the floor price because buying pressure would kick in...

It is really hard to predict these things... and even harder to buy into a token that has plummeted to 20 cents from $6. That said, there will be a lot of support for PolyCub down there.

Bonding assets with PoL is not loaning assets to PoL. You are actually selling those LP assets to the protocol and receiving POLYCUB in exchange that vests over 7 days

Yes,was about to comment on this, however, if that be the case, how sustainable and attractive is that? I mean I totally love the idea behind giving out loans via the Collateralized contract, but bonds?

Let's say, considering the current Apr of polycub-Weth pool, why would anyone choose to be in a pool(bond) to earn approximately 6% in 7 days, when that polycub-weth farm gets them approximately 11%?

The current yields will even out. Also market dynamics will determine what ROI is attractive for that particular bond. The bonds for POLYCUB-WETH and POLYCUB-USDC are likely to have a small % of the bond allocation.

The major bonds are non-POLYCUB bond. Like WETH-WBTC. It's similar to an HBD conversion game theory: you have the opportunity, when timed correctly, to make a few % ROI in a few days time.

Oh, that clears things up...

That makes a lot more sense in context but the ultimate overarching question remains unanswered

The ROI of a bond is determined by market demand for it. If there's a lot of demand for the bond, the ROI will be near 0% or even negative % until demand slows and it self corrects to a higher % ROI that people are willing to bond for.

Essentially, the treasury owns a stack of growing POLYCUB. It's selling it to users who want to buy POLYCUB at (potentially) a small discount. The discounts are likely to be super low but when timed correctly (similar to HBD conversions over 3.5 days).

There's heavy game theory involved. The treasury wins by getting more non-POLYCUB assets which are deployed in 2 ways:

Both of these can be done simultaneously which means stacked yield for the treasury = more POLYCUB bought and deployed for long-term LP incentive pool

You only put in the amount you're ready to lose, right?

Thanks for your analysis, they're always great to read!

Posted Using LeoFinance Beta

It makes me wonder if using the bonds will give better returns than locking up your LP on a farm. After all, if you can skip the early harvest penalty, then it might be the better option available. Either way, I still think it should be released so people can dive in and see how it actually works.

Posted Using LeoFinance Beta

I cannot but say this is true. The fundamentals and technology of the project is very important but then, if the price is going down, will this encourage people to use Bonding?

Posted Using LeoFinance Beta

Interesting read, I am not particularly familiar with certain mechanics that you speak about, but I did see a lot of valid points in both previous and this posts, I have to say that what I am looking for is the possibility to take out a loan against xpoly, as it would transmit a high level of confidence for anyone just getting into it on the later date, likely for people that are not very well versed in economics or defi concept, the loans could be a relatively simple way of understanding where the utility aka value is generated by polycub.

Posted Using LeoFinance Beta

Read how this all have started with Toruk

Posted Using LeoFinance Beta

Thanks for explaining,what vaults are because I have been seeing it in binance I don't understand it,is now I understood it.

Posted Using LeoFinance Beta

like

Posted Using LeoFinance Beta

My understanding of bonds adding value is that the protocol also earns trading fees on those pairs, even though yeah.. it's not much and I guess there's also the question of whether or not it make more sense to just buy LP tokens without using bonds.

But in that case, the protocol would have to dump polycub on the open market to get $ for LP tokens, so I think the bond mechanism makes far more sense than dumping polycub all the time.

From what I understand, Olympus DAO owns almost the entire liquidity pool for their token, and they make good money from those fees.

Idk.. I still haven't decided which way I lean. I got all my Polycub from farming "safer" assets and from CUB airdrops. I'm not convinced enough to load up on polycub with my own money, but I'm also not convinced that I should sell my polycub.

So I'm just riding it out and seeing how it goes. IMO this only becomes sustainable if/when we get to that "tipping point" of POL.

$100k can compound all day long and wont do anything to make the project get big.

$10M in POL is a whole different story. Question is, do we get to that tipping point and how?

Posted Using LeoFinance Beta

Thank you. This is a clear and detailed write up on PolyCub. I see so much fluff that has low information density. It's nice to see the opposite here.

Posted Using LeoFinance Beta