An Unfortunate Trend: Bitcoin Opportunists Gaining Fame as Crypto's Brand Ambassadors

Designed using https://www.canva.com/

Questioning the Motives of Crypto Advocates: Are They True Believers?

Crypto enthusiasts look up to certain personalities and it’s scary that these personalities are not the sort they should look up to. We all tend to admire these personalities just because they seem to be pro-Bitcoin.

I talked about Trump in my previous articles, but there are more such personalities, one of which is MicroStratergy’s co-founder, Michael Saylor.

The problem with us is that we don’t see through these personalities who act like they are brand ambassadors of Bitcoin, Web3 etc.

From https://www.worldlibertyfinancial.com

So what are their intentions behind presenting themselves as a pro-crypto brand personality and do they actually believe in the foundational values of Bitcoin, Blockchain Technology or Crypto?

Vitalik Buterin Urges Crypto Community to Look Beyond Pro-Crypto Stance in Political Support

Understanding a true Bitcoin enthusiast's mindset!!

Now, let me as a crypto enthusiast outline what Bitcoin, crypto means to me.

For me, Bitcoin (BTC) symbolizes sovereign finance and true ownership of wealth. It operates within a unique financial system that isn’t controlled by governments or governmental financial authorities.

BTC symbolizes freedom as it's a sovereign asset independent of Government control!

BTC is generated through an automated Bitcoin mining process conducted by specialized miners.

This mining mechanism is not overseen by a central authority; instead, multiple Bitcoin miners work together to secure the Bitcoin network.

Additionally, the dynamics of the Bitcoin mining process are influenced by independent factors such as Bitcoin halving rewards, hash rate, and mining difficulty. This ensures that the mining process remains independent of central authorities, as it adjusts according to the established rules of the Bitcoin blockchain.

As a result, no central authority issues Bitcoin or controls the mining process that leads to its creation.

We believe BTC is Digital Gold, superior to Government issued fiat currencies

My BTC shirt

Add to all this no Central Authority can manage the circulating supply of BTC that’s controlled by set mechanisms of the Bitcoin Blockchain like Bitcoin Halving.

BTC’s a digital asset with a supply cap of 21 million BTCs beyond which BTCs can’t be brought into circulation through mining. BTC is designed to get deflationary over time, as total supply is anyway hard capped and circulating supply is further decreased through Bitcoin halving events while the demand grows with growing adoption.

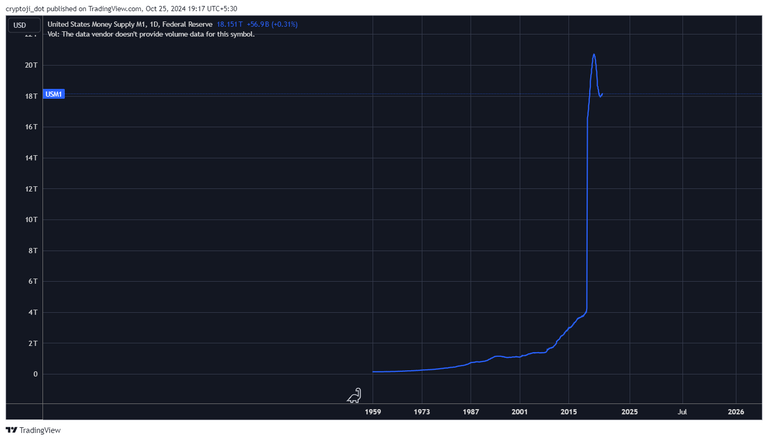

Here is where BTC scores against fiat currencies like USD. There is no supply cap for USD, so it’s inflationary in nature as US FED increases supply of USD from time to time through money printing!

Right now, the USD supply in circulation as measured by M1 Money Supply is 18 trillion which is bound to increase as well. Contrast this to BTC whose maximum circulating supply can’t go beyond 21 million!

All this makes BTC a hard currency asset like Gold, it's Gold 2.0 and is believed to also be a hedge against inflation asset to fiat currencies.

A valuable currency that empowers us to have ownership and control our finances freely!

My Graphic

Further add to this anyone can hold Bitcoin (BTC) in self-custodial wallets and transfer it to anyone in the world without needing permission from banks controlled by government authorities.

This empowers individuals to own an asset free from government control, which is what initially attracted me to the Web3 space.

I saw in this a system that recognised our right to own and have control over our wealth, and have some financial privacy. It was a liberating thought, and still is although very diluted but I won’t delve on that here.

For me, anyone who is a crypto advocate should atleast have respect to these basic ideals of BTC.

Learn more deeply about Bitcoin by reading my old Bitcoin articles -:

I’ve explained the fundamentals of the Bitcoin blockchain in my earlier articles. You can read them to gain a better understanding of the Bitcoin blockchain and the various mechanisms influencing the mining process.

Here is why Bitcoin should be in your portfolio - Get them Now!!

Fundamental mechanisms of the Bitcoin blockchain that keeps it intact

Bitcoin’s the goto asset whenever people fear a possible crash of their fiat currency

The Corona Lockdown is a challenging time for the Bitcoin Mining industry

My Songs praising the worth of Bitcoin - Ohh how I loved you!!!

Song 2 -: ‘Mighty Mighty Bitcoin to rescue me’

Song 1 -: ‘Oh dear Bitcoin your grown so much and you glitter now like gold’

The Freedom of Holding a Currency Designed to Empower Individuals, Not Centralized Authorities!

In the early days, so called pro-crypto personalities of today like Mr Trump were opposed to Bitcoin, because they feared it threatened Government issued USD currency.

Like many other crypto enthusiasts, I stepped into Web3 believing in the ideals of BTC and strongly felt that it's a superior asset to USD and Gold!

My Graphic

USD powered Governments, politicians and big Corporates, as it gave them power over wealth, including our wealth and our hard earned savings in banks. This was frustrating. Governments do have the power to control the movements of funds in banks and freeze accounts.

*Ai generated imaged in Canva signifying Banks hold so much control over our finances that they can restrict our access to our money *

I explained a scenario where my country government froze the bank accounts of the main opposition political party, preventing them from financing their political campaigns.

My Graphic

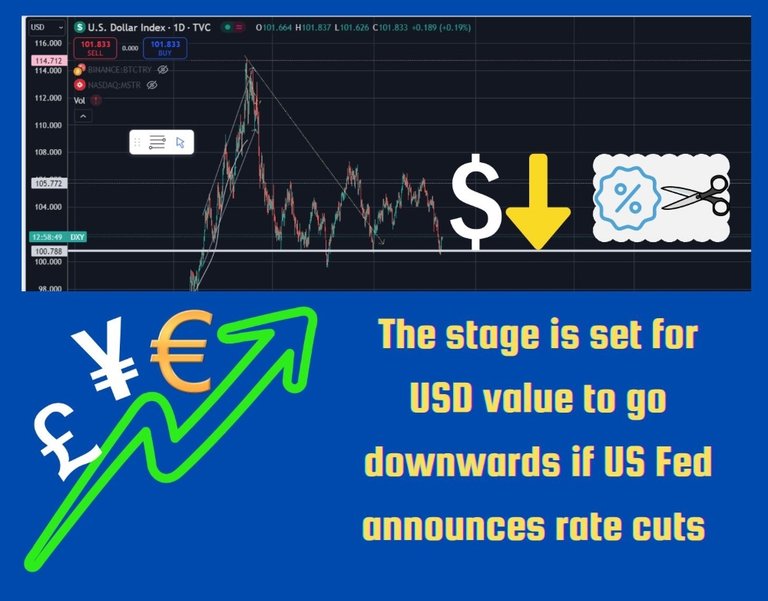

The value of USD depends on policies and measures taken by Central Financial authorities, i.e, US FED.

My Graphic

BTC’s value is set to appreciate because it’s a scarce asset whose demand tends to go up in time.

BTC is an attractive currency compared to fiat because of its trustless nature!

Another aspect that has led politicians, including Trump, to embrace Bitcoin—though they may not want to admit it—is the potential for USD devaluation.

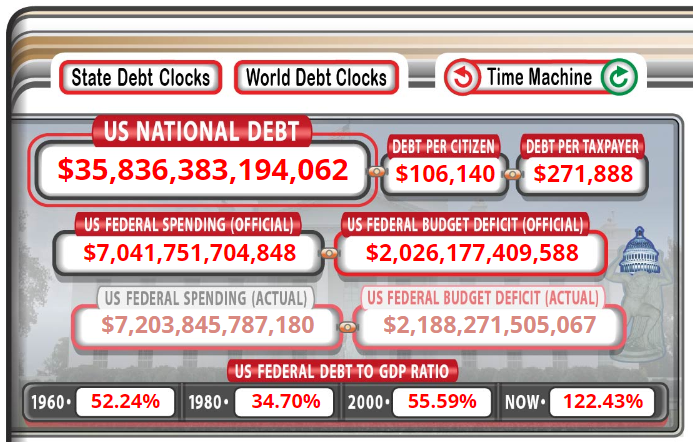

The USD is vulnerable to losing value and could even become worthless because the national debt is at unsustainable levels, with the total debt-to-GDP ratio at 135%. This ratio indicates that the U.S. economy has significantly more debt than the revenue it generates, suggesting that the actual value of the USD is not firmly solid, it's not fundamentally sound.

Perhaps this is why some American politicians, like Trump, discuss building a National Bitcoin Reserve Fund; it would back their Treasury's value in case the USD devalues.

Let’s all also underline the fact that USD's vulnerable situation is the result of Government's mismanagement of it's monetary and financial system. It just shows that we can't trust a currency whose worth depends on the policies and measures of the Government.

BTC in the other hand is truthless, we just trust the algorithmic processes that power the Bitcoin Blockchain. We don't need to trust policies of any centralised entity!

Therefore, Bitcoin was a beauty for early crypto enthusiasts, it often was said, it showcased the brilliant application of mathematics and one just trusts the open source code of Bitcoin Blockchain.

True BTC believers vs recently sprouted-up pro-BTC pretenders

True crypto enthusiasts like me believed and held hands with BTC much before Trump and Michal Saylor who were those days calling BTC names, criticizing it for the very same reasons we loved Bitcoin for.

As we adorned Bitcoin for being an asset class that Governments could not directly control, these guys hated Bitcoin for that very same reason.

They accused BTC of being an unregulated asset that aided criminals in laundering money and conduct criminal activities! (As if these things don't happen using fiat cash).

These characters, were initially anti-BTC because they did not like it challenging USD which threathened the stronghold these influential people had on the financial system!

Money can buy BTC just like love, but we BTC enthusiasts remain BTC admires

It's unfortunate for people like me who came into Web3 mesmerized by the ideals of BTC, to see that these hypocritical characters have a huge crypto fan following.

I almost feel like how this lover feels for his lady here, who values someone else than him even though he is the one who genuinely loves her straight from the heart!

I have understood that just like through money people can buy fake love, unworthy people and entities with lot of money can buy BTC , when it's little people like me with no money who truely value BTC for it's original ideals.

As Centralized Entities Dominate, Fewer Bitcoins Are Left in the Hands of Everyday Retailers!

Until 2020, Bitcoin (BTC) had very little institutional involvement. However, since then, institutions, corporations, and governments have been actively purchasing BTC.

As a result of this large-scale buying, BTC has become a significant asset, with a market capitalization exceeding $1.3 trillion ($1,361,289,012,394). A substantial portion of these bitcoins is likely held by institutions, banks, and corporations like MicroStrategy.

With the launch of Bitcoin ETFs, major corporations such as BlackRock and Fidelity have acquired substantial amounts of Bitcoin and have the capital to continue doing so. BlackRock currently holds Bitcoin assets worth $17 billion, while Fidelity has $9 billion.

My Graphic generated using https://www.freepik.com/ai/image-generator

It appears that governments, including the U.S. government, may be planning to hold Bitcoin in their treasuries, with politicians considering the establishment of a National Bitcoin Reserve Fund.

Consequently, it seems likely that a greater proportion of Bitcoin will be owned by centralized entities—ironically, the very forces Bitcoin was intended to address—rather than by us everyday individuals. This is the prevailing trend.

Think again, does Michal Saylor qualify to be a brand ambasssador for Bitcoin??

Now, coming back to Michal Saylor!

On Oct 21, in an interview with Madison Reidy, Michal Saylor who most of the crypto community look upto as a proponent of BTC, said something against the ethos of BTC. I am coming to this.

As Michal Saylor became active buying BTCs from 2020, saying he wants to keep MicroStratergy’s accounts in BTC as USD currency is inflationary, most of us thought favorably of him. Now, with him managing MicroStratergy’s Bitcoin acquition strategy the company has acquired a huge amount of BTC stash - 252,220 BTC.

I had talked about this earlier, observing that although MicroStrategy was making losses, Michal Saylor was buying up BTC taking on more debt.

My created Graphic...

You can read the article here -

How can MicroStrategy keep buying BTC when the company’s earnings are not profitable Michael Saylor???

Since, BTC’s price has been appreciating, MicroStratergy’s BTC stash is doing great in appreciation of MSTR’s share prices as well.

My Graphic designed using canva.com

This is because to get exposure to BTC’s price appreciation many buy up MSTR’s shares instead of just holding BTCs. So when BTC appreciates, share price of MSTR appreciates as well.

It’s to be noted that Microstratergy is one of the largest Corporate holders of BTC!

Why is Michael Saylor Labeling Responsible Bitcoin Holders as 'Crypto-Anarchists'?

Now, Michal Saylor has on the interview said that - it would be better if Bitcoins were held by institutions like Blackrock and Fidelity than by common people.

We people should trust banks in holding Bitcoins, because they are designed to safe keep assets and can be trusted.

He branded people who believed in owning Bitcoins in their wallets, ‘crypto-anarchists’ because we are not regulated, and don’t respect Government’s authority to have control over our finances and more such bat shit which you can hear about hear.

This angers me like it did many other true crypto enthusiasts. So, instead of safeguarding crypto by ourselves in our wallets, we just buy BTC from banks, and institutions. Hello!!!!

Who can forget the old saying – ‘not your keys, not your crypto!’

Well, Governments are thinking of holding BTCs in their treasuries, that’s a fact too! So, we hold Government controlled currency that’s backed by BTC, instead of owning BTC ourselves!

It appears in future, Governments may adopt the Bitcoin Standard if fiat currency should collapse!

This is capitulation as expressed by Dash marketer Joel Valenzuela, implying if Saylor was a Bitcoin bull, his ‘capitulation’ has happened.

Saylor is on the side of banks, institutions and Governments having full control over people’s wealth and Bitcoin was against this!.

I would say crypto community choose your crypto role models wisely. And listen to Vitalik Buterin, the ‘bat shit’ is the term I took from his criticism of Michal Saylor’s shown bit of Bitcoin talk.

Transparent Disclosure that I publish my content in multiple platforms -

Hive — https://ecency.com/hive-150329/@mintymilecan

Publish0x — https://www.publish0x.com/@greenchic

Medium — https://medium.com/@kikctikcy

t2World — https://app.t2.world/

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.