Another Massive 75 Point Hike - This One Is Going To Hurt

Another Massive 75 Point Hike - This One Is Going To Hurt

We haven't felt that much pain from the recent rate hikes. I would say the last one is when we started to feel a little bit of pain but now we are moving into territory that is going to start having drastic effects on not only the USA economy but the world economy. Let's take a dive into what this new 75 point hike means and what we can expect not only from this rate hike but future ones to come.

Adding Another 75 Points

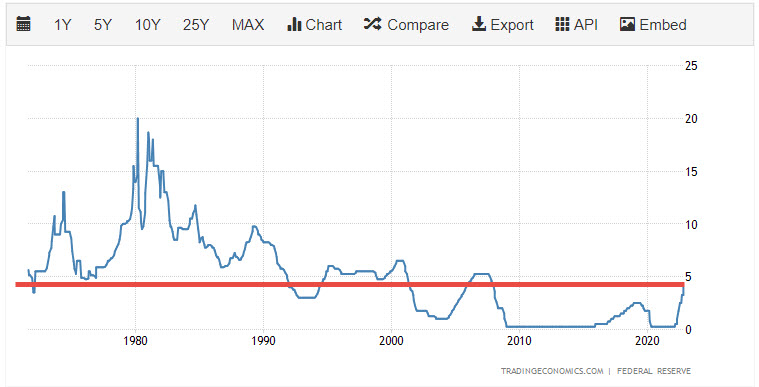

Before this rate hike we pretty much returned back to pre covid lock down rates. The fed rate was constantly slowly going up as the world economy was already showing signs of slowing down. However the rapid lock downs around the world because of covid sent shockwaves into that slowly economy that simply put crushed it. We then returned to zero % fed rates and the goverment paying us money only to suffer for it at a later time and that time has now come.

Not only are we battling vs a slowing economy we are now battling the followings...

High inflation caused by the stimulus and zero percent fed rates over two years during covid lockdowns. That's two years of what should have been 3%-3.5% fed rates that now needs to be made up for.

Bailouts and stimmy checks well you gotta pay for that money back at some point and boy are we paying for it now. Not only with high inflation but also in higher taxes (yep might not think it but your taxes have actully increased)

A global world war- Make no mistake about it the war in Ukraine is a global world war. It's not fought like world war one or two it's instead a small front called Ukraine in which the entire world is involved in. It's a energy, resource, cyber war that continues to get more and more costly.

All of these things are massive negative effects on not only the US economy but the global economy but the US is trying to play it's cards on a all new level which is soon about to bite them in the butt.

As the feds increase the rates at a rapid percent like they are now it does in fact make the dollar stronger compared to every other country. As other countries don't increase their rates as fast they actully owe more money back to the USA and trading becomes more and more expensive for them. It's a seriously ugly game and one that other countries are going to start to not tolerate soon and they are getting close to that breaking point. If we make it through this winter without EU and the UK breaking I'd be surprised to be honest.

A big area that is going to be hit is real-estate and the last time we had fed rates at these levels was right before the entire housing market collapsed. I honestly feel in 2023 we are going to have a collapse that may dwarf the 2008 crash.

The Next Few Months

With interest rate hikes we the people wont see the effects of this for months to come. A change in rates today means at least 30-60 days has to pass before we see the real results of those changes. The stock markets always suck this up the day of which always cracks me up and I bet you by Friday we will get another dead bump rally after a day or two massive sell off because of the news of the rate hike. It's odd but it continues to play out over and over again.

Because of this lag effect it's hard to understand how the economy is going and CPI reports also don't really account for any real data till months later or even a year when you compare your year to year inflation.

Honestly high inflation is most likely going to stick around because as far as I'm cornered it has nothing to do with high demand and everything to do with a slow economy that got crushed and now trade wars which is very much so restricting the amount of supplies their are available in the world.

We literally went from a age of abundance to a age of scraps in the matter of 3 years and it most likely is only going to get worse. So of course this is going to drive up inflation which should be enough in itself to slow demand for items and have people cut back. Instead we are going to get pummeled to the point so having nearly nothing and just trying to get by. This is where cash is king right now and stock as much of it as you can and take advantage of high interest rates to try and beat inflation with your money. In a few years you'll come out of it on top.

2023 Fed

The Fed is becoming more and more aggressive on this rate hike matter. In fact they stated they could become even more aggressive in the coming months and blow past that 75 point rate hike we have seen in the past. You're going to be begging for a 75 point rate hike. If the CPI report comes in two weeks from now and shows inflation has not moved or increase I honestly expect 100 points come December from the Fed if not higher.

The Stock Market

With these continued rate hikes stock markets and companies will continue to struggle. This is where saving and your dollar comes in. Most people will start exiting risky stocks which simply only look like they are going to keep falling and most likely will over the next few years. Instead that money will be deposited into safe havens like savings accounts earning 3% or higher yields. T-bonds backed by the USA government earning 4.5% or much higher. This is because these "safe" assets are actully paying MORE return than the stock market and while they don't beat inflation they at least miss the beating the stock market will continue to take.

What comes after all of this mess?

You guessed it... A massive bull run!

We most likely wont be seeing a bull run till mid 2023 or end 2023. I'm putting my bet on end of summer 2023 when the bull market starts however that can change quickly as the world stage continues to get more volatile.

*This article is not investment advise and is for entertainment purposes only.

Posted Using LeoFinance Beta

https://twitter.com/777743941617713152/status/1588178325062778881

The rewards earned on this comment will go directly to the people( @bitcoinflood ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for sharing. Medical premiums up 18% next year. Starting to feel to pain.

!PIZZA

oh yeah that CPI report does no justice for the real inflation that's happening. When you count things in like food, gas and medical you're at around 25% inflation

btw your #runi looks dope!

Thanks I am very happy with it. A pirate Runi.

!PIZZA

I gifted $PIZZA slices here:

@ijat(2/5) tipped @bitcoinflood (x2)

Please vote for pizza.witness!

Yay! 🤗

Your content has been boosted with Ecency Points, by @bitcoinflood.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more