Binance Accused of Taking Palestinian Crypto Funds

Binance Accused of Taking Palestinian Crypto Funds

In breaking cryptocurrency news, the world’s largest cryptocurrency centralised exchange (CEX), Binance, has been at the centre of a significant controversy. Allegations have surfaced suggesting that the platform seized funds belonging to Palestinian users at the request of the Israeli Defence Forces (IDF).

These claims have sparked widespread outrage and calls for boycotts against Binance, highlighting the ongoing tension between government regulations, crypto decentralization and user privacy.

The Allegations Raised at Binance

The controversy came to light when Ray Youssef, co-founder of the peer-to-peer crypto platform Paxful and CEO of Noones, took to social media platform X (formerly Twitter) to voice accusations against Binance. Youssef claimed that Binance had seized all funds from Palestinian users at the behest of the IDF, refusing to return the funds despite appeals.

According to Youssef, this action affected all Palestinians with potential implications for Lebanese and Syrian users as well. He shared a video allegedly showing a Palestinian confirming the pressure from Israeli authorities on Binance and other crypto exchanges to freeze Palestinian funds.

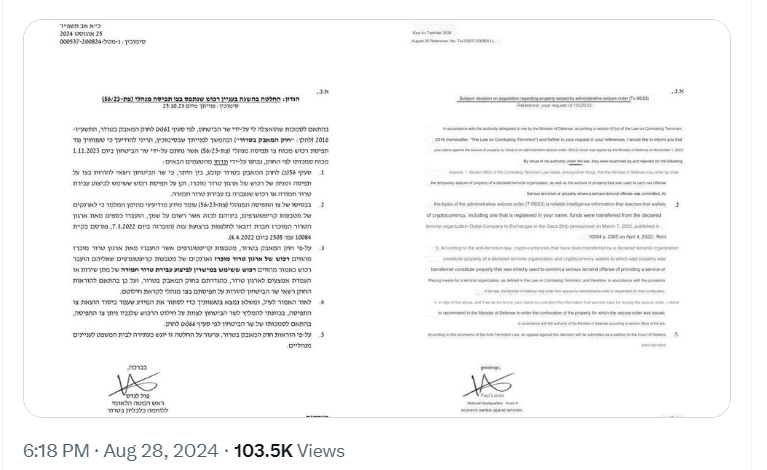

These allegations are supported by a letter reportedly signed by Paul Landes, head of Israel's National Bureau for Counter Terror Financing. The letter, written in Hebrew invoked anti-terrorism laws to justify the temporary seizure of property from entities designated as terrorist organizations or those using their property to commit crimes. The funds were allegedly linked to a Dubai Exchange Company operating in the Gaza Strip, which Israel classifies as a terrorist organization.

Binance Responds

In response to these allegations, Binance has vehemently denied freezing funds from all Palestinian users. A spokesperson for the exchange clarified that only a limited number of accounts were blocked, specifically those linked to illicit activities. Binance emphasized its commitment to complying with internationally accepted anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, similar to other financial institutions. The company’s CEO, Richard Teng, dismissed the allegations as “FUD” (fear, uncertainty, and doubt), aiming to counter the narrative that Binance is unfairly targeting Palestinians.

Despite Binance's public statements, the accusations have sparked significant backlash with many crypto users expressing outrage and calling for a boycott of the exchange. Some users accused Binance of complicity in what they described as "Israeli apartheid" and genocide, urging others to withdraw their funds from the platform to avoid potential seizures. These reactions bring to light the current distrust that exists within parts of the crypto community towards centralized exchanges especially in politically sensitive contexts.

The Broader Context

This incident is set against the backdrop of the ongoing conflict in Gaza, which has led to the loss of tens of thousands of lives and widespread destruction. The situation has amplified concerns about human rights and the ethical implications of financial institutions' compliance with government requests. The Israeli government’s actions are part of a broader initiative to dismantle financial networks they claim support terrorist activities, including entities like Hamas and the Islamic State. This has led to increased scrutiny of digital assets, which are perceived as potential tools for financing terrorism.

Ongoing Challenges and War

The Binance controversy highlights the inherent challenges crypto exchanges face in balancing regulatory compliance with user privacy and the decentralized ethos that underpins the cryptocurrency industry. The global crypto landscape is increasingly regulated, with governments pushing for more stringent AML and CTF measures. Binance’s cooperation with Israeli authorities is seen as a necessary compliance move to avoid legal repercussions and maintain its global operations.

However, this compliance comes at the cost of user trust. The allegations have fuelled concerns about the vulnerabilities of centralized exchanges reinforcing the adage, “Not your keys, not your coins,” which emphasizes the importance of users maintaining control over their private keys and by extension, their assets. For many in the crypto community the incident serves as a stark reminder of the risks associated with storing funds on centralized platforms that may be subject to government influence or seizure.

The ongoing controversy raises fundamental questions about the role of centralized crypto exchanges in politically sensitive regions and the ethical considerations they must navigate. As Binance continues to face scrutiny it will need to address these concerns transparently and work towards rebuilding trust within the crypto community. Meanwhile, the incident may prompt more users to migrate towards decentralized exchanges (DEXs) which offer greater control over assets and privacy, potentially reshaping the dynamics of the crypto market.

The allegations against Binance over the seizure of Palestinian funds highlight the complex interplay between regulatory compliance, user privacy and decentralization as a whole.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

Thanks for keeping us informed. Reading this and thinking that after everything that happened to Binance it is probably still too big and they need to discredit the exchange a little more.

I don't think much will change from its operating model and it will continue