My Hive 2022 Goals - Week 2

So I was doing some reading so reading this week keeping up with my goal to learn more about hive and I came across an article that I think the author made a couple good points. The first point being, what I am doing here is not so much goals but more my investment strategies for 2020. The second was his strategy which I think I'm going to apply to mine as well and it involves HBD and HIVE. This strategy is going to be if HIVE is $1+ my HBD will go into Savings (or some other high return), if HIVE is $0.50 - $1 then 50% HBD to saving and 50% buy more HIVE, if HIVE less than $0.50 then 100% HBD buys HIVE. Another thing I discovered this week is that I falsely assumed that all curation was

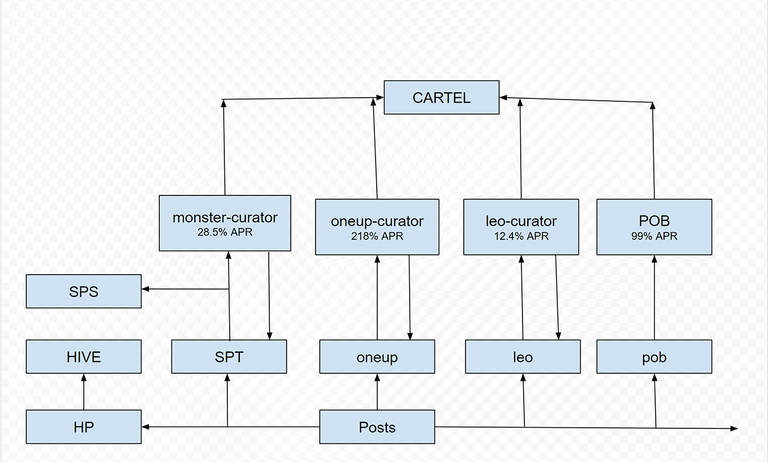

a similar APR and it is not. ONEUP is up around 218%, SPT is about 28.5% and POB is up around 99% so after observing this I will by most of my curation investments to ONEUP for that nice 218% APR.

| Token | Start Price | Total Value | Start | Start Liquidity | Start Stake | Start Delegated |

|---|---|---|---|---|---|---|

| SWAP.HIVE | 1.33 | 49.27050472 | 1.34928158 | 35.69621069 | 0 | 0 |

| HIVE | 1.33 | 0.39900000 | 0.3 | 0 | 0 | 0 |

| HP | 1.33 | 126.61334000 | 0 | 0 | 95.198 | 0 |

| HBD | 0.87916 | 7.48956404 | 0 | 0 | 8.519 | 0 |

| SWAP.HBD | 0.87916 | 3.71381141 | 4.2242725 | 0 | 0 | 0 |

| BXT | 12.144 | 27.32400000 | 0 | 0 | 2.25 | 0 |

| Cartel | 10.9725 | 230.42250000 | 21 | 0 | 0 | 0 |

| SPT | 0.00293 | 18.54941501 | 0 | 1707.593493 | 1000.264871 | 3623 |

| ONEUP | 0.03673 | 8.44286810 | 0 | 136.7486601 | 10.02842333 | 83.08591967 |

| LEO | 0.231 | 1.89858900 | 0.23 | 0 | 2.095 | 5.894 |

| POB | 0.0668 | 0.14132124 | 0.05883292 | 0 | 0.51384677 | 1.54290773 |

Liquidity Pools

I had 3.77624661 SWAP.HIVE and 132.80255083 in a liquidity pool that was giving 194.446% APR and gaining bonus shares daily but as more people get back into this pool because the rewards just renewed the APR will go down. I removed the assets from this poll liquidity pool, however ONEUP has a ONEUP:SPT Liquidity pool that is currently 325.118% APR and every 4 SPT I own is worth one airdrop point for daily SPS airdrops in splinterlands, so I swapped the 3.77624661 SWAP.HIVE for SPT and put it into that liquidity pool which should be giving me about 2.583 ONEUP daily. CENT:POB pool same problem here only giving 62.811% APR when I can get better from ONEUP so dropping it, pretty much dropped all liquidity pools except ONEUP:SPT, SWAP.HIVE:DEC and DEC:SPS. The two DEC pools are low APR but I'm holding DEC for airdrop points for daily SPS airdrops until General Sale on Jan 17th at which point it will buy me Chaos Legion packs, so I might as well get a little APR on it and DEC in liquidity pools is worth double airdrop points.

staking BXT gets me more hive but lower APR than ONEUP so I am thinking I should take a similar approach as HBD / HIVE. I will monitor the price and when it seems low buy some more growing the investment at lower cost and holding for higher value and taking profit at higher values.

I am continuing to acquire CARTEL. I think this token has huge potential, created by the same person bringing those high APR ONEUP pools. The 1UP-Cartel serves like a meta-guild, a meta-index token and a meta-curation service all in one. It will not only keep gaining in value but also in three to six months start paying dividends to token holders. I bought 21 at $10 each and they are worth about $10.97 now

Despite having a way lower APR than ONEUP I am continuing to curate and hold SPT because every 4 SPT I hold gives me one airdrop point towards the splinterlands daily SPS token airdrops. When the airdrops finish in 193 days, I will decide what I'm going to do with these. I am sure between now and then splinterlands will bring something else to add value to them.

ONEUP, the current star of my portfolio at about 218% APR for curation I will be liquidating most of my lower APR curation tokens as I get them and getting more one up. I am not sure how long this situation will last so I will have to adjust to the changing values.

LEO has a 12.4% APR on curation right now so most of my LEO will go to getting more higher APR ONEUP.

POB only has a 99% curation APR right now so I will start to shift some asset out of here and over to ONEUP.

So I make and curate post which earn me HP, SPT, ONEUP, LEO, POB and a few other tokens I have not added to the chart yet. The cartel has a group of curators that curate good quality posts in those token communities. I stake and delegate those earned token most of which will be ONEUP at the current APRs. The curators pay me out 95% of my delegated vote earnings and keep 5% for the CARTEL increasing the value of my CARTEL tokens. The SPT I delegate to monster-curator not only earns me more SPT but also airdrops points for more SPS token. Next week I will expand on the chart and hopefully have the rest of my tokens added into the table and I have given some starting numbers so we will be able to judge the strategy performance week to week.

Follow me to see how my strategy performs.

come play some Splinterlands

Join the Cartel