Gold & Bitcoin: reflections on wealth preservation

Gold is ramping up! It's been for ever that I'm watching gold's move. I even bough some PAXG a while ago, which ended up converted into bicycle parts {priorities}. With Gold's movement a few questions arise: Is it going to outperform Bitcoin? Or better... are people even buying real gold? Today's post is a reflection on gold and wealth preservation in times of chaos.

Photo by Dmitry Demidko on Unsplash

In terms of intrinsic fundamentals, gold is the ancient ancestor of Bitcoin. Before Gold, humans had to barter and deal with the problems associated (e.g. the double coincident of wants). That is to say, gold is a unit of account, a medium of exchange, portable, durable, divisible, and a store of value over long periods of time. Bitcoin, in my point of view, also carries these intrinsic values.

However, are people buying and storing [themselves] their gold? And in times of tyranny is it seizure-resistant?

The answer to the first question is no. Mainstream investors generally buy ETFs, which is a form of paper gold held by a sub-custodian fund — who will not redeem your paper for physical gold. Unless the investor buys physical gold (in form of bullion, jewelry, etc), the gold is not his. Some go as far as saying paper gold is a total fraud.

Chris Powell, Secretary of the Gold Anti-Trust Action Committee says that 80% of the gold owned in the world doesn’t exist. If he is right — it is the biggest case of fraud in the history. Source: Piotr Bania

Reflection: If your country goes through sanctions like in Russia and you [peasants like me] are holding paper gold, you are f@#$ed. If every mega-investor goes to Comex to redeem their gold, they are also f@#$ed. Just a few people hold physical gold and it's generally not huge sums.

Meanwhile, the answer to the second question is subjective and implies more questions: Are you able to hide a generous amount of gold? What if you need to flea the country, can you carry it?

Some historical facts to make you reflect

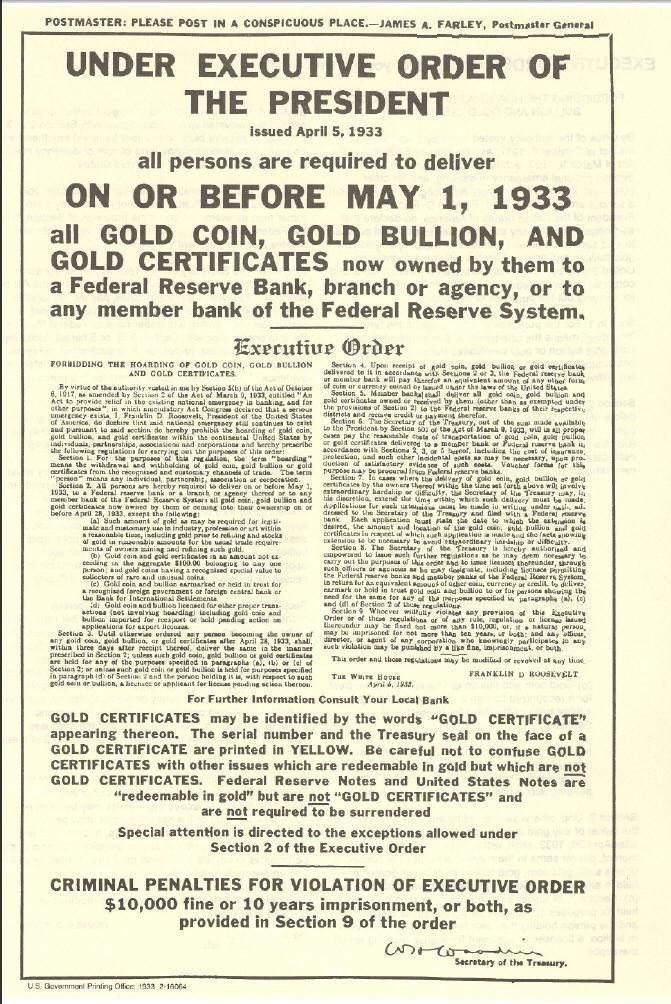

On April 5, 1933, US President Franklin D. Roosevelt signed the Executive Order 6102 "forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States."

Executive Order 6102 required all persons to deliver on or before May 1, 1933, all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve — Wikipedia.

In exchange, of course, the mafia Federal Reserve would compensate the citizens with colorful paper notes on a rate of $20.67 per troy ounce. But, hey! It gets worse. The Emergency Banking Act of March 9, 1933, issued that the violation of the order was punishable by a fine up to $10,000 (equivalent to $200,000 in 2020), up to ten years in prison, or both.

Now, I understand the bureaucrats can issue an order of same magnitude to Bitcoin — it might come earlier than we imagine. It's up to the public to decide to comply or not. And if going for the second option, which is more seizure-resistant? Some bullion or a flash disk?

Conclusion

I don't want to make a case for Gold vs. Bitcoin, although this post might look like it. With gold ramping up, many investors might jump on the train without reflecting on the issues before-mentioned. Paper gold, futures, PAXG and any other non-physical form of gold is just too risky when dealing with sanctions and a potential collapse of the financial system (not to say they'd become useless). Let alone if you have to run away like our fellow Ukrainians. It all boils down to which resource is best to survive if things go terribly wrong. Place your bets.

Remember: your wealth is your future.

Posted Using LeoFinance Beta

Congratulations @mrprofessordaily! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 250 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

https://twitter.com/mrprofessor_/status/1500983366904123396

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Damn I forgot about this alt account of yours, I need to check it out more often...

@tipu curate

Upvoted 👌 (Mana: 0/46) Liquid rewards.

Yoo, thanks! I'm focusing this account to whatever comes to mind, but this post I thought was so worth it to reblog on main.

hmm I am always divided on gold. On the one hand, it is supposed to have good inflation protection. But I ask myself, where is the younger generation going? The ones who are now studying, doing an apprenticeship, are at school? I honestly don't think they will go into gold and silver. More into cryptocurrencies and stocks. at least, that's what i hear from my friends. but who knows:) interesting post! i think gold might be the "safe" investment on the downside, but i doubt it will be the safer investment over the next decades.

Hey, thanks for the comment! That is a topic we could talk about for hours if you are really interested in the history of money (btw, you should check the money museum in Frankfurt as it would be an awesome post). I think older people are more likely to repel Bitcoin (for not understanding computers) than younger people are to repel gold. For younger folks Bitcoin sound cooler than that "ancient golden rock" \o\

I respect both assets (gold and bitcoin). I just lean towards Bitcoin for a reason: imagine we have to pack a bag and flea the country in 10 minutes. Bitcoin is impossible to be confiscated unless someone torture us. Anything else... not so sure.

Most of my friends are into stocks too. I think stock prices are dysfunctional ever since the central banks began to hyper-inflate the money supply.

yes that's right, you can talk about this topic for hours... oh, next time i'm in frankfurt, i'll definitely look at this museum, thanks for the tip! have not heard of the museum...

yes, i think so too, i even read that people who invest in bitcoin are preferred in dating haha. might have something to do with risk-taking;)

that's right, you can keep the 24 words in mind... although I would be afraid of an accident, but somebody else cant get it out of you if you arent willing to tell him.

I think stocks are also a good investment, the right stocks take the inflation in their price

Hah! Nothing is as risky as having our life savings in Bitcoin. Good analogy. I like Bitcoiners because they tend to lean more towards Libertarian.

did you know that countries' worth is measured in Gold? a bank is only ever going to float if it has gold. The dollar is nothing, gold is everything!

I know it because at work one of my colleagues has told us he had to do the audit of the popular bank. He has been taken to an undisclosed location blinded and had to count gold!!! makes you think about the USA going for countries rich in Gold (coughing, Libia, coughing).

What? Didn't get this one.

USA's gold is the biggest theft in history. It began with the Bretton Woods and ended with Nixon in 1971. How in the hell didn't the countries opposed that is beyond me.

So, a country can print as much money as there is gold. Same like banks - can only operate to the potential of the gold they own. Gold is everything!