Hong Kong Positions for Bitcoin Strong Hold

Hong Kong Positions for Bitcoin Strong Hold

Asia has long been a crypto stronghold first taking hold in China with coal mines being recommissioned to cheaply mine Bitcoin for decent returns, a sector that was starting to crumble under changing industrial pressures of renewable energy. suddenly got a new lease on life with the emergence of digital currencies and soon once dissolute and shut down coal power plants were once again brimming with life. No longer powering steel mills and other industries but entire factories filled with Bitcoin mining equipment.

Although, this was short lived as regulators quickly grappled with an economy that was building that could rival native Chinese currencies and soon Bitcoin and crypto currencies were outlawed in China with many Chinese nationals making a run to exchanges to claim their money.

image source

What was previously reported as a crack down on Bitcoin mining in Asia was not entirely true as we all came to believe through social media, the true reason for the destruction of over 1000 Bitcoin mining rigs was for stealing power.

A growing problem became to emerge as once power was stolen to grow hydroponic narcotics, it quickly became more profitable to steal power to mine bitcoin. Although as many learned Bitcoin mining rigs consume a lot more power and generate a lot more heat causing many dangerous fires to occur.

This led to joint taskforces being established to hunt down people stealing electricity to mine bitcoin however, China did continue to crack down on the mining of Bitcoin and miners fled to Malaysia.

China's impact

China was the largest Bitcoin mining nation with the nation accounting for 65% of the Bitcoin hash rate and their departure from the industry saw Bitcoin become easier to mine as nations jostled to claim the number 1 spot.

although, not all Bitcoin was dead in the water in China as many continued to operate under the cover of shroud moved to the edges of society so they wouldn't be found, much like the old moonshine days.

El Salvador quickly tried to move in on the craze legalising and accepting Bitcoin as a native currency and although it was a big hype at the time and the nation commenced purchasing large swathes of Bitcoin, not much changed.

Regulators continued to debate the legitimacy of Bitcoin and attempt to figure out it's future as they still continue to do so.

Hong Kong Steps up

With the continued turbulence within Asia as many can not decide if they should allow Bitcoin or not which also entangles the rest of the world as everyone is still navigating the complexities of blockchain tehnology. Hong Kong has decided to go guns blazing into the sector moving to establish a crypto hub positioning itself centre stage for the digital financial revolution.

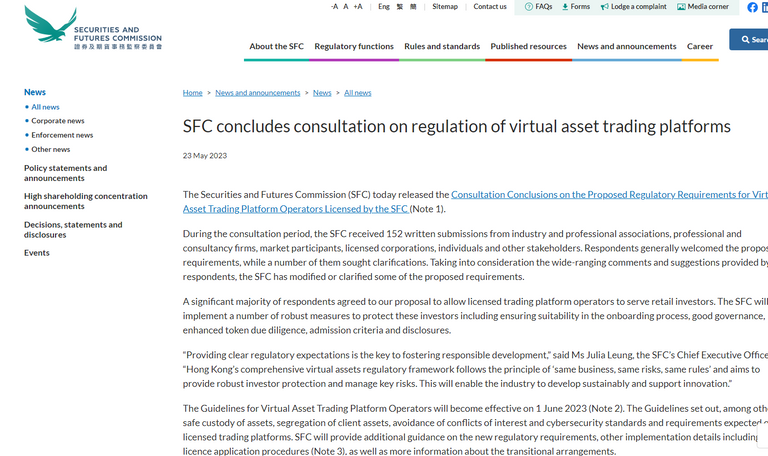

In a recent announcement by the Securities and Futures Commission Hong Kong will be moving to enable retail investment and commence providing license's called Virtual Assets Services Providers (VASPs) commencing on June 1 this year.

Although it isn't all straight forward as the license's will attempt to create a framework that focuses on responsible and secure trading. Although the trial was successful Hong Kong hasn't provided any license's just yet so retail investors may need to hold off before rushing in with cash to buy Bitcoin.

Clear regulatory guidance

The announcement further claims that the changes provide clear regulatory guidance which were developed through consultation of 152 sector participants whom overwhelmingly supported the proposal.

The new regulations focus in on voidance of conflicts of interest, criteria for admitting virtual assets for trading, prevention of market manipulative and abusive activities, accounting and auditing, risk management, cybersecurity, safe custody of assets, Know-Your-Client processes and anti-money laundering/counter-financing of terrorism (AML/CFT).

The SFC is stern stating that the registrations are now open and will become effective on 1 July 2023 and any businesses not willing to comply should close their businesses effective immediately.

Organisations that apply and receive a license will be gazetted by the government to ensure they are compliant and authorised to provide digital asset training to retail investors.

The move provides Hong Kong with an added benefit and no doubt more appealing to the Asian market which may see digital asset investments once again peak and the price of Bitcoin rise.

Are you pumped for the latest Crypto news? don't forget to upvote, follow and reblog

image sources provided supplemented by Canva Pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Eh...crypto was not actually banned in China. It was only off-limits for retail.

You bet institutions and special "chosen" continued to operate without problems.

!PIZZA

$PIZZA slices delivered:

@tin.aung.soe(6/10) tipped @melbourneswest

!LUV

@melbourneswest, @myintmo.shweyi(1/1) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

It's good for the crypto community to have clear regulations but I wonder what type of regulations they will place in. It could still be quite harsh even if it is clear. Either way, I prefer if more countries were clear about the regulations. The unclear regulations in the US has caused a lot of issues.