Bottom Fishing

Hello again!!! As usual I am here to help out newbies starting out in the world of crypto.

May I greet you in Cryptonian fashion before anything else: Hodliskey! It just means may you prosper more.

For today I am going to tell you on one of the strategies that have made me lots of profits trading cryptos. As you may already know by now that cryptocurrencies are perhaps the most volatile things to trade and so timing of entry is truly key to getting those big profits.

Right now we're experiencing a big pullback and prices are down. But the question really is when is the best time to get in.

In my experience, it's really hard to tell when is the right time to buy on a bear market. The lure of buying at a big discount is truly tempting but then as I tell you I've done this too that I thought that I got in really low but only to find, much to my chagrin, that prices can go down further.

So that means there has to be a perfect timing, right? Much of my trading experience has been about learning when to time buying at the right time or maybe at the lowest possible price.

Before I would just really look at BTC's lead if BTC is picking up then that's when I buy. But then sometimes you thought BTC was pumping and then comes another dump. And further sliding of prices of other coins automatically follow suit.

So how do we really time it right? For me, a good timing is not about getting in at the moment when you bought the coin and then it shoot up a few minutes later or the day after. Of course, that is the most ideal situation to be when you bought and a day or two later you're 100% up or more.

But then don't be fooled with that scenario. When bottom fishing you have to observe the coin you want. You have to check if a substantial amount has already been sold off(I mean dump really), so look at the volume. It wouldn't hurt to look also at the RSI charts to confirm oversold status.

As shown in the chart above, that is the chart for Polkadot. It shows that it is oversold. So for me, that is one confirmation that there has been a lot who sold already.

As I've mentioned observe the coin you want because this is truly key. What I'm on a lookout now is when the selling stops. Sometimes even if RSI is already saying oversold but then you can still observe that selling is still happening.

Another signal for me truly is when the price actually has a big support already. You can confirm support when you see there are ridiculous amounts of buy orders. This means that the buyers have deemed the price low enough that they would welcome it if someone dumps them more coin for the particular price they are willing to buy.

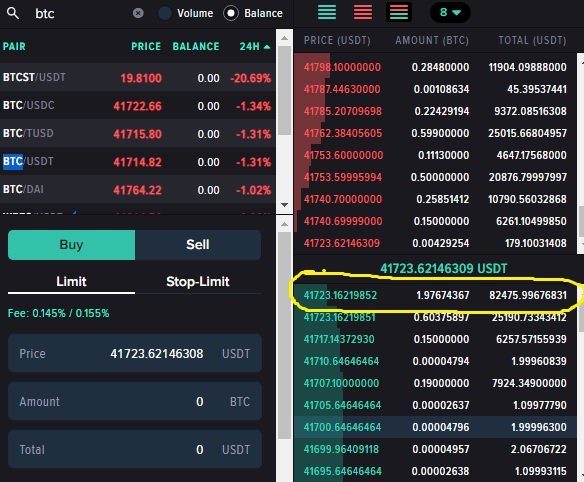

Since I can't find one coin with a legitimate support right now but if you look at the image below with the yellow circle, if that says 100 BTC, then you'll know that that is a sign that the buyers are now brazen enough to dare sellers to sell them at that price. Or demand for BTC is truly very high. But the image though shows that there is a buyer willing to buy 1.97 BTC at $41,723.16219852. For me, that is a flimsy support. Any whale can dump that amount of BTC and push down the price if they market sell even just 2 BTC.

So knowing if there is support would be a big help. But then when I bottom fish, yeah, I look at support and RSI. But then the last indicator I look at is that no one is selling anymore. Even when bitcoin gets pounded more but the coin you're monitoring doesn't want to go down further, meaning people are just holding on to their coin even if other other coins go down more.

This is the point where sellers have been saturated. For me that is the ultimate bottom. I would favor this indicator over support or RSI like if the coin say has been down 80% already from the ATH. Say RSI is neutral and support is weak, meaning not a lot of buy orders, but then no one is truly selling at that level. Holders of the coin would just rather hold on to their coin rather than sell them at a ridiculously very low price.

So then to get in, you have to put a buy order higher a bit than the highest bid you are seeing. I would hit the lowest selling price if it's not too far off from the highest buying order.

But this strategy though is not based on momentum so don't expect gains right away. Remember we are in a bear market so to get the full gain you have to sell when the whales decide to play again or when smart money starts to position themselves. Volume will only pick up when money is infused back into the market. For people with not much capital to trade the market as whales do, getting in at the lowest possible is the only way to pull a fast one on the whales.

This is how I bottom fish. Hodliskey!!!

p.s. Feel free to share your bottom fishing strategies.

Posted Using LeoFinance Beta

Thank you for the article. I had never thought about looking at the buy / sell demand before - I will certainly give this a try!

As a relative newbie, I had just purchased a small amount and then tried to play the micro gains/losses in the crypto market and make a few %'age (or loose a few %'age). I took a break when markets dropped a lot. Now when it drops I will look at buying and playing the macro gain market to buy low, hodl, and sell high.

Yes, learned this the hard way when I was starting. Thank you for your comment.

Bottom fishing is a solid entry strategy for buying crypto. Looking at the RSI indicator and buy/sell orders will definitely help in determining the price point one will be most comfortable with. Even if you don't hit it right on the nose, it won't be far off from the mark. It is also good to test the RSI setting for the particular crypto you are getting into. A 10-day lookback period for BTC might be better than the default 14-day lookback period, so test and retest even if it's just to be more comfortable in looking at RSI and the differences shown by different time frames. :)

Posted Using LeoFinance Beta

Thank you good sir for the additional tip.

Welcome, sir. I can only share the most basic. It's good to learn from experts like you who already have years of experience in trading.

Posted Using LeoFinance Beta

Ahaha, I wouldn't claim to be an expert though, but merely just observant on what's happening. And basically that's what I want to tell newbies, to be observant, then learn some TA too to reinforce decision making would be the right way to unravel the secrets of trading.

Well, from my observation, you certainly have more experience than most of us when it comes to trading. I did trade some stocks a few years ago, but that was just me playing around with a tiny amount of capital. LOL

Thanks for the tips though. I appreciate the insights from a seasoned trader. Maybe a blog post about the Figaro IPO?! :)

Posted Using LeoFinance Beta

Will look up on Figaro. I don't follow the stock market scene anymore because of our political landscape.

Yeah. It is a mess these days. I check up from time to time just to see what's happening to companies that have a certain vibe or weird connection to. For Figaro, its obviously the coffee. Thanks.

Posted Using LeoFinance Beta

For IPOs, I had a client before who would call up as many stock broker offices as he can. He would get opinions whether their respective brokerages are bullish or not. By the time he talks to me he knows more than I am. If you're still in touch with your broker you can ask how is the ipo subscription going. Broker houses have allocations and if the reserved slots are being subscribed then the demand is strong.

That's one way of getting the consensus from many sources. A really good idea.

Posted Using LeoFinance Beta

Well, from my observation, you certainly have more experience than most of us when it comes to trading. I did trade some stocks a few years ago, but that was just me playing around with a tiny amount of capital. LOL

Thanks for the tips though. I appreciate the insights from a seasoned trader. Maybe a blog post about the Figaro IPO?! :)

Posted Using LeoFinance Beta

I hope, you can spare some TA for Hive in your next TA post. since you already posted on the top the chart of Hive.

Honestly I'm not a TA guy but I just use volume, stochastics (Moving averages), RSI and sometimes bollinger bands, but that's it. I just use TA to confirm some things but not my sole basis for decisions. Let's see. I will try.

One other thing why I don't depend on TA even during my stock market days is that the graphs you see are based on done transactions and with crypto it's a bit dicey because one minute you might get a buying signal but then the next transaction could be a whale dumping or vice versa.

But I think Hive is not your typical crypto, so probably I could do that, but no guarantees. Most of the things I share are from the perspective of mass psychology, which can be supported by TA but from experience is not always the case.

It seems somebody has beat us into bottom fishing on Hive. I noticed Hive was around $1.11 while publishing my post but not it's on 1.16. The moving averages, the three lines are still above the candlesticks which technically still points to a don't buy signal yet. But then the red circle on top is showing quite a volume of buying is happening. The biggest resistance is 16k hive, then there's 7k, 5k, 1k and some smaller amounts so roughly about needing someone to buy up 31k hive coins to get it to $1.17. So whoever is buying didn't really wait for the moving averages to give a buy signal. No need to look at RSI someone is already buying.

What do you think hive price will go?

I cannot predict prices but what I know is that someone has started bottom fishing for hive at $1.11. Then we know hive already reached $3. If the bear market continues though, those have bought at .75 cents to .90 cents can still have the luxury to sell at a profit.

With crypto valuation, how I value crypto though is the changes that has occurred like is Hive different now from when it was at the 75 cents level? Is it a more powerful blockchain network now? Let's say Splinterlands players is what's driving the price of Hive higher, did the number of Splinterlands players increased? Or has the number of Hive accounts opened increased by how many percent? I mean, I would look at those numbers for me to conclude that Hive has gotten bigger as a community and has gained more utility. There could be other more factors like new games coming like Ragnarok or maybe Rising Star going mainstream too. Maybe 3Speak suddenly becomes hotter than YouTube.

I really think Hive is unlike other coins but then there has to be some catalysts at least to drive the price up. For now I see as catalysts are: More exciting games, more people using Hive, more Hive members buying Hive, or other things like Hive based NFTs suddenly become hot items, new partnerships perhaps?

In my honest opinion, Hive has a solid community and devs and so I see no reason for the price to appreciate.

If the people who bought at $3 thought Hive should be at $3 before the dump, then I would think that if Hive could improve more then it should be more than $3.

I learned a lot from your comments and I am glad that you spoke in such detail. Anyway, I welcome all your analysis. I still don't understand how much more it could go down for rebuy?

Thanks my friend. The market seems to be picking up right now so I guess this is a good price now.

I have no idea what caused the market to collapse۔ Anyway thanks for answering and wondering if i can buy Hive against Hbd?

For me reasons to sell are just excuses. The market collapsed because people cashed out. You could have really bad news but if no one pulls the trigger the price won't go down. In crypto, these whales are heavily leveraged and so they have to beat other whales to buying and selling. And that's why it quickly goes up because at some point they have to cover shorts before somebody beats them to covering their shorts.

It seems btc was just played. Goddamn whales.