This Weeks News And In Depth Job Market

This week, significant events are expected to impact currency and bond markets.

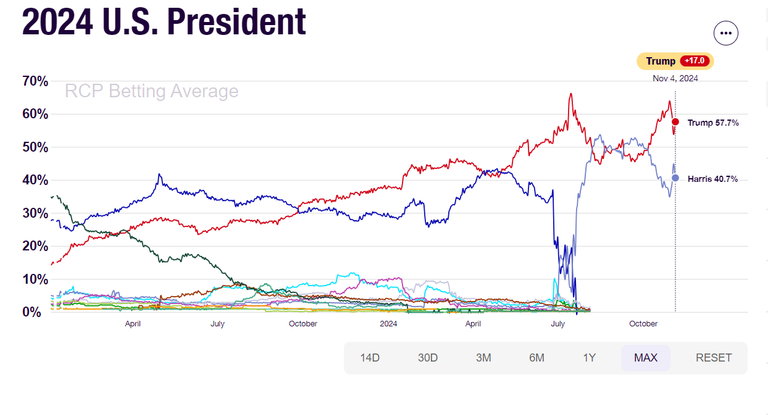

U.S. Presidential Election 🇺🇸: Differences in candidate policies could influence the dollar, cryptocurrencies, and U.S. bonds.

Fed Interest Rate Decision 📉: The Fed is likely to cut rates by 25 basis points, with markets looking for hints of further cuts.

Canada 🇨🇦: Economic data will indicate if the Bank of Canada will cut rates again.

Eurozone 🇪🇺: Key insights will come from Germany's manufacturing data and EU meetings.

United Kingdom 🇬🇧: The Bank of England might lower rates, and economic data will provide an October outlook.

Australia and New Zealand 🇦🇺: The Reserve Bank of Australia may hold rates steady, despite high inflation.

Japan 🇯🇵: Wage and consumption data will determine the Bank of Japan's next move.

China 🇨🇳: New fiscal measures and significant economic data on trade and inflation are expected.

A more in depth analysis from yesterdays post and the job market

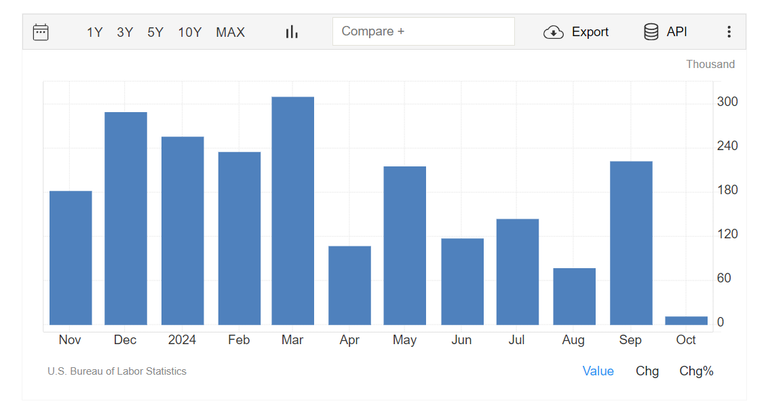

For starters, if we look at data from the last three months, the average job growth is over 100,000 per month. This month might have had a dip, but overall, the numbers are holding strong! And here’s the juicy part. According to pre-pandemic projections from the CBO (Congressional Budget Office), there are now about 3 million more jobs than expected. So not only are we not in trouble, but employment is in a much better state than expected.

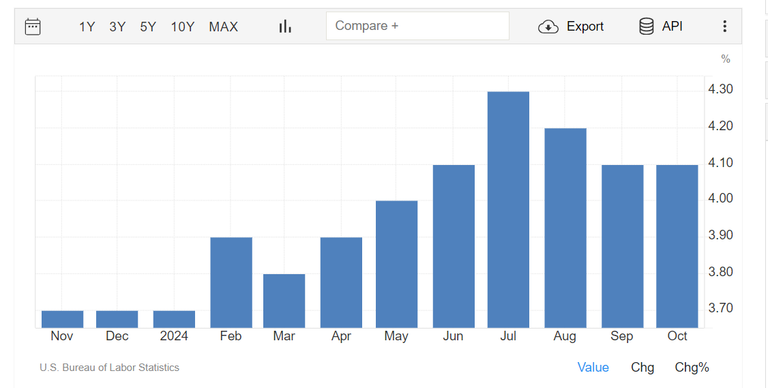

Okay, but what about unemployment? you might ask. Is it climbing? Not exactly! Unemployment is steady at 4.1%, holding strong. It’s been stable for two months now, and it’s been gradually decreasing since July. This shows that the job market is stable and strong. And you know what’s even more interesting? The fact that unemployment has stabilized seems to counter the Sahm Rule, which usually signals a recession when unemployment spikes suddenly. This is because unemployment is stable, interest rates are decreasing, inflation is down, and GDP growth remains solid. In short, the signs of a recession aren’t very strong!

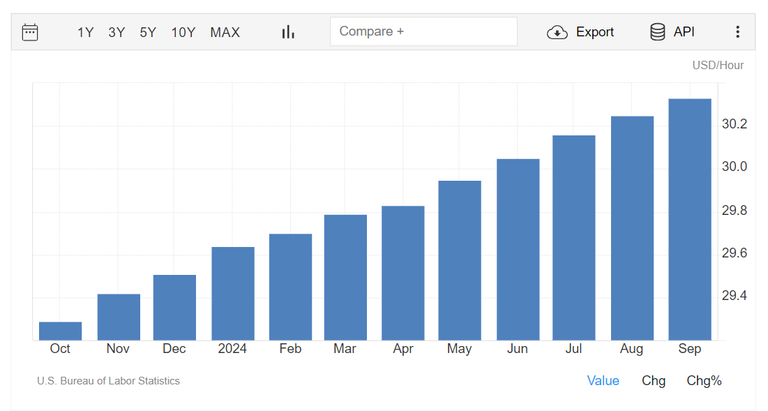

But we’re not stopping here—there’s more to look at, like wages. This is where things get even more encouraging! Wages continue to rise, outpacing inflation. So not only are jobs increasing, but those who work are also seeing their purchasing power grow. And naturally, this is a good sign for everyone, as it shows that the economy is generating wealth that reaches workers' pockets.

Investments

That’s all well and good, but what does it mean for us? Well, first of all, this shows that the U.S. economy is doing just fine!

More importantly, it reminds us not to draw conclusions based on a single economic indicator. One number alone can’t tell us if the economy is doing well or not. We must study all the data before making conclusions.

And of course, there will be months with lower numbers, even during periods of growth. This is not uncommon because the economy is also affected by external factors. Like in 2019, for example. Although it was a growth year, there was one month with very low job creation. The same thing is happening now.

Posted Using InLeo Alpha

Hamala apparently is leading the race but honestly Trump has demonstrated capacity and leadership to be president again ,therefore he deserves it

Deserved or not he won ! Let’s hope this time he will do a better job

@tipu curate

Upvoted 👌 (Mana: 26/46) Liquid rewards.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.