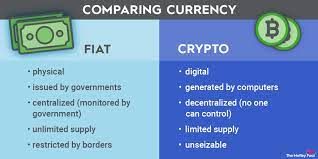

Crypto currency or Fiat

Digital money is a generally new innovation, however it can possibly essentially affect the government issued money of non-industrial countries.

From one viewpoint, cryptocurrency money can assist with expanding monetary consideration and decrease exchange costs. For instance, digital money can be utilized to send and get settlements more inexpensively and productively than customary strategies. Furthermore, cryptocurrency can furnish individuals with admittance to monetary administrations without the requirement for a financial balance, which is particularly helpful for individuals living in rustic regions or who work in the casual economy.

Then again, digital money is additionally unstable and unregulated. This can make it hazardous to use as a mode of trade or store of significant worth. Furthermore, digital currency can be utilized for unlawful exercises, for example, tax evasion and medication dealing (Hard drugs).

The general effect of digital money on the government issued money of emerging countries is as yet hazy. obviously cryptocurrency can possibly both disturb and work on the monetary frameworks of non-industrial nations.

Here are a few explicit instances of what digital money is meaning for government issued money in non-industrial countries:

In El Salvador, Bitcoin has been embraced as lawful delicate. This implies that Salvadorans can utilize Bitcoin to pay for labor and products, and organizations are expected to acknowledge Bitcoin as installment.

In Venezuela, many individuals have gone to cryptographic money as a method for safeguarding their reserve funds from out of control inflation.

In Nigeria, digital money is being utilized to send and get settlements all the more economically and effectively.

It is critical to take note of that digital money is as yet a generally new innovation, and its effect on non-industrial countries is probably going to develop over the long run. It is likewise essential to take note of that digital money is certainly not a silver projectile, and it won't tackle each of the monetary issues confronting non-industrial nations. In any case, digital currency can possibly assume a huge part coming soon for finance in non-industrial countries.

Policymakers in agricultural countries ought to painstakingly consider the expected advantages and dangers of cryptographic money prior to settling on any conclusions about its regulation.