Venmo Enables Cryptocurrency Withdrawals - Control Your Keys

Paypal's subsidiary Venmo announced it will soon allow withdrawals from the platform for the four cryptocurrencies it supports (Bitcoin, Bitcoin Cash, Ethereum, Litecoin).

The move comes five months after Paypal also enabled deposits and withdrawals of cryptocurrency in the US.

Owners of Bitcoin (BTC), Bitcoin Cash (BTC), Ethereum (ETH), and Litecoin (LTC) are free to transfer their crypto into non-custodial wallets, where they control the private keys and experience true financial freedom.

PayPal, Venmo And The Transition

Paypal and Venmo announced their support for Bitcoin, Bitcoin Cash, Ethereum, and Litecoin in October 2020, although both platforms restricted deposits or withdrawals.

Paypal received criticism from the cryptocurrency community for its approach that limited cryptocurrency capabilities.

In December 2022, Paypal opened both deposits and withdrawals for Venmo users could buy and sell cryptocurrencies on the platform, but transfers were limited only between accounts of Venmo and Paypal.

With the new announcement, Venmo also allows withdrawals, but not deposits.

Still, this decision ends this debate as both Venmo and Paypal evolve into a hub for the transition to the crypto economy.

The Transition To Self Custody

While most of Venmo's customers treat cryptocurrency speculatively, the purpose is different. Cryptocurrency enables self-sovereignty by providing the user with absolute control over their funds.

There is no trusted third party on the blockchain to freeze your account. With the two versions of Bitcoin (BTC and BCH) and Litecoin, there is no account on the blockchain but UTXOs (Unspend Transaction Output) which are used as input when creating a new transaction.

Ethereum uses an account model similar to a bank account.

For both UTXO and account-based models, controlling the private keys equals control of the funds.

This is how cryptocurrency empowers the individual and eliminates obstacles in commerce that create additional costs and problems (payment processors and various third parties).

Cryptocurrency needs no bank to survive and prosper, still it also requires adoption in the payments sector.

In this initial stage (the transition phase), centralized crypto exchanges serve to move funds from censorable forms of fiat (national and regional state-controlled currencies) to decentralized digital money.

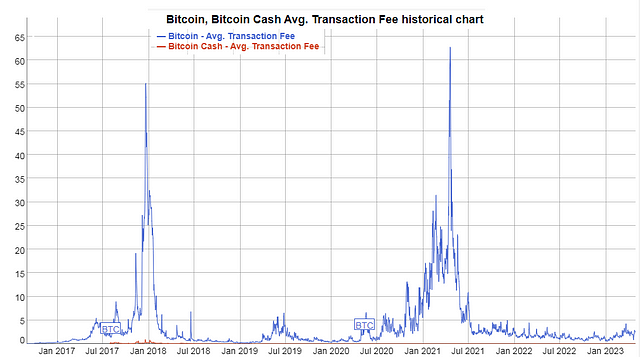

Bitcoin and Ethereum Exorbitant Fees

Source

Bitcoin (BTC) and Ethereum (ETH) bear a severe flaw. Both networks have reached a user limit, unable to expand into global-scale adoption.

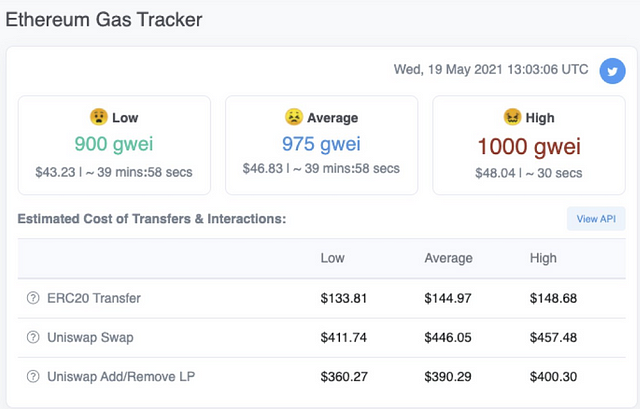

Fees will increase rapidly when the public starts using these networks. On two occasions (2017 and 2021), BTC fees surpassed $50, and Ethereum fees went even higher.

Finance does not need a broker asking for $400 fees, yet this was typical Ethereum behavior between 2020 and 2022, with DeFi on the rise.

Unreasonable fees offer no solution but further prolong the problem.

Sending crypto outside of Venmo or the PayPal network will incur a network fee, also known as the blockchain network fee. It isn't a Venmo transaction fee.

The Scaling Solution

Bitcoin Cash presents the scalability solution to Bitcoin's weaknesses, and Litecoin also offers a reliable and secure alternative to BTC with low fees and instant transactions.

Litecoin, on the other hand, has not pursued merchant adoption, but under Charlie Lee's (creator of Litecoin) wishes, the project proceeded as "silver to Bitcoin's gold" and reduced its potential by becoming a testnet for various BTC developments (LN, Segwit, Taproot, MimbleWimble, and more).

In Conclusion

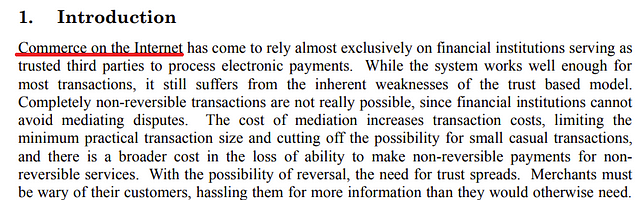

Upon studying the whitepaper, it is not difficult to decipher the intentions of the creator of Bitcoin.

Bitcoin: A Peer-to-Peer Electronic Cash System

Anyone with enough experience in banking payments and accounting systems completely understands the flaws in their design. A process containing restrictions, censorship, interventions, mistakes, and the absurd demand for trust in third parties hinders progress in commerce.

Eventually, the complexity and requirements of the current systems in the field of payments reduce prosperity globally.

Permissionless and trustless networks offer the solution, although scalability is essential to reach global adoption.

Venmo and Paypal mature as a new rail of crypto adoption.

All that remains is to educate newcomers on self-custody and the dangers of custodian platforms.

*Cover on Pixabay modified

Images, and material in this article are used for research, and educational purposes and fall under the guidelines of fair use. No copyright infringement intended. If you are, or represent, the copyright owner of images used in this article, and have an issue with the use of said material, please notify me.

Find me on:

Medium - Noise Cash - Read Cash - Hive - Vocal - Minds - Steemit - Publish0x - Twitter - Reddit

Subscribe & Like if you enjoyed this story!

Posted Using LeoFinance Beta