Bearish Dominance Eases With Rising Trading Volume on Ethereum

ETH may still be under short-term negative pressure as the Relative Strength Index (RSI), currently reading 37.54, falls below its signal line and into the oversold zone. As a result, traders can decide to wait to enter an extended position until the RSI rises above its signal line and leaves the oversold area.

On the 4-hour price chart, the stochastic RSI has a reading of 59.74, which is below its signal line. This action indicates that the asset is oversold and may shortly revert bullishly to the upside. If the stochastic RSI passes the signal line on the ETH market, it can indicate a potential trend reversal or shift in momentum.

ETH/USD 4-hour price chart Source: TradingView

Ethereum’s price drop and rising trading volume suggest a possible momentum shift, but caution is advised as the market remains oversold. The Fisher Transform line, which has a value of -1.22 and is below the signal line on the 4-hour price chart for the ETH market, indicates that the market is oversold and that a potential buy signal is approaching. The reversal will be apparent if the Fisher transform line crosses the signal line successfully.

By indicating escalating selling pressure, the Money Flow Index (MFI), which has a reading of 18.89 and is trending downward, supports the bearish momentum in ETH. Traders should exercise caution when evaluating long positions if the MFI declines and breaks below the oversold level. This movement may signal the start of a more severe downward trend.

Source: Santiment

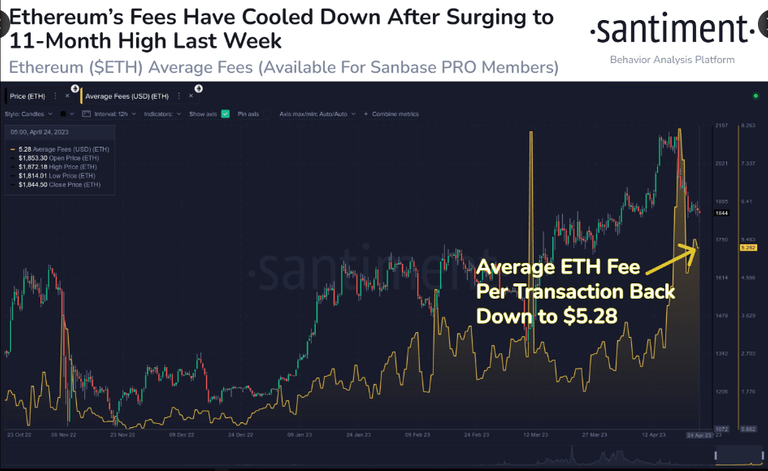

After falling below $2k last week, Ethereum‘s fees have risen to their highest level since May 2022. This shift was brought about by increasing network transaction demand, which caused congestion and delayed processing times. Though still high, costs have been reduced by 35%, alleviating consumer restraints and boosting network use.

After crossing back under $2k last week, #Ethereum‘s network saw its fees explode to their highest level since May, 2022 as traders polarized and figured out whether to buy or sell. Though still relatively high, fees have been discounted by 35% since.

Despite this, the bear’s hand was strong in the ETH market, with prices falling from a 24-hour high of $1,874.11 to an intraday low of $1,811.79. As of press time, the price of ETH has dropped by 1.60% to $1,817.41.

The market capitalization of ETH fell by 1.72% to $218,700,376,936, while the 24-hour trading volume increased by 9.88% to $7,960,648,581. This rise in trading volume and decrease in fees imply a rising demand for ETH, which might lead to a price hike soon.

Hey @quick-cycle!

Actifit (@actifit) is Hive's flagship Move2Earn Project. We've been building on hive for almost 5 years now and have an active community of 7,000+ subscribers & 600+ active users.

We provide many services on top of hive, supportive to both hive and actifit vision. We've also partnered with many great projects and communities on hive.

We're looking for your vote to support actifit's growth and services on hive blockchain.

Click one of below links to view/vote on the proposal:

Congratulations @quick-cycle! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!