WHERE IS GOLD WHEN IT IS NEEDED THE MOST?

As you know in order to gather knowledge about a particular subject, it is admirable to visit a site that explain it every second. There might be others to suggest but kitco.com does talk about gold non-stop. Actually lately they talk about all metals. Surprisingly they do talk a lot about crypto. I found it weird for them to have Bitcoin all over their site. I have to say it is a smart move for them as they gather information, the reader will make an informed decision.

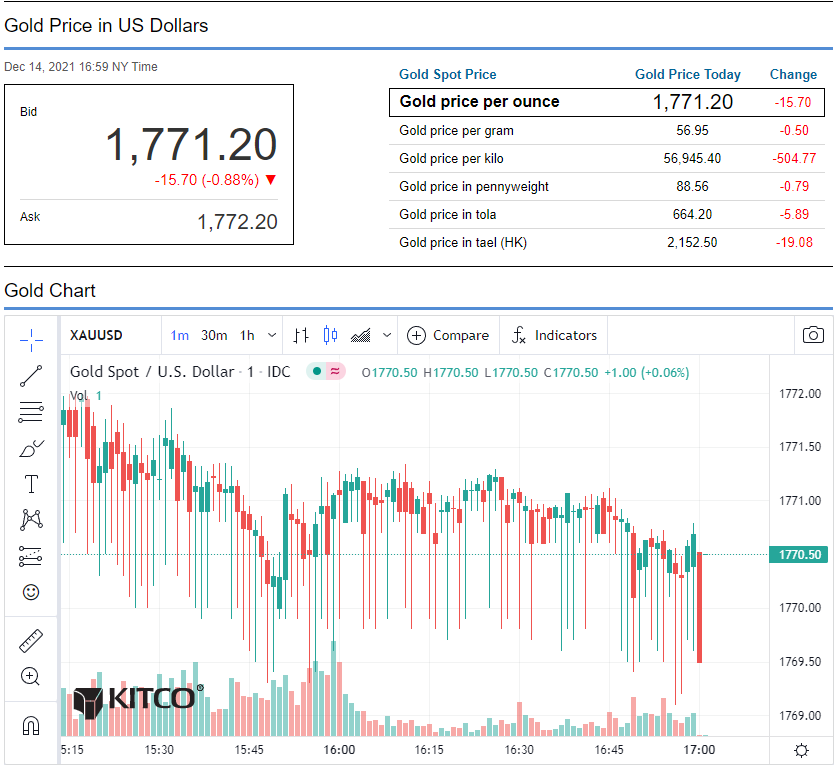

If you recall early 2020 gold did reach the top of $2000 per ounce. I think it was definitely a deal breaker since the world economy slid almost to oblivion. After that rise Gold has never keep a real momentum to deflect inflation. Gold remains an asset class worthy of its value. Many central Banks accumulated Gold for the purpose of maintaining a ratio against their currency and the US dollar.

Unfortunately Gold cannot sustain a real rise these days due to other assets like crypto. Lately folks invest to make a profit. Even with crazy volatility, crypto fits the profile a lot quicker than gold. If you recalled early 2021 when BTC reaches $60k+ many institutions did sell BTC and reap immensely profit pushing BTC till these days to roam around $48K.

it is clear to understand Gold has maintained its asset class value quite well. If you are not looking for profit, you are just looking for stability, maybe Gold does fit your profile.

At the same time inflation messes up everything. Gold value remains stagnant, inflation is rampant, what do we do? Time is the essence for crypto to bring positive value on the table.

Micheal Saylor has unlock the answer. Instead of buying Gold and remain in the shadow of an old asset class, the company he runs, invests heavily into Bitcoin.

That move allows #MTSR to get more businesses. The stocks gain value like we never seen before. Having BTC in the balance sheet changes the narrative greatly for the company that provide cloud services for other businesses. Arguably adding Gold to the company portfolio would not be a bad deal at all. The problem is the company will lose money. Nobody will buy the shares. He could lose his job as well knowing inflation does not play.

Lately Gold is on the table because it is Gold, nothing else. We are thriving in a technology world where everything is going so fast. Aligning yourself with crypto could be risky now. In couple of years this will be the norm for everyone. Since inflation is no longer transitory, we have to deal with it in a transitory way. I do not want to say it is permanent.

Shortage of cash, bottleneck supply chain, expenses, wages, those are many that indicate the consumer price index is rose across the board. Since Gold cannot help the way it should be, you can thank crypto for pulling the weight a little.

Gold will remain an important class asset for its formidable investors. Time is running out though.

Time shifts for good where gold will have a seat in the new era.

Until we comprehend inflation move, actually we can do something with inflation.

Keep vesting in you.

Posted Using LeoFinance Beta

Gold is not an investment, it’s stores buying power. Not the same asset class. Gold is a commodity. Crypto is an investment just like stocks.

Indeed many treat it this way prompting many to think

they will rekt everything by going to crypto.

Lately Gold really lays low and people who hold it

questioning their motives when crypto is amassing 10X over night.

!BEER

Posted Using LeoFinance Beta

It’s smart to hold both. Cheers

View or trade

BEER.Hey @silverd510, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

Well I learn something from your analysis. Thanks for putting this up.

Thanks for passing by.

Do you own paper gold or real Gold ?

Posted Using LeoFinance Beta

I don't own any for now...hoping to own one soon

then Gold is more stable but as you say it cannot generate as much profit as cryptocurrencies although we run the risk due to how volatile they can be. I still think we should invest in Gold and wait a bit to see how the movement is

Gold used to be de facto asset but lately nobody knows how many exist while BTC is fixed.

Inflation is playing with everyone.

Knowledge is power,

little you have can empower and change your vision for good.

Posted Using LeoFinance Beta

That is correct, knowledge is power, the more we know how Gold and Cryptocurrencies work, the better we can understand their behavior and there get the maximum benefit from them.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I actually don't mind gold that much but it's activity is kind of lacking. In a way I buy gold mining stocks and I generally sell premium against my positions to raise a little bit of cash. If I end up selling out of gold due to a pump, I am fine taking the profits.

Posted Using LeoFinance Beta

Gold is one of the oldest Store of value in the entire global economy . Bitcoin is currently maturing like a vintage aged Wine with limited Edition.

I think GOLD has been waiting the news from FED, which is to lower or stop the tapering according to increasing inflation rate.

Hey @pouchon, sorry to jump in off-topic.

Your support for our proposal this year has been much appreciated but it will end in a few days!

Do you mind renewing your vote for 2022 so the team can keep up with its work? Thank you!

https://peakd.com/me/proposals/199