C3.ai (AI): An Emerging Powerhouse in the Artificial Intelligence Sector

I have been meticulously observing the trajectory of C3.ai (AI), a burgeoning entity in the AI landscape. Based on my analysis of its substantial short position, the optimistic forecast for the industry, and the company's strategic positioning, I am convinced that C3.ai is poised for a significant upward trend. Let's delve into the details.

## The Potential for a Short Squeeze

Firstly, it's crucial to examine C3.ai's short position. As of April 28, 2023, the company had an impressive 28.94 million shares short, which constitutes 30.17% of the share float. This high level of short interest creates the potential for a short squeeze, a phenomenon that occurs when a heavily shorted stock begins to rise in price, compelling short sellers to cover their positions by purchasing the stock. This action can further propel the price upward. Given the recent increase in C3.ai's share price (from $17.82 to $27.2 within a month), the stage appears set for a potential short squeeze.

A Flourishing Industry Landscape

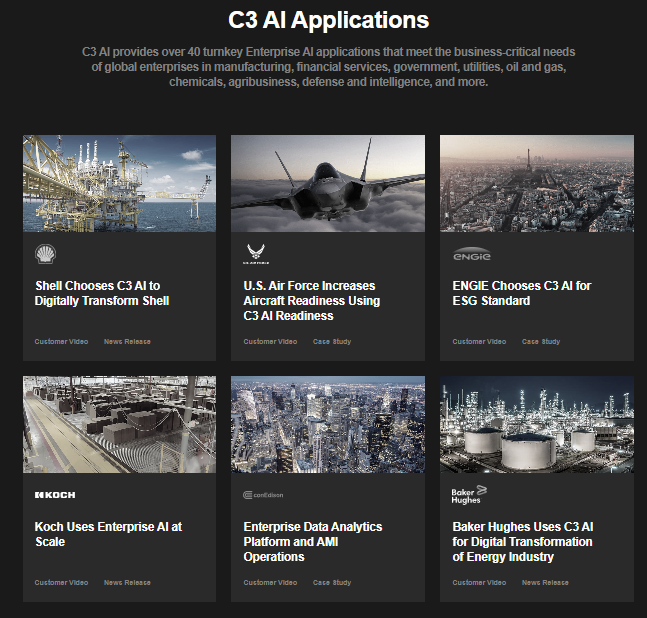

Beyond the short position, the overall outlook for the AI industry is highly promising. AI is transitioning from a specialized technology to a fundamental component of business operations across various sectors. From automating mundane tasks to extracting insights from vast data sets, AI is revolutionizing business operations. As the value of AI becomes increasingly apparent, the demand for AI platforms, such as those provided by C3.ai, is expected to surge.

C3.ai's Strategic Positioning

C3.ai's strategic positioning within the industry also warrants attention. Despite facing skepticism and criticism, the company has demonstrated its resilience and adaptability. It has successfully transitioned its business model to a transaction-based pricing method. While this shift has disrupted short-term revenues, it is anticipated to enhance long-term revenues by broadening the customer base.

The company's recent preliminary fourth-quarter results underscore the success of this transition. C3.ai generated revenue between $72.1M and $72.4M for the period ending April 30, exceeding both Wall Street's estimate and the company's own guidance. This positive trend, coupled with the closing of 43 deals during the quarter, indicates robust momentum that is likely to continue.

Final Thoughts

In conclusion, given the substantial short interest, the favorable industry outlook, and C3.ai's strategic positioning within the industry, I maintain a bullish stance on C3.ai. As with any investment, it is essential to acknowledge the inherent risks and conduct thorough research. However, based on the current evidence, C3.ai appears to be an emerging powerhouse in the AI industry, and its future trajectory is highly anticipated. Therefore, I urge investors to closely monitor C3.ai – this could mark the beginning of an exciting journey.

Congratulations @videosteemit! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 65000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: