Flat Tax: 5%-10%

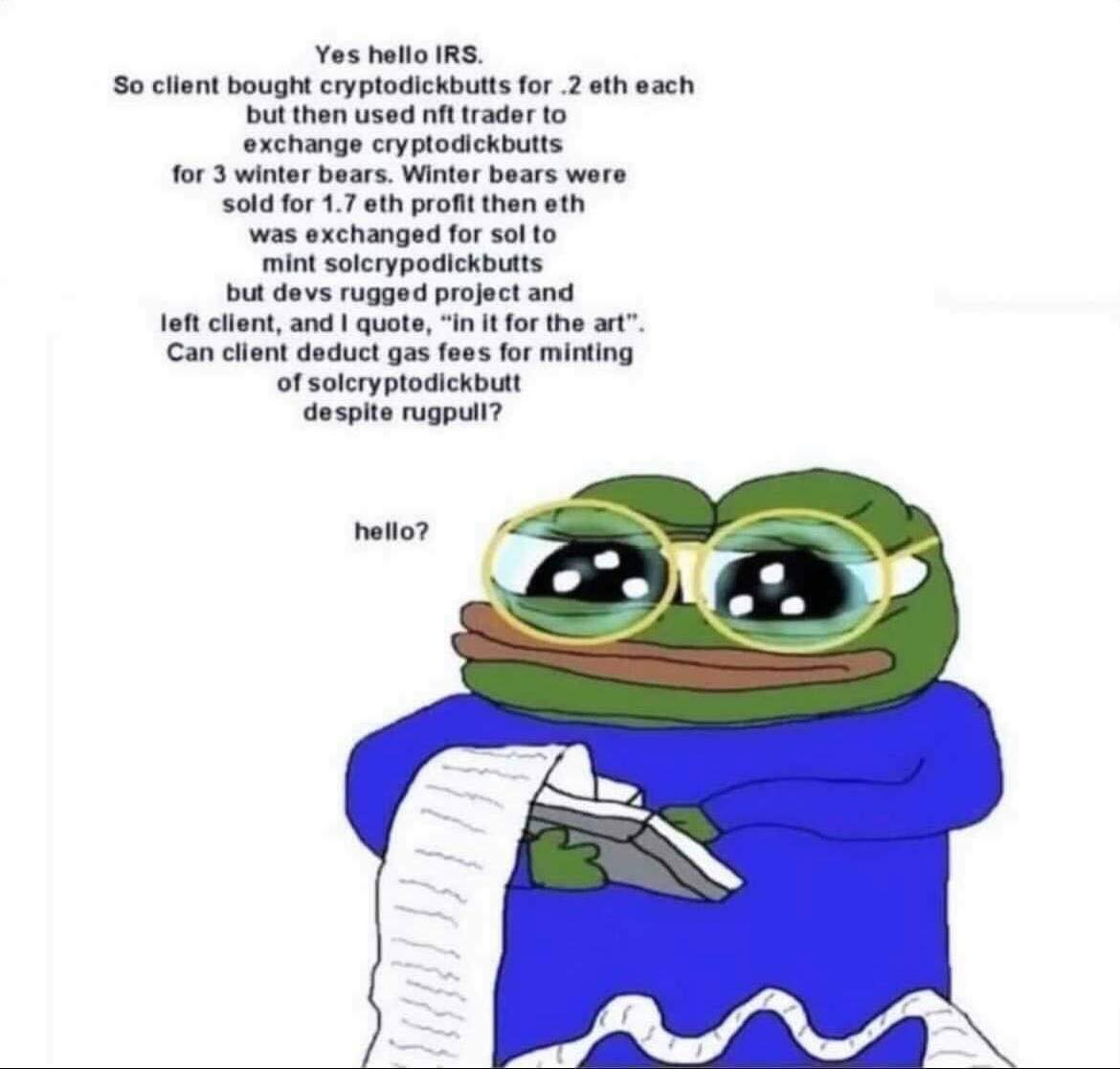

My girlfriend was convinced this was a fake scenario with fake names.

Oh, it's very real.

Cryptocurrency and taxes are a huge problem.

On a practical level, it is not even possible to pay your taxes 100% correctly even if you're not involved in crypto. Tax laws are that complicated and loop-holed to hell. There's always going to be something you missed. Did someone give you $20 to drive them to the airport? That's taxable income. Bet you didn't report that on your taxes. You're a criminal now.

This is why many times the IRS is very lenient with their punishments and also rely heavily on fines instead of actual jail time; They know exactly how ridiculous they are. Putting one person in jail for a year costs the state $42000 a year on average. California spends $8.5 BILLION dollars a year on the prison industrial complex. How's that for a mindfuck?

The IRS is in the business of generating income, not expending it. In fact, the IRS obviously pay for the prison industrial complex in the first place. No sense in bankrupting yourself by sending everyone to jail. Who would then pay for jail to exist?

Crypto Context.

So when we look at cryptocurrency, tax laws become not only x1000 times more complicated (making them literally impossible to follow) but also these networks aren't reporting to the IRS or even doing proper accounting like a regulated institution would be. Obviously, many people are going to just avoid that dumpster-fire entirely and just check the box on the form that says "no I don't own any crypto". I wouldn't recommend lying on an official federal document that you sign, but that doesn't change that fact that many will do it anyway if only to avoid the complexity and fear of being put under a microscope.

Flat tax

As the title implies the solution to all of this is to dumb down taxes back to a flat tax that can be calculated instantly by anyone. How cool would it be if you could cash as much money as you wanted out to your bank account and it only cost a 5% tax?

The rules of this system would be simple.

- All centralized exchanges that transferred fiat to bank accounts would skim 5%-10% off the top and give it to the government.

- This would be the only crypto tax and all that end of the year stuff would disappear.

- It doesn't matter if you made or lost money; if you want fiat in your bank account you gotta pay the 5%-10% tax.

Pros/Cons list

| Pros | Cons |

|---|---|

| It's easy and impossible to evade. | It taxes citizens that lost money or broke even. |

| It's instant and stress free. | It's instant and couldn't be deferred to the end of the year. This is an opportunity cost. |

| Very convenient and many people would obviously do it. | Very easy to circumvent if you pay for things directly with crypto and never cash out to a bank account (or transfer p2p). |

| It would generate a ton of revenue while at the same time allowing builders/innovators to accumulate more wealth. | People would complain that the rich aren't being taxed enough and that it's a burden on the poor. |

5% or 10%?

This is the sweet spot. Too much friction creates too many diminishing returns and chokes the industry, while too little doesn't generate enough income for the state and makes it too easy to move dirty money around. I always appreciate a 5% tax. As weird as it sounds, that's the fee for the World of Warcraft auction house, which is surprisingly a good testnet for a real economy. You can look that up on Google if you want; there are many studies on it.

The Netflix argument.

What does Netflix have to do with anything? Well, are people still pirating movies with torrents these days? Nope, that's not really a problem anymore. It took ten years, but the establishment finally pivoted into the correct direction and made a business model that was convenient enough to justify paying for rather than putting in that extra effort to get free movies and perhaps viruses and spyware on your computer. Now people just pay the Netflix sub because it's cheap, easy, and legal.

A flat tax for crypto is the exact same idea.

Make it super convenient and cheap to pay taxes, and everyone will gladly do it no questions asked.

I thought you said taxes are totally irrelevant.

Indeed, now that anyone can be their own central bank and anyone can print money out of thin air, the argument for taxes goes right out the window. If you are in a position of authority and you need money to pay for stuff, then at this point you should just be able to print the money and pay for stuff without taxing citizens. At least, that's the theory... we have to wait for mainstream adoption to kick into high gear before we see how this actually plays out in practice.

So then what is the point of taxes?

Taxes are great when they exist as a form of micro-charging. I've blogged a lot about micro-charges and how amazing they are and how real-time payment streams are the future of finance. When we want to guide the herd in a certain direction, we can use micro-charging (taxes) to achieve the desired result. Even something simple like charging 10 cents for plastic bags has a huge affect on public psyche. The difference between free and 10 cents makes a surprisingly huge impact on the usage of resources. The goal in this example was to reduce plastic garbage output, and it worked surprisingly well.

Taxes create friction

Sometimes friction is good. You wouldn't want to drive on a road that was made of ice, would you? Taxes can be the same way. We have to rebuild the entire paradigm of what taxes should be used for. I would argue that taxes are only good for discouraging people from performing a certain action and using that money to fund the solution to that problem or another problem within the community.

The most obvious context here is discouraging people from leaving your ecosystem. So imagine your city-state has a crypto and the leadership doesn't want people to exit the system with the value contained within the city. Conversely they want to entice value from the outside to enter the city. That is the PERFECT situation for taxes.

In this case, we charge 5% to anyone exiting the city, meaning City Coin is a reflection token that charges 5% and puts that money into a vault (if you trade into a token that exists outside the city). Where does that money go? Either to yield farmers who create the liquidity with the outside, or better yet it gets used as bait for outside money to enter the system.

Now if a bunch of billionaires leave your city you have a huge vault that acts as a honeypot that will offer money to outsiders who want to enter. Anyone that leaves creates entrance liquidity for everyone else. Taking this a step further the vault could also be used for other things like building internal infrastructure, and it could also be funded by other taxes (or just straight up inflation IE printing money).

When I was thinking about this yesterday I realized that this is exactly how my Magitek protocol works (or is supposed to work since I haven't worked on the project in like a year). Basically the only way to exit Magitek would be to trade FIRE tokens at a discount for Hive (because Fire tokens can be created by destroying Hive the only way to exit is to offer them at a slight discount).

USD is ironically the exact opposite of this.

I learned this when listening to Michael Saylor talk about Bitcoin from the perspective of a tech mogul. You never sell Bitcoin, you simply use it as leverage. That's because when you spend USD you incur no taxes but when you spend Bitcoin you incur heavy taxes.

In game-theory, USD is designed to be a game of hot-potato where you spend it as fast as possible because it is guaranteed to lose value over time in addition to incurring no taxes. This is why fiat has such a good history of being stable most of the time. It has high elasticity and high velocity and the supply is always slowly expanding over time (and contracting when necessary via elasticity).

What's the difference?

So basically the flat tax for our city state would ironically be exactly the opposite of a flat tax on Coinbase/Bittrex/Kraken. Rather than taxing people for exiting the system, the IRS would be taxing people that want to enter the system. This somehow makes sense because American citizens are already in America. America doesn't have to worry about everyone leaving America like a city-state would. Rather, America knows that people want USD because again, USD is very convenient to Americans. Therefore a tax to receive USD makes sense even though it's exactly the opposite of what we would do in a crypto community. I suppose this tracts considering fiat and crypto are opposites (debt vs store of value).

Conclusion

Borderless crypto does not play well with bordered governments. The entire legal landscape will be blown wide open because crypto can't be controlled by governments, and this is not something they've ever had to deal with before (except with torrents and it didn't affect them directly: only the entertainment industry). And let's be real, torrents won. Crypto will also win. They will have to pivot.

At a certain point crypto will be classified as actual currency. This is all but guaranteed when most products and services can be bought with crypto directly. That's when shit really hits the fan, because currency, like USD, can't be taxed for spending it (except for sales tax obviously). Things will get especially awkward when millions are earning their wages through crypto services pseudonymously without their "employer" never reporting to the IRS.

At the end of the day these networks are digital countries. This is something I've talked about at length, and it is ridiculous to assume that one country could tax another without defeating them in a war. But that's the thing about crypto and digital landscapes: the entire point of them is that they can't be subjugated via warfare. Again, this creates very awkward situations for all participants involved. While these crypto countries can't be taxed, dual citizens can be, but they will statistically continue to reject that narrative on a fundamental level because none of it makes any sense. Narrative matters.

A simple flat tax is really the only answer to these problems. Nothing else is going to work because of the complexity and utility of smart money. Developers will program around complex systems with ease. Implementing a flat tax on all bottlenecks that have a direct connection to bank accounts is the only way they are going to be able to play it. Of course it will probably take them ten years to figure this out, just like it took Netflix ten years to pivot around pirating entertainment IP. This time the IP is money itself. The stakes are much higher and both sides will fight harder. Stay safe out there.

Posted Using LeoFinance Beta

This would be an ideal solution, make it simple so the people can understand what are their duties, don't make a legal labyrinth of it. I'm scared to take out anything of my crypto to FIAT, never withdrawn anything for this very reason. And in my country, Spain the Supreme Court took down the penalties set by the gov because they were "abusive", they're setting new ones at lightning speed though.

In the long term people will buy products directly from crypto, it's a matter of a year or two to be mainstream, so any gov that wants to take his part of the cake will need to regulate this carefully. In that sense this fixed tax for all withdraws is the correct way to go.

My country have a flat crypto tax at the moment. Well, its 57%, but its still flat xD

Hahaha, at least it's unfair to everyone.

Yes haha! That is 100% true haha xD

Damn! That's steep!

Are they good at catching people who don't report their crypto? I would be tempted not to.

Posted Using LeoFinance Beta

No they suck at it xD

Interestingly... everyone I knew used to torrent movies and shows because it was just so hard to get anything... and then Netflix came along and everyone just... stopped. Unfortunately now with individual movies/shows being available exclusively on specific platforms I have to wonder if torrenting will come back. No one wants to have to play for 5-10 different streaming platforms (only to have that show you love disappear at some point).

When you say a Flat Tax... do you mean based on income... or like a sales tax? I'd much prefer a sales tax myself because income is so hard to measure in the crypto world.

Everybody I know uses torrenting, and never stopped, because why would you pay for things that are free?

In the same vein, I don't see why anyone would ever pay taxes, especially on things like crypto that have zero reason to even be attached to the Legal-Fiction-Strawman.

They're not free. Torrenting is theft. It means that the people who spent their own resources to create this thing don't get paid. If they don't get paid they won't be able to make more things. I believe the majority of people are happy to pay a fair price for a thing they enjoy.

Same with taxes... I like that I don't have to defend my property from roving gangs of bandits and have a number to call if I have an emergency.. and y'know, bridges and junk.

Really? Can you show me where an employee that worked on a movie or show was not paid their salary because the content was made available for free online?

Universal Studios is not a person, neither is Time Warner, or Fox, or Disney, and neither are Netflix, Hulu, etc.

You are mistaking fictional entities, created by the violence of the State, for people.

LOL. You are saying that you like having your property stolen by armed gangs, because they "defend" you from gangs...

You're suffering from Stockholme Syndrome.

Hahaha, I don't think I have Stockholme Syndrome... but I guess all sufferers say that.

What about all the people that worked on Cowboy Bebop on Netflix? It was cancelled after one season because Netflix couldn't justify it with the numbers they were seeing... but it was also pretty popular online with the exact demographic that enjoys torrenting. Firefly is another great example.

It's just basic economics. If people aren't paying for a thing, then there is no incentive for people to make that thing.

In terms of private companies running public utilities, you're forgetting about the huge cost in infrastructure that's required up front. A train network doesn't usually make money itself... the cost to build tracks and train stations and boom gates, etc is way too huge for any company to take on initially... but a good train network increases the productivity of the local economy by a lot - so it's better for everyone to have a good network - but no one except a government funded by tax dollars could afford to build it initially.

That show was a horrific bastardization of the source material, and fans knew it was DOA before it even came out.

Firefly came and went well before torrenting hit it's peak, and there is no claim anywhere that it's cancellation had anything to do with online viewers - simply with the studio's lack of interest in a Sci-Fi Western.

That doesn't match with Hollywood, where most projects get their income from product placement and advertisements. Notice that NO show/movie launched on Hulu, Netflix, etc actually makes any money itself (no tickets, no rental fees, etc.), they are all covered in that one monthly payment.

I'm not going to bother arguing against using the violence of organized crime syndicates calling themselves "government" - either you are opposed to the use of force, fraud, and coercion, or you're not.

Yeah, but Netflix and Hulu, etc pay a production company for that product... and if the product doesn't receive the numbers they want, they'll cancel it.

Of course I'm against governments using force, fraud and/or coercion against people... but I don't think that's actually happening. After all, as Edicted said, you can't get taxes if everyone is in jail. Most people are fine with paying taxes to pay for shared public infrastructure and most people don't know anyone that's been thrown in jail for not paying taxes. I think usually the IRS usually issues fines, or works with people on a payment plan process, etc way before it would ever consider putting someone in prison... and there are so many people in every country that don't pay their taxes properly... maybe everyone.

Obviously I think there are SO MANY improvements required on taxation processes and policy - I hate that so many people loophole their way out of paying their fair share... but I'm not at all against taxes entirely. We probably don't agree on that last point, and that's fine - thanks for the interaction.

Taxation: Give us your money, or we'll attack you until you're compliant or dead.

Torrenting: I'm looking at this thing you made.

You could argue that they're both theft; but if only one is...

I mean... to be fair, how many people has the ATO attacked or killed?

I would argue that Torrenting is theft and Taxation is the means to fund shared infrastructure and services... but I'm cool with disagreeing on that point.

It's the threat that's the problem. You walk into the bank and hand a note to the cashier, that's all you've done. If the note's a deposit slip, everything's good.

If the note's a threat and a demand, then we have a problem.

To say, They gave me the money so I didn't have to hurt anyone, while technically true, doesn't make the act any less a violent robbery.

All true.

I guess the other side to the discussion is that everyone benefits of varying degrees from shared infrastructure, but if some people refuse to pay their share, what's the fairest way to compel them? And do we as a society agree with those measures?

I don't think most people legitimately fear prison if they don't pay their taxes, but the fear of extra fines is definitely real and motivating.

I hear what you're saying... there's no real way to opt out, unless you move to a country with little or zero taxes... or you're rich and can pay people to find loopholes for you.

You could make the argument that it's necessary theft; but it is theft.

Kinda like cannibalism. Sure, your plane crashed in the mountains and you have no food, and Larry's dead anyway. You can argue that it's necessary cannibalism, or justified cannibalism, but it is cannibalism.

I'm just not sure what the alternative is though. We all need a certain level of shared infrastructure to survive, to be productive and to be happy. When people describe an area; they talk about safety, parks, transport, schools, etc - I'm just not sure how that happens without taxation.

sales tax

5% on everything no matter what.

all money that flows from centralizes exchanges to banks 5%

Yeah, love that. Edicted for Planet President!

This worries about withdrawals, but when it comes to crypto out of the banks we will find a way to evade tax 😆

A flat tax for sure will make things easier for everyone. Living in a country in Europe where I need to pay just 10% on crypto profits, looks like a blessing nevertheless.

Posted Using LeoFinance Beta

the only negative I could see with a flat tax is it will free up IRS agents to butt their noses into other areas since their enforcement team would be freed up from analyzing all these scenarios. We almost want them so distracted chasing their tails that they just keep getting behind year after year!

Posted Using LeoFinance Beta

lol that is a hilariously insightful point to make

A flat tax is fair in my opinion then it doesn’t matter how much money you have it’s all taxed the same.

That's not a bad idea actually. I would go for that if it meant no headache doing taxes. That's already hard enough as it is.

Posted Using LeoFinance Beta

I think a flat tax could also be applied to the stores or the merchants. Basically they get their cut baked into the prices and nobody needs to worry about anything. Most people wouldn't even notice it much afterwards and you don't have to pay for it later in the year either. Of course this means there might not be tax refunds for some people under the threshold.

Posted Using LeoFinance Beta

Flat tax with anyone under $50k does not pay taxes. No writes or breaks and everyone pays the same amount. Then businesses pay a higher flat rate. It’s deducted from pay and you don’t need to file. Get rid of the irs and automate the process.

Posted using LeoFinance Mobile

The taxing system is such a nightmare in the USA seriously. Nothing like spending 5% of your income to have someone try and go through all your taxes because it's confusing and complicated AF. Do they care though? Nope all of that just generates more taxable income for them. You legit get taxed out the butt because of all the jumps and loops you have to cross through. They doesn't hurt the ones on top because they can afford and profit well off of someone that understands it all. But for the every day person they constantly get screwed.

A flat tax does make sense and I do like the argument about BTC and your not really exchange money when doing so. It's going to be interesting to see as some of these new rules and laws start kicking in. What's important though is the crypto community speaks up and puts on the pressure when governments try to overtax and get away with sly things. It's going to happen often!

Posted Using LeoFinance Beta

Simplifying taxes is certainly legitimate and a goal to be pursued. I think having to pay 5% or 10% on what I transfer to the bank is simple but unfair, let me explain:

This mechanism seems unfair and, in my opinion, makes the investment more risky.

Posted Using LeoFinance Beta

This big tax for Crypto users are getting too much. IRS need to look for a way to reduce this tax because is going to make some people to drop out from using Crypto currency.

Posted Using LeoFinance Beta

“borderless crypto does not play well with bordered governments. The entire legal landscape will be blown wide open because crypto can't be controlled by governments, and this is not something they've ever had to deal with before (except with torrents and it didn't affect them directly: only the entertainment industry). And let's be real, torrents won. Crypto will also win. They will have to pivot”— what the government cannot control automatically becomes a headache. Crypto has you said is borderless, the mere fact the government has not dealt with something borderless like crypto before will make it so hard for them regulating it.

I must say that the issue of taxes is a very complicated one but somehow, I don't really know how it feels for you people over there in the US because over here, taxes aren't that complicating.

Posted Using LeoFinance Beta

There is a reason tax returns in many countries are complicated. A whole industry relies on you not understanding what to do!

The countries with the simplest tax structures, Hong Kong, Panama and Singapore come to mind, were successful because they attracted the right type of person to do business and live there. Government tax income increased because the people living there did well financially.

Minimal government interference (Hong Kong pre-1997 certainly) in how you conduct your affairs may also have had something to do with that.

In today's world it is all about incentivising people to do "the right thing". Who determines what that "right thing" is? The government of course. And how do they incentivise you? By charging a tax.

The problem is the utterly non-sensical allocation of resources governments undertake with this income. It is all about increasing their powerbase. And reducing yours.

Posted Using LeoFinance Beta

In Portugal is 0% tax on cypto or in Romania, flat tax on 10% made on profit, but only on the FIAT amount, for example you exchange $1000 in crypto, do your thing, and exchange back $10000 to FIAT, the 10% would be paid only on the $9000 profit.

Posted Using LeoFinance Beta

Instead of taxing peeps so high, governments should create businesses and raise their own pot. Do whatever the fuck they want to do with that money. Instead, they choose to burden the masses. Rich don't pay taxes anyway and they can hire highly paid accountants and lawyers to save their asses.

But I am okay with the sweet spot you mentioned. At least 5-10% seem reasonable. Let them have that share and slowly reduce it to the lowest levels.

India is imposing a flat 30% on crypto gains and 1% TDS on each transaction. Insane 😂

Posted Using LeoFinance Beta

I still sail the torrent seas. IP is a myth.