Studying Patterns In The Economy

The economy is a complex system. While it's often easy to feel discouraged about the health of the economy, there are patterns that can help us understand what's going on, key indicators that can help us predict how an economy might change and how to use these patterns to make better long-term decisions.

The Economy Is Cyclical

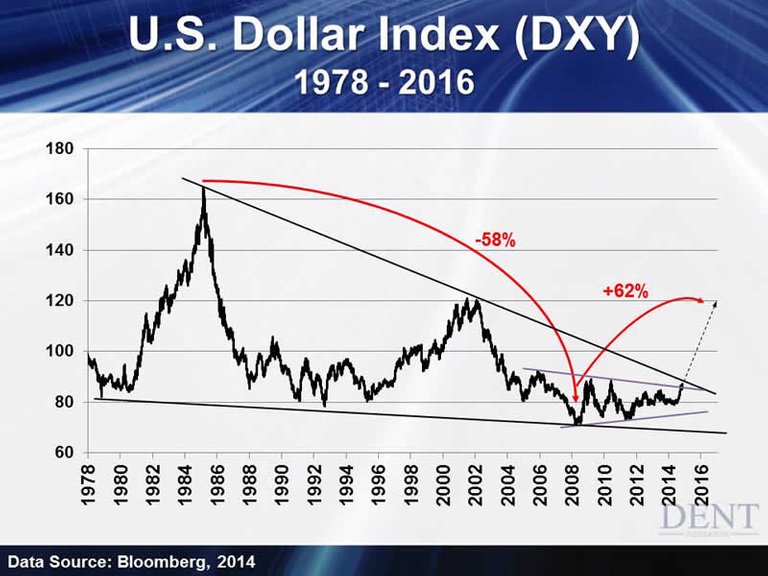

There are different ways to predict the economy, but it's important to understand that it is cyclical. The economy goes through cycles, meaning that there will be ups and downs.These cycles can last anywhere from a few years to decades at a time. The most recent cyclical downturn started around 2008 and lasted until 2013-2014, when we hit rock bottom and started seeing signs of growth again.

If you see prices on products going up or down steadily for several months in a row (especially if other factors like inflation don't affect those prices), then chances are good that something bigger than just gas prices has changed about how people spend money on certain products or services during this period of time.

Every System Has A Natural Cycle

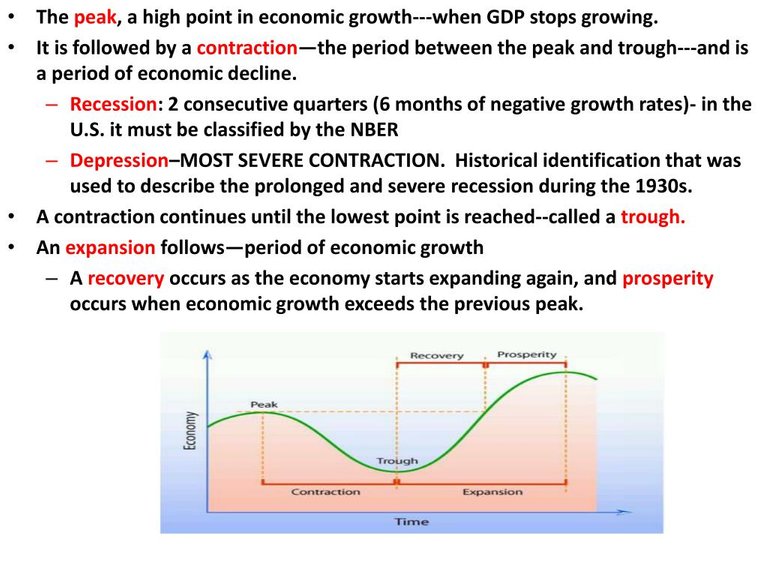

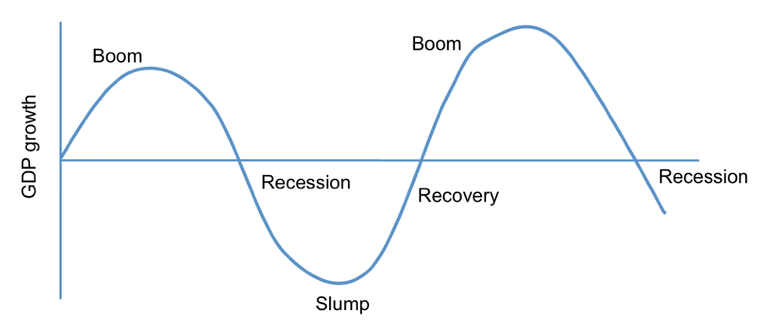

The economy is an intricate system, with many moving parts and variables. What's more, the economy is constantly changing. This means that understanding its patterns can be difficult—but it's not impossible!Every system has a natural cycle; this includes our economy. The boom-bust cycle describes the pattern of growth followed by contraction in which an economy goes through over time, with periods of expansion and recession alternating with one another until an eventual state of equilibrium is reached which normally happens for a short period of time.

Everything Expands And Contracts

There are cycles in the economy that run in parallel to one another.Variables change within each cycle: for example, the unemployment rate is lower when there's a low-growth economy than it is during a high-growth economy. The same is true for things like inflation and unemployment rates; they rise and fall at different times according to the stage of the cycle.

Cycles are predictable in nature and economists (or learned indivuduals) can forecast them years in advance with a 90% accuracy.

Different Cycles That Run In Parallel To One Another

There are different cycles that run in parallel to one another. For instance, the economic cycle is tied to the business cycle and is a function of how businesses operate.The political cycle is tied to elections and serves as a reflection of who’s running for office and their agenda.

Social cycles are related to demographics and populations; they can determine what type of people make up a community or country, as well as how those people behave or interact with each other (such as whether they favor certain policies).

Finally, technological cycles determine how technology develops over time—for example, you might see an innovation like Artificial Intelligence (A.I) become more advanced year after year because companies keep releasing new models with better features than before.

Variables Change Within Each Cycle

While the four-year cycle is a basic recurring pattern, each cycle has its own unique variables that change. These variables include changes in population and demographics, technological innovations, government policies and regulations, new products and services offered by companies in the marketplace, and other factors.Each of these variables plays an important role in determining how the economy performs during any given period. For example:

If you're looking to buy a new car or home but are concerned about how you'll pay for it, consider how different types of mortgages are offered through banks and credit unions at various times throughout each four years' cycle.

If interest rates have dropped since your last mortgage purchase (for instance), now might be a good time for you to refinance your existing loan into a lower rate.

Once You Know The Variables, You Can Tell The Path The Cycle Will Take

All economic cycles exhibit a pattern of boom and bust, with the bust part being far more severe than the boom. The cycle can be divided into several phases:A growth phase, where demand increases and businesses respond by hiring more workers and increasing output to meet that demand.

An oversupply phase, where everyone is working harder than ever, but cannot keep up with increased demand; products are piling up on shelves while employees go without pay raises or bonuses because they're too busy trying to fulfill their orders.

A downturn or recessionary period (sometimes called a "slump"), when companies no longer have enough cash flow or sales to cover all their obligations; they start laying off employees in order to cut costs until things improve again.

Take note of popular patterns: recessions happen every six years or so (as determined by seasonal analysis), and they last about two years on average; stock market crashes usually occur every eight years or so (by way of Dow Theory, and they last about one year on average; major stock market corrections occur every 15-20 years or so (by way of Elliott Wave Theory, and they last about 6-8 months on average (note: this does not include crashes).*

Conclusion

As we have seen, there are many patterns in the economy. Some of these patterns can be identified as seasonal, and others as cyclical.The patterns that occur every year are often referred to as seasonal because they follow a regular pattern throughout the year.

In contrast, cyclical patterns tend to occur on an irregular basis but don't necessarily occur every year or even every decade.

I think it's important for economists/individuals to understand these different types of economic data so they can make better predictions about what might happen next in terms of employment rates or inflation levels.

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Simple Ways To Not Drain Your Pocket During The Holidays

● Web 3.0 And The Opportunities It Presents For Early Adopters

● Innovation Is An Incremental Progress

● Lack Of Financial Knowledge And Its Consequences

● Is Money Really Becoming Worthless?

Dolphin Support: @cryptothesis

Posted Using LeoFinance Beta

Congratulations @young-kedar! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3000 upvotes.

Your next target is to reach 600 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Understanding the pattern is a key to success. Everything have a pattern to follow.

Thanks for this post

Yes, indeed. Studying patterns helps reduce the uncertainty of not knowing what comes next.