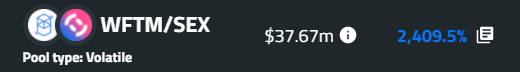

Weirdest Named DEX and Super HIGH RISK Farm for Fantom?

Yes.... it is ridiculously named hahaha...

A token that actually has nothing to do with the brain that first read its abbreviation of the pair... 😅😂

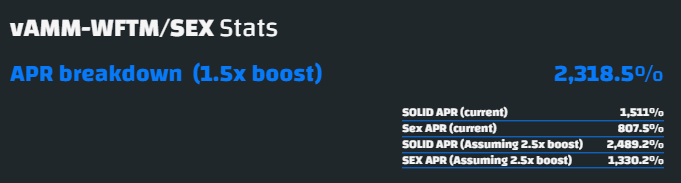

Not only that, it is in EXTREMELY INSANE YIELD! A invalidated union? 😂

If it is this high yield, yeah, probably you must know you are doing it at your own risk consenting such "pairing"

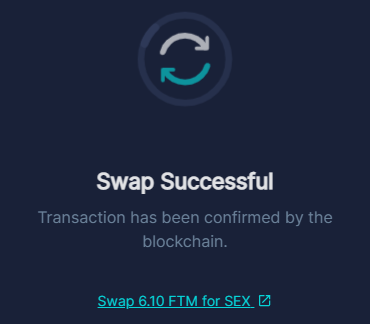

But did I fall into the lure?

🙈 Unfortunately.... it was too good to be true... I got to test it out! 🙈

Of course, it is definitely not an amount I cannot afford (but highly painful still) to loose.

Knowing the site

You got to know, all these yield farms without a solid project backing can be highly unstable as I do not see specific limit that each wallet can deposit its liquidity.

Moreover, to relying on another dex that doesn't have a pool on its own can be equally dangerous, just like how oxdao turn out to become.

Not to mention its pools can suddenly turn into 0% yield could only mean that this is actually a short term farming , so just like what Miles from Crypto Banter mentioned, this is an extremely high risk venture and it is best to spend some $FTM to collect the rewards and turn it back to a more stable token / coin desired.

Boo token could be a good option because it is still (one of the first) a solid DEX for Fantom and it is still going on strong, and we can compound it without risk in either Beefy.finance or turn it to xBOO token for additional manual compounding / farm other tokens.

Starting tiny

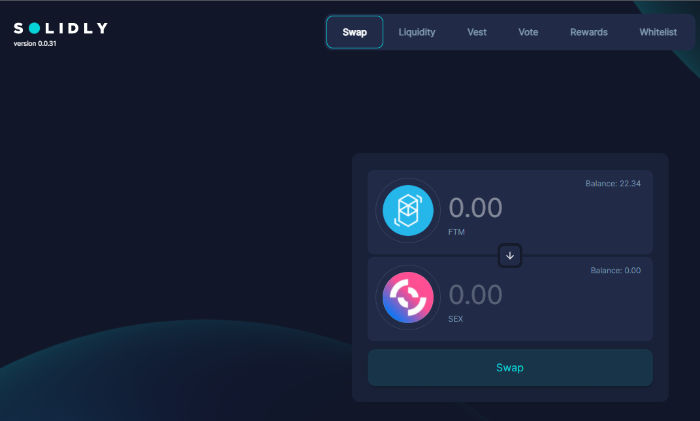

Just as I have mentioned above, I would never test these sites with a LARGE SUM of my capital; and just so happened I still have 6 wFTM (wrapped fantom) token lying around, I'll just invest an equal value of $SEX into the pairing to see how things goes.

The whole process is not cheap due to the fact my capital is small; but if you think you want to give it a try too with a larger capital just to reduce your cost - capital ratio, please feel free to do it at your own risk.

Another drawback...

Since it is not possible to do everything in Solidexfinance.com , the Liquidity Providing (LP) pair has to be done in solidly.exchange/ first then only head over to solidexfinance for staking, these are the (advanced) steps you need to know (for regular yield farmers)

Use centralised CEX to get your $FTM. (Binance is one of the cheapest)

Use solidity.exchange to swap your $FTM to desired pairs: wFTM and SEX

Add the 2 swapped tokens into the Liquidity pool. Beware there are 5 steps with gas fees calculated.

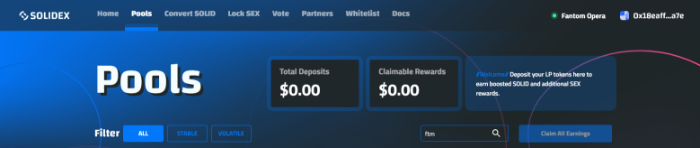

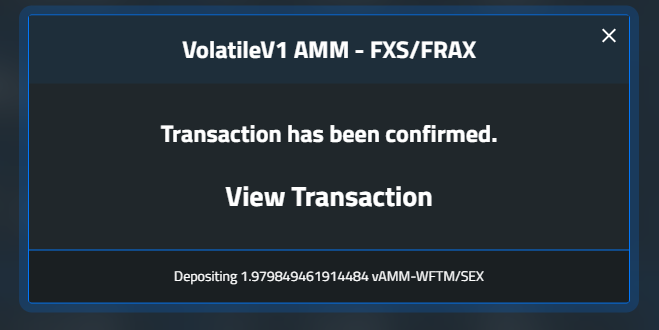

Don't panic if the final "staking step" has an error. You are not supposed to stake in solidly anways.Go to https://solidexfinance.com/#/pools and look for wFTM-SEX pair

Make sure your pair can be seen and press "MAX" to approve and deposit

Note: if you see that the page is not refreshing a long time but you received Metamask confirmation, just click on any of the page and you should see the list is updated

Will it work?

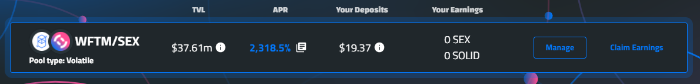

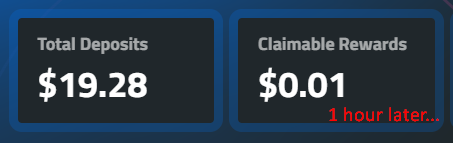

To be very honest, I am not 100% certain; but if every claim costs about 25 cents worth of FTM gas fee, I got to be certain that my tokens mined reaches that amount or else I am wasting my gas fees for something too small.

Let's hope this large amount will yield fast enough for my first withdrawal

Despite that $SEX and $SOLID both are pretty highly cost, with the current still available APR with this capital I am getting 1 cent an hour, maybe 24 hours later I can already withdraw, provided that there are no other investors ape in with a HUGE capital of LP pulling down the pool %.

That's the reason a lot of people say new DEX DeFi only has higher profitable chances when you are in the game early

What about you?

Do you dare to plunge in all into new projects that gives ridiculously high yield? Test the waters with tiny investments? Or never step in at all?

Until then

Posted Using LeoFinance Beta

The people doing V2K want me to believe it is this lady @battleaxe Investigate what she has been up to for 5 years. Its the next step to stopping this. Make her prove where she has been for 5 years or where she is now. She is involved deeply with @fyrstikken and his group. Her discord is Battleaxe#1003. I cant say she is the one directly doing the v2k. Make her prove it. They have tried to kill me and are still trying to kill me. I bet nobody does anything at all. Make @battleaxe prove it. I bet she wont. They want me to believe the v2k in me is being broadcasted from her location. @battleaxe what is your location? https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Sorry, couldn't understand what risks you're talking of.

Of course, there was a bug in their code which resulted in majority of their votes in favour of their own pairs viz. SEX & SOLIDsex, hence these got a high APR for this week. Hope it will be addressed in the next voting round.

And what's your complaint for Oxdao about?

If someone actually wanna take risk, I'd tell them to put their SOLIOD, OXD & SEX in the genesis pool of Ripae (https://solid.ripae.finance/farms) where APR doesn't imply anything 😜 (well, I did the same 😉).

Well, I guess I am benefiting from the bug that is favouring their pairs.

OxDAO? Price crash (even before BTC crash) and suddenly all the APRs are gone?

Or is it supposed to design that way?

If the pools with rewards are supposed to expire, then its UI is not friendly enough to tell people that their yield farms are expired.

Or maybe I am missing something else?

By the way, any farm is a risk, and high APR would have resulted high risk as well as I personally have not looked through the project deep enough on how good the developers / teams are, whether they are active enough to keep this going even if all hell break loose.

VikingSwap was a great example that anything can happen.

Posted Using LeoFinance Beta

Yes, you definitely need to do some research. These ain't your usual yield farming coins. And yes, Oxdao, vedao etc farms were meant to raise TVL only for the Solidly NFT airdrop. So obviously they were designed that way. (Read about vampire war among protocols on Fantom for gaining SOLID's voting power). Also research about the protocols backing SEX & OXD, you will be surprised. Most people don't understand how revolutionary is Solidly and how undervalued are these tokens at this stage. When people will realize the actual utility of these precious gems & lock them all away, it may be too late to accumulate them. (No, I ain't trying to shill anything here). Solidly is already over 2b in TVL and it has just started. Even if it doesn't go crosschain (which it will!), it's gonna be huge.

I think they are even more undervalued now. Especially extreme fear in the markets are looming again

Posted using Dapplr

True. Esp. after the Reaper's PIT/AT play, FantomKings' Batman/Spiderman attack and news of the error of 98% multiplier (instead of 2%) for SOLID emissions and Andre's disappearance from Twitter made it all sinking. To add to it all CVX unlocking due to the newly detected vulnerability has made everything available like some Black Friday sale. Even CRV followed them. so confusing, dunno what to accumulate, LOL!

hahaha you are indeed very bullish about FTM. Looking at Andre's sudden announcement with the SOLIDly's "warning announcement" page got everyone into a panic frenzy, I think finally FTM is stabilising allowing the rest of the protocols to climb back up and shine.

Posted Using LeoFinance Beta

Starting small is a good idea! Big APR, holy crap!

Posted Using LeoFinance Beta