My Personal Experience with GFC

I personally have nearly two decades of experience in the US stock market. This means I went through the 2008 - 2009 stock market crash. At the front of this post courtesy of New York Times is a chart of one of the bank stocks I invested in during the 08 crash. Today I want to reflect on those times again to remind readers and myself that bear markets can be ruthless.

Morgan Stanley

(Courtesy of The Guardian)

Not to confuse readers Lehman Brothers has no relation to Morgan Stanley but in 2008 when the financial banks were having bank runs they were all effected the same way. During the GFC the biggest banks around the world were having special meetings with the government. This was happening because people had lost faith in the financial system as many banks were showing heavily loses for holding bad mortgages.

(Courtesy of eoddata.com)

Before Lehman falling victim to bank run there was Bear Sterns. During March 2009 faith was lost and the bank stock value plummeted. It would take only weeks for Bear Sterns who has lasted for 75 years for it to go bankrupt. Bear Sterns went through the Great Depression but could not get through 2008 financial crisis.

Similar Lehman could not go through the 2008 crisis and by September 2008 it had filed for bankruptcy. At the time next in line to go bankrupt would be Merrill Lynch.

Strategically though Merrill would merge with Bank of America making a bigger bank with more equity and assets to back off the then fear in price evaluations. Rumors were then spreading that other banks were seeking mergers and that would be a positive to stock prices.

Buy The Rumor and Sell The News

One of the rumors was then Morgan Stanley rumors saying they would be looking for merger. At the time I thought it would be a good investment to hold long in Morgan Stanley because the government had promised to intervene to support the financial banks and furthermore there was proof that the bank merger between Bank of America and Merrill Lynch was a positive for bank stocks.

(Courtesy of reddit post.)

What appear to be so obvious in the Morgan Stanley stock turn out to be false. When I bought the stock ticker MS I remember it was in the high $20s. Within a day or so Morgan Stanley came out announcing that a deal with Mitsubishi was made but in the form of stock shares. Morgan basically inflated the stock shares by selling a +20% of shares to Mitsubishi instead of making a merger. This meant at the time current stock holders were diluted making their shares worth less with more shares in circulation.

Story reference here.

Heavy Financial Losses

Business Insiders estimated in 2008 the banks lost over $500 billion dollars. Repeat over $500 billion.

Back then the government and the FED and multiple central banks were all trying to ease lending and support banks finances by letting banks borrow from the government at essentially low rates.

Fast forward to 2020 the global pandemic made a united front on governments and central banks easing rules so that banks could operate with less strain since a lot of people across the globe was in lock down. Roll ahead another two years the same governments and central banks are now trying to slow growth and stop easing on finances because the economy's inflation is soaring.

Conclusions

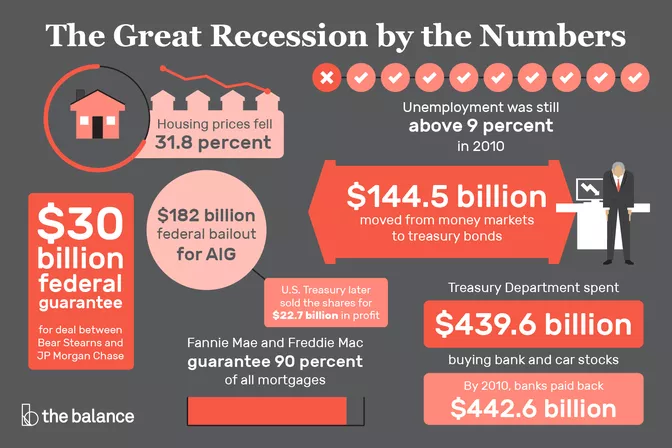

(Courtesy of thebalancemoney.com).

I was personally effected emotionally and financially from the Great Financial Crisis. What happened to my Morgan Stanley trade was that once the deal between them and Mitsubishi was announced the stock crashed. Furthermore the government was delaying in response as the weekend was near and the stock market across the globe sold off. Within less than a week I had lost more than 50% of my initial investment. Due mainly from the swift fall I decided to sell my stake and keep what I had left as it was most of my life savings at the time.

In addition to my trading lost I was apart of the +9% unemployed during the GFC. I had then lost my job in September 2009. It was a very difficult time for me to go through as I barely started my career as a recent college graduate. Without much experience it was difficult to get another engineering position. I was collecting unemployment checks for close to six months before I was able to find another job.

The reality is when economy goes bad it can go bad really fast. Bear markets in stocks are swift and 2008 was proof. I manage to lose most of my life savings during the period. The draw downs were ruthless. To stake odds against me my real life outside of trading was effected with the slowing economy. All in all the times were difficult and if the current 2022 bear market is any indication of difficult times ahead it will still have a ways to go to equate itself to that of the GFC.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I worked across the street from the Lehman Brothers building at the time. In the end, the building was their most valuable asset. Barclays took it over.

Yeah and I remember my uncle who at the time retired a year before from Bear Sterns that JP Morgan robbed them for paying $2 a share. JP did go back to $10 / share but still my uncle said the assets they bought were at least twice of that. !wine !PIZZA

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @imno.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.136

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Yeah and the Jamie Dimon came out telling everyone they were the victim. They were forced to buy those assets at half of what they were worth. They were given a $30 billion dollar by the fed to backstop loan if I remember correctly in case anything went wrong with the purchase too.

!WINE

!LOL

Congratulations, @imno You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/3 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.136

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

lolztoken.com

Long time no sea.

Credit: reddit

@mawit07, I sent you an $LOLZ on behalf of @imno

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(1/10)

I wasn't investing when the GFC happened but I do know that it was quite bad. The economy stakes the stairs up but the elevator down so things can get worst fast. So I think having a emergency fund is a good thing to have.

Posted Using LeoFinance Beta

Yes having an emergency fund is really useful. With current market conditions looking worse we maybe in store for another elevator down. !wine !PIZZA

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @jfang003.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.136

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

PIZZA Holders sent $PIZZA tips in this post's comments:

mawit07 tipped imno (x1)

@mawit07(2/5) tipped @jfang003 (x1)

Learn more at https://hive.pizza.