My Experience Investing in the Crypto Market

Good day everyone. I will be talking about my days of humble beginnings. During those periods, I learned a lot about crypto, unlike recently, when I am only concerned about what I stand to earn from engaging myself with the blockchain. To make this fun and more precise, I have done it in the question and answer session to carry everyone along.

.jpg)

Discuss your first experience investing in the crypto market.

Everyone must start from somewhere; for me, I started investing in the crypto market when the Binance Smart Chain (BSC) Blockchain was launched, and it was not that popular back then. I was fortunate to be very informed on the use of the blockchain, and I got helpful intel on how to get the best from the BSC Blockchain. So, my first experience investing in cryptocurrency was in 2020.

What is your first investment in the crypto market, and what drives you to invest in the crypto market?

Well, as of the time I made the first investment, it was on three coins, namely:

- CAKE

- BAKE

- JUL

What drove me to invest in these coins was that the concept of DeFi was trending at that moment. The coin listed above were the first set of DeFi coins ever launched on the BSC Blockchain. I was driven by the fact that I could get more coins just by staking it on their respective platforms on Binance Smart Chain. The high APR on these coins of those days also pushed me into investing in them, coupled with the meager gas fee the Binance Smart Chain offered at that time.

Have you ever encountered any loss as a result of the instabilities in the crypto market? Discuss

Of course, I have suffered many losses from the instability of the coin market. The most painful as of now was that I held my CAKE coin even though the coin clocked $47 per one. As of then, I had over 40 CAKE, but I was naïve, waiting for the coin to clock 100$ before I cashed out. I lost terribly as the value of CAKE is currently below $4 as of the time of writing.

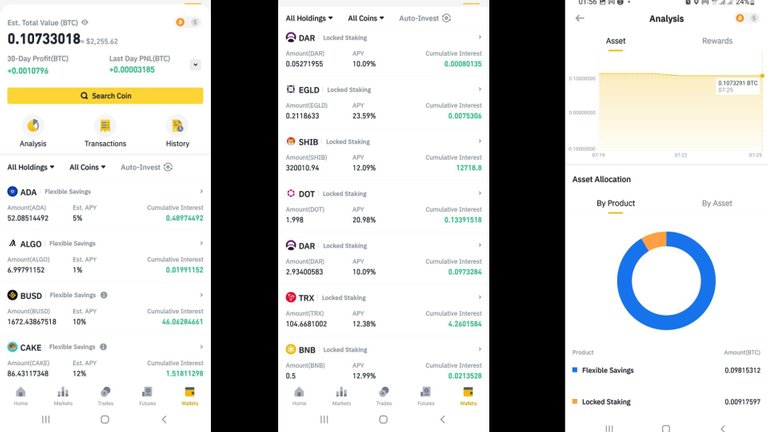

What crypto assets are you currently holding? Why did you invest in them? Please take a screenshot of your portfolio.

Well, I hold a lot of crypto assets as of today, but I am holding them because they are stakable, and some have use cases yet to be appreciated. Hence the reason why the value is low. Since my private wallet (Trust wallet) was hacked, I had to buy and invest only in coins that are available and listed on the Binance trading application.

As of the time of writing this post, the crypto assets I have are:

- Busd

- Cake

- Ada

- BNB

- SOL

- DAR

- STEEM

- TRX etc

I have over 20 crypto assets in my wallet, and although they are small in value, I can assure you that they used to be worth over $7k at a time, but it is what it is now. The reasons for having these tokens are simple: Binance provided a lock saving or flexible saving option. I took both options whenever available as I believe saving rather than spending is best. I have some STEEM tokens saved in my Binance wallet.

As an experienced cryptocurrency investor, Do you believe in Holding or Trading cryptocurrencies?

With the current level of experience that I have now, at this very moment, the concept of trading seems more reasonable to holding. The simple reason is that the market is quite unstable at the moment, which is depicted with BTC being under $22k as of the time of writing despite being around $23+k just three days ago. To gain much more in this market, buying when low and selling when high makes more sense, and the more frequently this has been done, the higher the turnover expected by an investor. Uncertainty in the market makes trading the best bet in this crypto market as of today.

What's your advice to a newbie investing in the cryptocurrency market

I have just four pieces of advice, which I have always done my best to preach from time to time. I want newbies to avoid the common mistakes I made when just starting in cryptocurrency.

The advice I have for newbies is that:

- Newbies should always conduct proper and adequate research on any project coin/token they intend to invest in. Conducting this research is vital as the scams and rug pull projects continue to litter the crypto market.

- Always invest what you can lose. The crypto market is unstable, and one could tend to lose all investment in an instant. The unstable market condition makes it advisable for newbies to invest funds they can lose.

- Continuously diversify your portfolio. Do not put all your eggs in one basket. Buy coins of different projects just in case a coin/token instant is doing well; the others could be experiencing a better fate.

- Always take profit at every turn. Never be the bigger fool of believing that you are going to the moon when the price of a coin skyrocket; take your investment back and maybe make a little profit. If it continues to rise, take profit from time to time.

Posted Using LeoFinance Beta

https://twitter.com/abiodunadeosu19/status/1554636656292073472

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.