Afraid to Invest? Overcome Investment Fear!

Let's address a very important question - Is it okay not to invest? Yeah, sometimes it's okay not to invest at all!

Maybe you are a hard-working person, and you can work like a robot all day long, and after a particular time, you save enough money to enjoy old age!

Secondly, money in the bank is actually better than putting money in the stock market and losing everything.

Thirdly, you have CPF money for retirement.

And lastly, if these are not still enough for you, you can ask for money from your children at old age! Okay, the last one was a joke, and nobody wants that.

Is It Okay Not to Invest?

Let's address all points one by one! Working hard and saving money for old age is bullsh** to me! No value of money if you can't enjoy in time! If you check some ratios, you'll find out that the majority of the people don't like where they work and are just working because of money. So you're sacrificing your liberty to save money and work where you don't love to work. Also, going to school, getting good grades, searching for a job, and saving money for old age doesn't seem like a good plan for life!

Life can be more than this! Maybe you can travel the world! How about taking care of animals or streaming video games? Probably for me writing articles and trading crypto! So yeah, life can be more than just work, and you can actually fix that by investing.

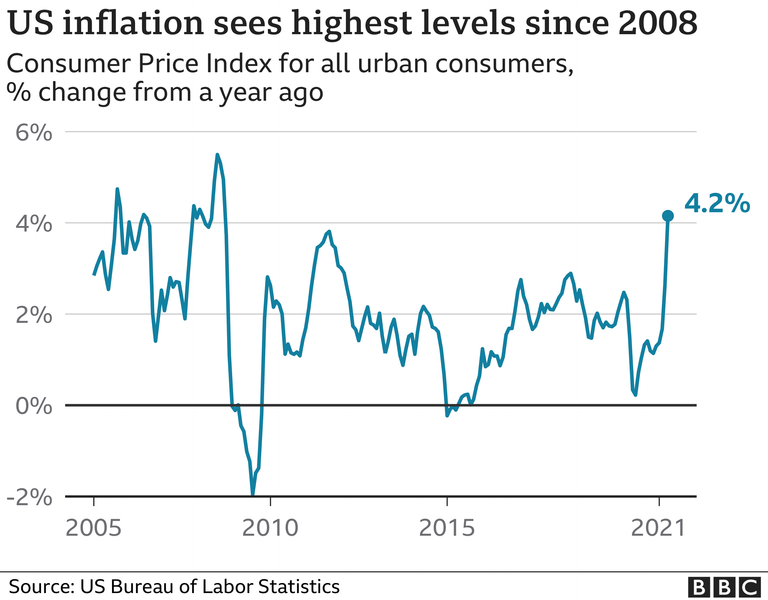

Let's move on to the second point! People feel that they can save as much as they want for old age, and by not investing, they can avoid losing money. But I have bad news for you because there's something called inflation! As long as your money is in the bank and earning poor interest like 0.5% per year, inflation will come like Satan and eat up your savings!

In just USA, the inflation rate was around 4.7% in 2021, which could be much more than the interest on your savings.

The annual inflation rate in the United States has increased from 3.2 percent in 2011 to 4.7 percent in 2021. This means that the purchasing power of the U.S. dollar has weakened in recent years. Source

Let's say you have worked 20 years, and you have 500k dollars. Assume that the average inflation rate is 1.5% per year. After 25 years, 500k dollars will be only left with around 344k Dollars. Where did the money go? The inflation ate it!

You just haven't realized it yet. You will only find out when you will read news like public transport fare increases, house price increases, electric and gas price increase, food cost increase; everything increased except your payroll!

The third point is CPF! While CPF will be the payout and the amount every month after you retire, again, the amount will be worthless in the future because of inflation. Still, even if the amount is acceptable, you have to work until old age. Secondly, the amount is only enough to pay for your basic standard of living. For example, if you want to travel the world after you retire, maybe your low CPF money won't allow that! On top of that, let's assume that you are in good health. If you fall in sick, you need more money!

Why Are We Scared?

Let's take a step back and find out why we are scared of investing! I can imagine a few reasons.

We always see scary news as the market crashes everywhere. You will see many articles saying that people lost lots of money in investing! Here's my advice - don't listen to those idiots! They are just spreading fears! Imagine if the article says - everything is normal! There's no crash at all! You will be like, meh, this article is boring! And you won't read it anymore.

By the way, here's a fun fact! Those people who always warn us that a market crash is coming always go up after their warning! Every year they keep shouting the same thing! And then one year there's a crash and they are like - "See? I was right!"

So why are you actually afraid of investing? Because you've never done it before! And we always see bad news in the stock market, spread by those who're actually earning from the stock market.

Let me show you another scenario! We always travel around in cars! According to the data, there's about a 0.82% chance that you'll get into a car accident. And that's about 2.2 deaths from every 1000k people. So, if traveling in the car is so scary, why do we still do it? The answer is because we are used to it, and it doesn't seem dangerous to us!

Overcome The Fear!

I bet once you'll take the first step of starting to invest, you'll find out it's not scary at all.

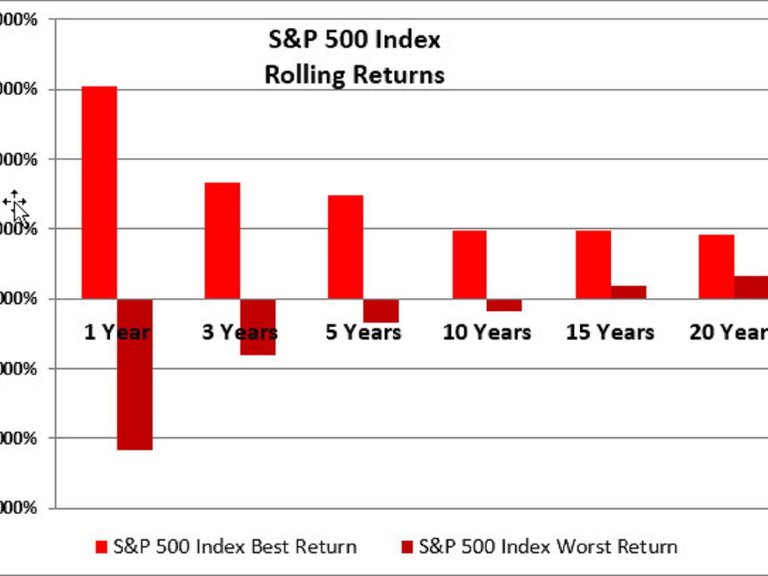

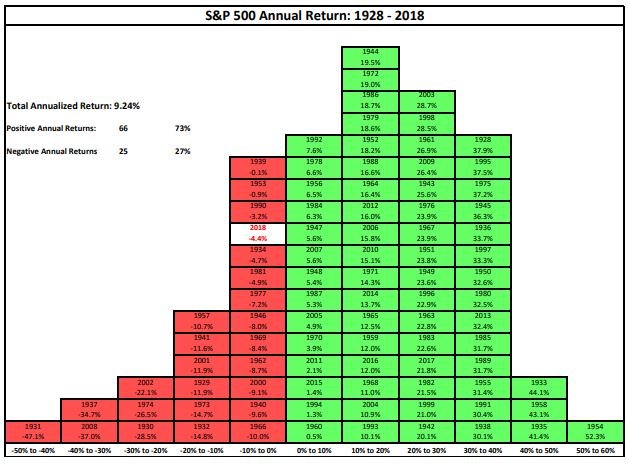

Let me show you some actual data on why I feel incesting isn't scary. From 1928 to 2018, the market had positive years 73% of the time! So technically, there are 3x more chances that you'll end up positive every year after investing.

Even though there's a market crash everywhere, it isn't as scary as you think.

If you were a long-term investor, the worst twenty years delivered a return of 6.4% a year, which occurred over the twenty years ending in May 1979. The best twenty years delivered an average return of 18% per year, which occurred over the twenty years ending in March 2000. Source

Here're some bits of advice while investing -

- Invest in some good stocks and crypto. If you buy meme coins and blame Elon Musk, that's not Elon Musk's fault! That's your fault!

- Start small! Don't invest everything at the beginning! Understand the market. This is not a make-money overnight process.

- Follow the DCA method, which means Dollar Cost Average. When the market down, you buy; when the market crashes, you buy more instead of being panicked!

I hope you like all of my pieces of advice. Let me know if you are still scared if investing!

Posted Using LeoFinance Beta

There is an old saying in trading that no position is still a position.

It's all about protecting that capital for future opportunities and the concept is exactly the same here.

Posted Using LeoFinance Beta