Our Vision to Build a Deeply Liquid Derivatives Exchange for Hive & HBD

If you've been keeping up with the latest LeoFinance content - both written posts and video clips from the weekly AMAs - we've been talking disproportionately more about HIVE lately.

It's become clear that there are going to be a few winners in the coming bull market. We believe that decentralized protocols with real-world utility are going to make their ultimate debut on the stage of this next bear-bull cycle. We're seeing it take place right now with air tokens like FTT going poof.

This is an important time to focus on building real utility for tokens. BTC, naturally, is chief among the "real utility" aspect of cryptocurrencies. HIVE is a close second for us. We've always held a strong belief in the long-term value and mission of Hive - making this obvious by building our entire project with Hive as the central pillar - but recent changes to HBD and the Hive ecosystem have drastically improved our outlook (even more bullish than it already was).

One issue in the crypto space is decentralized liquidity. It's an issue for many cryptocurrencies. BTC has solved it by being the big dog in the space - almost every crypto asset has a pair to BTC on one exchange or another. This has a natural effect of spreading BTC out onto as many exchanges as possible.

It's one of the many reasons why BTC is least affected by things like the FTX Exchange meltdown. If all of the BTC in circulation was concentrated to FTX, then we would see an even greater plummet in the BTC price as FTX would sell off all that BTC they're holding and scare the market even more than they already have.

Hive is one of the most decentralized blockchains in the space... but liquidity is highly centralized to Upbit and Binance... it's time to change that!

Great efforts are being made on the internal market and with Hive-Engine. These efforts cannot go understated. It's so ridiculously important that we build as many outlets for HIVE & HBD trading as possible.

This is not about competing with each other. It's about building multi-variate exchanges to spread out the liquidity and trading volume of HIVE & HBD. That's how we - as a blockchain ecosystem - become anti-fragile.

Our Vision to Build a Deeply Liquid Derivatives Exchange for Hive & HBD

It is no secret that CUB has not performed well over the last several months (the last year, actually). CUB's previous model was inefficient. It lacked real utility - the main source of revenue was from autocompounding vaults (kingdoms) but these didn't generate enough revenue to outpace inflationary pressures.

We spent so much time trying to figure this out and crack the code on generating revenue for a DeFi protocol. Little did we know that the answer was right in front of us the entire time: Hive.

Hive - with no surprise - is the solution to our revenue problem and we can be a solution for the Hive liquidity problem.

Make no mistake: we are not the end-all-be-all. There needs to be many different projects - Hive-Engine, the Internal Market, etc. - that all spread out liquidity. We believe CUB will become a key player in this with the bHIVE and bHBD derivatives.

Our mission is to deepen the liquidity. It helps Hive and it also helps CUB through real utility: generating disproportionate revenue on the Multi-Token Bridge. Last month, we generated $8,000 in revenue from the Multi-Token Bridge (HIVE/HBD wrapping fees, arbitrage revenue and on-chain oracle staking).

Where CUB is Headed

CUB has done a complete 180 to change direction here. We are now focused on growing the use case of the derivatives: bHBD and bHIVE.

Our focus is on adding more utility to these derivatives and ultimately deepening the liquidity of them on the BSC Blockchain. This is just another way to decentralize the liquidity and trading volume of HIVE & HBD.

Now that you know the broad-based vision of CUB, below you'll find some pieces of the new roadmap. We're actively working on these now and our efforts are all aimed at building more utility and liquidity for bHBD & bHIVE.

CUB Variable Staking

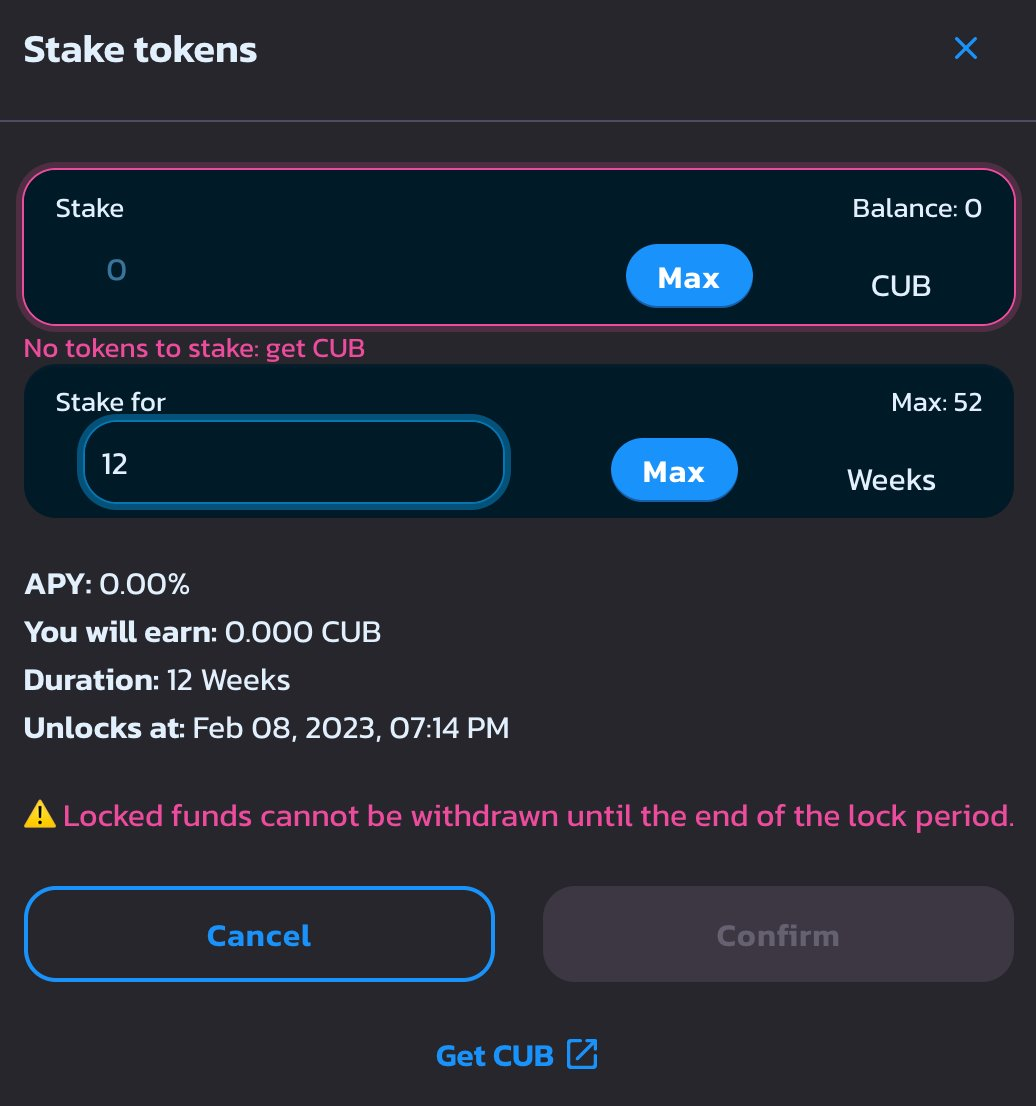

The newest feature release on CUB should land this week (if testing goes according to plan). This will replace the current CUB Kingdom and allow anyone to stake CUB for a preset amount of time.

You can flex stake CUB for a low APY with instant liquidity or you can lock your CUB for anywhere from 1 week - 52 weeks. This will allow you to earn more APY the longer you stake.

This development adds utility to CUB as you tap into the MTB Earnings Potential + More APY the longer you stake as opposed to people who want to keep their CUB liquid to sell. #GameTheory has arrived to CUB Staking.

... This development also seeds to ground for the next idea on our roadmap:

HIVE & HBD Bonds

Hive & HBD bonds are something that a few key players on Hive have talked about. @taskmaster4450 wrote a number of posts talking about this idea.

With the development of our CUB Variable Staking contract, we believe we can port this over into a bHIVE & bHBD bond contract.

This would allow you to single-sided stake HIVE & HBD.

How many of us are worried about Impermanent Loss? The number is actually quite high. We've seen many people saying that this is one of the reasons they don't like liquidity pools.

They would much rather stake HIVE by itself and/or HBD by itself than be exposed to potential impermanent loss in a liquidity pool.

Single-Sided staking was just released on Thorchain for native coins like BTC, ETH, etc.

This has inspired us to release a HIVE & HBD single-sided stake in the form of a variable staking bond. We are going to test this on CUB first and then roll it out for bHIVE & bHBD if everything goes well.

Imagine if you could stake your HIVE or HBD for anywhere from 1 week to 52 weeks and earn high yields for doing so.

But What About Productive Liquidity?

Thorchain is using Synths to allow their single-sided staking pools to generate productive Liquidity Pool capital. Deploying these bonds for HIVE & HBD will allow us to do a similar model and deepen the liquidity of bHBD & bHIVE while allowing users to single-sided stake the assets.

CUB DAO

The CUB DAO has been growing. Revenue continues to grow month-to-month and burn activity has grown exponentially. Yesterday, we just crossed 1.5M in total CUB burned with 400k burned in the month of October and likely the same (or higher) burned in November.

This is a great thing for CUB. It turns out that building a HIVE & HBD derivatives smart contract can be highly profitable. Who woulda thought!

At the same time, buybacks and burns of CUB has been increasing the APY (accordingly with price) for the bHBD and bHIVE Liquidity Pools.

This creates a pinwheel effect for bHBD and bHIVE liquidity: as more liquidity enters the pools, more revenue is generated by the DAO, more CUB is bought and burned, CUB APYs increase, more liquidity enters the pools 🔂

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

https://twitter.com/1149806884335050752/status/1593301884084916232

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You haven't come up with anything new - it's an old topic / but you can try - but I'm not involved in this!

Posted Using LeoFinance Beta

What is the utility of BTC? This is something hard to see. It isnt a medium of exchange since they are pushing the payments to the second layer.

It has to be something else, which I am not sure has really been defined at this point.

Posted Using LeoFinance Beta

IMO it's the original idea of BTC itself. It's not a medium of exchange, it's a decentralized, sovereign and mathematically-verified storehold of wealth.

BTC is gold 2.0. That's the narrative I've always bought into and believe it's the "correct" one

Posted Using LeoFinance Beta

Trustless, uncensorable, unseizable transfer of a scarce (fixed supply of 21,000,000) digital asset between more than 100 million distributed individuals accepted by 15,000 businesses, found on 500+ exchanges, with thousands of trading pairs. Not to mention with a huge first mover advantage.

Bitcoin has huge utility.

If you need to find out more about Bitcoin, you can pick up a copy of The Bitcoin Standard by Saifedean Ammous.

It seems Polycub fell of the radar.

A back and forth game.

Posted Using LeoFinance Beta

Negative ghost rider, same plan in place on POLYCUB.

We do think a PIP is required to fix the monthly halvenings. This has hurt liquidity and we have talked about it multiple times recently.

CUB has shown that a balance of emissions + liquidity can create positive price action through buybacks - as the more liquidity there is, the more buyback potential there is.

We proposed a PIP to maintain inflation on POLYCUB at 0.0625 per block and vexPOLYCUB / xPOLYCUB holders denied it.

This is the benefit and tradeoff of a DAO. The POlYCUB holders weren't in favor of it. Since then, the price has fallen further. We're hoping CUB will showcase to them that it is a good idea to have a static inflationary rate that can seed the ground for pHBD / pHIVE growth.

All it takes is CUB to break through the noise, then POLYCUB will undeniably adopt it. A new PIP will be proposed soon™️ with some revisions as requested by a few large vex / xPOLYCUB holders. We'll see if that one gets passed.

Posted Using LeoFinance Beta

I will be looking forward to this. POLYCUB has less than $6,000 in trading volume last 24 hours. It won't be that difficult to pump the price and massively increase the APRs. I'm wondering if an IDO on POLYCUB could help with this.

!PIZZA

Posted Using LeoFinance Beta

I joined and bought pCUB from day 1 and right now I still have a doubt of keeping pCUB.

The mechanism behind the scene to create pCUB value is the key. How to make a sustainable stream that keeps adding value to pCUB (like CUB) with an attractive profit (or APR) will create the need of pCUB.

I'm also looking forward to see the new proposal with pCUB :)

Posted Using LeoFinance Beta

I love tbe idea of diversifying hive and hbd , spreading hive and hbd into another exchange reduce the risk if one exchange falls it won't affect just like usdt and BTC ,not only reduCe the risk more people will know more of hive and they will be more demand

Posted Using LeoFinance Beta

100%

Posted Using LeoFinance Beta

Leo Bonds?

In one of our recent Team calls we were toying with this idea as well. a bLEO bond would be a cool way to add some utility and single-sided staking for LEO.

Depending on how the CUB, bHBD and bHIVE bonds go, we may add bLEO as well.

Posted Using LeoFinance Beta

Focusing on Hive and HBD is the best choice that Leo Finance has made and I applaud the efforts in uplifting this entire ecosystem. Together we are stronger and push forward an amazing blockchain where more and more successful projects are rising!

Posted Using LeoFinance Beta

🦁 I think we've hit a really cool model with bHBD and bHIVE. We just need to deepen liquidity.

Of course, the goal is to build a high volume derivatives exchange for bHBD and bHIVE that is all built on smart contracts. It's awesome to see this plan come together and work so well so far

Posted Using LeoFinance Beta

There are over 20,000 cryptos and only 480 Exchanges and the Bankers are trying to shut down any independent exchanges. I think its a great idea to create a new exchange that allows us to transfer HIVE or HBD into any currency.

https://hive.blog/stwt/@titusfrost/stwt-238-the-bankers-great-chess-plan-wef-cbdc-s-via-ftx-endless-war-china-s-rise-via-bri

I do like these new directions and in particular the way CUB will be working just like Cake in terms of the long term holds. So huge potential stored up here and while it's a little harder to build up liquidity in a very bear market doing so is going to put us ahead.

Posted Using LeoFinance Beta

I like the variable staking for Cub. The single sided stake sounds interesting as well but I will need to understand it a bit better

Posted Using LeoFinance Beta

This is the best utility for the CUB universe so far, I hope this grows a lot!

Hive,hbd and Leo, are the best and I sensed it that it will be the best and the strongest ecosystem

I gifted $PIZZA slices here:

@vimukthi(3/5) tipped @leofinance (x1)

Join us in Discord!

HBD is a great utility for me personally.

Bonds really seem to give a lot of promise to more utility.

On the next bull run it will be great to be able to sell off some HIVE on the way up and keep it as HBD liquid or at earning 20% interest. This makes it easy to do some swing trading all on the Hive Blockchain.

Posted Using LeoFinance Beta