Thorchain: Creating Trustless Bitcoin Swaps in a World of Economic Turmoil and Banks Dying

Thorchain (RUNE) has always been a fascination of mine - ever since @shanghaipreneur, @jk6276 and @nealmcspadden started talking about it here on LeoFinance.

I bought into RUNE under $0.40 and overtime, continued to accumulate. In the bull cycle, I took some profits but I still hold RUNE as one of my largest crypto portfolio holdings. I participate in the RUNE-ETH LP and hold the rest as liquid RUNE, signaling my long-term belief in what they're building.

The world economy is hurting right now. We've seen some of the largest banks in the world go under. We're seeing a clearer picture in terms of banks losing customer funds and being negligent overall.

It's no surprise... We all know that banks are crooks. That's half the reason Bitcoin and Crypto even exist today. The 2008 crisis and subsequent bailout was cited in Satoshi's paper.

The problem? 14 years after BTC's creation and we are still heavily reliant on crypto on-ramps and off-ramps. Additionally, we are highly dependent on centralized exchanges like Coinbase, Binance and others.

Our reliance and inability to trust these exchanges was proven with the collapse of FTX. The constant FUD around stablecoins and CEXes like USDC, Binance, etc. continue to prove themselves as a targeted weakpoint in our industry.

A lot of projects are aiming to solve these problems. Thorchain has long been a fascination of mine since they have aimed high and actually achieved the many milestones they've set out to achieve.

Nothing happens in a straight line though. Thorchain has had a number of issues over the years including a few hacks that resulted in millions of dollars lost. I believe most of those LPs were made whole from RUNE reserves, but the damage of the hack remains in peoples' minds.

Thorchain: Creating Trustless Bitcoin Swaps in a World of Economic Turmoil and Banks Dying

We've identified the problem: we have a massive reliance on both banks as onramps/offramps as well as crypto CEXes for crypto-crypto trading.

We need to fix both of these problems. Crypto-crypto trading is slowly being solved with the advent of DEXes like Thorchain, Uniswap, Pancakeswap, 1INCH, etc.

We're seeing a colossal level of innovation in this arena of crypto-crypto trading liquidity and volume. This trend needs to continue.

Thorchain brings native crypto assets and a multi-chain future into focus. Wrapped assets can have a whole other layer of issues (and values) but having some native layer for trading is huge.

Native BTC swaps are the core value prop of Thorchain.

This tweet calls up a huge point in crypto. Swapping assets - especially across blockchains - is still relatively difficult. You often have to use some kind of centralized intermediary like a multi-chain bridge or a CEX to convert across chains.

Thorchain solves this.

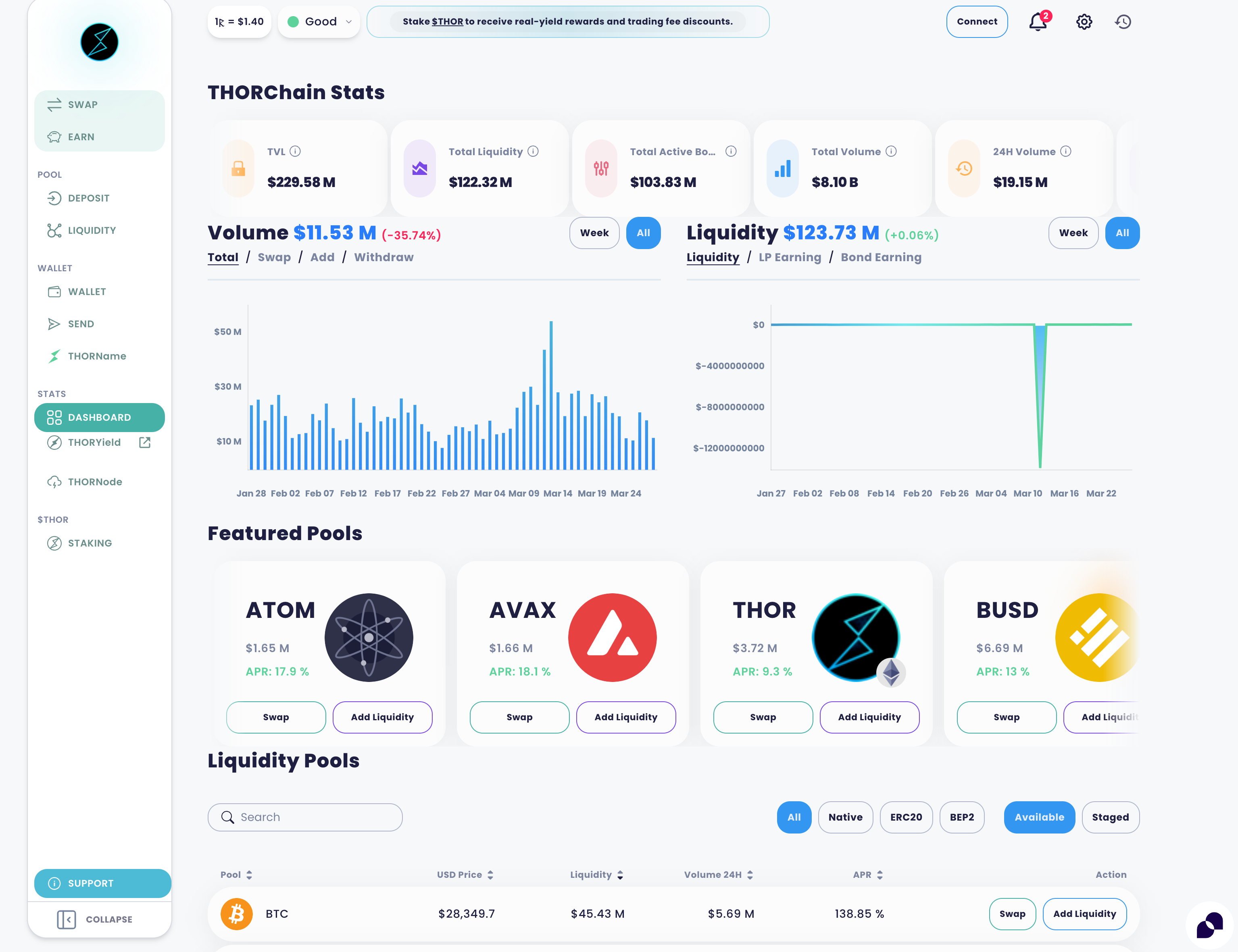

Thorchain offers a wide variety - hundreds of altcoins, native BTC, ETH, LTC, etc. - of crypto trading options.

You can now trade assets in a trustless, decentralized and permissionless way on Thorchain.

Why No Mass Adoption?

It isn't all sunshine and rainbows. There isn't mass adoption of Thorchains cross-chain trading rails.

Why is that?

A lot of it - as I mentioned before - comes down to trusting the protocol. I think a lot of people fear the Thorchain protocol and they are afraid to LP given its history.

That combined with a lack of overall awareness, marketing, etc. Thorchain has many of the same problems that Hive does. Great technology, amazing community but growth is challenging.

Growth for Hive means more users. Growth for Thorchain means more liquidity.

Gaining liquidity requires a mix of trust, incentives, etc. We need Thorchain to deepen their liquidity pools to kickstart a pinwheel effect.

As thorchain LPs deepen in liquidity, there will be a lot more trading volume. More volume = more incentives to provide liquidity and so on and so forth. I wrote an article way back in the day about black hole theory.

I think mass adoption for protocols like Thorchain is more important now than ever before. The real thing standing in the way of decentralized trading in the crypto space is having sizable liquidity for low slippage. We're slowly seeing this become reality on Thorchain.

The question isn't if... but wen.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

Thank you for sharing your thoughts on Thorchain and its potential to solve some of the issues in the crypto industry. I agree that the reliance on centralized exchanges and banks for on-ramps and off-ramps is a problem that needs to be addressed, and Thorchain's focus on trustless crypto-crypto trading and native BTC swaps is a step in the right direction.

However, as you mentioned, there are challenges to achieving mass adoption, including the need to build trust in the protocol and increase liquidity. It will take time and effort to overcome these challenges, but the potential benefits of decentralized trading are significant.

Some day i bought a Little of thorchain, AND in other Time i Sell it, but i am try yo rebought. Again, it would be a great investment posible.

Call me crazy, but it's kinda feels good seeing banks dying, haha!

I love the idea of Thor and I think I have some Rune... I swapped some UNI into it back in the ERC20 and I think I moved it to a Thor wallet somehow but...

Everything about using THOR is insanely badly explained and has defeated me.

Can you link to some EASY explanations?

Posted Using LeoFinance Beta

Use xDefi wallet (you can enter all your wallet into it) and then thorwallet or thorswap and that's all.

Posted Using LeoFinance Beta

I think the first major obstacle to mass adoption is ease of use, even before the lack of good marketing.

The crypto environment is vast and complicated in itself, many words are new or have acquired new meanings. We add that the documentations are only in English which is not a language that everyone masters at an adequate level. For example, I can handle some simple problems speaking or writing in English but it is much more difficult for me to learn from English a topic I don't know. It's not impossible, for other sectors I did it because they were fundamental in life, work or otherwise. But DEFI and decentralization is NOT perceived as such by the masses, who don't want to commit to it or don't have time to do it because life is already too busy.

In my opinion, and I speak as a marketing consultant, it is useless to promote yourself if you don't become more user friendly. You need to build how-to guides for basic use and other guides that explain use cases as simply as possible. And it is necessary to translate them into many different languages, to reach the widest audience, because the main beneficiaries probably coincide precisely with those who do not master English well.

That said, I didn't know Thorchain except by hearsay, but I didn't know what he was for. Interesting but I see that unfortunately he doesn't support Hive. Do you know if it is expected in the future?

https://twitter.com/1472693700933345286/status/1641572450042515456

The rewards earned on this comment will go directly to the people( @kalibudz23 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The funniest and most bizarre thing is, when everyday people start to trade and barter between themselves with crypto there is no on, or off ramp anymore. Its all right there already yet people are people. We wait for the 100th monkey to use crypto and off we go.

Like you, I have watched THORChain for years now, since its early days. I remember the big hack of the LP and the big losses - the dev team spent months rebuilding to re-establish some trust with its community.

With that being said, the Tornado Cash crackdown brought out a glaring issue with most DeFi projects: publicly-doxxed developers. Maya Protocol just launched its mainnet with its genesis block this past week, was wondering what your thoughts were? I would be much more inclined to invest in an LP on Maya rather than THORChain because of the further layer of separation between the developers and the protocol. Additionally, Maya is integrating DASH as one of its native tokens for swaps, something that THORChain has dragged its feet on - same goes for Monero on THOR.

As a big privacy and anonymity advocate, I fear reciprocal action could easily be taken against the developers of THORChain, as happened with Tornado Cash

Posted Using LeoFinance Beta