DeFi Chad Journal: The 2021 Harvest and the 2022 Sowing

I become a humble farmer on the 20th of September 2020, when I participated to the 1st Creativity Contest with some dunk memes! Fast forward to 2021 and I already had a nice bag of $FARM staked in the auto-compounding pool. Now that I think about it ... I staked $FARM even before the pool was auto-compounding. How good was 2021 as a DeFi year and how's the harvest going in 2022?

I always said that a man has to provide for his family, and even if I had a dream to live from crypto ... I failed. I am earning pennies ... it's not much but is honest work. Harvest Finance was the most stable source of passive income in the last two years!

The Harvest community not only introduced me to Decentralized Finance, but helped me create a mindset that involves charity and helping others. I paid it forward many times and evolved from small donation and sharing toy tractors as Santa Chad to raising thousands for underprivileged children or planting thousands of trees.

Many happened at Harvest, launching products like iFARM or fCASH, LP pools with insane APY or deploying farms on Binance Smart Chain and Polygon. I walked in my muddy boots along the Harvest tractor and been there for every step of the evolution. I celebrated one year of Harvest Finance in August 2021 with farm animals and country music!

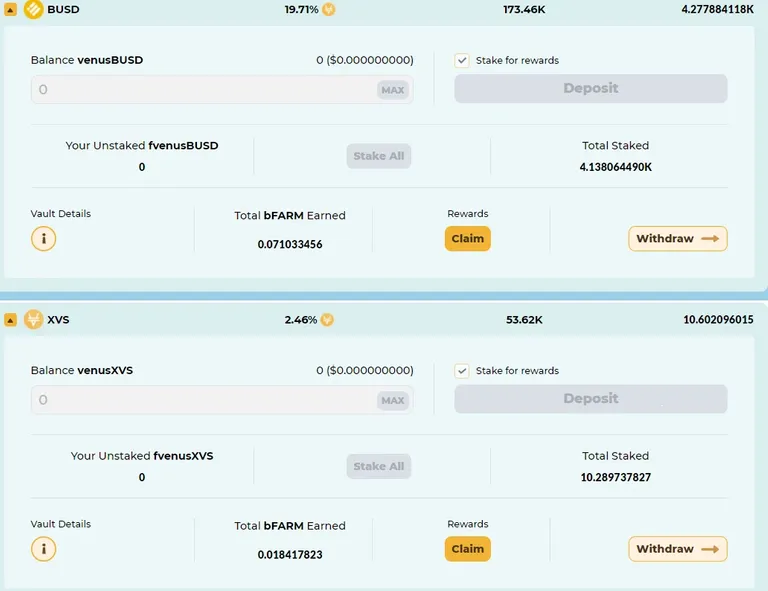

Drawing a line over 2021, and I am pleased about all the things I learned. Half way through 2022 and I am thankful for the opportunities I found. The BUSD single stake pool on BSC was as good as rain over the corn fields, with an average 20% APY for a stablecoin. Was good as it lasted and I was able to pump my stablecoins bag.

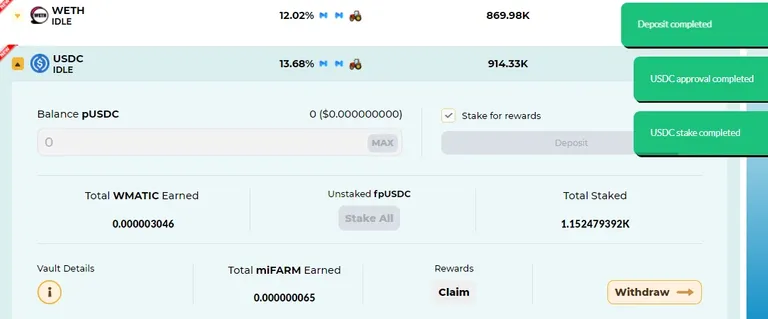

I bridged to Polygon and the BUSD was swapped in USDC, staked at 13% for miFARM, wMATIC and auto-compounding USDC. Good APY, good gains and good fees - compared to Ethereum mainchain. Another pool that I loved, and unfortunately ended as well.

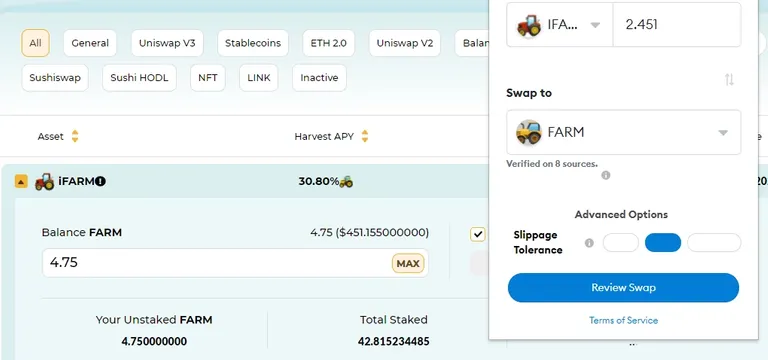

As all the non-ETH single stake opportunities ended, I decided to boost up the FARM pool and leave it on auto-farming. This was backed up by the removal of FARM from P0x tipping system. I had 4.75 FARM to stake, and 2.45 iFARM to swap.

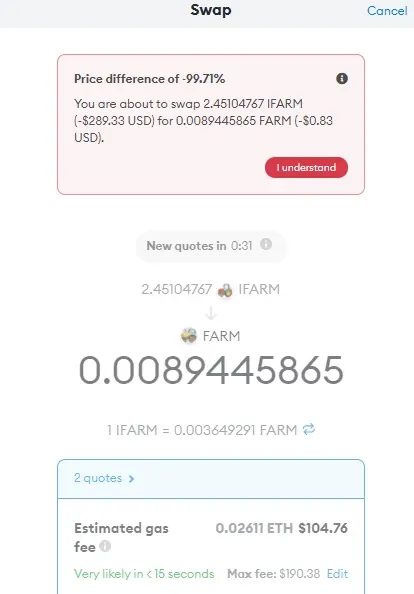

I wanted to try to integrated swap on Metamask but gave up after the quotes. They wanted to swap $289 worth of iFARM for $0.83 worth of FARM, a 99.71% price difference. I love Metamask but this tool sucks more then the Kardashians.

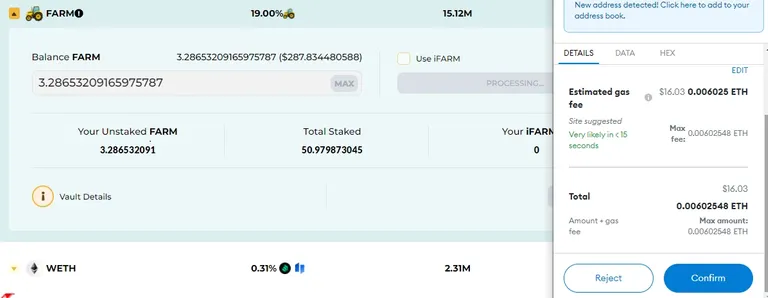

I done the iFARM to FARM swap the farmer's way, by unstaking iFARM, for $20.96 gas fee. If Metamask integrated swap sucks, so does the gwei! I just remembered why I abandoned most of the Ethereum farms and moved on other chains.

The $FARM holdings went past 50 units, and paid $16 more to add the unstaked FARM I earned from blogging. The new total was 54.26 FARM, currently autocompounding at 19% APY.

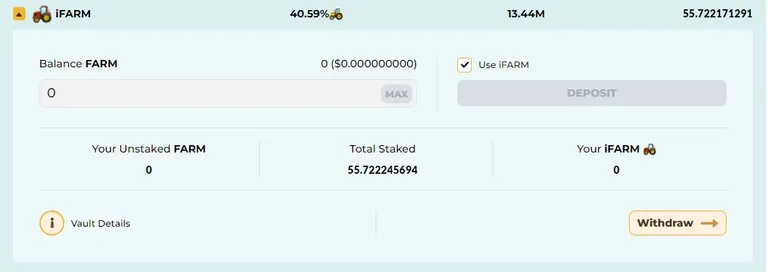

Remembered to check the current stake while writing this post, and was nice to see the 40.59% APY. The $FARM stash grew by 1.5 FARM in few months and will grow even more until I will think the price is right for cash out - waiting for $1000 per FARM!

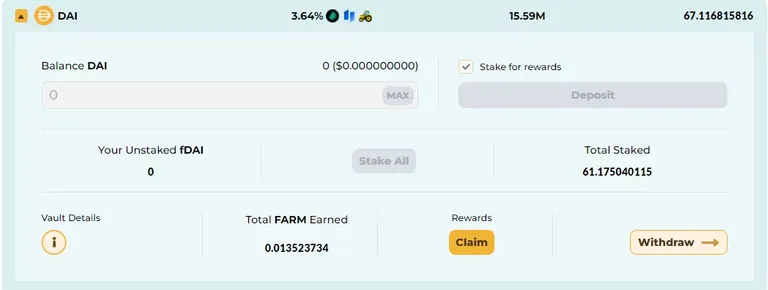

Still have some DAI I staked about 15 months ago, when paid a fortune for the sake of the experiment. The 50 DAI I deposited long time ago are now worth $67 and growing. However, at the current gwei values will be more expensive to unstake. Waiting for Eth2.0 to be able to claim the rewards and take the stable out. #BreadForThePeople

Farmers are down to earth, and farmers are sometimes weird. This is off-topic but sums up the weird world we have around. Keep humble and remember that size doesn't matter... it's all about gwei!

Residual Income:

DeFi bounty at CakeDeFi with $30 DFI for new users

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN