What is a cross-chain Bridge? - Primer with VSC

Introduction

It’s no secret that thousands of different cryptocurrencies exist on hundreds (or even thousands) of different blockchains. It’s great to see more awesome technology be developed in other ways, however this innovation comes at the cost of fragmentation. Long gone are the days of being familiar with just a couple of different blockchains and feeling like you have this whole cryptocurrency thing figured out.

With the large number of different blockchains, tokens, NFTs, and more, it becomes clear that there would be a need for something to link those different chains together. Looking at USDT, for example, it exists on 15+ different blockchains, yet it is difficult to move across chains requiring KYC and high minimums. This starts to lead down the road of cross chain bridging, we will discuss in-depth in this article.

What is a bridge?

A bridge functions as a link between two different blockchains, enabling the transfer of assets and data across them. There are a number of different types of bridges, and different bridges with varying blockchain support. Cryptocurrency bridges play a crucial role in interoperability between blockchain networks, enhancing the overall user experience and expanding possibilities in DeFi.

Some allow the transfer of native assets like USDT between different blockchains, and some allow you to get what's known as a "wrapped" version of the original asset on a different blockchain. While these types of bridges do offer similar functionality, they are fundamentally different in the way that they receive and issue assets. It's important for users to understand some of these key differences because each has their place in the space.

Wrapped token bridges

In nearly all major blockchain, at least one bridge exists that allows the wrapping of assets to be used on different blockchains. You might know or have heard about some of them such as:

- Wrapped Bitcoin (WBTC): A wrapped version of BTC on the Ethereum blockchain that allows users to use BTC in smart contracts and DeFi products. It’s important to note that the Wrapped Bitcoin bridge is centralized and requires the users to trust a 3rd party custodian.

- Wrapped Ethereum (WETH): A wrapped version of ETH (on Ethereum and Layer 2’s) usable in smart contracts and decentralized exchanges to interact with other ERC-20 tokens.

At VSC, we prefer decentralized options for a number of different reasons, but WBTC is one of the most widely used wrapped assets. There are more decentralized options such as IBTC on Polkadot, and of course we have developed our own wrapping technology. WBTC and WETH are just some examples for context.

A wrapped token bridge locks the original asset in a smart contract (preferable) or a custodian (third party) on the source blockchain, ensuring that the asset is held as a reserve to back the new asset. After that, the bridge contract issues a wrapped token on the destination blockchain, such as wBTC for example. This token represents the original asset and can be used within the ecosystem of the destination blockchain, allowing users to participate in applications and other blockchain-specific activities without losing the value of their original holdings. The collateral asset (BTC in this case) is held to ensure that wBTC on Ethereum has a 1:1 backing at all times. With a 1:1 backing of trusted custody, users can interact with wBTC with confidence, knowing they can always get back their BTC.

When a user wants to redeem their wBTC for BTC on the Bitcoin blockchain, the process is reversed. The equivalent tokens (wBTC) on the destination blockchain are burned, in order to get them out of circulation (in most cases). Consequently, the original asset (BTC) is unlocked from the smart contract (or custodian) on the source blockchain and returned to the user. This mechanism ensures that the total supply of assets remains consistent across both blockchains, maintaining the integrity and value of the assets involved. In the case of wBTC, the process is a little more complex, but hopefully, this example helps you understand the important parts.

Native asset bridges

Some assets have native support on different blockchains/L2s, and those are known as "cross-chain assets" when they are moved from one blockchain to another. In comparison to wrapped assets like wBTC, a cross-chain asset is the exact same token, just migrated to a different chain. You could argue that these assets are more secure as they don't require custody of a collateral asset. Some of the most popular bridges that allow transfer of native assets across different chains are:

- Polygon Bridge: Facilitates the transfer of assets between the Ethereum blockchain and the Polygon network, known for its layer 2 scalability solutions. It enables faster and cheaper transactions compared to Ethereum's mainnet.

- Wormhole: A decentralized bridge that allows the transfer of different assets between Layer 1 blockchains.

These bridges typically operate in a decentralized way with smart contracts for security. This reduces counter-party risk because the end user does not have to trust a third party to custody their assets. The Polygon Bridge, for example, serves as a way to move ERC-20 tokens or NFTs between the Ethereum and Polygon blockchains in a trust-less way.

When using the Polygon Bridge, the asset is locked on Ethereum in a smart contract, before the asset is issued on the Polygon chain. The smart contract generates a cryptographic proof that the asset has been locked on the Ethereum, and then uses that proof to issue the asset on Polygon. These proofs serve as a way to ensure that assets are only locked/issued when a proof is generated, keeping the assets balanced.

A similar mechanism is in place for the other direction as well. When an asset is moved from Polygon to Ethereum, the assets are burned on Polygon. The smart contract generates a cryptographic proof showing that the assets were burned on Polygon, and then the assets are unlocked on Ethereum. This ensures that the token supply stays the same, and prevents double-spending of assets. No need to trust a third party with custody of a collateral asset, everything is handled automatically and in a decentralized way.

What are we bringing to the table?

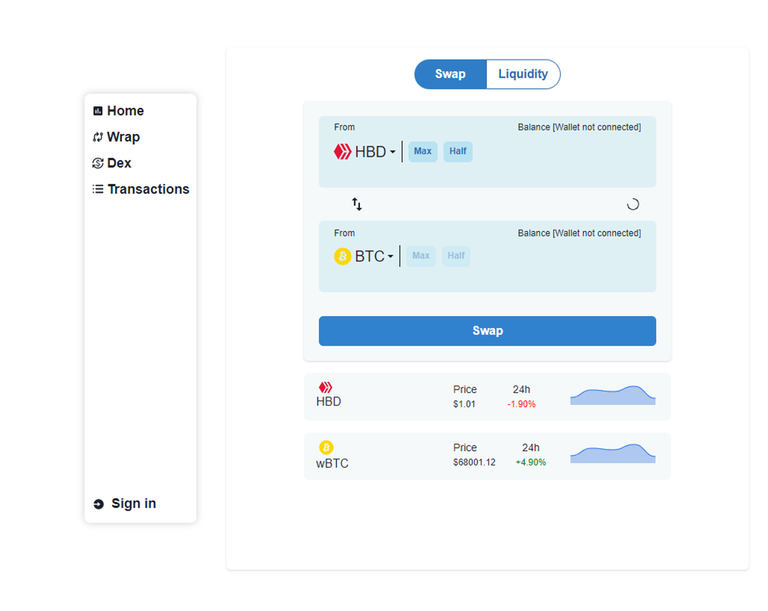

If you haven’t been following our development, let us bring you up to speed with what we have been working on. Since the inception of this project, a primary goal has been to develop a decentralized and secure wrapping technology. This is extremely important because it means that there is a way for outside capital to move into VSC easily. There are a ton of advantages to using wrapped assets on our network, such as faster transactions and zero transaction fees. Once an asset is wrapped and on VSC, it is able to move around with the speed of Hive, making DeFi much more attractive. If you have ever tried to use Bitcoin for anything, you’ll know it's incredibly slow and the fees are very expensive, so can understand how amazing this is. Here's a sneak peek at the DeFi application we are building (this is not the final design).

Bitcoin wrapping on VSC

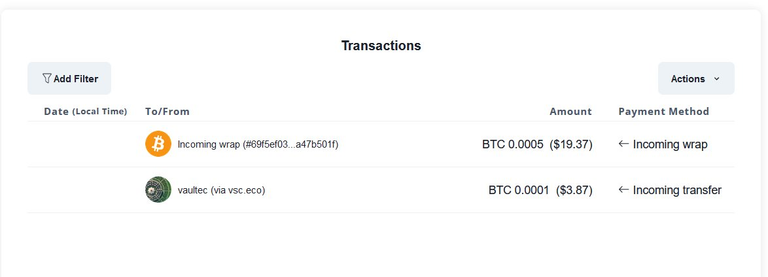

Some of you might remember the time when we opened up our test DeFi site for anyone that wanted to test our Bitcoin wrapping system. We had users all over the world sending and receiving BTC using their Hive wallets! It was definitely an exciting time as our proof of concept came to life. Here is a quick screenshot showing a send transaction and a wrap transaction moving BTC on VSC.

Enabling a fully decentralized Bitcoin wrapping system is not the only thing we are working on in this regard. Our technology will allow users to send BTC directly from their Hive wallet to a BTC wallet, and vice versa. It will also enable users to buy and sell HIVE/HBD directly using BTC. We are also working in collaboration with @v4vapp, which is a bridge between Hive and wrapped assets on Bitcoin Lightning Network. We are heavily focused on making HBD the stable coin of the Lightning Network and creating powerful payment technology for everyday use.

We plan to make our BTC wrapping system as decentralized as possible, and we even plan to open the system to other assets in the future. We will begin expanding asset support, starting with LTC, DOGE, and DASH in the future. We have also acknowledged efforts to bring Hive to the broader ecosystem using protocols like Thorchain and Maya Protocol. We believe that having Hive connected to these ecosystems will be the catalyst to propel Hive further as a transaction layer.

Hive needs connections to the broader cryptocurrency ecosystem, and we are playing a crucial part in that. This is just a small piece of our overall vision to make Hive a hub for DeFi and cross-chain trading. The power of smart contracts is being unleashed as you read, and we’re just getting started. Stay tuned and check out our latest articles below! Don't forget to drop a comment and let us know what you're excited about.

More articles:

- Resource Credits on VSC

- VSC and Hive Accounts - Explainer

- Hive is now EVM compatible, thanks to VSC

- HBD Staking on VSC

is the dex already open for testing?

Shortly after mainnet launch! (early 2025)

Good to know :))

Absolutely outstanding work :)

Exciting times ahead!

It seems the blockchain will soon be tested with massive transactions from various sources: upcoming game launches, Hive lite accounts, and collaboration with Dash. We may also see an influx of new users, especially considering a bull market appears to be on the horizon.

With the VSC network bridge, I believe this will be a good trial for the blockchain to undergo. Is this correct? Or most transactions will be handled by VSC network itself?

Anyway, I think that the VSC Bridge should be able to help address the liquidity challenges that Hive is currently facing, right?

VSC can process transactions both on Hive and on it's own system. For EVM wallets these transactions would be handled by VSC directly.

As for the bridge, it will dramatically improve Hive's access to liquidity

Watching the progress with excitement 😄

Also, I would like to know how it affects Hive-engine, bee token, bxt and more.

So much to learn from real life examples.

VSC is unrelated to Hive engine, and all hive engine wrapped assets are centralized.

I am well aware of this that's why I wrote what I wrote.

When one business thrives it might unintentionally steal the other business user base.

For sure

Hi, @vaultec,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

Hey Let's Mine MetaDev Qoin (MDQ) Install App From Google Play And Signup With the Code

MDQ85V43Q20VTo Get Initial Bonus of 50MDQ Instantly.Educate the people!

Nice article

!ALIVE

Hello vsc.network!

It's nice to let you know that your article will take 10th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by deepresearch

You receive 🎖 0.4 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 464 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART