Russia-Ukraine War 2022: Winners and Losers (Part Two: Winners)

In war, whichever side may call itself the victor, there are no winners, but all are losers (Neville Chamberlain).

War has no winners and peace no losers (Ashok Kallarakkal).

I can not believe that war is the best solution. No one won the last war, and no one will win the next war (Eleanor Roosevelt).

Hi Everyone,

In this two-part series, I discuss who I believe will be the likely winners and losers from the Russia-Ukraine war. In Part One, I discussed the losers and in Part Two, I discuss the winners.

At this point, we should assume that this war is based around Ukraine. The military conflict is confined to Russian (including separatist groups) and Ukrainian forces (including foreign volunteers), and the non-military conflicts such as economic, social, information and political extend to many other countries but are arguably based around the military conflict between Russia and Ukraine. Our discussions around who stands to gain or lose from this war will change if the military war extends to more countries.

Winners from this war

The people who benefit the most from war often do so regardless of who wins the military conflict. Their interests often lie with the overall fallout of the war. The winners are often more difficult to identify as we often need to work with incomplete information (e.g. censorship) as well as misinformation (e.g. propaganda). The winners I discuss in this post, are based on my opinion as well as the information I have been able to obtain and trust. Therefore, this post should be considered subjective and incomplete. Below is a list of who I believe are/will be the winners (benefit) from this war.

- Centralised Global Organisations

- European Union

- Oil companies

- Most Governments (Western)

- CBDC (Central Bank Digital Currency)

- Military Industrial Complex

- Some Big Business (banks, construction, and media)

- Green Energy

- Gold, Silver and other precious metals

- Cryptocurrency

- Vladimir Putin

- Countries not sanctioned (e.g. Saudi Arabia or China)?

Centralised Global Organisations

The World Economic Forum (WEF) used Covid-19 to advance the Great Reset agenda. WEF focuses heavily on global responses to proclaimed global problems. Covid-19 was considered a global pandemic. Therefore, the leaders of the WEF considered the best and possibly only viable response to Covid-19 was a global one. Many countries responded to Covid-19 in the same manner. They enforced lockdowns. They placed harsh restrictions on all social activities. They heavily promoted experimental drugs (e.g. vaccines). Many even implemented health passes, which restricted activities to only those who had the required number of shots. From a health; social; and economic perspective, the response to Covid-19 was a massive failure. Despite this massive failure, WEF and many other global organisations considered these responses as necessary. Instead, they were advocating more of the same actions but with greater coordination.

Major wars have led to the creation of several global organisations. For example, the League of Nations was created as a direct response to the Great War and the United Nations and NATO (Soviet Union focused) were created as a direct response to World War 2. Even though, the direct military conflict is between Russia and Ukraine, the non-military war is almost global. The entire western world and many other countries around the world are attacking Russia with sanctions, theft, and discrimination. These sanctions could hurt the sanctioning countries more than Russia. However, like the response to Covid-19, they will be deemed necessary even if they are unsuccessful at stopping the Russian Invasion. The WEF and other large global organisations will most likely claim that these actions should have been better coordinated and harsher. This could lead to the expansion of the roles of existing global organisations such as the United Nations or it could lead to the creation of a new global organisation that is able to enact sanctions against any country that does not follow its rules. This organisation would consist of world leaders from the largest most powerful nations and possibly even representatives from some of the world’s largest businesses.

A key aspect of the Great Reset is global governance. It can be described in the figure below.

Global Governance

Source: World Economic Forum

A global coordinated response to a country deemed to be unduly acting aggressively towards another country would likely fall under this intended global governance structure. International security is linked to global governance and is expanded in the figure below.

International Security

Source: World Economic Forum

European Union (EU)

People living in countries in the EU will suffer greatly because of this war and even more so because of the sanctions. They will experience high inflation across most sectors. They will experience shortages in critical areas such as energy and food. However, the EU as a body will benefit. They will be able to claim the benefits of close trading partners in addressing shortages. They might even be able to expand the number of EU countries by offering the benefits of reduced tariffs and reduced bureaucracy for trading with EU countries. If the sanctions are proving to be disastrous to the UK economy and when the labour party form government (the major parties take turns running the Government in a two-party system; labour will get its turn again at some point in the next ten years), the EU might be able to entice them back into their single market.

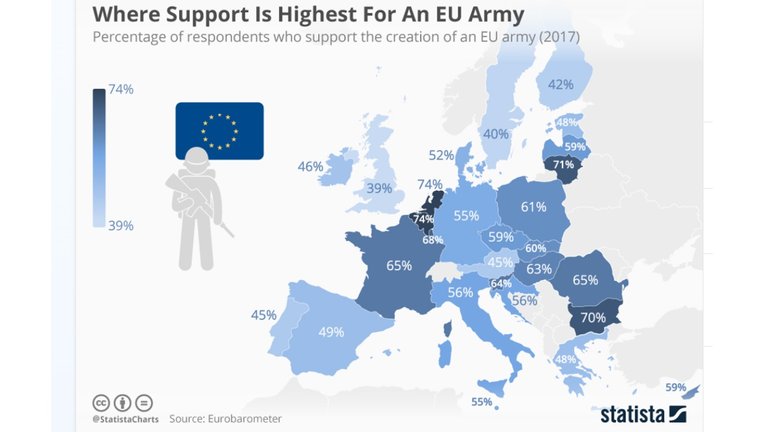

Several leaders of the EU have backed the idea of an EU army (The Week). Currently, the idea does not appear to have sufficient support from enough countries to become a reality. However, it might not be far off it. See figure below regarding support for an EU army.

Support for EU army (2017)

Source: Statista

Support for an EU army might have gained more ground after the US/NATO suddenly pulled out from Afghanistan (France 24). The withdrawal proved that European nations had no choice but to follow the US’s leader. We could argue that NATO is just an extension of the US military because it is strongly dependent on the US.

Russia’s invasion of Ukraine highlights the weakness of NATO when there is minimal support from the US. Imagine the following hypothetical example. If Russia choose to expand their invasion into Europe and if the US response is minimal, Europe could fall. Eventually, the US would most likely intervene but significant damaged would have already been caused. The European armies could be used as fodder so that the US could face a weakened enemy with minimal loss to their own forces. An EU army could be argued as necessary for European security. There would be incentive for the EU countries to invest more on defence, as they will know their defence lies in their hands rather than hoping the US will help when it suits them.

Oil and Gas Companies

In 2020, Russia was the second largest exporter of oil in the world. It accounted for 11% of global oil exports (World’s Top Exports). In 2020, Russia sold about a third of its oil to China and about another third to the European Union (EU) countries (mostly Netherlands, Germany, Poland, and Italy) (Statista).

It is possible that the sanctions will reduce global oil exports by as little as 1%. However, in the short to medium run, a 1% reduction in supply could lead to a 20% increase in the global price. The demand for oil is very inelastic; this is because of a lack of viable energy and fuel alternatives. The supply of oil is also inelastic; this is because oil is only exported by a few countries. Over 65% of oil exports are from just 6 countries (Saudi Arabia, Russia, Iraq, UAE, USA, and Canada) (World’s Top Exports). If Russia choose to sell their oil at a discount to its trading partners, they might be able to sell more of their oil. This could reduce some of the pressure on price but that might be minimal.

Russia’s Oil Exports

Source: Statista

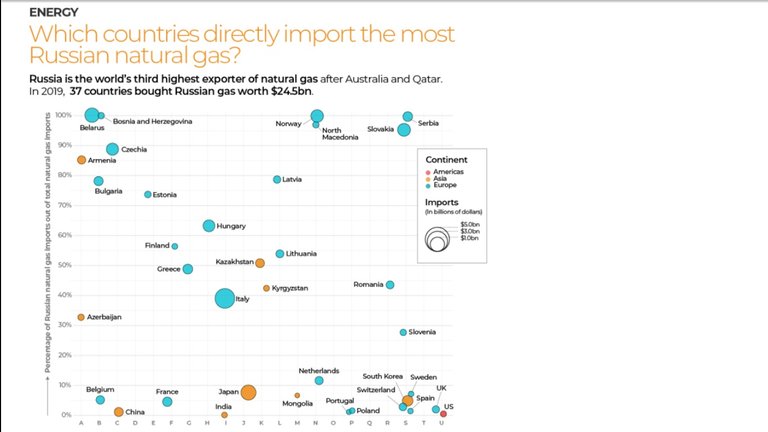

In 2020, Russia was largest exporter of natural gas in the world (Wikipedia). In 2020, EU countries (mostly Germany, Italy, Netherlands, and Hungary) bought about 50% of Russia’s gas exports (BBC & Aljazeera).

Sanctions could reduce the supply of gas by a larger percentage than oil. However, the increase in price might not be as high because demand for natural gas is not as inelastic as oil. This is because there are more substitutes available for the uses of natural gas. For example, natural gas is used to heat buildings and water, or to cook food; these activities can be performed using other energy sources. Like oil, the supply for natural gas is inelastic because it is exported by just a few countries; Russia, USA, and Qatar combined account for about 40% of the world’s exports of natural gas (Aljazeera).

Russia’s Gas Exports

Source: Aljazeera

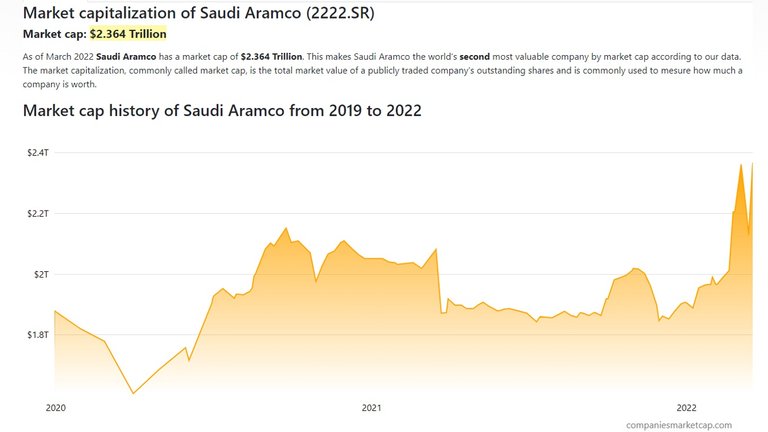

There are several large private oil companies operating in Russia such as Exxon, BP, and Chevron. Ceasing operations in Russia will come at a financial cost. However, if their investment in Russia is not significant, profits from higher prices from oil and gas should offset these loses. Saudi Aramco is the largest oil company in the world based on market cap. It is based in Saudi Arabia and is owned by the Saudi Arabian Government. The market cap has already begun to climb rapidly from just before Russia’s invasion to its current all-time high. See figure below

Market Cap of Saudi Aramco (01/01/2020 to 18/03/2022)

Source: Companies Market Cap

We are seeing similar jumps in market cap from several other oil and gas companies such as Chevron, Equinor, and ConcoPhilips. These are early days but if the sanction persist or even grow, we can expect oil and gas companies to increase their profits. Even Russian owned oil and gas companies could become more profitable despite the reduced market from sanctions.

Most Governments (Western)

It is important to distinguish between the people of a country and their governments. The Russia-Ukraine war and sanctions will hurt the people of most countries in the world. This is not the case for many governments. Bad events, global ones in particular, are normally good for governments. These bad events offer perfect scapegoats for their failings. After the disastrous response to Covid-19, many countries were heading towards recession (falling output) and/or high inflation (possibly stagflation), and health crises as fallout from restrictions and vaccines. Russia can be blamed for all these problems because the sanctions against Russia were “necessary”. The war can also be used as a distraction from other failings within government (e.g. Partygate investigation in UK).

The war in Ukraine can also be used to promote the Government as being heroes. They can claim they stood up to the evil forces of the mighty red army. They can boast about the power of democracy and their everlasting support for it, despite, ignoring it for the past two years. The outcome of the war in Ukraine will be treated as a victory regardless of the outcome. If a peace deal were reached, they would argue that Russia backed down. If Russia captures all of Ukraine, they would argue that their stand scared Russia into halting its invasion into Europe. If Russia invades Europe, they will argue they won at whatever point the war stops.

The war in Ukraine has enabled Governments to gain more power over their people. We have seen this with the seizing of assets from Russian “Oligarchs”. It appears that someone does not need to be proven guilty of any crime to be punished. If the Government does not like you, they can punish you. We can expect these powers to be used on other people for other issues in the near future.

Governments are censoring media that do not promote their narrative or spread their propaganda. The EU and the UK governments (or government supported or approved bodies such as ofcom) have banned media (e.g. RT and Sputnik) that present a different view regarding the war in Ukraine. This is a step up from the censorship that occurred during the two years of Covid-19. We should expect this trend to continue regarding other information or perspectives that the Government (in some cases, the broader establishment) does not want its people to know.

CBDC (Central Bank Digital Currency)

As discussed in Part One, traditional fiat money (e.g. paper money) is losing its value as well as its reliability. People are likely to want to move away from fiat money. Gold, silver, and precious metals may have been viable alternative in the past but the complexity of modern financial systems as well as trade makes gold and silver an impractical money alternative for most people.

Cryptocurrency is a more practical alternative to gold as a replacement for fiat money. However, Governments do not like cryptocurrencies because they hard to regulate (discussed later in post). Governments and the media have spent years trying to discourage the use of cryptocurrencies. They have claimed criminals use them to launder money. They have called them Ponzi schemes. They have claimed they are financially dangerous because of price volatility.

The WEF have acknowledged some of the advantages of cryptocurrencies and blockchain technologies but they also call for more regulation. A response to cryptocurrencies is Central Bank Digital Currencies (CBDC). Some might argue that CBDCs are similar to cryptocurrencies but safer and more secure. In reality, they are very different from most cryptocurrencies. They are completely centralised and controlled by the Central Bank issuing them. There is no role for the community in governance or token distribution. The value of CBDC will be linked to the national currency and not market forces. Therefore, CBDCs will not solve the problem of a collapsing national currency. However, they will be promoted for other reasons such as faster transactions, reduced fees, greater security, etc.

CBDCs will help Governments track people’s activity. Every transaction will be recorded by the Central Bank. CBDCs could also be programmable to control usage. For example, they might be able to restrict how much alcohol a person can buy. CDBCs will make tax collection for Governments easier as all earnings and profits will be recorded (no cash-in-hand tax escapes).

Military Industrial Complex

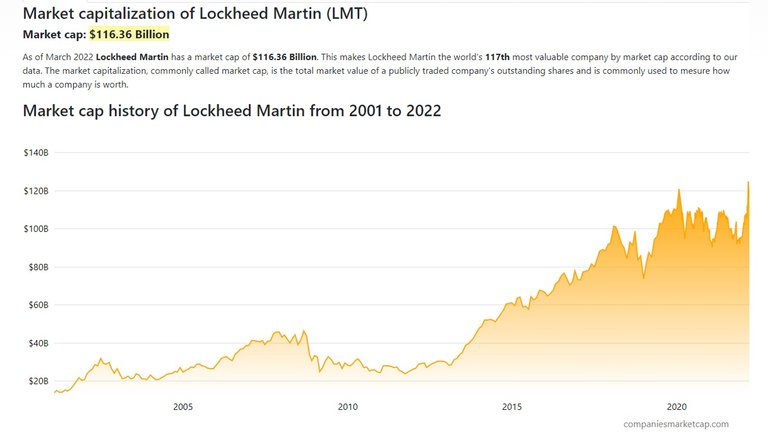

The most obvious winner from any war is the Military Industrial Complex. More weapons are built and sold as they are being used by the countries at war. The countries not at war normally buy weapons because they are afraid the war will spread to their country. The Russia-Ukraine war could prove to be more lucrative than most other wars. Countries from the around the world are donating weapons to Ukraine to fight Russia. The USA alone, has donated over a billion dollars worth of weapons and the EU has donated and is currently donating several hundred million Euros worth of weapons to Ukraine (DW).

If the EU form their own army as a response to this war, the demand for weapons will increase again. If the EU does not form their own army, it is likely the European NATO countries will increase their military expenditure as a response to Russia.

The figure below contains the market cap of Lockheed Martin (largest weapons manufacturer in the world). Their market cap has climbed significantly since the beginning of 2022. Their market was also climbing far faster from 2010 onwards, which aligns with the escalation of many wars around the world (see Part One of this series).

Market Cap of Lockheed Martin (2001 to 2022)

Source: Companies Market Cap

The military industrial complex also stand to gain from the non-military responses to Russia. The Rand Corporation are heavily involved in the USA’s non-military attack on Russia. They have published an outline of interventions the USA can take to harm Russia (the people more than the Government) (RAND). If this information is available on the internet, the amount of work and analysis performed by RAND for the US Government must be considerably more extensive and most likely cost a significant amount of money. The extent of the work done also indicates that a non-military attack on Russia has been planned for a long time.

Wars are also good for people high up in the military or Governments’ defence departments. War enables military officers to progress their careers. They can earn higher salaries, receive promotions, and earn medals. Defence departments can increase their budgets and their level of influence within Government.

Big Business (banks, construction, and media)

Many businesses are going to struggle because of the higher costs. Small businesses, in particular, will be hit hard (See, Part One). Many big businesses will struggle but most of these can be expected to survive as they have a better chance of adsorbing the higher costs. There will also be big businesses that will even increase their profits. We have discussed how oil and gas companies and military businesses will profit. A few other types of businesses could also profit.

Banks are likely to benefit greatly from this war (as they do from any war). Wars are expensive. Money is needed to fund the wars and money is needed to rebuild after wars. Banks can lend money for Governments to buy more weapons and recruit and support more soldiers. Bank can lend money to produce more weapons. Banks can lend money to fund reconstruction projects of areas destroyed in war. Banks also stand to benefit from new Government policy regarding the security of funds held in banks. Banks might be able to freeze and/or seize funds of their account holders when they feel necessary.

Construction companies could profit greatly from the reconstruction of cities and infrastructure destroyed in the war. For example. Mariupol in South Ukraine looks to have adsorbed considerable damage. A large part of the city will need to be rebuilt.

Some mainstream media companies are benefiting from this war. For example, BBC has experienced a viewership spike since the war began (Broadcast). People needed to see something other than Covid-19 in the news. Wars are also dramatic and attention grabbing. Some media are treating the events in Ukraine like a Hollywood movie. Mainstream media that play by “the rules” also stand to benefit from their competition being censored. It gives the remaining media greater monopoly power on information. Less competition also leads to higher profits.

Green Energy (Mostly EU and UK)

It may seem a little contradictory to say that both green energy and oil and gas companies can benefit at the same time. However, high prices and shortages could make both possible. The EU are highly dependent on Russia for oil (over a quarter of imported crude oil to the EU is from Russia) and natural gas (2 fifths of natural gas used in the EU is from Russia) (World Economic Forum). Sanctions will cause energy shortages in the EU. The EU will need alternative energy sources to meet these shortages. They could try to obtain oil and gas from other countries but the options are limited. They may try to find possible substitutes to oil and gas such as nuclear power (treated as taboo by mainstream media).

Green energy (renewable energy such as solar, wind, hydro, humidity, etc.) should be considered as substitutes to oil and gas (non-renewable). On a large scale, green energy is not a strong substitute to oil and gas; it is inefficient, costly, and unreliable. Existing infrastructure and equipment is designed to use oil or gas. Replacing or adapting this infrastructure and equipment takes time and costs money. The higher oil and gas prices makes green energy and investment in green energy relatively less expensive. If the impact of the sanctions are prolonged, investing in green energy could become economically viable or at least investment in it by Governments could become defensible. It is also worth noting that green energy is part of WEF's Great Reset agenda.

Gold, silver, and precious metals

Whenever there is a crisis, people seem to turn gold. Many people consider gold to be a safe asset. It rarely falls significantly in price. This is because it is scarce. There is a finite quantity of physical gold in the world. If the value of everything else is falling, gold will hold its price because it is scarce and because people buy it because they know the value is secure. This pushes the price of gold higher during a crisis.

Price of Gold (2018 to 2022)

Source: Royal Mint

Similar arguments can be made about silver but silver has struggled more to hold its value than gold. However, a spike in the price of gold could lead to a spike in the price of silver if people consider silver relatively undervalued. Some weapons such as missiles contain a considerable amount of silver. If demand for weapons increases, the demand for silver should also increase.

Cryptocurrencies

If traditional fiat money (paper) and CBDC are prone to inflation and gold is not practical, people may turn to cryptocurrency. Cryptocurrencies such as Bitcoin and Ethereum have proven to be good stores of value in the long-run. They are also becoming more widely accepted. They have the advantage of being more decentralised than CBDCs. Many cryptocurrencies are also much better at protecting privacy than CBDCs. Cryptocurrencies should be the future of currency.

The biggest concern with cryptocurrency is that Governments do not like them. They cannot control them and they are difficult to regulate. Governments may choose not to intervene in cryptocurrency. If that is the case, we can expect them to grow in popularity and some coins could reach mass adoption reasonably soon.

However, if Governments strongly target cryptocurrencies their growth will be greatly hindered. Governments could target businesses by regulating or banning their usage. Governments could target distribution by banning mining. Governments could target trade by placing tight restrictions on exchanges.

Many countries around the world have attempted to control cryptocurrencies but with very little success. Activity tends to move to where it is easiest to do so. International borders have not restricted this from happening. The incredible increases in the price of some cryptocurrencies has made the potential for profit too great for Governments of large economies to ban them completely. They would face too much resistance from wealthy investors, which could prove disastrous to the survival of that Government. Cryptocurrencies will benefit from the collapse of fiat money; the only question is by what extent.

Vladimir Putin

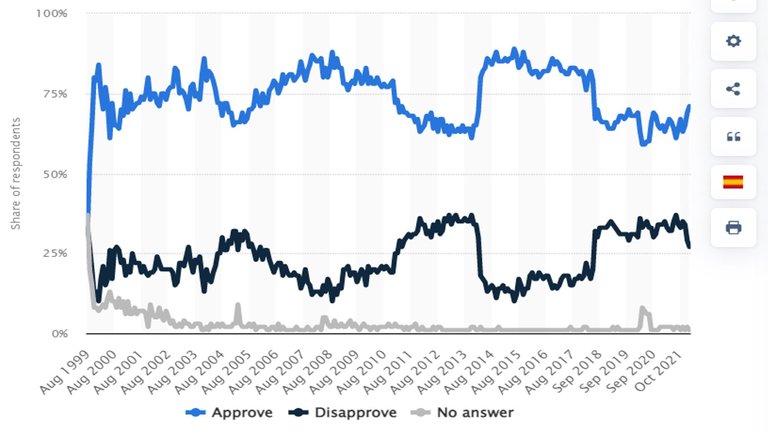

Vladimir Putin is the man the western world is vilifying. Some media are even comparing him to Hitler. Despite western medias attack on Vladimir Putin’s character, it appears Vladimir Putin’s popularity is climbing quite sharply in Russia (over 10% increase) (Daily Mail). The report claimed the popularity increase could be fake or based on Russian media propaganda. Despite new laws in Russia regarding the reporting of fake news, some international media is still reporting and broadcasting in Russia (The Guardian). If we assume the poll on Vladimir Putin is accurate, people of Russia have more faith in their own media than international media.

Vladimir Putin’s popularity has been consistently high throughout his two stints as president (2000-2008 and 2012-present). The last time Russia was at war with Ukraine (2014), Vladimir Putin’s popularity spiked as well. It appears the people support his causes for military action. See figure below.

Vladimir Putin’s Popularity

Source: Statista

Before and during Russia’s invasion of Ukraine, Vladimir Putin has had several demands of Ukraine and NATO. Based on several different reports, these demands can be summarised as follows:

- Ukraine to be neutral (e.g. Ukraine never to become a NATO member)

- No further expansion of NATO towards Russia

- Cease aggression towards the Donbass Region

- Recognition of Donetsk and Luhansk as independent states

- Denazification of Ukraine

- Demilitarising of Ukraine

- Restore water supply to Crimea

- Recognise Crimea as Russian territory

These demands form the reported basis of Russia’s invasion of Ukraine. The invasion could be summarised and sold as an act of protecting Russia’s security as well as the rights of Russians living in contested territories. The increase in Vladimir Putin’s popularity would indicate most people in Russia believe some form of military action is justified.

Ukraine were unwilling to meet Russia’s demands prior to the invasion. Ukraine have started to concede on some of Vladimir Putin’s demands but it appears an agreement is still unlikely. It is possible Vladimir Putin would like to reach a deal; he is showing his people and his allies he is making an effort. However, a deal is not necessary, it appears his military campaign could achieve everything he claims he wants and more.

The extreme sanctions on Russia may eventually hurt Vladimir Putin’s popularity but they may also the have the opposite effect. The sanctions could be used to unify Russian citizens against the West as well as be used to cover for any hardship caused by other Russian policies (e.g. Covid-19 policies).

Countries not sanctioned (e.g. Saudi Arabia or China)?

It may appear intuitive that countries that avoided sanctions (i.e. sanctioning or sanctioned countries) would benefit from the war in Ukraine. As mentioned earlier in the post, we need to distinguish between Governments and the people of a country. Governments often benefit at the expense of their people.

People (Most likely not winners)

The people of these countries do not feel the direct impact of restricted flow of goods and services but there is still an indirect impact as well as possible disruptions to supply chains. These disruptions could still cause prices to rise and shortages of some goods and services. Oil and gas prices are determined globally. Therefore, the price of oil and gas will increase everywhere. It is possible some countries could receive a slightly lower price if they make a deal with an oil producing country. For example, India made a deal with Russia (NDTV).

Governments (More likely winners)

Governments of many countries that have not decisively taken sides in the non-military war between Russia and the West, face a difficult decision. Taking sides comes at a cost. Supporting Russia could lead to sanctions from the West. Supporting the West, involves placing sanctions on Russia (possibly even greater cost). Remaining neutral is likely to be perceived by the US as siding with Russia, which could also have ramifications but to less extent than directly supporting Russia.

The Saudi Arabian Government are in a great position because they own the largest oil and gas company in the world (Saudi Aramco). They will benefit as described earlier in the post. However, this does not mean that the Government’s profits will find its way to the average Saudi Arabian worker.

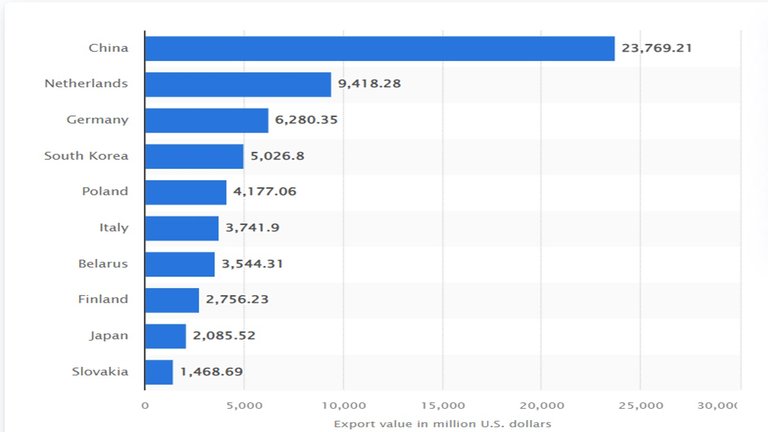

The Chinese Government remain in a strong position because the world is dependent on China for manufactured goods. Sanctioning China would be catastrophic for any western nation.

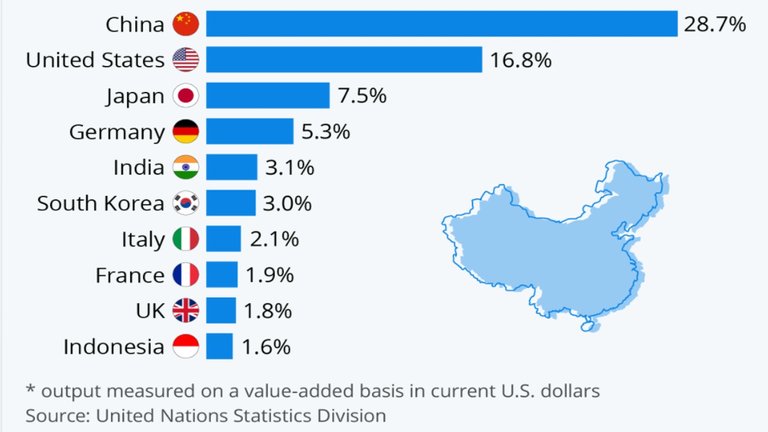

China’s dominance in manufacturing (2019)

Source: Statista

China could remain neutral or support Russia with little to no consequence. The Chinese Government could make deals with Russia to reduce inflation. They could continue to make deals with the West as well. The Chinese Government could build off Russia’s success in Ukraine to pressure Taiwan. Russia’s invasion of Ukraine demonstrates the West’s inability to stop a super power from taking another country. The sanctions used against Russia weakens the West in being able to take any action against China if they decide to take back Taiwan.

End of Part Two

There are many losers when it comes to war but there are also many potential winners. It is easier to identify the losers of war as they face direct consequences of the war (e.g. civilians in the war zone, soldiers fighting the war, displaced people, etc.). The losers of war predominantly belong to the working or middle classes in society.

The winners of war are less obvious and less discussed. However, we know they exist because wars persist. If we do some investigating, it is possible to find out who most likely stands to benefit. The winners are often the rich (big businesses owners) and powerful (world leaders, Governments, Government bodies, international organisations). The winners often have the same economic or political backgrounds as the people most responsible for starting, funding, and/or provoking the wars.

For additional perspective on my thoughts regarding the Russia-Ukraine, I recommend that you read my post Russia Invades Ukraine: What is going on?, the comments are also very informative.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media

What a super post - I love reading different perspectives outside of my local news media about the Ukraine/Russian conflict. In reading your Winners list I was waiting for you to discuss Taiwan - can't help but feel it is the country on the edge - well, outside of Europe. If Russia can't complete their takeover of Ukraine, or it ends in an absolute destruction of their economy with ongoing sanctions - you can't help but see Taiwan as the major winner in all of this. The other side of the knife, if Russia can normalise relations with the west and insert a puppet government in Ukraine - well, Taiwan, watch out.

Green Energy - as a tangent thought, a lot of western countries in Russia, who were developing green energy assets have moved out of the country - could set back green energy years in Russia itself. There is a company in Australia - Fortescue, who is actually a big iron ore miner, but they have a green industries arm - and are seeking hydrogen projects around the world. Think they have walked away from a significant project in Russia's east - where the assumption is the Russian river systems could be a green energy flow of 'gold'.

Thanks for your time.

Tim

Taiwan should feel pretty nervous about how events are unfolding in Ukraine. If the war in Ukraine escalates and China becomes involved, Taiwan could become a strategic target. I think the best outcome for Taiwan would be if peace talks between Russia and Ukraine resolves the war as soon as possible.

I was not aware of the green energy work going in Russia. If these companies are pulling out permanently then green energy could be setback. It also depends on the extent of the work being carried out and how that compares with work done elsewhere.

You have to figure any pullout of those green energy projects will likely not be dependent on the companies themselves, but where it is 'trendy' to remain pulled out - and indeed, whether Russia would take them back in, or simply take over their infrastructure in place! If I was a dictator with a grudge, I'd do the latter for sure!

I dunno, if Ukraine completely falls, the biggest threat to Taiwan is that democracies can, and indeed, have fallen. This line seems to be it's biggest security card, 'I am a democracy, therefore, have allies that will fight for democracy'. That said, for China's government to maintain their own narratives about unrivaled economic growth - they need the west. Sanctions would cripple the country given their place in the world is far more significant in its reach than Russia, whose energy markets will be more buoyant at same point.

Following the COVID shutdown of ports, and the realisation of the need to diversify supply chains away from China - it may well be that those moves will start to ready the West for an exclusion of China from our economies. India is becoming more entrenched into Western partnerships, I'm thinking the QUAD with Japan, USA, Australia - that it may well continue to raise its influence in Asia and given its population, becomes the natural counter balance to China - especially when or if its population becomes the highest in the world.

Given China's birthrates being in decline - the window to take Taiwan cannot stretch on forever.

Looks like the sanctions are now extending to China (Zero Hedge). How far will this escalate? We are heading down a very dangerous path.