LBI increases its PoWeR

One of the projects that LBI has been working towards building a position in is the PWR token based project run by @empoderat. It is a well run, and professionally managed project aiming to build a base of HIVE Power and reward holders of the PWR token with distributions and dividends. We set up a new wallet to hold our investments in this project - @lbi-pwr - and started out with a little HP delegation to start earning PWR.

Just over a month ago, this wallet was set up and announced in this post:

https://inleo.io/@lbi-token/setting-up-our-next-investment-jf8

Since then, the delegation has been increased a little, and rewards have gone over to the wallet to slowly but steadily build the LP position. However, yesterday, I had some funds to invest as I had pulled some HBD savings out to give a few of our investments a top up. So some of these funds went to this wallet, to get added to the LP and fast track the position a bit. 1000 HIVE was sent over, swapped half into PWR and added to the pool.

From that original post, here was the plan for this investment:

Grow the delegation to @empo.voter over time.

Transfer all PWR earned to @lbi-pwr

Swap half to HIVE, and add to the PWR/HIVE liquidity pool.

This will generate more PWR, which will also be compounded into the pool.

From next month, funds in the pool will earn HIVE payouts, along with PWR.

The HIVE earnings will go to the income wallet, all PWR will be compounded.

The yield generated on the PWR delegation to @empo.voter is fixed at 8%. On our current delegation of 3000 HP, we are receiving 0.658 PWR tokens. From tomorrow, this delegation will increase to 7500, with the ultimate goal being to build it up over 10K. The first thing I'll note is that the 8% yield is less than other options. That's ok though, because it is very reliable (I haven't seen it miss a day) and the PWR is "pegged" to HIVE (its a soft peg, but feels pretty reliable currently).

So once I get the delegation increased tomorrow, we should be earning 1.65 (roughly) PWR per day. On top of that, the pool now will earn some PWR as well, bringing us up close to 2 PWR per day. Does not sound like much, but compounding over a few years can work magic.

The purchase we made, buying 500ish PWR out of the pool did move the price a bit. Prior to our buy, it was around 1 PWR = 0.98 HIVE. After, it is now tracking around 1.02. So we moved the market a bit, but that is to be expected and that is pretty much the normal range that PWR trades around. I couldn't really have put much more in in one hit, as it would have moved the price too much.

The numbers.

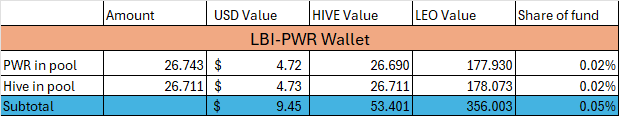

In last weeks report our position was still small.

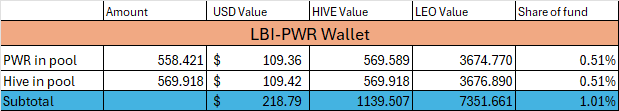

Now, after this change, here is what it looks like today:

So we now have 1% of the funds total assets deployed in the PWR pool. Still not a significant amount yet, but it will be interesting to see how that changes through organic growth. Overall, once the delegation gets updated in the coming hours, we will have a bit over 7.5% of the fund committed to the PWR project overall. 7500 HP delegation, plus 1139 HIVE value in the pool, compared to an overall fund size of 112000 HIVE value.

Admin

So, just for clarity, here is how this portion of the fund is administrated.

- 7500 HP (soon) delegated from the main @lbi-token wallet.

- PWR from that transferred to @lbi-pwr each day.

- Yield from the pool comes as half PWR, half Hive.

- Only the HIVE portion is sent to @lbi-income for the weekly distribution.

- All the PWR then gets split 50/50 and added to the pool.

In this way, we continue the theme for LBI now of layers of asset growth eventually feeding into a source of income. The LP will grow by close to 2 Hive in value per day, and the income generated will be around 0.25 Hive value currently. As the LP position grows, so to will that income.

Building multiple streams of passive income on the back of reliable asset growth is the name of the game for LBI these days. PWR fits this bill perfectly.

The main goal in the short term is to keep building the HP delegation up to 10,000 HP, and keep growing the LP position.

I had some funds to invest as I had pulled some HBD savings out to give a few of our investments a top up.

This was one of the things I did with the funds I pulled out of HBD savings. More posts on other moves will be out in the near future with some of the other positions I've added to.

Thanks for reading, hope you have a great day,

Cheers,

JK

To learn more about LBI, and what we have been up to recently, here are some posts with more info:

https://inleo.io/@lbi-token/major-change-for-our-eds-wallet-9ba

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

https://inleo.io/@lbi-token/dividends-resume-for-lbi-holders-bci

Posted Using InLeo Alpha

PWR has been rather solid over the months I've been with it

It's a pretty straightforward project that does what it promises. Pays 8% delegation rewards daily, and rewards LP holders. Nothing complex, just a straightforward set up that works.

Hi, @bitcoinflood,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

Huh that’s a new one. I’ve been missing out on some of these assets! Looks like I’ll need to spend some hive and get some power! I’m assuming we can stake the power or is it just a hold asset?

You earn PWR by delegating HP to @empo.voter.

There is no staking, yield on PWR held is only paid to PWR in the liquidity pool. PWR is designed to be put in the pool, paired with HIVE to earn more PWR and HIVE everyday.

Cool thanks. I am terrible with liquidity pools so I have stayed away from them up to this point lol. I think I participated with Cub but that’s about it. I have yo refresh myself on how it all works.

Hey, maybe this could be of help, it's the documentation of the project with a few guides

https://hive-power-ventures.gitbook.io/hive-power-ventures

Btw, If you have any question, you can reach me through discord and/or just tag me here and I'll answer you within a few hours.

Damn you! If I didn't hold LBI too I would be so livid! 😃

Wait until LBI overtakes you with DBONDS - Then you can be livid. 😉

I'm not too worried about DBOND due to the way that all works. I've been selling my DBOND lately anyway to buy more RUG.

That's thw thing I don't like, you switched 15% APR for 8% APR and decreased HBD savings below 5k target. Please keep HBD in savings and use the Hive's built-in features as much as possible.

On the other hand, I'm happy you noticed Leo is totally unreliable. Even with DHF funding and hype propaganda, the inflation is far too big for this to work. If you want to increase pwr exposure get rid of Leo. Undelegate HP. They're mostly focused on their runes, Thorchain, Maya protocol and treat Hive as a faucet.

It's funny how we are deep in mud with Leo and InLeo didn't support LBI in any way.

Leo inflation isnt actually as crazy as it used to be. The problem is that they have lost most of the trust and nobody wants to buy it anymore :)

To add a bit more on this, it's thanks to lbi that I no longer dump all my Leo earnings, instead I swap half for lbi and pool the rest on lbi/leo

Same here

If you let me play devils advocate there, 15% APR on HBD is great, but only in bear markets (Vs HIVE). It seems that markets will heat up soon, and a small increase in HIVE price terms it's enough to justify the apr reduction.

In that sense PWR it's like a HIVE derivative, but with a much higher apr and the possibility to stay "liquid" in the pool.

Regarding leo... nothing to add. I feel more or less the same.

Have a great day.

I'm sorry if my comment sounded that way. It wasn't against your project (I'm also involved in it), but it was rather against decision-making that contradicted the previous decisions of participants who expressed support for increasing the HBD stake.

Or not. But for me Hive has greater potential than Leo, so I'm happy to increase pwr exposure at the expense of our Leo stake. Increasing pwr stake in LP also removes liquid Hive from circulation, which is also another building block of Hive's success

I wasn't salty or something sir, didn't know that about that HBD "promise" though. Enjoy ur Saturday

I understand your concerns with HBD, and assure you it remains an important part of the plans. This was just one of the things I did with the funds, and all of them were moving into HIVE priced investments. Yes, our HBD is below the 5K target for now, but I made the decision, and so far it has been in our favor. Time will tell if it was good timing, but so far the move is about $100 in front thanks to HIVE's price increase. That $100 would be about 8 months worth of interest on the 1000 HBD.

As for the LEO concerns, I don't necessarily disagree. My plan is that when I started running LBI, I'd treat it as a fresh start and work from that point forward, without looking at previous issues too much. Since taking over, I've cut the leo.voter delegation twice, almost in half, as a result of the unreliable payouts.

Overall, I made a call, and stand by it. My goals for LBI are much bigger than just collecting 15% interest on HBD, people can do that themselves if that is their goal. My goal is to put funds into some of the best layer 2 projects on HIVE and build this fund up over the coming years. I think we are much better off now than the path LBI was on a few months ago, overall. I get not every decision will please everyone, but I'm doing what I think is in LBI holders best interests for the long run.

Just make us rich sir

Thanks for the dirty marketing job sir, let me drop a few upvotes on the comments.

I'm very happy to see people jumping aboard to the liquity pool. Although the rewards are being diluted (currently at 17% which it's still very decent) so far it's been very reliable and seems that people are valuing this.

As always, whatever think I could do to help/support, let me know and let's talk :)

Sir I need a new wife

17% is very competitive, particularly in a liquidity pool that has very little impermanent loss risk. The way it is set up fits LBI's methods perfectly - the Hive portion goes to our income distribution and the PWR portion gets compounded back in, with the delegation rewards.

Thanks for the support on our content, it's much appreciated

This sounds cool. I never knew about the PWR tokens. Is PWR earned from holding LBI tokens or do I have to delegate HP?

PWR is a separate project which LBI is invested in, you (very likely) won't get PWR directly by holding LBI unless it gets added as dividends at some point.

Right now it's just indirect exposure

Thanks for your response. What do you mean by indirect exposure?

You're not a direct holder or receiver of PWR but since you're invested in LBI and LBI in turn is invested in PWR you are exposed to the PWR project via LBI

Exposure in this sense isn't negative at all, but neutral..

Hello lbi-token!

It's nice to let you know that your article won 🥉 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You and your curator receive 0.0069 Lu (Lucoin) investment token and a 5.85% share of the reward from Daily Report 429. Additionally, you can also receive a unique LUBROWN token for taking 3rd place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART