Buying and Selling Game (Business Version) Contest 23 Results

Hi Everyone,

Welcome to the ‘Buying and Selling Game’ (Business Version) Contest 23 results post. This post contains a video of the ‘Buying and Selling Game’ Excel Model generating the demand for each good, quantities sold, and profits for each participant for this contest.

Winner determined in this video

What is the Buying and Selling Game (Business Version)?

For the benefit of those who have not entered this contest, here is a brief explanation of how the game works.

The participants are required to buy or produce goods with an allocated budget. They are given a choice of three types of goods to buy or produce. They are required to buy or produce these goods in combinations specified in the question. The participants are required to set the prices of the goods they have bought or produced. All costs are provided in the question. However, demand for each good is not provided.

The demand for the goods are determined with an Excel Model, which uses triangle distributions. The participants are informed of the minimum, maximum, and mode values used to determine these distributions in the contest question. The Excel Model uses the calculated demand and prices entered by the participants to calculate the number of goods they have sold. The prices, costs, quantities bought or produced, and quantities sold are used to determine the profit for each participant.

The participant with the highest profit after selling his or her goods is the winner.

Responses to the contest are made in the comments section of the post. If several participants make the same profit, the person who entered (commented) first will win. The account with the winning entry will receive 30 Hive and the first 12 entries will be given upvotes. The winner may win an additional 5 Hive if he or she has a profit higher than the profit generated by the model estimator. If nobody makes a profit (i.e. zero or negative), the prize will be rolled over to the next contest.

The format of the required entry is explained in detail in the contest itself.

For a more detailed explanation, you can access the contest post using the following link.

Results of the contest

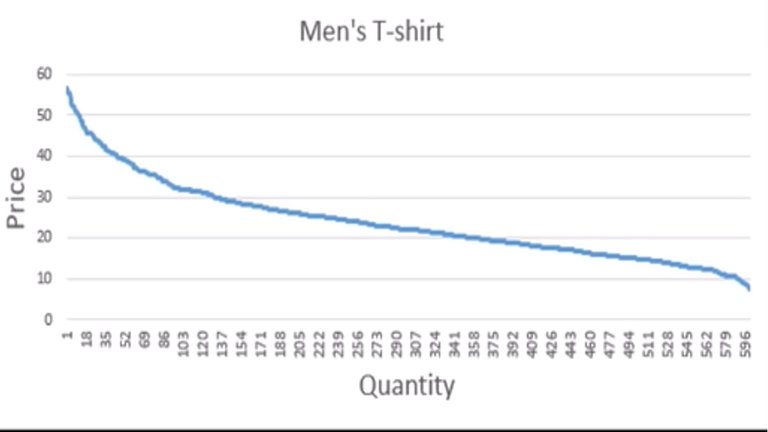

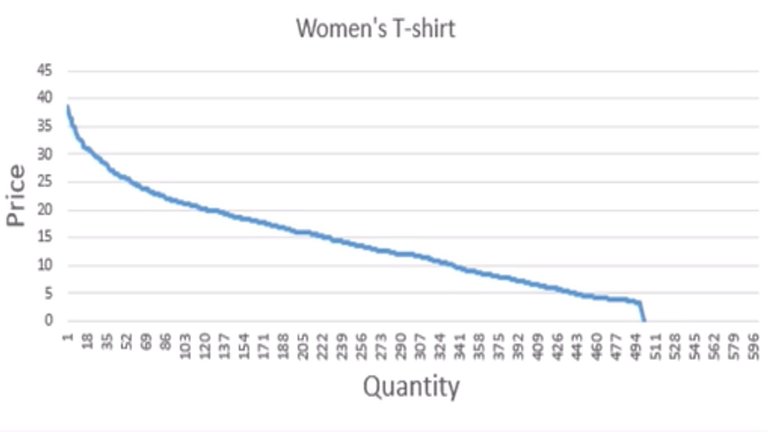

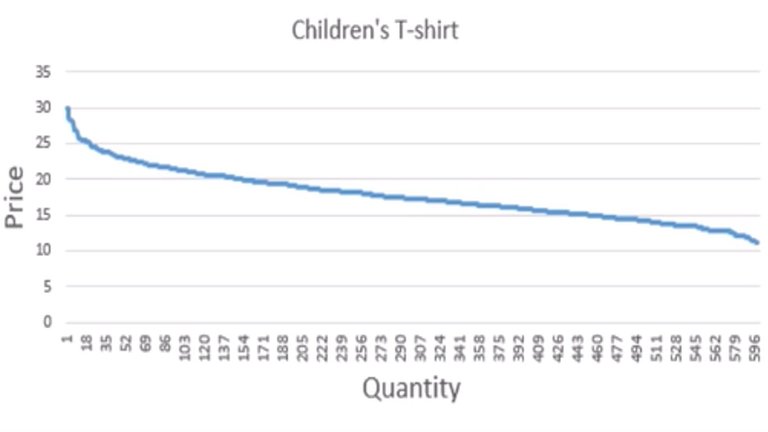

Figures 1, 2, and 3 contain the model-generated demand curves for men’s, women’s, and children’s t-shirts respectively.

Figure 1: Model Generated Demand Curve for Men’s T-shirts

Figure 2: Model Generated Demand Curve for Women’s T-shirts

Figure 3: Model Generated Demand Curve for Children’s T-shirts

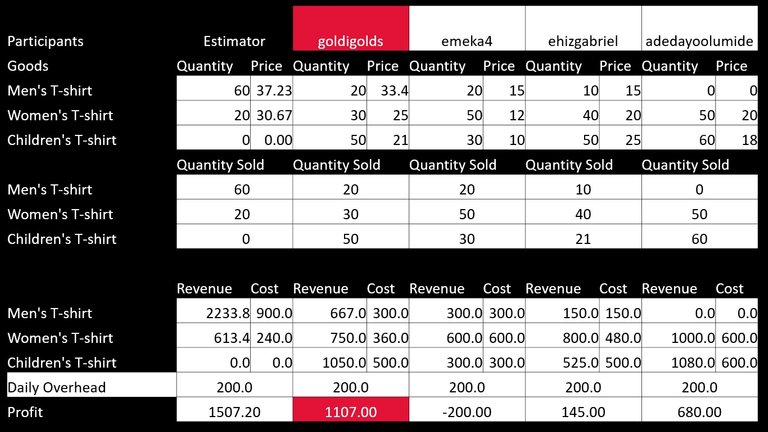

Table 1 contains responses, quantity sold, revenue, and the profit made by each participant.

Table 1: Participant responses and profit

Congratulations to @goldigolds for winning Contest 23 of the 'Buying and Selling’ Game (Business Version).

@goldigolds purchased 20 men’s t-shirts at $15 per a t-shirt, 30 women’s t-shirts at $12 per a t-shirt, and 50 children’s t-shirts at $10 per a t-shirt. They were priced to sell at $33.35, $25, and $21 respectively. At those prices, all the t-shirts that were purchased were sold. A total revenue of $2,467 ($667 for men’s t-shirts, $750 for women’s t-shirts, and $1050 for children’s t-shirts) was generated. The total cost for purchasing these t-shirts was $1,360 ($300 for men’s t-shirts, $360 for women’s t-shirts, $500 for children’s t-shirts, and $200 for daily overhead). @goldigolds’ total profit was $1,107.

@goldigolds was unable to achieve a higher profit than the estimator. The estimator focused on men’s and women’s t-shirts instead of children’s. This was because of the low budget and the higher willingness-to-pay of men and women for just a few t-shirts. If the budget had been higher, the estimator would have focused more on children’s t-shirts as they have a more elastic demand (more can be sold for a profit).

I would also like to thank @emeka4, @ehizgabriel, and @adedayoolumide for participating.

Contest Tips

For the business version of the Buying and Selling Game, a participant needs to understand three areas. These areas are:

- Impact of working under a budget.

- Relationships between costs, demand and price.

- Shape of the demand curve.

The size of the budget plays an important role in determining how much of each good should be purchased or produced.

If the budget is large, production of goods should be more widely distributed across all three available types of goods. Generally, goods with elastic demand should be bought in higher quantities than goods with inelastic demand. Goods should be bought close to the point where new customers’ willingness-to-pay (i.e. marginal revenue) is almost at cost (per unit).

If the budget is small, goods with inelastic demand and high maximum price should be favoured over goods with elastic demand and lower maximum price. Prices should be high to capture as much consumer surplus from customers with high willingness-to-pay. If the budget is exceptionally small, it might be optimal to produce just one good.

Understanding the relationships between cost, demand, and price is essential for optimal pricing of goods. Goods must be priced above cost to make profit but if the prices are too high, insufficient customers will buy the goods, which will reduce profits.

The maximum, minimum, mode, and diminishing marginal utility determine the shape of the demand curve. High diminishing marginal utility increases inelasticity of demand. A large difference between maximum and mode price, increases inelasticity of demand in the top portion of the demand curve. A large difference between minimum and mode price, increases inelasticity of demand in the bottom portion of the demand curve. The top half of the demand curve is most relevant when the budget is small. The bottom half of the demand curve is normally more relevant when the budget is large.

Other important things to consider are batch size and costs of goods. Large batch sizes may force participants to focus on less goods, as the optimal number of some types of goods may fall short of the number in the batch. If the business is dealing with very low cost goods, a participant is more likely to make a higher profit by spreading purchases across all available goods. If the business is dealing with high cost goods, a participant is more likely to make a higher profit from focussing on one or two goods. This is because quantity demanded for high cost goods is normally lower than for low cost goods.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media

▶️ 3Speak

Keep up the good work @spectrumecons and congrats to the winner

Thanks @emeka4 .

Thank you so much @spectrumecons . I don’t know how many times I should read the contest tips to learn.

You’re a big brain. 🤯

Thanks again. 🙂

You are definitely on the right track when it comes to pricing. Product selection can be very tricky and sometimes it doesn't make a big difference. Well done on your win. I hope to see you next month.

I’m excited to play the game and learn. See you.

Excellent work @spectrumecons... Thanks

Thanks @ehizgabriel.

Hey there @spectrumecons

@iliyan90 Here sorry to bother you I hope you don't see it as spam.

I'll attach a Proof of Brain video explanation of why I will unfollow you from this account and refollow you from @calisthenicsdrop

Read the entire post here:

https://ecency.com/hive-172868/@iliyan90/oryzhloh-hive-172868

You know I'll keep on following your time spend on Hive blockchain!

I hope you see my vision.

Namaste

here