Week #226: Parent's wallet is the child's first financial textbook!

Hello, everyone. Today, I want to share my thoughts about one of the topics given by @galenkp.

Do you feel giving children a grounding in financial matters is the parents' or a schools' responsibility and why? If you do it for your children how have you done so? Use your own photos.

Giving children a foundation in financial matters is the responsibility of parents because I, as a teacher, believe that parents are their children's first teachers.

Based on my experience as a student from a low-income family, I witnessed financial difficulties at a young age.

My parents couldn't always give me money for school, so when they did, I made sure to spend and use it wisely.

So now that I earn my own money, I understand the importance of spending money wisely.

I believe in the statement, "Parents, your wallet is your child's first financial textbook."

Children imitate their parents' actions early on, often without their parent's knowledge.

It is never too early to start discussing money with your children. Take this logic further and commit to openly discussing money with and around your children early on.

Talking about money with young children can be awkward at first, but there's no reason to kick them out of the room so that adults can have a candid conversation.

If you are concerned that they will spread the word about these conversations, emphasize that financial details are appropriate to discuss at home rather than with friends, teachers, or random people at the supermarket.

Young children may not understand everything you say, but that's fine. They do not understand every word of the stories you read to them. That does not deter you because you believe they will learn it with practice and age.

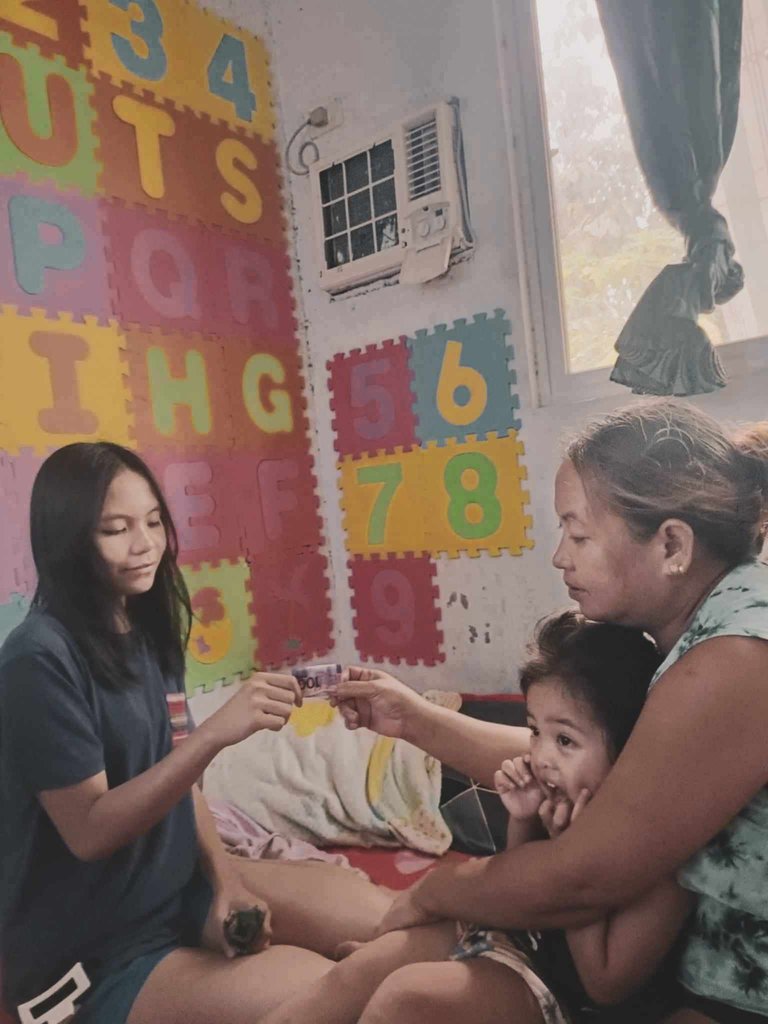

You are your children's most visible and influential role model.

You show your children that it is possible to live within your means by putting your financial advice into practice. Since they are sensitive, kids often pick up on cues without you calling them out. On the other hand, polite repetition will improve the clarity and memorability of your message.

So, when instructing your child on money management, explain why and how. Look for teachable moments everywhere you go. Mundane activities like shopping trips are ideal for reinforcement. It only takes a few seconds to explain why you chose the less expensive generic over the functionally equivalent name-brand product for your child.

Don't give your kids an open line of credit. Instead, set spending limits, even if you can't resist treating them on occasion.

You're used to saying no to your kids in other situations. You must set this benchmark early on for your kids' financial education. Old habits get harder the longer you wait to break them.

The level of involvement is entirely up to you. Teach your children how to save! They will eventually understand that to make larger purchases, they must save money.

This is the perfect opportunity to spark your children's interest in anything concerning prudent financial management.

Children resemble snowflakes. Every one of them is unique. And parents are, too.

When it comes to instilling good financial habits and teaching your kids the value of money, you, as a parent, have a lot of leeway.

Regardless of how you decide to teach your children about money, it would help if you always remember that it is your responsibility to ensure they can grow and manage their funds for years. After all, long after you hang up your working hat, you can rely on your kids' frugal ways for support.

You're right meme