Say it aint so: 'Bullish' on CBDC?

If you had asked me a year ago, I would have told you that Central Banking Digital Currencies have absolutely no future within the decentralized flat architecture that we are building up around us. How could it? Crypto is superior. CBDCs aren't a step forwards, they are a step backwards. Nothing about CBDC is any different than the deal with get with fiat. Etc. Etc. Etc.

But now I know better.

Because now that I've done a good amount of research on how these legacy systems actually work, and I can say quite definitively that CBDCs are absolutely nothing like central banks in the slightest. The entire point of a central bank is to smooth over logistics in a non-digital world.

What do I mean by this?

Central banking does not make sense in the world we live in today; Not by a long shot. Central banking only makes sense in the context of the Internet not existing. Remember that central banks are much older than the Internet.

This is also true about the Electoral College. The way in which the president of the United States is elected doesn't make a damn bit of sense in the 21st century, but we keep doing it the way we are doing it because that's just how things are. This can be thought of as inertia. Things in motion tend to stay in motion, unless there is an opposing force preventing that from happening.

The Internet and Crypto are the opposing force that are going to change everything.

The Internet was not complete until Satoshi solved the Byzantine General's problem posed in 1976. Even way back then scientists knew that the Internet had a big big problem: trust. With crypto, that intrinsic trust issue has been solved, and we can now begin to dismantle all the absolutely corrupted institutions that have been in charge for so so long.

This infographic is highly deceptive.

Central banks do not have this much power. Specifically, central banks do not mint coins or print money. That's exactly why they are central banks. Central banks only interact with retail banks. It's retail banks that issue the loans and actually add fiat into the economy. Why is it like this? Because central banks were invented long before the Internet was invented. This was literally the only way to do it that made sense. Responsibilities needed to be delegated out so that the system could scale up.

The same is true with the electoral college. It was another one of those systems that was invented a long long time ago and only makes sense in the context of the technology involved when it was invented. These are relics of the past that we still use today because using these relics still serves the purposes of the elite that control them. Otherwise they would have been abandoned long ago.

The only thing slower to change than government, is religion.

But fear not, because now CBDCs are here to fix the problem. I'm actually excited to see what will be done with this technology going forward. There are literally no rules and any country can change the rules on the fly whenever they want. This is the nature of centralized control.

This is something I had never considered. As we all know the value of CBDCs to the actual crypto community is zero, so we discount the possibility of CBDCs having any value. However, this argument makes it very clear that even central bankers can profit from crypto by getting rid of the middleman banks.

Hm yeah, so I wrote that on November 13th, 2020, and I realize now that even that is complete bullshit. Again, the middleman banks might prevent their own demise by doing what everyone else and their mother is doing: creating their own cryptocurrency.

Think about how ridiculous it is to think that some random idiot in the world can create some shitcoin on Binance Smart Chain and rugpull everyone a week into the project, but we never stop to consider that perhaps legitimate respected banks could do the same (minus the rugpull). Like... duh... right? If your business is threatened by crypto, and all you have to do to not only eliminate that threat, but also profit greatly from it, is make your own cryptocurrency... then OF COURSE the retail banks are going to do it. They might even create a central retail bank token that connects multiple banks together under the same digital currency (XRP anyone?).

Now under today's laws it's easy to make the claim that this would never happen because of regulations and whatnot. Yeah, well... crypto has been eating away at regulations for a decade now, and it is only picking up speed. Things like BSC and Hive probably couldn't exist without the security and protection of unkillable Bitcoin within the ecosystem. Soon, some other cryptocurrency thing that gets invented will make it much harder to regulate retail banks and corporations. We can already see this happening on a day by day basis.

So what is a CBDC?

In theory a "central" banking digital currency is controlled by the government directly rather than by a private bank like the "Federal" Reserve. This makes it not a central bank by definition, because the entire point of a central bank is that it is a bank for banks, which is obviously not what a CBDC is. A central bank governs other banks, but a CBDC is just a cryptocurrency controlled by politicians or some other elite group.

What could possibly go wrong?

Probably less than you'd think. This is due to the permissionless and inclusive nature of cryptocurrency itself. If a crypto controlled in a centralized nature is garbage, then no one is actually going to use it because there are a thousand other better options available.

To which the argument devolves into one of force

Therefore, we must now assume that not only has congress created this CBDC and successfully implemented it, AND it's garbage, but we must also assume that the other options available have been make illegal by the same governing body that implemented the CBDC. Fortunately, such a thing is largely impossible because that's a huge conflict of interest and everyone can see that politicians are openly creating laws that give themselves a monopoly on currency itself. There's no way to spin this story to get citizens to actually go along with it.

Main point: Narrative trumps everything.

Most people think of politicians as bumbling fools, but they are actually masters who have ascended to the highest ranks of their field because they are so good at their job. The problem is that most people think the job of politicians is to serve their best interest. This is obviously false, which is why so much confusion comes into play when trying to rank their effectiveness.

In order to get a population to agree to an authoritarian ruleset, they must convince said population that said ruleset is good for society as a whole. Again, it's all about narrative. Drugs aren't illegal because they are bad for you, but the government says drugs are illegal because they are protecting society from them. The Securities Exchange Commission is currently prosecuting Ripple Labs 8 years after launch to "protect investors" (another lie). Bitcoin is bad because only drug dealers and terrorists use it. Oh shoot everyone knows that's a lie now so they pivot and lean into the left-wing liberal narrative that Bitcoin is wasting energy and is the reason why the Earth is getting so polluted (another obvious lie).

So we can see that in order to make cryptocurrency illegal, the propaganda has to be believable enough that registered voters actually believe the bullshit coming out of the politician's mouths. CBDC completely ruins that entire narrative. CBDC ironically legitimizes all crypto in the eyes of the people and makes it impossible to ban and harder to mudsling.

With this in mind, it becomes obvious that even if CBDC tech gets implemented across various economies, it's still going to be forced to not only compete with crypto, but with central banking fiat itself. CBDC and fiat are two totally different things. We assume that central bankers and their cronies are the ones who are going to want to implement CBDC. This is 100% false. Crypto allows anyone to be a central bank, therefore central banks have the most to lose and the least to gain from crypto (even CBCD implementations).

It then becomes obvious that not only is crypto going to force CBDCs to compete, but also CBDCs are going to force central banks to complete. We haven't seen this level of forced competition in human history. Never has such a monolithic institution like fiat been forced to the negotiation table like this. Usually we'd have to wait for central banks to fail under the weight of their own corruption before we could implement a new system (that would probably devolve right back into the old system). The more things change the more they stay the same.

It's important to note that the definition of CBDC may become a thing that's up for debate. Could a corporation create a CBDC? We may start defining CBDC as any cryptocurrency that has a centralized governing body. We must then ask ourselves what the advantage of centralization is and in what context should it be employed?

Decentralization is a spectrum.

With this in mind, it becomes obvious that the best networks are going to be the ones that create near-perfect blends of centralized control structures that are counterbalanced by decentralized governance models. What are the tradeoffs?

- Security: decentralized in nature.

- Efficiency: centralized in nature.

That's... pretty much it.

Do we want more security and less potential corruption, or do we want higher scaling and more efficiency? This tug-o-war push and pull is the root of every network's underlying model. We want as much efficiency as we can get without introducing corrupting forces that will eventually collapse the entire system.

The very nice thing about crypto is that if corruption should set in and it can be easily identified, it isn't hard to slice up the network and cut out the cancer like we did with Hive and Justin Sun. Lucky for us, Sun was just about as non-sneaky as they come, and cutting him out of the system was remarkably easy. If it happens again... it won't be so obvious. How many CBDC communities will fork and simply remove the centralized controlling party from the system? That'll be good for a laugh or two for sure.

Getting off topic.

The ultimate point I'm trying to make here is simple. Why would CBDCs be classified by the government wielding them? If a corporation is more powerful than a small country, then it doesn't matter that the corporation is a corporation. If the corporation creates a centrally controlled digital currency... that's a CBDC. CBDC is defined by the internal governance, not the layer-zero entity who controls it from the outside. It doesn't matter if politicians are controlling the currency or if it's a board of directors or an individual, all of these tokens could have an IDENTICAL codebase, in theory.

So what is CBDC then?

Imagine if witnesses on Hive controlled all Hive inflation. That would be a CBDC. Take away for the ability to allocate inflation, and what do you have left? A currency who's inflation is controlled by a centralized oligarchy. A CBDC. Funny how many witnesses have actually said on-chain that we should get rid of the reward pool and basically turn Hive into just that.

But it's more than that.

In order to take it a step further, imagine if, after we removed the reward pool from Hive, that witnesses could just vote to create however much Hive they wanted, and allocate it in any way they saw fit. This is the true power of CBDC: total control delegated to the oligarchy.

And it still won't be as bad as it sounds.

Why? Because again, they are FORCED to compete or no one is going to use their bullshit currency. So again, what is the advantage of centralized control? Near-infinite scalability and, somehow even more importantly, leadership and direction. We've already seen how bad leadership, governance, and direction of a network is when no one is in charge. Everyone just runs off and does their own thing, making it quite difficult to build any really cool projects on a massive scale. CBDCs potentially fix that problem in a big way. The oligarchy can just print money out of thin air and allocate it to any project they see fit.

I see CBDCs as a bastardized and even more centralized version of DPOS.

This is what gets me excited about CBDCs. When Bitcoin maximalists look at Hive they see centralized hammered dogshit, but at the same time when I look at CBDCs I see centralized hammered dogshit. I'm beginning to realize that, like Bitcoin maximalists, I might be totally wrong, and some really cool CBDCs could get invented that surprise everyone.

CBDCs will be permissionless in a lot of ways.

In order to have any value whatsoever, CBDCs must connect to the cryptosphere. Users must be able to trade the CBDC to Bitcoin and vice versa. The more regulations that stop that from happening, the more people will just ignore the CBDC.

Again, this is a competition issue. So imagine there are 50 CBDCs out there and one of them decides to remove the regulations for moving in and out of the cryptosphere. All of a sudden exponentially more users are going to use the one CBDC that pulled its head out of its own ass, and the other CBDCs will be highly incentivized to follow that lead and drop whatever regulations they can afford to in order to compete in the attention economy. When it comes to CBDC, pretty much everyone is ignoring this glaring fact that they will be forced to compete with all the other options available.

List of entities that will create CBDCs:

- Governments

- Retail Banks

- Corporations

- MLM Ponzi

- Religions

- Cults

- Literally anyone who wants to create a currency with them in charge.

Because again, we've been thinking about this all wrong.

What defines a CBDC isn't the layer zero community (politicians).

It's just the fact that a permissioned layer zero is in control of inflation.

Taxes become irrelevant.

When CBDCs go live there will be no reason to tax anyone. Taxes will become a thing of the past. Why? Because the government currently can't actually print money like people assume they can. Not even the Federal Reserve prints money.

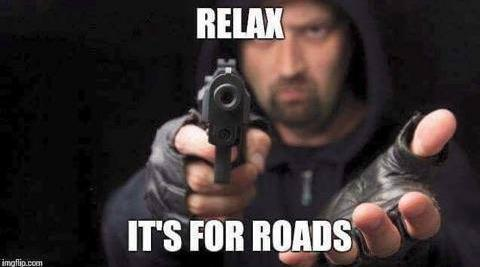

Once CBDCs allow the oligarchy in charge to simply print money whenever they damn please, this again destroys the entire narrative that taxes are necessary to "pay for roads". If you want to pay for roads just print the money and then give the money to the construction workers directly. Again, before the Internet existed such a thing was literally impossible to do. Now everything has changed.

Will CBDC even be debt-based?

Another important variable to mull over. The business model of a central bank is to be a bank for banks and to charge those banks interest rates. This is literally the only way to make money as a central bank (at least it used to be, in theory, the only way). CBDC is not a central bank, because CBDC doesn't give loans to retail banks, it leverages the Internet to link-up to the economy directly via liquidity pools and employee payrolls.

So, if there are no retail banks, there are no interest rates, and there are no loans... Unless you are loaning the token to the people directly... which you aren't because no one would take that deal because crypto is already offering a much better deal (on top of the fact that payroll is not a loan situation). Besides, most citizens have zero or even negative net-worth and live paycheck to paycheck... so they don't even have the collateral required to get a loan from a "central" bank in the first place.

It becomes clear that CBDC might not even be debt. How will the oligarchy in charge make money without interest rates and loans? As already stated and as already known, printer go brrrr. They'll just print their own salaries rather than trying to give loans to retail banks. Again, this becomes a superior and much more sustainable system than the debt-based one we live in today.

Conclusion

After so many years of talk regarding central bank digital currencies, it's amazing to me how grossly incorrect we've all been regarding this topic. It was so so easy to simply dismiss CBDC as some failed worthless thing before it even existed, but now that I've done the research on how the legacy economy actually works it becomes quite clear that CBDC is not only completely different than anything we've ever seen, but also isn't even a central bank like the name implies (much like how the Federal Reserve isn't federal).

Tell me, if I create a token on Hive and the rules are such that only account @edicted can print tokens... what is that? I'd call it a central bank digital currency that I control. Funny because this is basically how all token on Hive Engine technically operate. What do we think the "mute" button is? It's a permissioned system where the creator of the token has full control of everything, and we trust them to not abuse that power, just like a central bank.

And upon this revelation I say: wow, CBDCs are working much better than expected, and they will likely continue to surprise us. What defines a CBDC is not the party in charge of the token, but rather the underlying rules of that token itself. If one person or a small group of people control all/most of the inflation of a particular token, it's not a stretch to call that token a CBDC. As far as I know pretty much every yield farming on Binance Smart Chain (and possibly Ethereum as well) is unilaterally controlled by the dev team that created it. This is why rugpulls are so commonplace. They can't be prevented by the underlying code that has been written. I say again... I think all yield farms are already technically CBDCs at this point.

In fact, I'm just now remembering my Soul token idea, which would give every account on Hive a "Soul" and essentially turn every account on Hive into a CBDC. This is the weird future of things to come.

It becomes obvious that CBDCs are already everywhere, and they are doing quite well and even celebrated (lets go CUB!). It doesn't matter that the dev team of XYZ token is not the governing body of Ecuador. Full control is full control, no matter who the controlling party is. Funny how much success the projects have even though they are indistinguishable from CBDC tech.

At the end of the day, crypto is forcing everything to compete. A CBDC issued by politicians probably isn't going to be that bad, because the worse it is the less users it will lure into the system. This is the nature of the emergent attention economy. Issuers of CBDCs can't just magically make all the competition illegal. Even trusting citizens aren't going to swallow that propaganda.

Manipulating the narrative is a mastered craft. It is so easy to assume that politicians and the elite individuals that control them can just do whatever they want. It's easier to assume that the people at the top simply have unlimited absolute power rather than actually diving deep and realizing that the world is a totally chaotic and very hard to control scaled up meat grinder. Everyone is vying for more power, and crypto is leveling the playing field in a big way, even with the advent of CBDC technology. Take note, because the next ten years are going to be a thing of legend. No one is going to be able to predict what happens next. Not even me (especially not me).

Posted Using LeoFinance Beta

I should try to figure out which witnesses want that and remove my witness votes for them.

Posted Using LeoFinance Beta

I haven't heard anyone trying to push that bullshit narrative in a long long time.

But it's definitely worth remembering that it happened at one point.

This is the danger of a token collapsing 99% in value.

People are willing to try anything to fix the "problem".

Even if it means giving people absolute control of the network.

Hopefully they don't have that position any longer, I would totally remove my vote from that shit. Removing the reward pool is just a bored person with a shitload of stake trying to figure out what to do, in my opinion. Thankfully I haven't seen the discussion in a long time!

The CBDC is obviously not the banks. After all we just need to look at the digital yuan and see how they want to control every aspect of a person's life. I don't want to be living in a world where a digital credit score and have every single personal action looked into detail.

Posted Using LeoFinance Beta

Right, but, the question I am posing is:

There is no obvious outcome.

This chaotic clusterfuck is totally unpredictable.

This entire social credit score bullshit requires that everyone on the grid be hopelessly dependent on the state, but we already see that real crypto is putting a real big wedge in those plans.

True but I just think that it is natural for it to happen before people move off the grid. People's dependence on government won't change easily nor will it be fast.

Posted Using LeoFinance Beta

Sketchy part about CBDC's are the portions where a "bank" doesn't like what you are purchasing or you have too low of a "social credit" so they just turn off your funds. They are certainly trying that shit out in China!

Weird future! No doubt we have a weird present as it is. Nothing is quite like it seems. Never say never. It's like we blink and things change. Never a dull moment!! Go Hive!!! Lol

Posted Using LeoFinance Beta

If CBDCs allow for the trade of Bitcoin then I can explicitly state that we have won

The primary difference between a centralized digital currency and a community-based digital currency is whether or not a DAO is implemented in which the token holders have the ability to submit proposals and vote on them to automatically upgrade the protocol.

Of course if > 50% of the tokens are allocated to the founders from the beginning then it's completely centralized, but if the founders only own a small percentage of the tokens and the rest are programmed for distribution to active community members over a span of years or decades, then the power will rightfully shift to the most active members.