A president working at McDonald’s

I don't know if you saw this, but Donald Trump worked at McDonald's! What do you mean he worked at McDonald's?Well, he put on his apron, got behind the counter, and started serving fries to customers! Naturally, the customers just so happened to be wearing MAGA hats and were Indian and Black—classic Americans, always putting on a show. In short, he made a little “guest” appearance as a fast food worker to hand out orders and, of course, to grab some attention. But, of course, such publicity stunts don’t happen without a reason.

So, while the employees were showing him how the fryer and the drive-thru worked, he didn't miss the chance to take shots at Kamala Harris. "I've worked 15 minutes longer than she has at McDonald's," Trump said, implying that Harris had never worked there, contrary to what she’s claimed many times. There’s generally a bit of a feud over this since Kamala has said that, when she was younger, she worked at McDonald’s. But that’s not our topic.

This move by Trump reminded us that the elections are coming up. So, it's a good opportunity to see where things stand and what to expect!

ELECTIONS

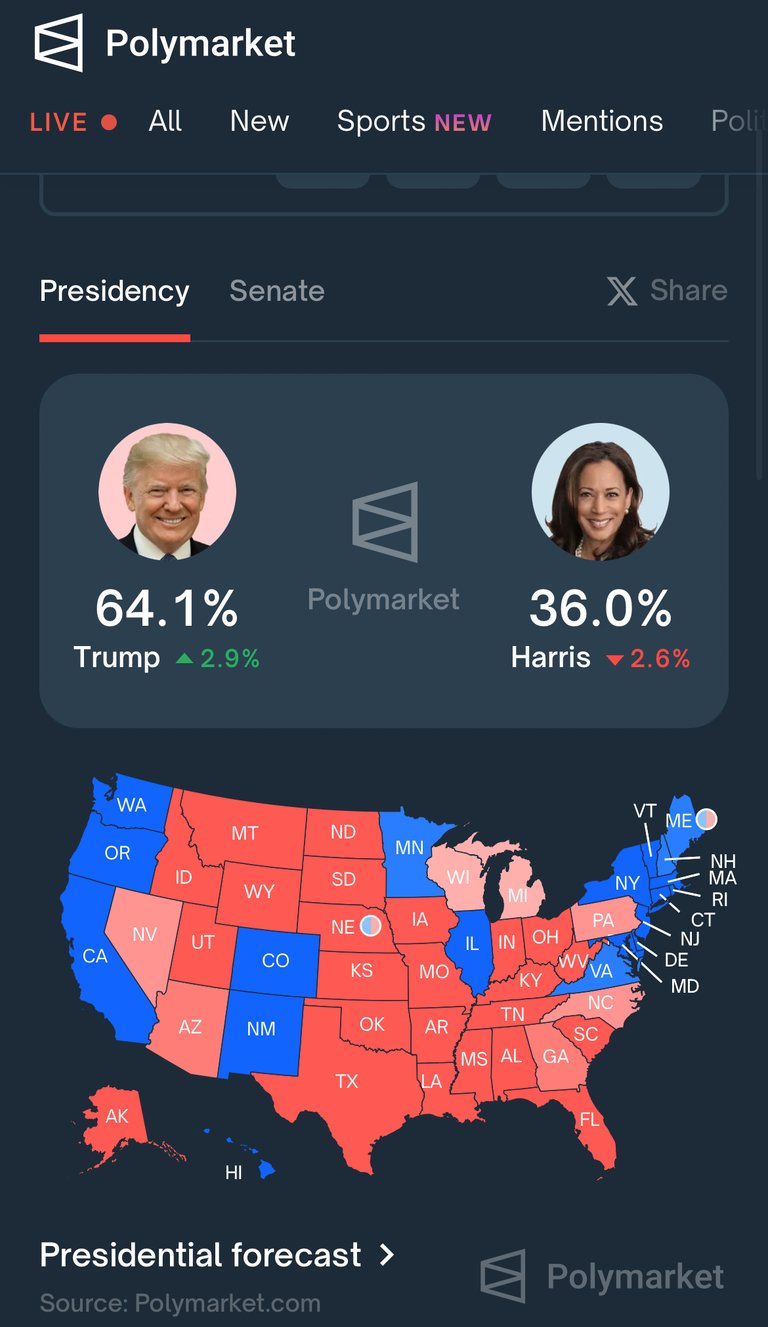

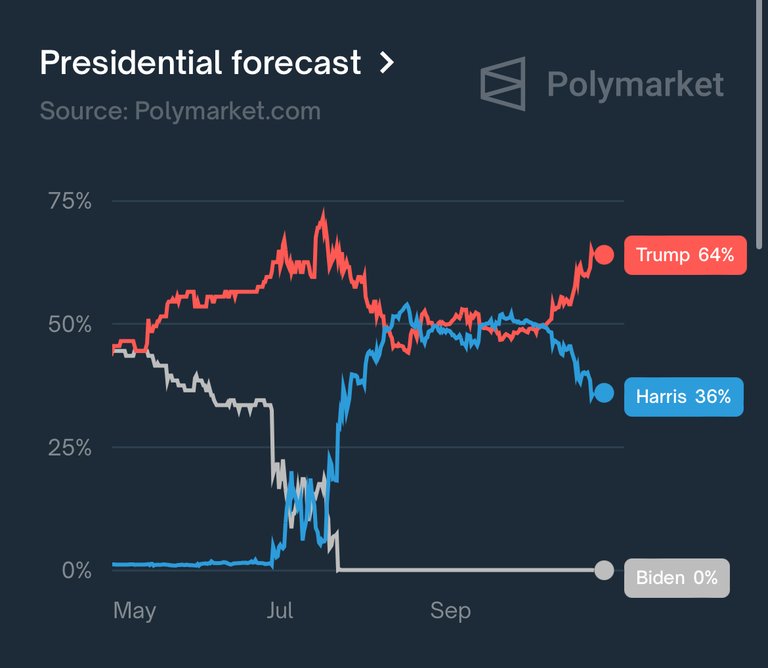

It hasn’t been like this the entire time, though. After the announcement that Harris would take Biden’s spot for the candidacy, we saw the two candidates neck and neck.

The last time we touched on the topic of the elections was about a month ago, and the truth is, a lot has changed since then.

So, here we are, exactly two weeks before the elections, and as it seems, the bets are showing a clear Trump victory, with a lead of more than 20%!

TRUMP VICTORY

The markets have already started pricing in a possible Donald Trump victory.

And as we’ve all noticed, various indices, stocks, and cryptocurrencies are reflecting this optimism. It seems investors are preparing for a more favorable environment in the event of Trump’s reelection.

“And why would the environment be more favorable if Trump wins?” you might ask. Well, the expectation is that the benefit markets would see from a potential Trump administration. You see, industries that benefit from reduced regulations, such as banks and large corporations, expect to profit from Trump’s agenda.

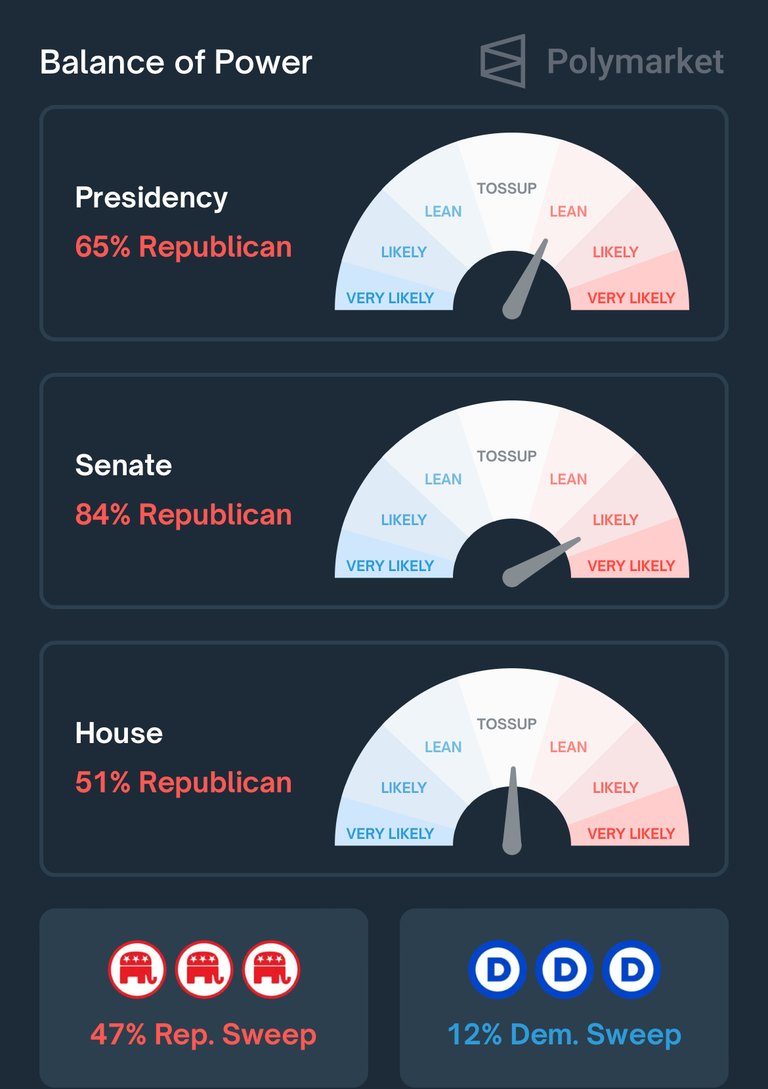

A “Red sweep,” meaning Republican control of both the White House and Congress, would free businesses from various regulations, giving a fresh boost to the markets.

Posted Using InLeo Alpha

🍟 Yes that was a smart move by Trump.

Pretending to work in McDonald?

Getting those iconic pics out of it. 😉

This is an interesting take on Trump's recent publicity stunt at McDonald's! It's fascinating how such events shape public perception and draw attention to key political figures. With the elections just around the corner, the shift in betting odds and market sentiment reflects how deeply intertwined politics and economics are. Seeing how these dynamics play out in the coming weeks will be intriguing. Thanks for sharing this insight!

Americans love that kind of stuff

While this definitely looks good for Trump and bad for Harris, it's important to realize what these particular numbers mean. These are betting odds, not how much Trump leads by. In other words, at least according to Polymarket, Trump has a 64.1% chance of winning (actually 64.5% as I write this). However, in some key battleground states, Trump's lead, according to polling, is within the margin of error so these numbers could still shift easily. After all, a couple of weeks ago, it was basically 50/50 and there is still that long to go. And taking the odds at face value, Kamala Harris still has a better than 1 in 3 chance of winning. Whatever happens, it should be interesting.

From what I am reading this is going to be an epic battle

Such a depressing marketing strategy.

True it’s like taunting them .

Sponsored Obesity Food Advertising

It was a fake!

Trump 2024

Pretty stupid, but a lot of Murican voters base their votes on shit like this.

I disagree with your prediction of a clear Trump victory and a favorable environment for the markets. While Trump has a loyal base, there are strong indications that a "blue wave" is more likely this election cycle, and this could be beneficial for the economy, especially in the long term.

First, races in traditionally red states like Texas are unexpectedly close, with polls showing Ted Cruz in real danger of losing his Senate seat. This shift in Texas reflects a broader national trend, where tight races in key swing states like Georgia, Pennsylvania, and Arizona are not in Trump's favor. Trump lost the popular vote in both 2016 and 2020, and the fact that swing states are still competitive this close to the election suggests that the enthusiasm for Trump may not be as strong as it appears. His inability to win over a majority of the electorate in past cycles is a significant red flag for his reelection chances.

Moreover, while it’s true that a Republican win may reduce regulations for businesses, Democrats have historically boosted markets through increased government spending, which fuels economic activity. For example, the market performed well under Obama and Biden during the recovery from the financial crisis and pandemic. Democrats often prioritize infrastructure projects, stimulus packages, and social spending, which directly benefit industries like construction, healthcare, and green energy, leading to long-term growth. Investors are aware that Democratic administrations tend to inject more money into the economy, stimulating demand, and driving market growth.

In the end, while the markets might react positively to the prospect of reduced regulations in a Trump administration, a blue wave could bring more sustainable benefits through increased government spending, boosting the broader economy and fostering stronger consumer confidence.