8.2% What To Expect For The Rest Of 2022

8.2% What To Expect For The Rest Of 2022

8.2% a number we all look towards each month to try and figure out what the FED is going to do next. This is called the CPI report or Consumer Price index. This number actully increased by 0.4% in a month when another huge rate hike kicked in.

But here's the real kicker the CPI report does not average in items which are considered necessities such as fuel and food and these come in at a whopping 11.2% for food and 19.8% for energy of which 58.1% comes from Fuel oil. We have also seen a staggering increase in piped gas services up 33.1%. Again these numbers are not even factored into the CPI report because they are considered necessities. Put those in and your CPI explodes to levels that would share the daylights out of the public and have them begging for 8.2%

The Next Moves

More than likely the Fed is going to kick in another high rate hike in just three weeks from now Nov 2nd and most likely another large jump in December. That number will most likely come in at another 75 points or who knows they might kick it up higher now that the 75 points does not seem to be effecting the inflation number.

What the FED is now expecting is that inflation wont be going away for another few years and with these continued rate hikes it means the stock market is going to remain rather stagnate but first depressed as people sell off and move their money into other areas.

The Dollar

The global currency is getting stronger than ever (which I cover a bit below in the what I believe is going on section) this is because everyone around the world has agreed to make transactions in USD. Inflation is not a USA problem it's a world wide issue and because of that we are seeing some big changes taking place.

Countries are looking for places to park their money in order to get the best return. Because the USD is considered safe and stable compared to any other currency countries are now pumping money into the USA through government backed treasury yields.

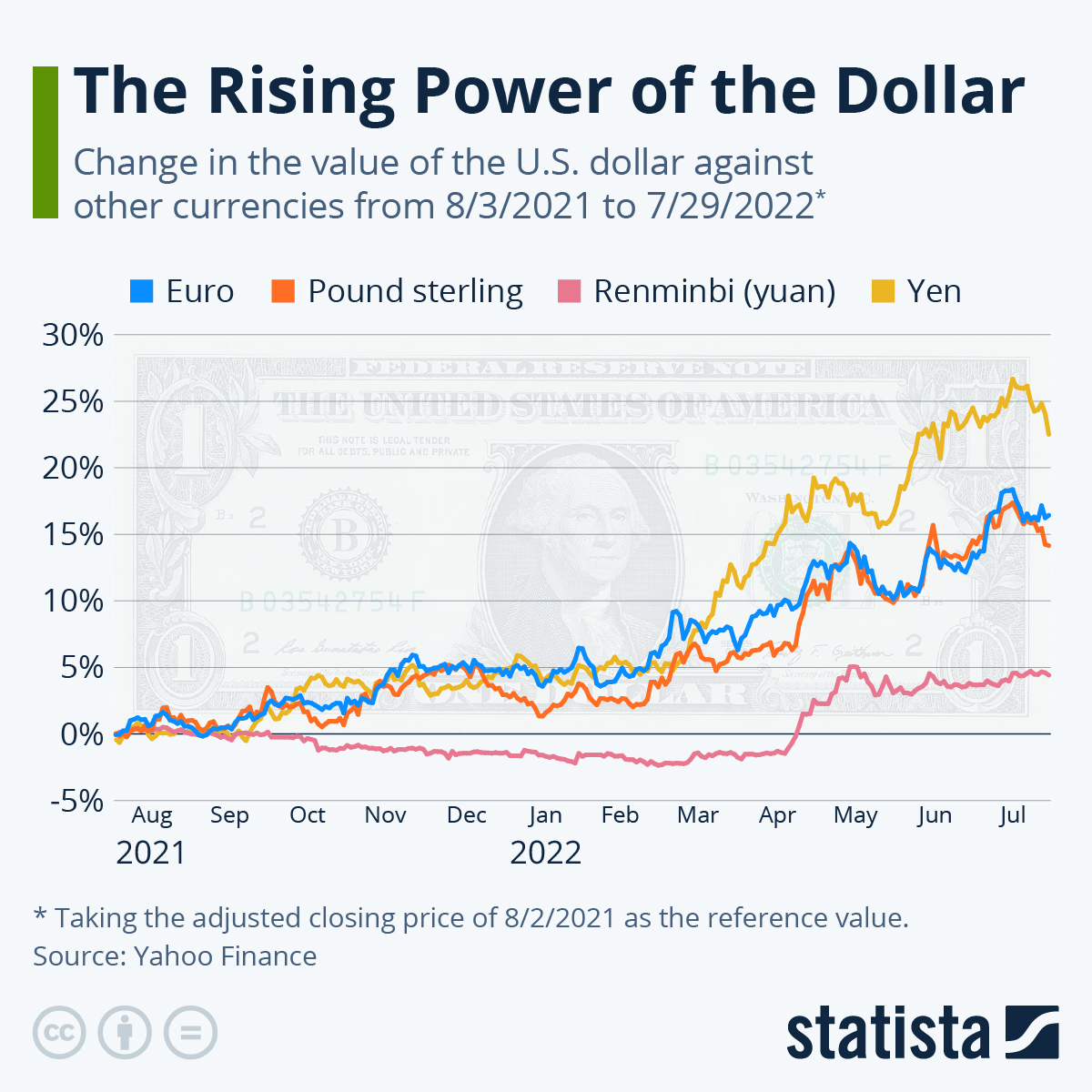

Your dollar is losing value here in the USA as you see with how expensive things are getting compared to a year ago. However the flip side of that is the dollar is becoming much stronger just take a look at this graph for the last year and things really start to come into perspective. and yes even the Chinese Renminbi continues to lose value compared to the USD.

*Image pulled from Statista.com

What I believe Is Going On

Right now the world is in a mess and the united states actully has an opportunity to effectivly take over even more market share quickly. How do they do this? They do this by increasing the FED rate which means any country that owes us money through loans and is into increasing their interest rate at the same value we are, are actully paying us MORE money then before.

This is kind of when a bank gives you 0.01% interest but you get out a loan and pay 4% increase that again to todays values and you're looking at about 2% and 7%+ for the loan. You're actully losing more and more value of your dollar and paying back more and more when paying back that loan.

Essentially the united states government is stuffing their pockets with more wealth and value than ever before which in a way they kind of have to. Have you seen the massive amount of money that is invested into military over other EU countries it's mind boggling and honestly the EU relies way too heavily on the united states in that aspect and way to heavily on Russia for resources in the other. Making these countries honestly pretty damn worthless on their own.

Aside from that the FED rate hikes are going to have very limited impact. The reason for this is oil production is down, food imports are down, the amount being produced and shipped out from other countries is down and overall the goods of the world are just reduced thus the demand remains the same but your supply is suffering and continues to suffer. Throw in huge rate hikes and these businesses start slowing down more which is counter productive to the scenario we now find ourselves in. Now you have even LESS supplies going out and less people now working. Essentially you have a huge gap of where poor people get poor or middle class moves into poor and upper class well their disposable investment money keeps them on top with better loans and assets that hold value compared to holding on to cash.

Posted Using LeoFinance Beta

https://twitter.com/777743941617713152/status/1581087642019860481

The rewards earned on this comment will go directly to the people( @bitcoinflood ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

People are looking for where to save their money in other to be save, especially in Africa where their currencies is not stable people use usd as their saving grace

Posted Using LeoFinance Beta

Insightful, What return are we going to make on our RRSP's goin' forward ?

Dismal , how I feel about the economy.

Hopeful, how I feel about crypto

Optimistic, how I feel about Cubfinance & PolyCub

Happy, how I feel about Leofinance.

Posted Using LeoFinance Beta

Your posts are always very interesting. At this point I also believe that we will have a subdued 2023. In the next six months a lot of people will most likely be exiting the stock market, so I expect some stocks in the stock market to continue to decline. honestly I never thought that this inflation could go away as fast as it came, I think that before disposing of this inflation it will take maybe two years, if I have to give a date when things will perhaps be settled I would feel like saying that we have to wait for 2024 or 2025

Well basically you are right though I do not (want) to see several things that negatively. BUT at the end of the day the message is clear: If one wants to keep his/her head above the water the need is to invest into scarce things that keep value and ideally generate some Cashflow: Stocks with quality dividends, Kryptos like BTC or Hive or some precious metals.

Do you agree?

This is a good time to keep investing in the stock market for dividend income in the coming months. The price of those assets will stagnate. The energy crisis will become worthless in the coming years as more people jump to get electric cars.