USA Bank Deposits and Yields as of 2022

It is staggering to see inflation spreading across the globe but how have the banks been doing through this inflation? For those unaware post Covid19 a lot of customer cash has been deposited into banks. The banks then were filled on the brim with cash and as of now still have a lot of customer deposits.

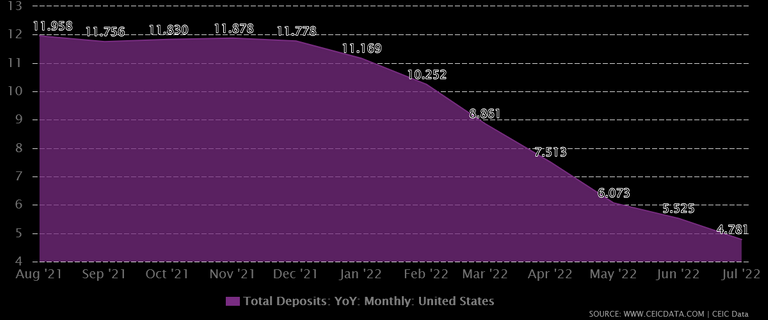

Chart at front of post courtesy of ceic data shows that in just the past six months costumer deposits in US banks have fallen by half. Yet what is staggering even after the drop there is still a record average amount of deposits.

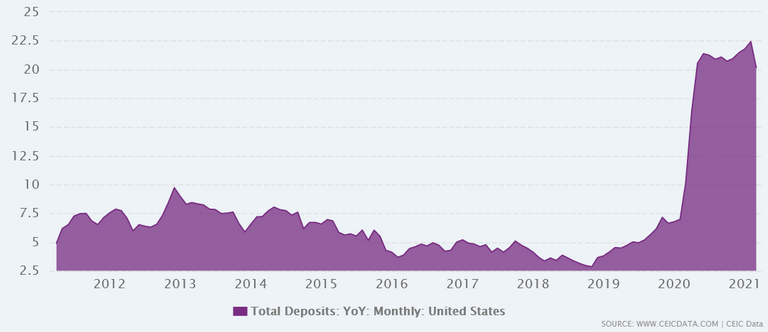

2020-2021 there was simply a lot of cash and a lot went into the banks. With that much money in banks you would think people were putting the money to work by storing it in the banks.

Banks Interest Rates

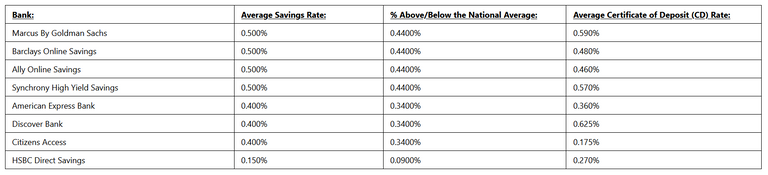

(Courtesy of elite personal finance)

As we have now heard Fed has been raising rates for months and current funds rates is around 2.5% - 2.75%. Well right before the rise in rates the interest rate banks were giving out to customer's deposits were little to zero as shown in 2021 numbers.

(Courtesy of elite personal finance)

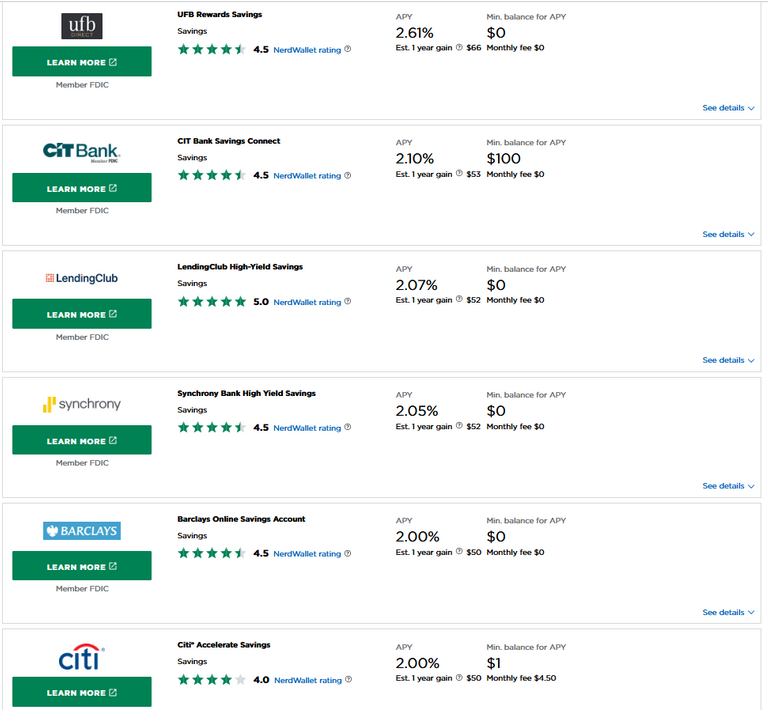

As of 2022 the % rates from banks are all up but not as much as the Fed's rates. However they are mostly higher than even the top bank rate of Capital One exceeding 0.40% of 2021 with today's rates. Also worth noting the banks are slow in raising rates.

Snapshot of some of the top bank rates in saving accounts shows all are still under Fed's rates but climbing. A lot of options are at 2% yield and this all happened in less than a year, pretty much the past six months. However not without a big cost.

Inflation is high and last checked closed to 8% yearly increase and it has been the major force to why the Fed has raised rates to cope. With increase rates the banks are now having less cash due to more customer withdraws.

Conclusions

For over a decade interest rates in banks have hovered at close to zero but it would take a massive inflation that would force the Fed to raise borrowing rates and in turn raise bank rates. The end result now is a depletion of cash from the economy while the demand for cash is rising!

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!PGM Reblogged

Reblogged for being awesome !PGM

Reblogged for being awesome !PGM

!PGM Reblogged cause you are awesome, has anyone told you that today?

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

!PGM

!LOLZ

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

It's not a surprise because the interest rates are so low. People would prefer to throw it into investing even if they don't understand it well to preserve their spending power.

Posted Using LeoFinance Beta