New optimism to Bitcoin price – where are we headed next?

What Market Phase are we entering into has been the introductory question for our last appointments. Are we going to listen to the Bulls or the Bears? Are we going to see a Bull Market or a Bear Market?

Welcome to Surfing the Market, we are already at our 36th appointment and I hope that with these easy tech analysis we have helped you in some forms, even just to evaluate different market perspectives.

Welcome back guys and girls after the Holiday break, where we had almost no volumes in the market and I decided to suspend this weekly appointment since it would have been quite boring. For me and for you!

Let’s start from our usual weekly perspective

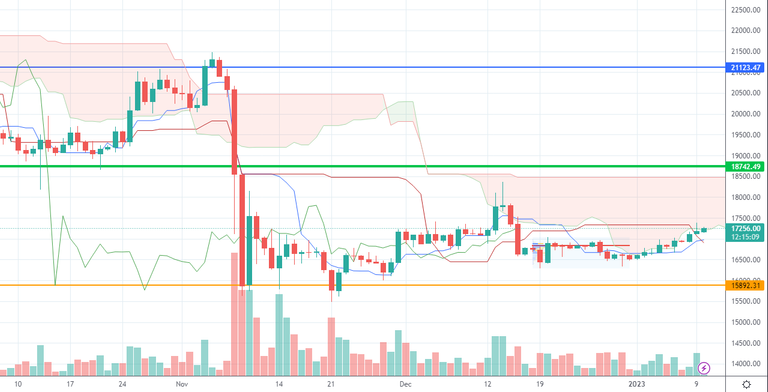

“In this “post-FTX-era” we are consolidating on a new price level in the 16500$ area and the volatility dropped. Investors are now cautious both in buying and in selling. Price in the moment has still some chances to raise up a little bit, towards the green line, but we have to see if other exchanges are going to default soon. Voices are running about a potential weakness from Crypto.com and Gate.io. You can read my last content about this topic here”

That’s what I wrote in the three editions of Surfing the Market analysis and as you can see, the price held solid the Orange support, breaking upwards the 17.000$ price.

I will keep quoting myself:

“As said before, in my personal opinion Bitcoin price can only drop towards 15000$ if major bad news come up, like a huge electricity crisis, a mobile network crisis or a gas limitation from Russia.”

Well, in this case, the major event happened but I did not consider the default of a Tier1 Exchange. And more Tier1 now are under the spot-light!

What do I expect from a daily perspective?

Orange support is resisting for the moment, even if I do not exclude some fake-breakout during the incoming weekend, where less volumes come into play and the market is potentially more easily orientable.

We encountered the fake breakout on 21st and 22nd December. Then some rising attempts (with too low volume to be trustable) and here we are, rising up again, with more volumes than before.

Dollar Strength Index found a strong support in the 104 points area. Made a breakout and now is plummeting, breaking the support in the 104 points area.

We all know that fall in DXY is usually followed by commodities prices rise. That is why also for Bitcoin we can expect some more upwards movement.

50MA has encountered the price and acted as a dynamic resistance on the 27th December. Now the price has broken up the 50MA in a bullish movement.

Ichimoku Clouds are now wide and acting as a potential local resistance. Anyway, the upper level of the Ichimoku Cloud is corresponding to the green line we see since weeks. So I may expect that the Ichi Clouds can be cut in a rising trend from the price, headed to the green level of price.

I will be careful anyway, because volumes are still quite low so before yelling at a bullish movement I want to see more volumes entering into the market.

Stochastic is confirmed in the overbought area and locally this can lead to a move downwards but during a bullish movement oscillators stay in the overbought area for almost all the trend.

Stochastic confirms the bullish movement but how are we from a volume perspective?

Volumes are still very low, even decreasing over time. So before yelling at a bullish movement I want to see if this is a long squeeze, where institutionals create a bull-trap to trigger their shorts.

What to observe particularly?

I am quietly bullish but I am afraid we re looking at a Bull-trap. So before taking any actions, be careful and do your evaluations.

I would be become more confidently bullish if the price keep rising for two or three days more, being confirmed at the opening of the next week of the Stock Market.

Let me know what you think about this new weekly appointment, and what indicators you would like to be taken into consideration more (or even explained).

Stay tuned and be sure to follow to get noticed when my contents come out.

Promotional suggestion

One more thing: if you really do not care of technical analysis or you do not like spending time onto the markets, make sure to give a look to the Zignaly platform, an Official Binance Broker Partner with huge volumes under management. They offer great services of Profit Sharing Trading, where you copy other Professional traders, sharing the profit with them! Make sure to give a look!

If you are interested in getting noticed in advanced on the release of our partner’s indicators, leave a comment here so we understand if there is some interest!

None of what I write can represent a financial advice in any form. So Do your own research before taking any kind of action.

Binance is trash.

I know, but it works as an exchange. Besides, I am developing a semi-auto trading system of the Futures and Binance works quite fine for that

Thanks for the analysis. Yeah the market looks twisted at the moment, seems like a few weeks or 1 month+ bull.