What is a wrapped token?

(Edited)

Blockchain101 an explainer series.

- Today I will explain what wrapped tokens are, why they are needed and what they are used for in cryptocurrency, and more specifically decentralized finance.

Background

- Ethereum is a blockchain, and every token created or minted on this blockchain is an Ethereum token.

- Ether is a token created or minted on the Ethereum blockchain, so it is an Ethereum token.

- Dai is a token created or minted on the Ethereum blockchain, so it is an Ethereum token.

- ‘USDC is a token, created or minted on the Ethereum block chain, so it is an Ethereum token.

- So every token created or minted on the Ethereum blockchain is an Ethereum token.

- Ethereum tokens which are not Ether are called ERC-20 tokens.

- A place you go to wrap your tokens is sometimes called a Bridge

- Your original asset is held on the Bridge in a place called a Vault.

- Keywords: Ethereum, ETH, ERC-20, wrapped tokens, cryptocurrency, blockchain, asset, wrapper, Ether, bridge & vault.

#

source

What are wrapped tokens

- They are tokens created or minted on blockchain A, which represent the value of a token from blockchain B.

- So a wrapped tokens on Ethereum, is a token, created or minted on the Ethereum blockchain, which represent the value of another token on another blockchain.

- On the Ethereum blockchain this type of Ethereum token is called an ERC-20.

- On Binance Smart Chain blockchain this type of token is called a BEP-20.

- So for example: a wrapped Bitcoin token on the Ethereum blockchain, is a token created or minted on the Ethereum blockchain, usually represented as WBTC.

- WBTC is an Ethereum token, but it represents the value of a token from another blockchain, in this case, the Bitcoin blockchain, and specifically a Bitcoin token, on the Ethereum blockchain. It is a ERC-20 token.

- Keywords: #Wrapped token, #blockchain, #asset, #WBTC, #ERC-20, #BEP-20, WBTC, Ethereum & Bitcoin

Why do we need wrapped tokens?

- First, only Ethereum tokens can be used on the Ethereum blockchain.

- So if an investor who wants to invest the value represented by their cash money or the value represented by their cryptocurrency, in a project on the Ethereum blockchain, the value of that capitol investment must be represented by an Ethereum token.

- ‘All investment in projects on the Ethereum blockchain must be in the form of Ethereum tokens, usually ERC-20 tokens.

- This can be accomplished in many ways, but the two most common are purchase/exchange or wrapping.

- Keywords:Ethereum, Ethereum tokens, ERC-20, wrapped tokens, cryptocurrency, blockchain, purchase, Bitcoin, exchange or wrap.

Purchase/Exchange

- You send your cash money or fiat to a centralized exchange and trade it for Ethereum tokens like Ether, Dai or USDC.

- ‘You send your Bitcoin, or Hive to an exchange and trade it for Ether, Dai or USDC.

- This Ether, Dai or USDC now represents the value of your cash money or fiat currency on the Ethereum blockchain.

- Now you can use those Ethereum tokens to invest the value of your money in DeFi projects on Ethereum like the MakerDao or the Uniswap decentralized exchange.

Further explanation- optional reading:

- If you have 1000 dollars USD and trade it for 1000 Ethereum tokens called USDC, each of which represents the value of one US Dollar on Ethereum, then you would receive 1000 USDC tokens.

- ‘However if the price of Ether was 1000 US Dollars, and you used your 1000 US Dollars to buy Ether instead of USDC, then you would get only one Ether. And that one Ether would represent the value of your 1000 US Dollars on the Ethereum blockchain.

Wrapped tokens

- You can trade or exchange your Bitcoin, Hive or Leo for a wrapped versions of these tokens on Ethereum. These wrapped versions are Ethereum tokens created or minted on the Ethereum blockchain specifically to represent the value of your other cryptocurrency on the Ethereum blockchain.

- So one Hive would be traded for one Wrapped Hive. This new token is an Ethereum token created or minted on the Ethereum blockchain to represent the value of one Hive token on the Ethereum blockchain.

- The same can be done for Bitcoin. A Ethereum token is created or minted on the Ethereum blockchain to represent the value of one Bitcoin on the Ethereum blockchain, and this new token would be called Wrapped Bitcoin.

Further explanation- optional reading:

- When Leofinance creator @khaleelkazi wanted to help Leofinance investors invest the value of their Leo tokens on Uniswap, a DeFi project on the Ethereum blockchain, he created or minted an Ethereum token, which represented the value of one Leo token on the Ethereum blockchain. These tokens became known as Wrapped Leo, which was subsequently know as WLEO.

Critical Security Aspect

- I address this last, but it is not the least important.

- A critical aspect of using wrapped tokens is that your original token, whose value you invest on the Ethereum blockchain is the asset that gives your Wrapped Token value and it must be stored safely, or your wrapped token becomes worthless.

- And you must trust that you will be able to get it back.

- Think of the Wrapped Token as a Promise to Pay. or what Americans call an IOU meaning I owe you.

- A Wrapped Bitcoin is a Promise to Pay you one real Bitcoin.

- So that real Bitcoin must be safely stored.

- ‘This means you must trust the place you take your Bitcoin, Hive or Leo to, to wrap your token, hold your Bitcoin, Hive or Leo safely and to give it back to you in exchange for the wrapped version when you want it back.

- ‘This is one reason there is only one or two places investors use to wrap their Bitcoin, because they are sure they can get their Bitcoin back.

- ‘This also the reason that the places which wrap tokens get hacked, because they are like banks.

- So you need to trust the token wrapper not only to be honest, but also to know how to keep your tokens safe.

Last Words

- I hope this post has brought you greater understanding of the term wrapped tokens.

- And I hope this knowledge will help you feel safer investing your hard earned cash or tokens in DeFi projects.

- If you have questions, please put them in the comments below.

- And if you liked this article please follow me for more content like this.

@shortsegments

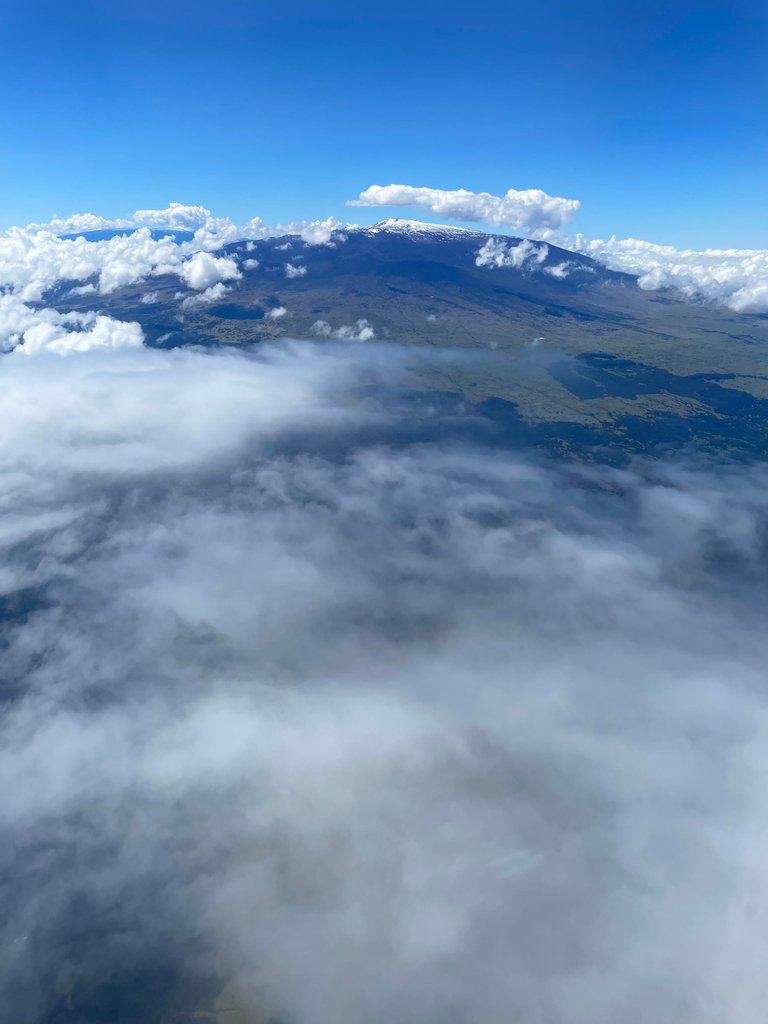

Studying cryptocurrency is like viewing the peak of a mountain rising through the clouds, a beautiful, and majestic creation. But we only fully appreciate it when we are able to view it from sea level to the top.

The Peak

The mountain

Posted Using LeoFinance Beta

LEOGLOSSARY Links are in Yellow in the above article

0

0

0.000

I searched this topic on Google. The number one hit was Binance Academy:

https://academy.binance.com/en/articles/what-are-wrapped-tokens

Now

I study this article to see if it contains keyword mine does not, and how I can study it to see how my article can rank higher.

Wrapped token, cryptocurrency, blockchain, asset, wrapper, vault, bridges, tokenized, native, non-native, ERC-20, BEP-20, WBTC, Ethereum, Ether, WHive, WLEO, WETH,

The full text of the article:

Now

I study this article to see if it contains keyword mine does not, and how I can study it to see how my article can rank higher.

Posted Using LeoFinance Beta

https://www.investopedia.com/terms/c/cryptocurrency.asp

Full Tex of an Article from investopedia on cryptocyurrency:

Cryptocurrency Explained With Pros and Cons for Investment

Learn what you need to know before you invest in a virtual currency

By JAKE FRANKENFIELD Updated February 04, 2023

Reviewed by CIERRA MURRY

Fact checked by SUZANNE KVILHAUG

Cryptocurrency

Investopedia / Tara Anand

What Is Cryptocurrency?

A cryptocurrency is a digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

KEY TAKEAWAYS

A cryptocurrency is a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities.

Some experts believe blockchain and related technologies will disrupt many industries, including finance and law.

The advantages of cryptocurrencies include cheaper and faster money transfers and decentralized systems that do not collapse at a single point of failure.

The disadvantages of cryptocurrencies include their price volatility, high energy consumption for mining activities, and use in criminal activities.

1:55

Watch Now: What Is Cryptocurrency?

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies underpinned by cryptographic systems. They enable secure online payments without the use of third-party intermediaries. "Crypto" refers to the various encryption algorithms and cryptographic techniques that safeguard these entries, such as elliptical curve encryption, public-private key pairs, and hashing functions.

Cryptocurrencies can be mined, purchased from cryptocurrency exchanges, or rewarded for work done on a blockchain. Not all e-commerce sites allow purchases using cryptocurrencies. In fact, cryptocurrencies, even popular ones like Bitcoin, are hardly used for retail transactions. However, cryptocurrency values have made them popular as trading and investing instruments. To a limited extent, they are also used for cross-border transfers.

Blockchain

Central to the appeal and functionality of Bitcoin and other cryptocurrencies is blockchain technology. As its name indicates, a blockchain is essentially a set of connected blocks of information on an online ledger. Each block contains a set of transactions that have been independently verified by each validator on a network.

Every new block generated must be verified by each node before being confirmed, making it almost impossible to forge transaction histories.

1

The contents of the online ledger must be agreed upon by a network of individual nodes, or computers that maintain the ledger.

Experts say that blockchain technology can serve multiple industries, supply chains, and processes such as online voting and crowdfunding. Financial institutions such as JPMorgan Chase & Co. (JPM) are testing the use of blockchain technology to lower transaction costs by streamlining payment processing.

2

Types of Cryptocurrency

Many cryptocurrencies were created to facilitate work done on the blockchain they are built on. For example, Ethereum's ether was designed to be used as payment for validation work done on the blockchain. When the blockchain transitioned to proof-of-stake in September 2022, ether (ETH) inherited an additional duty as the blockchain's staking mechanism. Ripple's XRP is designed to be used by banks to facilitate transfers between different geographies.

Because there are so many cryptocurrencies on the market, it's important to understand the types of cryptocurrencies. Understanding if the coin you're looking at has a purpose can help you decide whether it is worth investing in—a cryptocurrency without a purpose is likely to be riskier than one with utility.

Most of the time, when you hear about cryptocurrency types, you hear the coin's name. However, coin names differ from coin types. Here are some of the types you'll find with some of the names of tokens in that category:

Utility: XRP and ETH are two examples of utility tokens. They serve specific functions on their respective blockchains.

Transactional: Tokens designed to be used as a payment method. Bitcoin is the most well-known of these.

Governance: These tokens represent voting or other rights on a blockchain, such as Uniswap.

Platform: These tokens support applications built to use a blockchain, such as Solana.

Security tokens: Tokens representing ownership of an asset, such as a stock that has been tokenized (value transferred to the blockchain). MS Token is an example of a securitized token. If you can find one of these for sale, you can gain partial ownership of the Millenium Sapphire.

3

If you find a cryptocurrency that doesn't fall into one of these categories, you've found a new category or something that needs to be investigated to be sure it's legitimate.

Are Cryptocurrencies Legal?

Fiat currencies derive their authority from the government or monetary authorities. For example, each dollar bill is backstopped by the Federal Reserve.

But cryptocurrencies are not backed by any public or private entities. Therefore, it has been difficult to make a case for their legal status in different financial jurisdictions throughout the world. It doesn't help matters that cryptocurrencies have largely functioned outside most existing financial infrastructure. The legal status of cryptocurrencies has implications for their use in daily transactions and trading. In June 2019, the Financial Action Task Force (FATF) recommended that wire transfers of cryptocurrencies should be subject to the requirements of its Travel Rule, which requires AML compliance.

4

As of January 2023, El Salvador and the Central African Republic were the only countries to accept Bitcoin as legal tender for monetary transactions.

5

In the rest of the world, cryptocurrency regulation varies by jurisdiction.

Japan's Payment Services Act defines Bitcoin as legal property.

6

Cryptocurrency exchanges operating in the country are subject to collect information about the customer and details relating to the wire transfer. China has banned cryptocurrency exchanges and mining within its borders. India was reported to be formulating a framework for cryptocurrencies.

7

Cryptocurrencies are legal in the European Union. Derivatives and other products that use cryptocurrencies must qualify as "financial instruments." In June 2021, the European Commission released the Markets in Crypto-Assets (MiCA) regulation that sets safeguards for regulation and establishes rules for companies or vendors providing financial services using cryptocurrencies.

8

Within the United States, the biggest and most sophisticated financial market in the world, crypto derivatives such as Bitcoin futures are available on the Chicago Mercantile Exchange. In the past, the Securities and Exchange Commission (SEC) took the stance that Bitcoin and Ethereum were not securities; however, in September 2022, SEC Chair Gary Gensler stated he believes cryptocurrencies are securities. This stance implies that cryptocurrency's legal status may become subject to regulation.

9

Although cryptocurrencies are considered a form of money, the Internal Revenue Service (IRS) treats them as financial assets or property for tax purposes. And, as with most other investments, if you reap capital gains selling or trading cryptocurrencies, the government wants a piece of the profits. How exactly the IRS taxes digital assets—either as capital gains or ordinary income—depends on how long the taxpayer held the cryptocurrency and how they used it.

10

Are Cryptocurrencies Safe Investments?

Cryptocurrencies have attracted a reputation as unstable investments due to high investor losses as a result of scams, hacks, and bugs. Although the underlying cryptography is generally secure, the technical complexity of using and storing crypto assets can be a significant hazard to new users.

In addition to the market risks associated with speculative assets, cryptocurrency investors should be aware of the following risks:

User risk: Unlike traditional finance, there is no way to reverse or cancel a cryptocurrency transaction after it has already been sent. By some estimates, about one-fifth of all bitcoins are now inaccessible due to lost passwords or incorrect sending addresses.

11

Regulatory risks: The regulatory status of some cryptocurrencies is still unclear, with many governments seeking to regulate them as securities, currencies, or both. A sudden regulatory crackdown could make it difficult to sell cryptocurrencies or cause a market-wide price drop.

Counterparty risks: Many investors and merchants rely on exchanges or other custodians to store their cryptocurrency. Theft or loss by one of these third parties could result in losing one's entire investment.

Management risks: Due to the lack of coherent regulations, there are few protections against deceptive or unethical management practices. Many investors have lost large sums to management teams that failed to deliver a product.

Programming risks: Many investment and lending platforms use automated smart contracts to control the movement of user deposits. An investor using one of these platforms assumes the risk that a bug or exploit in these programs could cause them to lose their investment.

Market Manipulation: Market manipulation remains a substantial problem in cryptocurrency, with influential people, organizations, and exchanges acting unethically.

Despite these risks, cryptocurrencies have seen a major leap in prices, with the total market capitalization rising to over $1 trillion.

12

Despite the speculative nature of the asset, some have been able to create substantial fortunes by taking on the risk of investing in early-stage cryptocurrencies.

Advantages and Disadvantages of Cryptocurrency

Cryptocurrencies were introduced with the intent to revolutionize financial infrastructure. As with every revolution, however, there are tradeoffs involved. At the current stage of development for cryptocurrencies, there are many differences between the theoretical ideal of a decentralized system with cryptocurrencies and its practical implementation.

Some advantages and disadvantages of cryptocurrencies are as follows.

Advantages

Removes single points of failure

Easier to transfer funds between parties

Removes third parties

Can be used to generate returns

Remittances are streamlined

Disadvantages

Transactions are pseudonymous

Pseudonymity allows for criminal uses

Have become highly centralized

Expensive to participate in a network and earn

Off-chain security issues

Prices are very volatile

Advantages Explained

Cryptocurrencies represent a new, decentralized paradigm for money. In this system, centralized intermediaries, such as banks and monetary institutions, are not necessary to enforce trust and police transactions between two parties. Thus, a system with cryptocurrencies eliminates the possibility of a single point of failure, such as a large bank, setting off a cascade of crises around the world, such as the one triggered in 2008 by the failure of institutions in the United States.

Cryptocurrencies promise to make it easier to transfer funds directly between two parties without needing a trusted third party like a bank or a credit card company. Such decentralized transfers are secured by the use of public keys and private keys and different forms of incentive systems, such as proof of work or proof of stake.

Because they do not use third-party intermediaries, cryptocurrency transfers between two transacting parties can be faster than standard money transfers. Flash loans in decentralized finance are an excellent example of such decentralized transfers. These loans, which are processed without backing collateral, can be executed within seconds and are used in trading.

Cryptocurrency investments can generate profits. Cryptocurrency markets have skyrocketed in value over the past decade, at one point reaching almost $2 trillion. As of January 2023, Bitcoin was valued at more than $450 billion in crypto markets.

13

The remittance economy is testing one of cryptocurrency's most prominent use cases. Currently, cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency. This method streamlines the money transfer process and makes it cheaper.

Disadvantages Explained

Though they claim to be an anonymous form of transaction, cryptocurrencies are pseudonymous. They leave a digital trail that agencies like the Federal Bureau of Investigation (FBI) can investigate. This opens up the possibility that governments and authorities (and others) can track financial transactions.

Cryptocurrencies have become a popular tool with criminals for nefarious activities such as money laundering and illicit purchases. The case of Dread Pirate Roberts, who ran a marketplace to sell drugs on the dark web, is already well known. Cryptocurrencies have also become a favorite of hackers who use them for ransomware activities.

14

In theory, cryptocurrencies are meant to be decentralized, their wealth distributed between many parties on a blockchain. In reality, ownership is highly concentrated. For example, just 100 addresses hold roughly 12% of circulating bitcoin and total value.

15

One of the conceits of cryptocurrencies is that anyone can mine them using a computer with an Internet connection. However, mining popular cryptocurrencies require considerable energy, sometimes as much energy as entire countries consume. The expensive energy costs and the unpredictability of mining have concentrated mining among large firms whose revenues run into billions of dollars. For example, only 98 (2%) of the 4,882 Bitcoin blocks opened from Dec. 29, 2022, to Jan. 29, 2023, were opened by unknown addresses—the other 98% were opened by mining pools.

16

Though cryptocurrency blockchains are highly secure, off-chain crypto-related key storage repositories, such as exchanges and wallets, can be hacked. Many cryptocurrency exchanges and wallets have been hacked over the years, sometimes resulting in millions of dollars worth of "coins" stolen.

17

Cryptocurrencies traded in public markets suffer from price volatility. For example, Bitcoin has experienced rapid surges and crashes in its value, climbing to nearly $65,000 in November 2021 before dropping to just over $20,000 a year and a half later.

18

As a result, many people consider cryptocurrencies to be a short-lived fad or speculative bubble.

How Do You Buy Cryptocurrencies?

You can purchase cryptocurrency from popular crypto exchanges such as Coinbase, apps such as Cash App, or through brokers. Another popular way to invest in cryptocurrencies is through financial derivatives, such as CME's Bitcoin futures, or other instruments, such as Bitcoin trusts and ETFs.

What Is the Point of Cryptocurrency?

Cryptocurrencies are a new paradigm for money. They promise to streamline existing financial architecture to make it faster and cheaper. In addition, their technology and architecture decentralize existing monetary systems and make it possible for transacting parties to exchange value and money independently of intermediary institutions such as banks.

What Are the Most Popular Cryptocurrencies?

Bitcoin is the most popular cryptocurrency, followed by other cryptocurrencies such as Ethereum, Binance Coin, Solana, and Cardano.

Are Cryptocurrencies Securities?

In the past, the SEC has said that Bitcoin and Ethereum, the top two cryptocurrencies by market cap, were not securities. In September 2022, SEC Chair Gary Gensler stated he believes cryptocurrencies are securities and has asked SEC staff to begin working with crypto developers to register their crypto. However, he also clarified that he did not speak on behalf of the SEC; he was only speaking for himself. He encouraged those starting in the crypto space to register their crypto in the spirit of getting ahead because "It's far less costly to do so from the outset."

9

The Bottom Line

Cryptocurrencies are digital assets that are secured by cryptography. As a relatively new technology, they are highly speculative, and it is important to understand the risks involved before making an investment.

Investing in cryptocurrencies and other initial coin offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Because each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Posted Using LeoFinance Beta

How to Build a Cryptocurrency Exchange: 7 Keys Features

Cryptocurrency exchange market has proven itself to be highly profitable if approached correctly. The number of exchange platforms increased but the quality of some resources’ services can still be a question. Given that cryptocurrency exchange rates are not governed, they have boosted to unthinkably high levels with, however, no guarantees of them staying there.

On one side this huge hype around the question “how to build a cryptocurrency exchange” makes this market pretty competitive.

But the more the market develops, the more trust it gains from users, and the more benefits it brings to those who know how to work with it. That is why creating a high-quality cryptocurrency trading app is an amazing idea. So, let’s see what do you need to pay attention to and how to start a cryptocurrency exchange service via the app.

Sign in/Sign up

The signup or login page is the first thing a user will see, but the main point of it is not just to let people in after registration but to also protect the system from any unauthorized logins, hack attacks, or any other kind of manipulations. For this reason, this functionality should be very well developed and correspond to the highest standards. Besides the general login/password combination, there is also a 2FA to provide additional security for users.

User Verification

One of the reasons the crypto exchange market is so trusted among the users is that every user is thoroughly verified. Depending on the type of verification, the verified users generally have more possibilities. For example, the limits for withdrawal for the verified users are higher than for the non-verified. The verification is important to ensure the transparency of trades and to minimize the possibility of a scam.

Deposit/Withdrawal

This feature allows traders to deposit money into the internal wallet featured by the cryptocurrency exchange software, as well as to withdraw money to the wallets outside of the software according to the limits set by the company.

Transactions creation

Every user should have the possibility to buy or sell currency to other users in the system. It’s very important that all the trades are happening fast and without any system errors. The system should have several possibilities for orders creation in order to allow the user to choose the one which is convenient for them at the moment.

Analytics

A very useful feature which allows creating various graphs and stats for better visibility.

Internal API

The exchange’s own API is required to allow users to create their own automated trading systems or the data exchange among the verified devices using the cryptocurrency exchange script.

Admin Panel

With the help of the admin panel, the employees of the exchange company will be able to monitor trades and to manage the actions made on the exchange based on their access level.

These are only the main features required by any application of such type. There is much more to be implemented in the app to make it not only usable but also secure and user-friendly.

Recommended: How to develop a Minimum Viable Version of Your Product

5 Steps to Build a Cryptocurrency Exchange

It’s no secret that, lately, most of the applications’ development process is divided into the aspects which are handled separately. Various aspects are generally developed by different teams in collaboration with each other. Such moments can include an API, web interface, etc. The number and variations of them depend on the complexity of the application.

An exchange trading system like Binance would require the following app-building aspects to be taken care of:

Design

This is the first thing for the client to see before starting to use the application. In order to develop a harmonic design combining both beauty and usability, we advise you to follow the trending best practices and take into account the product equireents. The design creation includes the following stages.

Wireframes – the base of the future design where its key features are implemented.

Prototype – the detailed visualization of the user’s interaction with the application that allows preventing the possible UX-related issues.

Client-side development

The web part of the application contains the client-side logics of all the pages of the website and is based on the previously created design. Front-end developers usually make the design work by HTML, CSS markups, and Javascript programming language including Angular.js, React.js, Vue.js frameworks.

Recommended: The Guide to the Cryptomarket

API

API is the back-end part of the application that is not visible to the end-user. The server part of the application is responsible for performing the application’s internal logic and handling the basic functions:

User authentication and authorization

Server-side function of admin panel

Newsletter

Cryptocurrency bets and deals of the users

API that can be used by third-party organizations

Blockchain

The part which is responsible for the actual processing and storing of data concerning trades between users in a secure environment (any alteration by any party is impossible thanks to the blockchain).

Read more: The Guide to Blockchain for Business Owners

Testing

An obligatory part of modern application development. It is extremely important as it allows distinguishing and eliminating most of the bugs within the logic, as well as within the UI before actually launching the application.

Security

Since the application is storing the sensitive information of its users, it has to be properly secured in order to prevent possible data leaks and hacking attacks. We advise securing the user information in the following way:

Secure architecture – while developing the back-end part of the application, pay attention to creating a secure way of storing and exchanging confidential information.

The key components of the exchange are located at the different servers and interact through dedicated channels

The encryption keys are also located at the dedicated secured servers

User’s authentication – in order to prevent the possibility of unauthorized login to the user account, it is best to implement two-factor authentication by generating a one-time token. Additionally, the users receive notifications about logins to their account specifying the location and the IP-address.

The exchanging of the encrypted data is performed with the help of the newest algorithm SHA-256 that is currently impossible to hack. It generates a hash – a unique signature of the text that is changed each time the initial message is edited. It allows checking if the sent hash matches the received one, and to find out if the data was edited. Since a hash is not an encryption, the original message cannot be decoded

Conclusion

Considering the popularity of the crypto exchange all over the world right now, it is understandable why more and more people are involving themselves in these systems.

Digital currency exchange provides great opportunities for both those who are just getting familiar with the market and those who already have quite a good experience in it. But the market still has quite a few limitations depending on the country or the currency provided and this always means growth potential.

Creating a high-quality application for your own cryptocurrency exchange company can bring you a great profit in very short terms.

The table below provides approximate pricing for application development.

Cost of developing Binance#

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thank you.

What is a wrapped token?

Binance Article written on Jan 19, 2021 and Updated on Nov 16, 2022.

The TLDR:

Posted Using LeoFinance Beta

https://twitter.com/1021896104118341632/status/1628865247330340864

The rewards earned on this comment will go directly to the people( @shortsegments ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.