Sam Fried With 25 Year Sentence

Sam Fried With 25 Year Sentence

Crypto currency has long been a highly debated topic since the birth of Bitcoin and regulations have long been discussed however, the growth in digital assets hasn’t been all that great in comparison to other investment options. Until recently that is.

2021 saw a massive influx of investment into Decentraised Finance (De-Fi) which brought massive collapses none more so than the FTX and Terra (Luna) Network collapses. While there has been ongoing news and now a recent sentence handed to the former FTX CEO, Sam Do Kwon is next in line to face the music.

This shows that the U.S Government is still supporting Free Enterprise but it is there to pick up those who are doing the wrong thing through the courts. While the U.S Securities and Exchange Commission (SEC) still has a long way to go in developing a proper framework, these court rulings will support decentralised growth and provide legal examples to help ward off others who wish to break the law.

New York Set's Global Precedent

So let’s to get covering the latest breaking news that is following the now disgraced Sam Bankman-Fried whom was once hailed as a prodigy in the crypto currency world amassing billions of dollars in investments and millions of followers. His popularity has now ended as he has been dealt a severe blow as he faces a 25 year prison sentence for orchestrating one of the largest financial frauds in history. The co-founder of the now-defunct FTX exchange Bankman-Fried's downfall marks a significant point in the crypto currency sector and will have everlasting consequences.

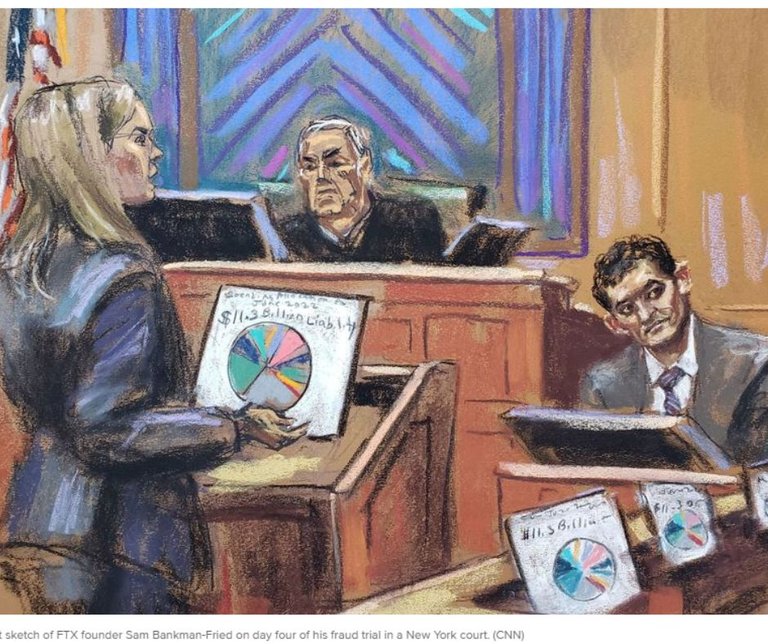

The verdict was delivered in a New York courtroom and now solidifies the staggering decline of the former billionaire who ascended to prominence as a vocal advocate for crypto before his empire crumbled in 2022. Found guilty of defrauding customers and investors, Bankman-Fried's sentencing sets a new precedent and sets the bar of the reckoning faced by those who exploit the allure of digital assets for personal gain.

During the trial evidence revealed how Bankman-Fried siphoned more than USD 8 billion from unsuspecting customers while diverting funds for his personal investments, political contributions and real estate acquisitions. His actions were and are a core reason for the collapse of FTX and the once titan in the crypto exchange realm. The collapse was so sever it triggered panic among depositors and in exposing the extent of his malfeasance he is a large reason on why many around the world lost their savings.

Life Of Luxury On Other People's Money

Judge Lewis Kaplan, in his scathing rebuke of Bankman-Fried's conduct highlighted the defendant's deliberate deceit and lack of remorse. Despite Bankman-Fried's claims of ignorance regarding the misuse of customer funds the court deemed his assertions false looking at his calculated exploitation of trust for selfish ends.

The severity of Bankman-Fried's sentence while one of the largest handed out to date falls short of the potential maximum term he could have faced. Prosecutors had pushed for a lengthier sentence citing the egregious nature of his crimes and his flagrant disregard for legal boundaries. However, the judge's decision while imposing the sentence also considers Bankman-Fried's potential for rehabilitation and future risk to society.

Bankman-Fried's legal team has indicated plans to appeal the conviction, signaling a protracted legal battle ahead that could go on for many years. Nevertheless, the ruling marks a pivotal moment in the ongoing scrutiny surrounding crypto currency practices mainly those of centralised exchanges (CES) serving as a cautionary tale for industry players and regulators alike.

Centralised Exchanges Now Have A Line In The Sand

The repercussions of Bankman-Fried's actions extend beyond the confines of the courtroom and will cast a shadow over the broader crypto landscape and the operations of centralised exchanges, which is in part why the SEC has focused on allowed ETFs to come about.

As investors grapple with the fallout of FTX's demise and the loss of billions in digital assets questions linger about if people will receive their funds back while FTX still holds one of the largest amounts of Solana tokens and a range of other investments which are appreciating.

In the aftermath of the sentencing, voices from within the crypto community have expressed a mix of resignation and resolve. While some view Bankman-Fried's fate as a necessary reckoning for the industry's unchecked ambitions, others see it as a sobering reminder of the pitfalls inherent in the pursuit of untamed wealth.

As Bankman-Fried begins his appeal of his quarter century prison sentence, the crypto world braces for the aftershocks of his downfall. Amid the chaos, stakeholders grapple with the enduring challenge of fostering innovation while safeguarding against exploitation and there are still many of rug pulls and Scams out there for people to be mindful of.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

https://inleo.io/threads/melbourneswest/re-leo-curation-93cwyx4x

The rewards earned on this comment will go directly to the people ( melbourneswest ) sharing the post on LeoThreads,LikeTu,dBuzz.

Centralised exchange is really the key right now

That was actually really a massive sentence to me

Hello @melbourneswest

You have been losing all curation rewards by upvoting comments from the accounts "biyimi" & "precab".

The account belongs to a well-known scammer (identity thief, plagiarist, spammer, etc).

Thank you for letting me know

Thank you too!

This is not true. I have myself clear over and over again in their discord server that we are not the same person.

We are different people. Biyimi just happened to introduce me to this platform. You can read through my introduction post to confirm that.

I am been accused for what I didn't do and I have made it clear to them in their discord server but they will not listen.

I dropped comments in communities I follow also. They didn't talk about that?

I replied comments, they didn't talk about that?

I dropped quality post, they didn't talk about that also?

And I have also made myself clear that it is not what they are thinking by me those list of recommended users. Of course there are other people I comments on that didn't upvotes me but I still comments on.

What else do you think I should do.

I am innocent of all this false accusations.

My reputation on this platform is at stake because of this false accusations

@melbourneswest

@hivewatchers