Mistakes New Investors Make

Since I start my business, I have been seeing many people seeking to invest in cryptos and other ways that can multiply their funds and I have been guiding most of them to stay on the profit side.

However, recently, a young man came to me for crypto investment advice and I gave the best I could. He invested in some assets and he calls me almost every 3 days to complain or show excitement because of the state of the market.

Investing is very easy now. Anyone can become an investor in any asset within a few minutes where there is an internet and a device, but most people do not understand what it takes to invest or the fundamental things to do when investing.

Here, I will state some mistakes people make while investing.

Lack Of Patience

The term “Investment” means long time savings. Don’t expect it quick. Understand long time value. I helped someone to invest in some crypto asset and after 5 days I saw him and he was already expecting to see his money flying on the roof. Many people lack patience in investment. They want it quick. You should give yourself a minimum of 12 months on investment.

Investing Without Understanding

I was a victim of this. I was introduced to a master node investment some time ago, and I did not do any research on my own because my ex-boss introduced me and this made me lose a lot of money. This is how many people are losing money on their investment because they do not understand the metric for the sustainability of the company or assets they are investing in. Information like “Invest $1,000 and you will start making money is not enough.” Read, ask questions before investing a dime. I preach this always for all my cryptos newbies.

Selling Early

This isn’t a new thing at all, especially in the blockchain and cryptocurrency space, but not limited to cryptos. Hive was just $0.08 at a point. Bitcoin was $700 when I knew about it. An investment of $1,000 on bitcoin at that point that turned $8,000 looks like a huge gain but it is not. HODL and understanding delay gratification is important. My only advice here is to take out your investment when you have accumulated enough gain. Do not liquidate all your assets at once. The future might hold more than you are seeing.

Following People

It is good to follow professionals, not people. There has been noise over many investments. You can't invest in everything. If you can hold a few assets that have good long time values, gently build with them. It is good to diversify but don’t feel left out because you did not invest in Shiba Inu or any asset that turned big. If you follow people too much, you will lose more. Follow stability and value.

Confusing Skill With Luck

Some investment earned you a lot of money based on luck. Because you earned huge on an asset doesn’t mean it is a good long time asset. You have bought at the right time and sold before the massive dump and the project dies. You are happy while other cries. You have made the right decision for the project, you may later make the worse on another. You must understand the right metric for investment. Understand the token economy if it is a crypto project or scan through the process of how the company pays off investors.

60 years of man came to my office for investment advice some months ago and he shared an investment opportunity with me. I told him, “Sir, take your money off that company because in the next 2 or more months the company will fail and you will lose”. Then he said: “I have worked with the Central Bank Of Nigeria, I understand that this company will not fail”.

After 6 weeks he came and told me: “Young man, you are right”.

How did I know this?

I asked the man..."How are they making the money they pay investors?" He showed me and I saw it doesn’t look sustainable.

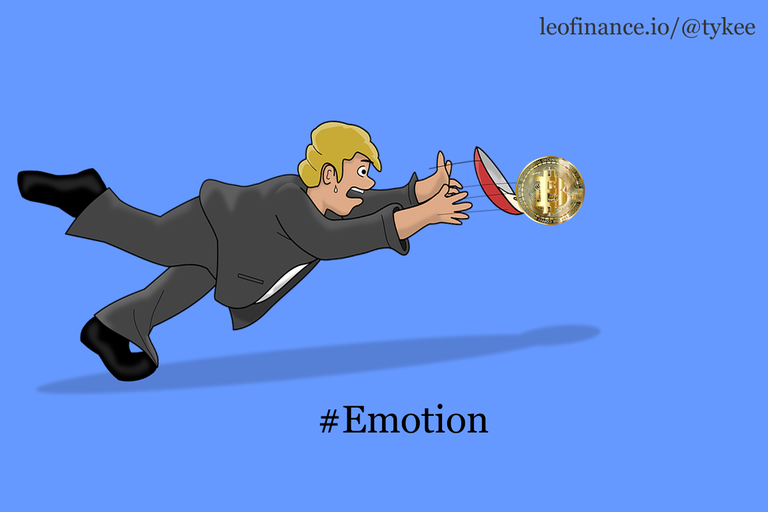

Emotion

Do not tie your emotion(fear and greed) with your investment. I broke out of this many years ago. The fear of loss will keep you losing and greed will hand you poor decisions. If you do not understand how investments work, read about how to invest or get a professional advisor that will help you decide.

Conclusion

Investing right is more than just dropping cash on assets. Mistakes are also part of investment processes. Knowing and understanding how to avoid them would help you. And, there is a lot about investment and you learn every day as you seek more.

Thank you!

My name is @tykee (Barlogun Michael), a web developer, Civil engineer, content writer and the founder of Meshboc Technology & Digital Services Limited. I am using my content to share my opinions on tech, lifestyle, and finance, to promote myself and impact my readers. I always like to learn. Education is the most thing I cherish.

Contacts

Twitter

Instagram

Discord: tykee#8770

Posted Using LeoFinance Beta

May I ask what you found out when he showed you the data?

The inflow is low and not sustainable when they have large investors.