High dividend ETFs - a buying opportunity?

For the past 6 months or so I have been focused on building a stock portfolio that includes a combination of growth oriented stocks with a high proportion of income stocks, or high dividend yield stocks.

It was the search for high dividend yield stocks that took me to the US markets, it’s here that you’ll often find stocks generating yields upwards of 5% per year and with a high payout frequency.

The dividend payments can be paid as frequently as fortnightly, however my preference is to only buy stocks with a payout frequency of monthly or less frequent than this. The fortnightly payments frequency stocks appear to perform very poorly.

My first purchase was the Global X NASDAQ-100 Covered Call ETF (NYSE: QYLD) which generally has an annual dividend yield of 11-13% with a monthly payout frequency. After observing the price performance of the stock over a few months, I determined that a good buy in price is anything below $21 as the price typically bounces between $21 and $23. I made two purchases of shares over the next few weeks. One purchase at just below $21, and a second purchase at the recent mini-crash at $19.80.

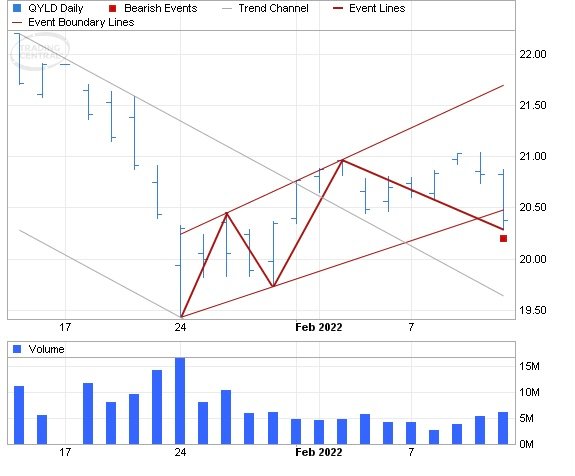

However, analysis of the this week has identified that QYLD is displaying a bearish signal suggesting that the stock price may fall from $20.38 to the range of $17.40 - $18.00. The pattern formed over 14 days which is roughly the period of time in which the target price range may be reached. This price movement is suggesting that the price could be resuming a sharp decline after taking a brief pause.

A bearish flag pattern such as what we are seeing in the daily chart above occurs during a market decline, where you witness short pause as the market takes a breather before resuming movement in the same direction. The pattern is typically identified via two parallel trend lines that generally slope upward against the prevailing downtrend, and is confirmed when the price breaks down through the lower trend line as the price continues its downward movement.

I don’t view this price movement as necessarily a reason to depart with my holdings of QYLD. I purchased this ETF as an income generating stock, and historic price ranges suggest that this downwards pressure is likely to ease with positive market sentiment, and I would expect to see the price above $20 again.

I view this downward momentum as a buying opportunity. Therefore, I will add to my existing position with QYLD to lower my average buy in price and increase the income generated from this ETF.

I hope this information is useful to someone out there in the LeoFinance/Hive universe.

Posted Using LeoFinance Beta