Inflation and Deflation evaluation in Cryptocurrencies!

One of the critical indicators that must be referenced before burning the native platform coin to the portfolio is an inflation rate. Many people usually have interested in all issues, and the degree of movement of the price, and this inflation rate is this inflation rate, so let's talk about it.

Importance of Inflation

Most coins or tokens have an inflation mechanism that is newly issued daily as a common currency. Inflation is a key mechanism that is essential to operate with a node participant compensation, an incentive mechanism for an ecosystem expansion to stably maintain a network.

However, if the supply (= distribution amount) of the token continuously increases daily, the scarcity is reduced, and the market price of the token is declined. Because it is infinitely increased by increasing the supply amount, And the design of the inflation mechanism for each coin is large.

Total issues are determined and there is a bitcoin with a half-life (Halving) that has been reduced to half the inflation rate in a period of four years, while the total issue is not determined, and the inflation rate is reduced by the inflation rate according to the schedule.

In the case of the latter coins, it is also possible to adjust the distribution through an irregular token incineration or token mix changes in the Foundation, which holds a token in the development team or many proportion to the development team that has been developed from the initial stage of the chain. This is a part that it can be seen that the token is issued and supplied by the token, and prevents the ecosystem, which is a policy to keep the ecosystem.

Can the coin with high inflation rates, can not be invested in value?

We can say it is not. In fact, most coins follow the long curve that reduces the token inflation rate every year (the way the issue gradually decreases over time). Therefore, it is common to have a relatively high tilt (high inflation rate) in the early days. So you should compare both the ages of the coin, the entire issue, and the current price, such as the current price. For example, comparing the inflation rate of coins that was born for five years and last month, which is born in the crypto world, can be said that the control of the variable is not appropriate.

And even if the inflation rate is high, the story may vary if there are more or more embedded adapters that can be used, or have a deflational mechanism that can offset the inflation effect.

Representative case of deflation

Representative examples of UltraMaps, which are well equipped with an existing native token, are the ETH and BNB.

ETH

In August 2021, this is an introduction of ETH deflational mechanisms through London Hard Fork with EIP-1559, EIP-1559

Approximately 1.83 million ETHs were incinerated after the introduction of the mechanism, and 3.29 ETH per minute is incinerated. Even in 2016, ETH, which had 10% inflation rate, has fallen from an inflation rate of about 4.3% since the introduction of the deflational mechanism.

BNB

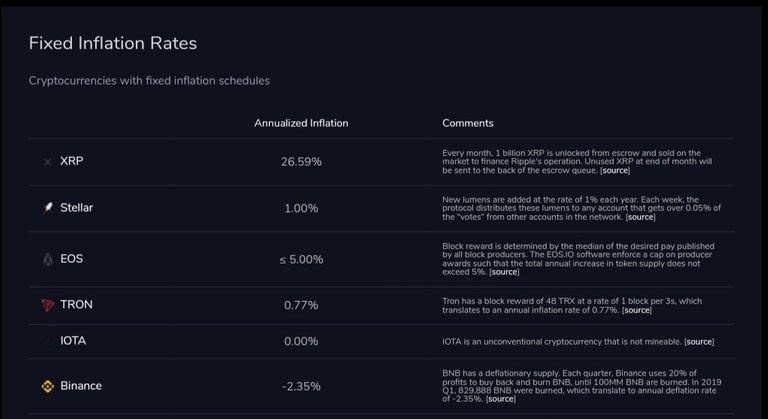

Binance Exchange Token, which is started with the Binance Smart Chain (BSC), which is used as a native coin of the Binance Smart Chain, is the only coin that shows the only minus inflation rate among existing platform coins.

A total of 45,000 BNBs were incinerated after the BEP95, which is the real-time BNB incineration mechanism on November 30, 2021, and about 500 BNBs have been incinerated for average

BNB Quarterly Burn, which incinerated 50% of the Binance Exchange operating profit, will be relaxed and applied to BNB Auto-Burn, and the incineration program will continue until a total of 100 million BNB total supply. To date, 3,449 million BNBs corresponding to 17.2% of the existing total supply volume were incinerated, resulting in the inflation rate of BNB is - 2.35%

If the inflation rate of a particular coin is relatively high compared to the inflation rate of other similar coins, this is because the incentive structure design has the potential to be designed incorrectly, which is the fact that the inflation is distributed, the actual input cost of the node (minor). It is recommended that you look at how your return is.

However, it is a case where the inflation rate is 0%. Some have already published a token to have a token in a particular wallet, and some are paying a different compensation coin, and some are paid by creating other compensation coins, and some of which are subject to only transaction fees There are a variety of characteristics.

In addition, if the node (validator) does not need to stake the large assets, it is recommended that you look at this structure because the incentive that is allocated as an inflation is a risk that the incentive that is allocated as an inflation is incomingly cashed.

Posted Using LeoFinance Beta

There is a lot of nuance to ensuring that the coins have enough scarcity to be worth it, but also are sort of easy enough to get into so that their price increases due to popularity. It is a lovely spectacle to watch from the sidelines!

!1UP

!PIZZA 😊🙏

You have received a 1UP from @mezume!

@leo-curator, @bee-curator, @stem-curator, @vyb-curator, @pob-curator, @neoxag-curator, @pal-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

PIZZA Holders sent $PIZZA tips in this post's comments:

@vikbuddy(5/10) tipped @mezume (x1)

Learn more at https://hive.pizza.

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism