Bitcoin overview: Interest Rates | Bitcoin | COT

Bitcoin weekly has just closed. What can we expect from Bitcoin?

Those who follow my analysis might think I'm always sitting on the fence. Truth is — and I've said on the previous Bitcoin overview — that, although Bitcoin has the best intrinsic properties to serve as money, it's still a rather speculative asset. As a Bitcoin advocate, I don't hide my bull bias; I also can't ignore the bear ideas either. The strategy aims up while planning future opportunities. Capiche?

Seventeen days ago Bitcoin was shy above $28.000 when I said a rally was likely. Price ramped to $32.383, retraced, visited mid $31.000, and retraced again near the previous low at $26.000. Low volume; high selling pressure.

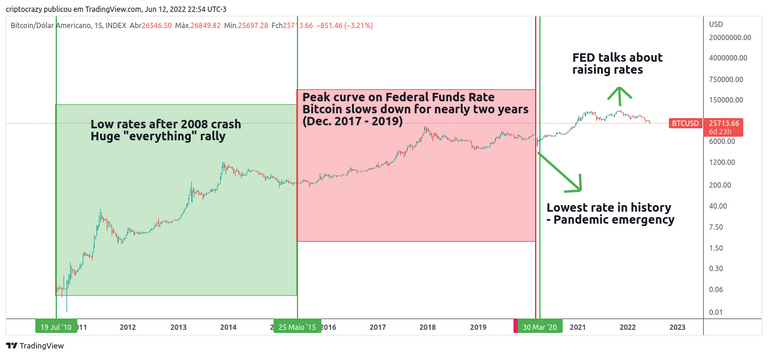

In my view, one main factor is driving the price down: raising interest rates. For those readers learning the ways of currency, higher interest rates means, wildly summarized, more expensive credit, which means big market players are at greater risk carrying leveraged trades (in this case, Bitcoin is going to see a market "reset" along with stocks.)

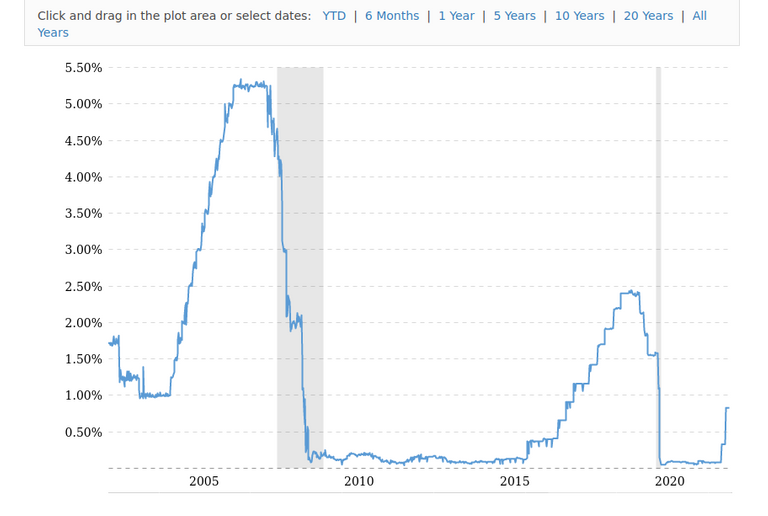

New York (CNN Business): The Federal Reserve is widely expected to raise interest rates by a half of a percentage point for the second consecutive time at the end of its next meeting on June 15. After that, all bets are off. Bigger rate hikes could be in the cards as consumer prices surge. — CNN Business

It's difficult to draw a parallel between interest rates and Bitcoin's price because the effect of credit lags. That is, expanding credit takes a while to manifest as inflation. (Note: inflation is not necessarily CPI, but also assets ramping up.)

Federal Funding Rate

The crash of Lehman Brothers marks the 2008 crises (Sep. 2008); Bitcoin was born in October. The first Bitcoin block, named Genesis, carried a message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Current interest rates match the levels of April 2017. Bitcoin had its worst, wildest bear performance during 2018-2020, when the funding rate was forming its peak parabola. The question is: How much leverage is into Bitcoin? And by how much is the FED going to raise rates?

Price Action

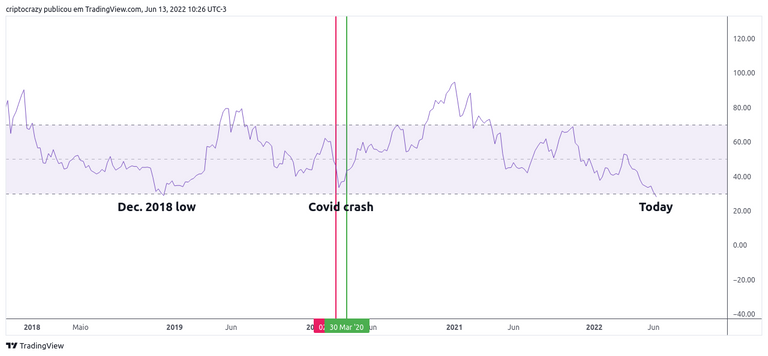

Price looks bad. And so are the economies around the world. For those with spare cash it might be an opportunity. In terms of price action, Bitcoin has failed to make another leg up the rectangle formation; it looks more like a double top.

Bitcoin has breached the 200-day EMA, which it rarely does. Last time Bitcoin closed a weekly candle below this mark was in Dec. 2018 low.

Bitcoin's Relative Strength Index is also touching oversold territory. Last two times RSI was that low marks two important bottoms in price.

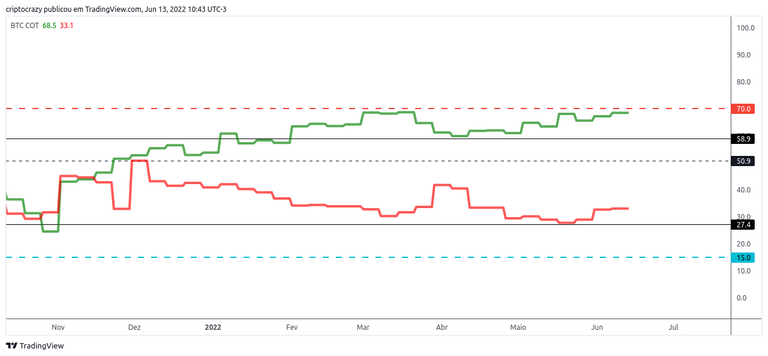

Commitment of Traders (COT)

This graph shows the % of open interest held by the four largest longs (green) and % of open interest held by the four largest shorts (red) on CME. At aprox. 33%, it feels like big market players do not want to short at these levels.

Increasing open interest represents new or additional money coming into the market while decreasing open interest indicates money flowing out of the market.

Conclusion

It's impossible to predict a floor for Bitcoin, though it might be close. When everything is bleeding, the best action is not acting at all. Stocks, Gold, and cryptos are suffering. Consumer prices are ramping around the world. If I had to choose: Bitcoin, Gold and land.

Embrace for impact, and use the time to study.

Cheers.

Posted Using LeoFinance Beta

Congratulations @mrprofessordaily! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 700 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!