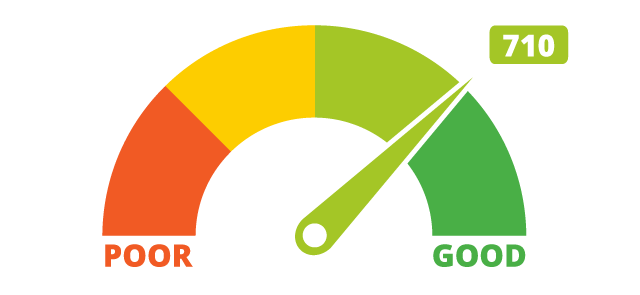

Credit Score

My credit score rose two points today.

Mastercard also notified me that my credit limit has increased. It's weird putting effort into gaining reputation within the legacy system, but it still has a lot to offer. Being able to leverage our own identity into a loan is pretty powerful stuff if we're actually responsible with what we do with it.

For all the shit I talk about the legacy system and how this is all "debt slavery"... it's really not that bad. I exaggerate a lot. Everything is relative. You know what would have really sucked? Getting publicly crucified 2000 years ago while dying a slow an agonizing death, hoping that a soldier would pop by to stab you in the lungs for the mercy kill.

The history of humanity and society in general is just one series of fully metal events after another. You know those aliens are up there thinking, "Damn! These monkeys are savage as hell." Meanwhile, I'm still waiting for the mothership to come pick me up.

Anyway... "debt slavery"

What happened when I didn't pay back that $10k in credit card debt 5 years ago? Did they throw me into the gulag? Did they take away my freedom? Did I get inconvenienced one single bit?

No, no I did not.

It just so happens that I didn't need a good credit score for anything during that time. I did have to pass a background check one single time in order to lease an apartment for a year. Know what I did to "prove I had the money to pay rent"? I didn't have a job, so I just went into the office with a $2000 bankroll and said I was a professional poker player.

They were actually pretty impressed. Probably because no one sees cash anymore. Luckily they didn't decide I was a drug dealer (or maybe they did and decided that I definitely would pay rent). For anyone that needs to hear this: never say you're a professional poker player at a job interview. That worked for me about zero out of five times, even though it was the truth. It never works.

So yeah even though I was a professional poker player in Portland, I never found a good cardroom in Sacramento. There are several, but damn the rake is just too much. The cardrooms in Portland are amazing because of the gambling laws. Zero rake, $10 per day cover charge only, all the dealers are "volunteers" who work for tips (paid $0 an hour). So yeah you're somewhat expected to tip heavy but the fact that there's no rake means you can make bank if you grind out a ten hour day. The players there weren't even good. Plenty of degenerate gamblers.

I basically paid my rent for a year with credit cards and a dwindling savings account. By the time the year was up I was completely out of money and ended up moving in with my girlfriend, crippled by debt and no job. In fact the only reason I got the job at Amazon was because the warehouse was right next to her work and there was a "we're hiring" sign and being broke A-F was a huge strain on our relationship. Fun times.

What was I talking about again?

Oh yeah, so I borrowed $10k and just didn't pay it back... AND there was no punishment for doing so. Hilarious. Now my credit score is going back up. I have a credit card. My limit on my secured card has increased from $200 to $1000. My score is now high enough to leverage it into another credit card with a higher limit and a better interest rate. I've officially legally stolen $10k with no punishment (or at least the punishment had zero affect). Crazy stuff. Maybe I should do it again? lol jk I would never (unless shit really hit the fan just like it did back then).

The crazy thing about crypto is that the legacy economy can't track it, and even if they can track it, they can't force us to give them the money or freeze our assets. This is going to come into play once crypto goes mainstream. The stories will be a thing of legend; mark my words.

Conclusion

Time keeps tick tick ticking away. Back when I realized that I'd never pay back that $10k in credit debt, it was hard to ever imagine that my credit score would ever recover. Here we are, almost right back where I started. It won't be long now before I make it back up to 700+ points. Maybe one day I'll do a post on all the ways we can game the system to increase this ridiculous number. Most people don't even try.

Posted Using LeoFinance Beta

It effects nothing, I didn't pay back $9000 and nothing to date has changed, my credit is still fine too somehow.

Interesting, was it medical bills?

No a visa from a Canadian financial institution, I didnt get any credit checks for a few years to be safe.

The next time I needed a credit card I got approved.

It was odd to basically take $9000 and then be trusted again.

I did this but with more money. Bankruptcy was the best decision ever. Wiped clean for 2 grand and now I have really good credit.

Posted Using LeoFinance Beta

That's awesome congrats!

And what would happen when we borrow money from a DeFi and not return!

Posted Using LeoFinance Beta

Most DeFi wants you to over-collateralize before they lend you money.

In whatever we do as human, doing our best is what move us father in life. Building a good reputation consistently is the best way to achieve that.

Am glad your credit score was increased. I need to work on myself on that.

Thanks for sharing

Cheers 🍻

Did debt collectors go to your house? Could the credit card company take you to court at the time?

I hear people collect Government loans here and just leave the country. The loans don't come to everyone, so if you're lucky enough to get them, you just run away with them.

Posted Using LeoFinance Beta

Loool they do? But won’t the government sieze the collateral? Sure they can’t run away with it.

Those Covid-19 loans made people millionaires, from what I heard. The government didn't ask for that money and people just ran. Some called th loans, some called them grants. But nobody paid back.

Posted using LeoFinance Mobile

Mad o....normally they’ll collect collateral. Never heard this was going on

This was early last year and the year before that, I think.

Posted using LeoFinance Mobile

Too bad that was not yet in Venezuela in those days, as I would have borrowed $5K from the bank and left the country haha.

Posted Using LeoFinance Beta

I'm pretty sure they would completely understand

Posted using LeoFinance Mobile

Since the apr for hbd has gone up I occasionally dream of taking out a big loan to put into it but I can never find one with agreeable enough terms to make the math right... Maybe I should just take the money and run :P J/K

Lmao

I think the key to going long with debt is to get very good secured loans, kinda like Michael Saylor. You put up your house as collateral and get a 2% loan. Then all you have to do is make monthly payments and you get to keep the house no matter what the market does.

Of course this assumes that you own a house, which I don't and you probably don't either.

So what really needs to happen is an epic house collapse where we "buy the dip" and get a house 50% off after the hedge funds dump the market.

And now if you have a house or still live with your girlfriend?

I can't give as a guarantee a house, since I don't have one either, I live in houses taking care of them while the owners are in other countries.

Posted Using LeoFinance Beta

I actually just bought a house last April so I don't really have much equity built up yet to do anything like that 😅

Hahahah. This all sounded like a post made while tipsy on some wine or something. You're having a good time, congrats on the improvement.

I don't really understand, though, how did you borrow this $10k? From whom? And what was the ineffective punishment when you couldn't pay back?

Posted Using LeoFinance Beta

Credit card debt.

I borrowed it from banks that issued visa cards.

We don’t even have this in Nigeria. Non that I know of. Lol

In economies like ours, it is not worthwhile for a bank to extend credit.

Posted Using LeoFinance Beta

If possible I would take as much money I could from the bank and never pay back.

Posted using LeoFinance Mobile

Zombie debt laws vary state by state. Here in Minnesota it’s six years and then creditors can no longer try to collect on debt. Most creditors give up trying long before that and just write it off as a loss. One exception is Target, those suckers are tenacious.

In Venezuela something like this happened but with inflation, since my parents had asked for a credit to the bank of $1200 (which was a lot) but the bank granted it in bolivar, and in just one year the inflation made the Venezuelan currency the bolivar, cost 6BS/$1 to 1000BS/$1 which made that with the work of a day they paid the debt of the bank hahaha.

Posted Using LeoFinance Beta

I couldn't pay my credit card payment for a few months in 2020 and the bank hounded me like a bunch of crazed mafia bosses. Considering that everyone had to close their businesses unless you were deemed an essential services (when the Covid lockdown hit) had no bearing on it either. It was very annoying. I managed to sort it out but I've hated that bank ever since. I don't like credit at all to be honest, but everything these days runs on debt.

I'm very curious to know how they were able to harass you so badly.

Maybe I got away clean because I never pick up the phone for random numbers?

And the notices in the mail were comical, every month a new deal with a slightly lower number on the negotiation. How about zero, friends? Zero sounds good to me.

They phone from different numbers every time - from a call center I think and they were kinda painful about the whole situation. They never offered me any sort of reduction. I'm surprised they didn't start threatening to break my knee caps lol. I know that here they used to come and repossess stuff to recover the value but I don't know if they still are allowed to do that legally.

Hahahah so you seriously just kept getting it reduced until they wiped it off your name?

Get The Money and run 🤑

Lol that's it. My daughter's jamming to this now lol.

The good thing about credit scores is time cleans them up. Screw up. Fine. Just dont screw up for a number of years and things start to fall off. Even bankruptcy isnt the end of the world although will mess you up for about 7 years.

Posted Using LeoFinance Beta

I've lived 20 years with absolutely no credit. It would have been the death of me, because I've worked for myself this whole time and have been living day to day by the skin of my teeth. It was a good thing that I destroyed my credit when I was 23 because if I had credit I surely would have used it to survive, gotten myself into debt slavery, and would have had to work a job to pay it off which is my worst nightmare. OR... like you I could've just let it go I guess. I destroyed mine with a mere $1,000 maybe I should've kept going. Ha, doesn't matter to me we've bought old Toyotas cash and didn't mind living in a trailer we bought with cash with a tiny monthly lot rent to allow us the freedom to exist and do the things we like to do to make our money.

Since the time I destroyed my credit, new innovations have come into being which allowed me to easily rebuild my credit which has been a fun and easy game I've been playing essentially since Covid hit. I found out about Self Financial, and it's just been super, super easy. They take out an automatic payment for me every month of a small amount that gets put into a savings account, and then after a while they offer me a credit card, I make a small purchase of less than 30% of my credit allowance on there, and voila that credit score just takes off. Then other people offer me cards. All the time actually. And it is kind of nice to have extra funds to build my business more than I used to. My credit score is now up to 716 with absolutely no headache from me. I did it so I could get a mortgage.

Just shredded a file with papers from this nonprofit I used to work with that was trying to help me fix my credit. Amazing how much easier things are now looking back at that. So many apps that make life so easy!

Anyway, on that same road as you with the credit! Had to read your experience.

The FBI and SEC love your publication hahaha.

Posted Using LeoFinance Beta

I have heard that this is a huge issue and some people suffer the penalties while others do not. I don't really know but I have heard that more people are taking the buy now, pay later approach to get by with the increased costs. I believe the government is going after those institutions.

Posted Using LeoFinance Beta

I really cannot relate to this credit card thingy because where I come from I’ve never seen or experienced such . You can’t even go Scot free when you don’t pay back a loan . If you were not punished for paying back a 10k debt , then it Really puzzles me how the credit card system works over at yours !

Oh god I'm getting ideas reading all these comments🤣🤣🤣🤣 preety deep in credit card debt myself.

I didn't know we can walk away from card debts just like that and even ironic to be getting a high credit score after some time :) I think that's one to try, lol!

Posted using LeoFinance Mobile

The trick is to make it not financially worth it for anyone to sue you :D.

If you get sued you might have to pay $5k just to declare bankruptcy.

Aha, that's something I didn't see between the lines. Don't have the guts to try it here, lol!

Posted using LeoFinance Mobile