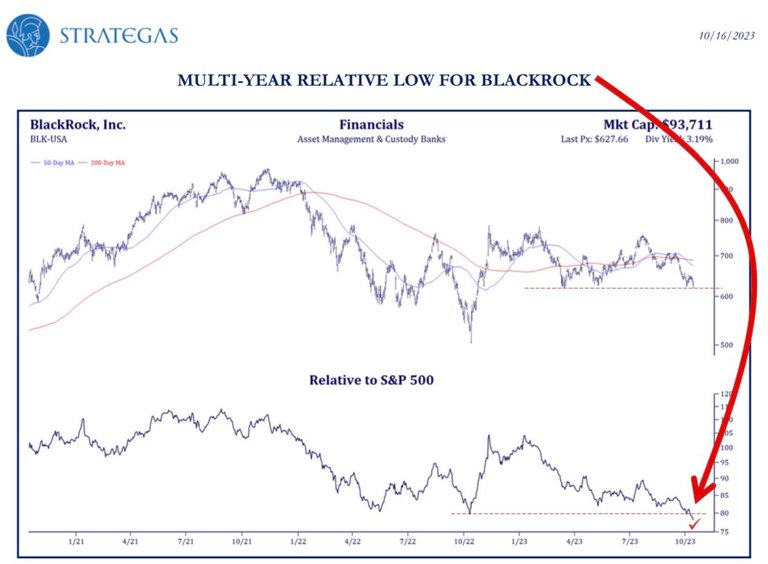

DOES BLACKROCK NEED MORE BITCOIN TO STOP DECLINING?

The image above shows a graph of Blackrock's stock price over the past year. The graph shows that Blackrock's stock price has been declining in recent months.

There are a number of factors that could be contributing to this decline, including the overall decline in the stock market, as well as concerns about Blackrock's exposure to risky assets such as Bitcoin.

Bitcoin is a cryptocurrency that is not regulated by any government or central bank. It is known for its volatility, and its price has fluctuated wildly in recent months. Bitcoin is also a relatively new asset class, and it is not yet widely accepted by mainstream investors.

So, does Blackrock need more Bitcoin to stop the decline? The answer is really really complicated, and there is no easy answer.

On the one hand, Blackrock is a large and well-established company with a lot of experience in investing. This could make it a good fit for investing in Bitcoin. On the other hand, Bitcoin is a risky asset class, and it is not clear whether or not it will be successful in the long term.

The image below shows the behavior of Bitcoin in the Last few months, Bitcoin has been on decline in the last few minths getting to a year, and the best way to solve the decline jn bitcoin price will depend on the causes of the decline.

Ultimately, the decision of whether or not to invest in Bitcoin is a personal one. Investors should carefully consider their own risk tolerance and investment goals before making any decisions.

In the context of the image above, it is difficult to say definitively whether or not Blackrock needs more Bitcoin to stop the decline. The decline in Blackrock's stock price is likely due to a number of factors, and it is not clear how much of a role Bitcoin is playing.

However, it is worth noting that Blackrock has been increasing its exposure to Bitcoin in recent months. In October 2021, Blackrock launched a private investment trust that allows clients to invest in Bitcoin futures. The company has also been investing in Bitcoin mining companies.

This suggests that Blackrock is bullish on Bitcoin, and that it believes that the cryptocurrency has long-term potential. However, it is important to remember that Bitcoin is a risky asset, and that investors should carefully consider their own risk tolerance before investing.

WHAT IS THE BEST WAY TO RESOLVE THIS DECLINE?

The best way to resolve the decline in Blackrock's stock price will depend on the underlying causes of the decline. If the decline is due to the overall decline in the stock market, then there is likely not much that Blackrock can do to stop the decline in the short term. However, Blackrock could take steps to improve its long-term performance, such as by investing in new businesses and expanding into new markets.

If the decline in Blackrock's stock price is due to concerns about its exposure to risky assets such as Bitcoin, then Blackrock could reduce its exposure to these assets. However, this could also reduce Blackrock's potential returns in the long term.

Ultimately, the best way to resolve the decline in Blackrock's stock price will depend on the company's long-term investment goals and risk tolerance.

WHAT DO I THINK?

I think that Blackrock should carefully consider its long-term investment goals and risk tolerance before making any decisions about whether or not to invest in Bitcoin. Bitcoin is a risky asset class, and it is not clear whether or not it will be successful in the long term.

If Blackrock does decide to invest in Bitcoin, it should do so cautiously and as part of a diversified investment portfolio.